-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - US Curve Consolidating Post-CPI Flattening

Highlights:

- Tsy curve consolidates post-CPI bear flattening move

- EUR/GBP higher for first session in eight on soft UK CPI

- Focus turns to US retail sales, empire manufacturing

US TSYS: Consolidating CPI Bear Flattening Ahead Of Data Deluge, 20Y Supply

- Cash Tsys little changed after yesterday’s CPI-induced bear flattening, tracking -1.0 to +0.2bps across the curve ahead of a deluge of data including retail sales plus 20Y supply.

- 2YY -0.2bps at 4.614%, 5YY -1.0bps at 3.991%, 10YY -0.2bps at 3.742% and 30YY +0.2bps at 3.776%, whilst 2s10s of -86.5bps is very close to fresh multi-decade lows.

- TYH3 trades 2+ ticks higher at 112-13 on slightly below average volumes. It cracked trendline support after CPI with yesterday’s low of 112-03 now forming initial support, whilst to the upside sits the 50-day EMA of 114-00+.

- Data: Empire mfg Feb (0830ET), Retail sales Jan (0830ET), IP & Cap Util Jan (0915ET), NAHB Feb (1000ET), Business inventories Dec (1000ET), TIC Flows (1600ET) plus weekly MBA mortgage data (0700ET).

- Bond issuance: US Tsy $15B 20Y Bond auction (912810TQ1) – 1300ET

- Bill issuance: US Tsy $36B 17W Bill auction – 1130ET

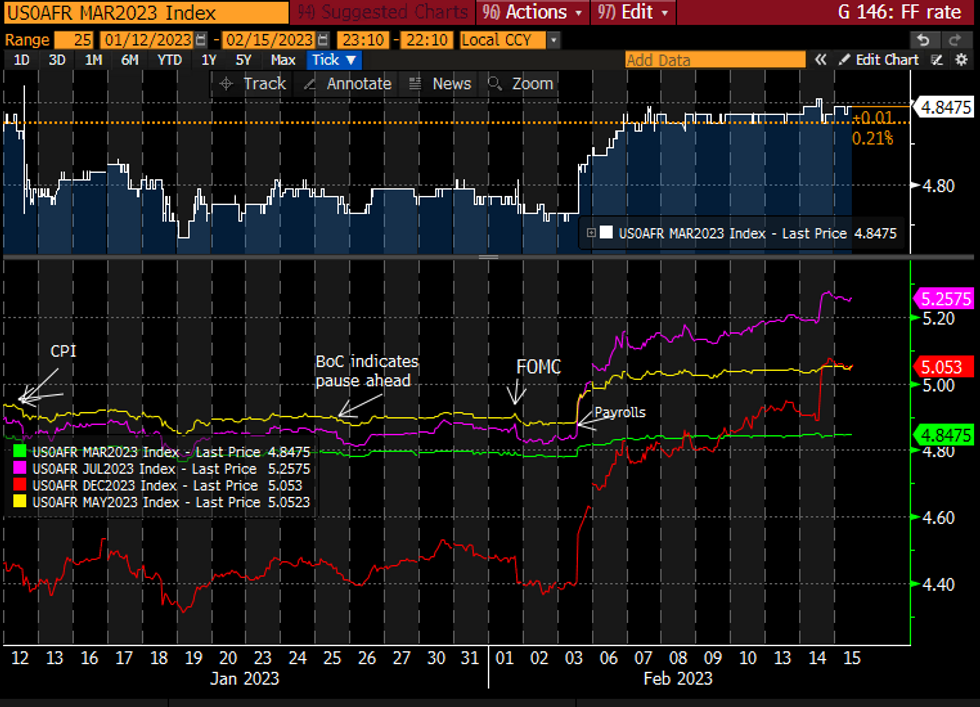

STIR FUTURES: Fed Path Consolidates Post-CPI Push Higher

- Fed Funds implied hikes sit off yesterday’s highs that included a terminal touching 5.29% but broadly consolidate another significant push higher.

- 27bp for March (+0.5bp), cumulative 47bp for May (unch), 68bp to a terminal 5.26% Jul (-0.5bp, with Sep higher than Jun) before only 20bps of cuts to 5.05% year-end (-1.5bp).

- No Fedspeak scheduled today after Logan, Harker and Williams (all voting this year) helped see the terminal move in a 5.25-5.29 range. There is a solid docket though including retail sales, IP and Empire giving the first business survey for Feb.

Source: Bloomberg

Source: Bloomberg

Summary Of Analyst Views Post CPI

Most analysts remain below market pricing of a terminal hitting an effective 5.26% after 68bps of additional tightening from current levels (high of 5.29% yesterday). Some notable changes/views:

- DB revise their terminal 50bps higher to 5.6% whilst Barclays and Citi keep to their prior top of consensus range of a terminal target rate range of 5.25-5.5%.

- On the dovish side, RBC and SEB stick with their call for one last 25bp hike in March whilst ING see the door open to rate cuts in 2H23. See table

EUROPE ISSUANCE UPDATE:

German auction result:

- Mixed results with the German 30y Bund auction.

- The 1.25% Aug-48 Bund saw very strong results with a tight tail, strong bid-to-cover and LAP in excess of the prevailing price.

- However, the 0% Aug-52 Bund was weak. It was technically uncovered, saw a wide tail and even the mid-price was below the prevailing market price.

- E1bln (E808mln allotted) of the 1.25% Aug-48 Bund. Avg yield 2.3% (bid-to-cover 2.29x).

- E1.5bln (E1.202bln allotted) of the 0% Aug-52 Bund. Avg yield 2.26% (bid-to-cover 0.9x).

- New 30y Jun-54 OLO: Size set at E5bln (in line with MNI expectation)

- Spread set earlier at 1.40% Jun-53 OLO mid +8bps

- Books closed in excess of E34bln (inc E2.9bln JLM)

- 12y Feb-35 SlovGB: Spread set at MS+80bp, books in excess of E6.2bln

- 20y Feb-43 SlovGB: Spread set at MS+120bp, books in excess of E4.9bln

FOREX: EUR/GBP Snaps Losing Streak on Soft UK CPI

- The greenback is on the up early Wednesday, extending the recovery off the post-CPI lows printed Tuesday.

- USD strength has been particulatly noted against GBP following UK inlflation data. CPI fell short of forecast across both headline and core measures. GBP/USD slipped upon release, drifting to daily lows of 1.2071. Similarly, EUR/GBP bounced further off the 50-dma support to snap a seven-session losing streak.

- AUD trades heavy, slipping against all others in G10, on the back of local equity weakness and softer stock markets in China and Hong Kong. The currency wasn't impacted by RBA Governor Lowe's comments to a senate committee, at which he stated that rates needed to rise further but unsure by how much and that the Board was "serious" above bringing down inflation.

- Focus for the session ahead turns to US retail sales and empire manufacturing releases, both of which are expected to improve from the prior month. ECB's Lagarde is also scheduled to speak from Strasbourg.

FX OPTIONS: Expiries for Feb15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0490-00(E554mln), $1.0650-70(E1.3bln), $1.0700(E1.2bln), $1.0715-20(E694mln), $1.0800-05(E1.1bln), $1.0830-50(E1.3bln)

- USD/JPY: Y130.00($1.1bln), Y130.15-21($1.1bln), Y134.00($1.2bln)

- AUD/USD: $0.7000(A$1.2bln)

- USD/CAD: C$1.3300(E700mln), C$1.3400(E690mln)

- USD/CNY: Cny6.8500($2.2bln), Cny6.9500($1.3bln), Cny7.0000($1.3bln)

EQUITIES: S&P E-Minis Steadies Following Turbulent Post-CPI Price Action

- EUROSTOXX 50 futures traded higher Thursday last week to breach 4265.00, the Feb 3 high. Despite the pullback from last week’s best levels, the fresh cycle high confirms a resumption of the uptrend and opens 4303.20, the 2.382 projection of the Sep 29 - Oct 4 rise from the Dec 20 low. Note that the trend is overbought. A pullback would represent a healthy correction. Key support lies at 4097.00, the Jan 19 low. Initial support is at 4167.50, the 20-day EMA.

- The S&P E-Minis trend condition is bullish and the latest pullback is considered corrective. The contract has pierced initial support at 4069.52, the 20-day EMA. Firmer support lies at the 50-day EMA, at 4006.63. A clear break of this average would signal scope for a deeper pullback and potentially highlight a reversal. Key resistance and the bull trigger intersect at 4208.50, the Feb 2 high. A breach would resume the uptrend.

COMMODITIES: Gold Breaks 50-Day EMA Support, Trend Conditions Bearish For Now

- WTI futures showed above the Friday high ahead of the Monday close, marking an extension of the recovery from $72.25, the Feb 6 low. The rally has confirmed a break of the 50-day EMA, at $78.34, strengthening the current bull cycle. Prices have faded slightly since, however the medium-term view remains unchanged. Key resistance remains at $82.66, the Jan 18 high. On the downside, initial firm support has been defined at $76.52, the Feb 9 low.

- Trend conditions in Gold are bearish for now, and the yellow metal remains in a corrective cycle. This follows the strong sell-off on Feb 2 / 3 as well as the break of support at the 50-day EMA early Wednesday. A clear break here would strengthen a bearish case and suggest scope for a deeper pullback - towards $1825.2, the Jan 5 low. On the upside, key resistance and the bull trigger is at $1959.7, the Feb 2 high.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/02/2023 | 0930/0930 | * |  | UK | ONS House Price Index |

| 15/02/2023 | 1000/1100 | ** |  | EU | Industrial Production |

| 15/02/2023 | 1000/1100 | * |  | EU | Trade Balance |

| 15/02/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 15/02/2023 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 15/02/2023 | 1330/0830 | *** |  | US | Retail Sales |

| 15/02/2023 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/02/2023 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 15/02/2023 | 1400/1500 |  | EU | ECB Lagarde at Plenary Debate on ECB Annual Report | |

| 15/02/2023 | 1415/0915 | *** |  | US | Industrial Production |

| 15/02/2023 | 1500/1000 | * |  | US | Business Inventories |

| 15/02/2023 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 15/02/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 15/02/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 15/02/2023 | 2100/1600 | ** |  | US | TICS |

| 16/02/2023 | 0030/1130 | *** |  | AU | Labor force survey |

| 16/02/2023 | 0915/1015 |  | EU | ECB Panetta in Discussion at Centre for European Reform | |

| 16/02/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 16/02/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 16/02/2023 | 1330/0830 | *** |  | US | PPI |

| 16/02/2023 | 1330/0830 | *** |  | US | Housing Starts |

| 16/02/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 16/02/2023 | 1345/0845 |  | US | Cleveland Fed's Loretta Mester | |

| 16/02/2023 | 1500/1600 |  | EU | ECB Lane Dow Lecture at NIES London | |

| 16/02/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 16/02/2023 | 1600/1100 |  | CA | BOC Governor Macklem at House of Commons hearing | |

| 16/02/2023 | 1700/1700 |  | UK | BOE Pill Fireside Chat at Warwick University Think Tank | |

| 16/02/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

| 16/02/2023 | 1830/1330 |  | US | St. Louis Fed's James Bullard | |

| 16/02/2023 | 1945/2045 |  | EU | ECB de Guindos Students Discussion | |

| 16/02/2023 | 2100/1600 |  | US | Fed Governor Lisa Cook | |

| 16/02/2023 | 2255/1755 |  | CA | BOC Deputy Beaudry speaks on "The importance of the Bank of Canada’s 2% inflation target" | |

| 16/02/2023 | 2315/1815 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.