-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessPull Higher On Support Measures & Hope For More, Mainland Inflows Via HK-China Links

It was another volatile trading session for Chinese equities, with multiple rounds of headlines providing support. The CSI 300 ended 3.5% higher, while the Hang Seng added 4.0%. The HSCEI outstripped both, adding 4.9% on the day, while the major tech sub-indices added over 6.0%.

- Supportive factors included:

- China’s sovereign wealth fund vowing to increase its holdings of ETFs.

- The securities watchdog encouraging more share buybacks and increasing focus on guiding funds to increase long-term A-share holdings.

- BBG sources reporting that President Xi is set to be briefed by the Chinese regulators on financial markets, raising hopes of further, relatively imminent market-supportive/stimulus measures (the meeting could take place as soon as Tuesday, per the sources).

- Feedthrough from Monday’s after hours comments from the CSRC re: margin matters and a crackdown on illegal trading activity, as well as reports of limits surrounding total return swap and quant fund trading activity.

- This bucked the recent trend of under delivery vs. market appetite for deeper support.

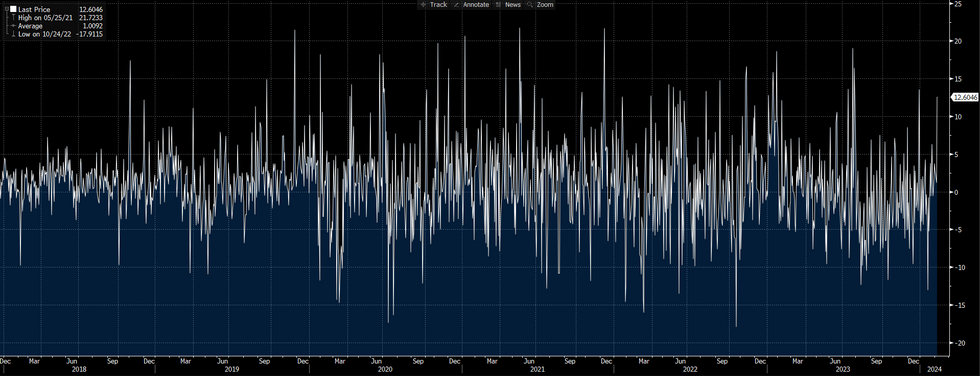

- Flow wise, the latest instances of official support (outlined earlier) triggered the largest round of northbound net daily purchases via the HK-China Stock Connect links since late December (CNY12.6bn), as international participants deployed capital in the hope that the support levers will allow the CSI 300 to move away from ~5-year lows.

- This was the sixth consecutive day of net purchases of mainland equities via those links. ~CNY24.3bn of net purchases have been lodged over that timeframe.

- Note that ETF volumes were not as pronounced as what was seen in recent sessions.

- Some desks have estimated that the national team has already purchased CNY70bn+ of mainland equities in recent weeks.

- Looking a little deeper, L’Occitane befitted from M&A discussions.

- Cosmetics names benefited from spill over surrounding Estée Lauder’s earnings.

Fig. 1: Daily Net Northbound Flows Via The Hong Kong-China Stock Connect Schemes (CNY bn)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.