-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI US MARKETS ANALYSIS - US 10y Yields Within Reach of Breakout Level

Highlights:

- EUR/USD finds support just ahead of yesterday's pullback low

- Markets watch 4.175% level in US 10y yields

- Fed speakers dominate the agenda - Mester, Kashkari and Collins due

US TSYS: Off Lows For Modest Twist Steepening, 3Y Supply and Fedspeak Ahead

- Cash Tsys have pulled back from overnight highs but still trade 2bp richer to 0.5bp cheaper. The twist steepening sees a pivot after 20s, leaving 2s10s at -30bps (+1.5bp) but only back to yesterday levels.

- TYH4 at 110-28 it as the lower end of relatively narrow ranges on solid volumes of 325k, but remains above yesterday’s 110-22+ in a move that pierced the bear trigger at 110-26 (Jan 19 low). Further support is seen at 110-16 (Dec 13 low).

- No data of note sees Fedspeak and 3Y supply headline the docket, the latter kicking the week off for coupon supply with 10s tomorrow and 30s on Thu. 3Y supply should provide a litmus test for demand after the recent run higher in Tsy yields since Friday's payrolls report.

- Fedspeak: Mester (1200ET), Kashkari (1300ET) and Collins (1400ET) – see STIR comment for details.

- Note/bond issuance: US Tsy $54B 3Y Note auction - 91282CKA8 (1300ET)

- Bill issuance: US Tsy $80B 42D CMB bill auction (1130ET)

STIR: Fed Rate Path Consolidates Sizeable Push Higher

- Fed Funds implied rates consolidate yesterday’s push higher in a continuation of the hawkish reaction to payrolls.

- Cumulative cuts: 5bp for Mar, 20bp for May, 40bp for Jun and 116bp for Dec.

- Fedspeak fills an otherwise light docket:

- Mester (’24 voter retiring June) starts on the economic outlook at 1200ET (text + Q&A) – she last spoke Jan 11 saying March probably too early for a cut, policy in good place, focusing on balancing both sides of mandate this year.

- Kashkari (non-voter) in moderated discussion at 1300ET – he wrote in an essay yesterday that the Fed has time to assess economic data before cutting rates, with the neutral rate possibly higher now.

- Collins (’25 voter) gives opening remarks at labor market conference at 1400ET – a rare appearance as she last spoke in mid-November.

OI Points to Mix Of Long Cover & Short Setting On Monday

Yesterday's extension lower in Tsy futures and preliminary OI data point to a mix of net long cover (FV, TY & WN futures) and net short setting (TU, UXY & US futures).

- The former dominated the latter in net curve terms, although DV01 equivalent net OI swings across contracts and the wider curve were contained.

- A reminder that the stronger-than-expected ISM services survey (particularly the prices paid and employment components) provided a major input for yesterday's move lower in futures. Fedspeak & $IG issuance also factored in.

- A reminder that last Wednesday saw notable net length added across the futures curve (a little over $12.5mn DV01), which has likely factored into the apparent long cover seen post-NFPs/ISM services.

| 05-Feb-24 | 02-Feb-24 | Daily OI Change | OI DV01 Equivalent Change ($) | |

| TU | 3,917,357 | 3,913,107 | +4,250 | +157,018 |

| FV | 5,863,318 | 5,888,298 | -24,980 | -1,057,458 |

| TY | 4,699,406 | 4,725,058 | -25,652 | -1,626,388 |

| UXY | 2,185,182 | 2,175,447 | +9,735 | +880,684 |

| US | 1,431,882 | 1,431,482 | +400 | +53,573 |

| WN | 1,650,383 | 1,652,668 | -2,285 | -478,599 |

| Total | -38,532 | -2,071,170 |

OI Points To Mix Of SOFR Futures Short Setting & Long Cover On Monday

The combination of yesterday's move lower across most of the SOFR futures strip and preliminary OI data points to the following mix of positioning swings to start the week.

- Whites: A mix of net short setting (SFRH4 & M4) and net long cover (SFRU4). It is harder to be sure when it comes to the movement in SFRZ3 given its unchanged price status on the day.

- Reds: Apparent long cover across all contracts.

- Greens: Apparent net short setting across all contracts.

- Blues: A mix of net short setting (SFRZ6 & H7) and net long cover (SFRM7 & U7), with the former dominating in net pack terms.

- A reminder that the stronger-than-expected ISM services survey (particularly the prices paid and employment components) provided a major input for yesterday's move lower in futures. Fedspeak also factored in.

| 05-Feb-24 | 02-Feb-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRZ3 | 1,210,902 | 1,206,004 | +4,898 | Whites | +19,498 |

| SFRH4 | 1,181,252 | 1,152,507 | +28,745 | Reds | -26,738 |

| SFRM4 | 1,054,684 | 1,046,509 | +8,175 | Greens | +32,736 |

| SFRU4 | 881,076 | 903,396 | -22,320 | Blues | +6,050 |

| SFRZ4 | 1,039,290 | 1,056,158 | -16,868 | ||

| SFRH5 | 588,479 | 593,693 | -5,214 | ||

| SFRM5 | 659,014 | 661,186 | -2,172 | ||

| SFRU5 | 597,971 | 600,455 | -2,484 | ||

| SFRZ5 | 675,372 | 661,712 | +13,660 | ||

| SFRH6 | 423,462 | 414,439 | +9,023 | ||

| SFRM6 | 446,674 | 438,799 | +7,875 | ||

| SFRU6 | 306,153 | 303,975 | +2,178 | ||

| SFRZ6 | 270,678 | 268,847 | +1,831 | ||

| SFRH7 | 148,807 | 144,137 | +4,670 | ||

| SFRM7 | 154,974 | 155,407 | -433 | ||

| SFRU7 | 144,224 | 144,242 | -18 |

FOREX: USD Off Overnight Lows, With Focus on Fed Speakers

- Having started the session on better footing, EUR is extending slippage off overnight highs, with EUR/USD's new daily low well in range of first support at the Monday pullback and cycle low of 1.0724 - clearance below here opens levels last seen in November last year.

- Pick up in volumes evident on the decline, with more sizeable activity evident in futures on the leg lower from 1.0737 to 1.0726 (cash equivalent of ~$600mln traded on the move). Slippage in spot tilts prices away from the most sizeable option expiries of the day, and well away from the E2.5bln that was set to roll off at 1.08 at today's NY cut.

- Moves not triggered by the ECB's CES, monpol pricing or that bumper German factory orders, shrugged off due to the presence of sizeable aircraft orders - and unlikely aided by a speech from ECB's de Cos, who confirmed expectations that the next likely move on rates will be a rate cut.

- The USD Index is off the overnight lows, but a more solid bounce is lacking. Antipodean and commodity-tied currencies are instead favoured, helping AUD, CAD to outperform modestly early Tuesday.

- Datapoints are few and far between Tuesday, with the Canadian Ivey PMI the sole release of note. As a result, more attention will likely be paid to the speaker slate - Fed's Mester, Kashkari and Collins are on the docket, as well as BoC governor Macklem - who speaks on the "effectiveness and the limitations of monetary policy".

FX OPTIONS: Expiries for Feb06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0740-50(E915mln), $1.0795-00(E2.9bln), $1.0815(E574mln)

- USD/JPY: Y147.00-20($1.3bln), Y148.25($557mln), Y148.50($641mln), Y148.70-75($786mln), Y149.10($658mln)

- AUD/USD: $0.6470(A$708mln), $0.6570-90(A$2.6bln)

- NZD/USD: $0.6005(N$703mln)

- USD/CNY: Cny7.2225($1.6bln)

CHINA: Pull Higher On Support Measures & Hope For More, Mainland Inflows Via HK-China Links

It was another volatile trading session for Chinese equities, with multiple rounds of headlines providing support. The CSI 300 ended 3.5% higher, while the Hang Seng added 4.0%. The HSCEI outstripped both, adding 4.9% on the day, while the major tech sub-indices added over 6.0%.

- Supportive factors included:

- China’s sovereign wealth fund vowing to increase its holdings of ETFs.

- The securities watchdog encouraging more share buybacks and increasing focus on guiding funds to increase long-term A-share holdings.

- BBG sources reporting that President Xi is set to be briefed by the Chinese regulators on financial markets, raising hopes of further, relatively imminent market-supportive/stimulus measures (the meeting could take place as soon as Tuesday, per the sources).

- Feedthrough from Monday’s after hours comments from the CSRC re: margin matters and a crackdown on illegal trading activity, as well as reports of limits surrounding total return swap and quant fund trading activity.

- This bucked the recent trend of under delivery vs. market appetite for deeper support.

- Flow wise, the latest instances of official support (outlined earlier) triggered the largest round of northbound net daily purchases via the HK-China Stock Connect links since late December (CNY12.6bn), as international participants deployed capital in the hope that the support levers will allow the CSI 300 to move away from ~5-year lows.

- This was the sixth consecutive day of net purchases of mainland equities via those links. ~CNY24.3bn of net purchases have been lodged over that timeframe.

- Note that ETF volumes were not as pronounced as what was seen in recent sessions.

- Some desks have estimated that the national team has already purchased CNY70bn+ of mainland equities in recent weeks.

- Looking a little deeper, L’Occitane befitted from M&A discussions.

- Cosmetics names benefited from spill over surrounding Estée Lauder’s earnings.

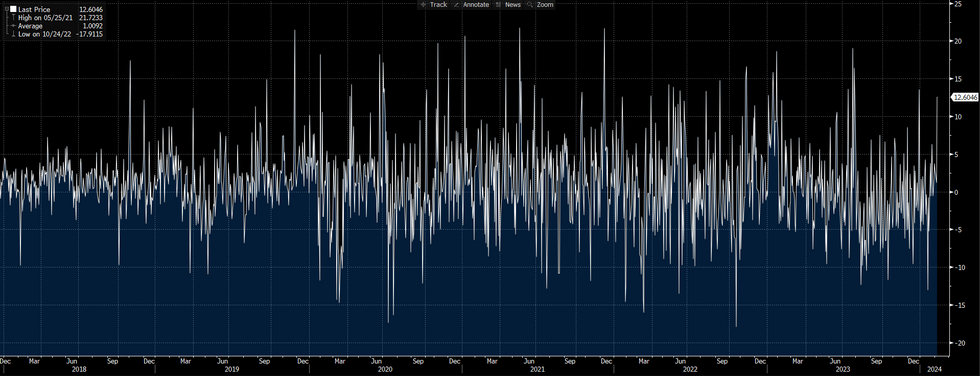

Fig. 1: Daily Net Northbound Flows Via The Hong Kong-China Stock Connect Schemes (CNY bn)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: E-Mini S&P Holds Onto Bulk of its Recent Gains

- Eurostoxx 50 futures remain firm and the contract has traded higher today and delivered fresh cycle highs, confirming a resumption of the current uptrend. This reinforces the bullish importance of the recent break of a key resistance at the Dec 14 high of 4634.00. A clear breach of the 4700.00 handle would pave the way for a climb towards 4725.50, a Fibonacci projection. Initial firm support lies at 4586.80, the 20-day EMA.

- A broader uptrend in S&P E-Minis remains intact and the contract is holding on to the bulk of its recent gains. The price has recently traded to fresh cycle highs, confirming a resumption of the uptrend. Recent corrections have been shallow - this also highlights a strong uptrend. The focus is on the psychological 5000.00 handle. On the downside, initial key short-term support has been defined at 4866.00, the Jan 31 low.

COMMODITIES: WTI Futures Remain Soft Following Last Week’s Steep Sell-Off

- WTI futures remain soft following last week’s steep sell-off. The move lower undermines the recent bullish theme and a continuation would expose support at $70.62, the Jan 17 low, and $69.56, the Jan 3 low. For bulls, a reversal higher is required to refocus attention on the key short-term resistance at $79.29, the Jan 29 high. A break of this level would reinstate a bullish theme. Initial resistance is at $76.95, the Feb 1 high.

- Gold has pulled back from last week’s high but - for now - remains above the Jan 17 low of $2001.9. Recent short-term gains improved a bullish condition and a resumption of gains would signal scope for a climb towards $2088.5, the Dec 28 high and a key resistance. For bears, a stronger reversal lower would refocus attention on $2001.9 where a break is required to reinstate the recent bearish theme.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/02/2024 | 1200/1200 |  | UK | Asset Purchase Facility Quarterly Report | |

| 06/02/2024 | 1330/0830 | * |  | CA | Building Permits |

| 06/02/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 06/02/2024 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 06/02/2024 | 1700/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 06/02/2024 | 1745/1245 |  | CA | BOC Governor speech/press conference in Montreal | |

| 06/02/2024 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 06/02/2024 | 1800/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 06/02/2024 | 1900/1400 |  | US | Boston Fed's Susan Collins | |

| 07/02/2024 | 2145/1045 | *** |  | NZ | Quarterly Labor market data |

| 06/02/2024 | 0000/1900 |  | US | Philadelphia Fed's Pat Harker | |

| 07/02/2024 | 0645/0745 | ** |  | CH | Unemployment |

| 07/02/2024 | 0700/0800 | ** |  | DE | Industrial Production |

| 07/02/2024 | 0745/0845 | * |  | FR | Foreign Trade |

| 07/02/2024 | 0800/0900 | ** |  | ES | Industrial Production |

| 07/02/2024 | 0840/0840 |  | UK | BoE's Breeden Speaks At Women In Economics Event | |

| 07/02/2024 | 0900/1000 | * |  | IT | Retail Sales |

| 07/02/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/02/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 07/02/2024 | 1215/1215 |  | UK | BOE's Woods et al : Treasury Select Committee 'work of the PRA' | |

| 07/02/2024 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/02/2024 | 1330/0830 | ** |  | US | Trade Balance |

| 07/02/2024 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 07/02/2024 | 1600/1100 |  | US | Fed Governor Adriana Kugler | |

| 07/02/2024 | 1630/1130 |  | US | Boston Fed's Susan Collins | |

| 07/02/2024 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 07/02/2024 | 1830/1330 |  | CA | BOC Minutes (Summary of Deliberations) | |

| 07/02/2024 | 1900/1400 |  | US | Fed Governor Michelle Bowman | |

| 07/02/2024 | 2000/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.