-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - US Curve Sits Modestly Flatter Ahead of Tues CPI

Highlights:

- US curve sits modestly flatter ahead of Tuesday CPI

- JPY slipping as markets gear for Ueda nomination

- Equities hold above Friday lows as earnings season comes to a close

US TSYS: Twist Flattening Ahead Of Thin Docket In CPI's Shadow

- Cash Tsys have twist flattened overnight with the front end extending Friday’s net push cheaper whilst the 10Y pushes richer after a refusal when testing the 3.75% level.

- A very thin docket consisting only of Fed Governor Bowman (voter) speaking on banking supervision at 0800ET before bill issuance likely sees headlines and flow dictate the session, all with tomorrow’s US CPI in mind.

- 2YY +1.5bp at 4.532%, 5YY +0.7bp at 3.930%, 10YY -0.2bp at 3.730% and 30YY -1.6bp at 3.800%. 2s10s of -80bps remains off Thursday’s fresh multi-decade low of -86bps.

- TYH3 trades just half a tick higher at 112-22+ on below average volumes, having poked through to a new low of 112-18+ that now sits above trendline support at 112-14+ drawn from the Oct 21 low.

- Bill issuance: US Tsy $60B 13W, $48B 26W bill auctions (1130ET)

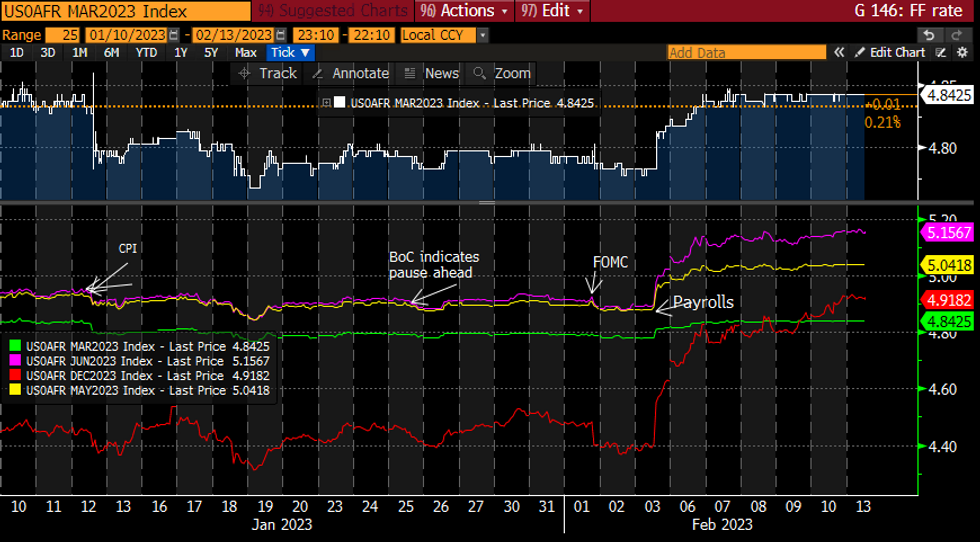

STIR FUTURES: Fed Path Holding Last Week’s Substantial Push Higher For 2H23

- Fed Funds implied hikes are near unchanged overnight after last week saw the Dec’23 implied rate rise 30bps since Friday’s post-payrolls close and ~50bp pre-payrolls.

- 26bp for Mar, cumulative 46bp for May, 61bp to a terminal 5.19% for Jul before cutting 27bps to 4.92% by year-end, the latter only sustainably moving above the expected March rate for the first time this cycle on Friday.

- Gov. Bowman speaks on banking supervision 0800ET including text. She last spoke Jan 10 wanting to see compelling signs that inflation has peaked and is on a downward path.

Source: Bloomberg

Source: Bloomberg

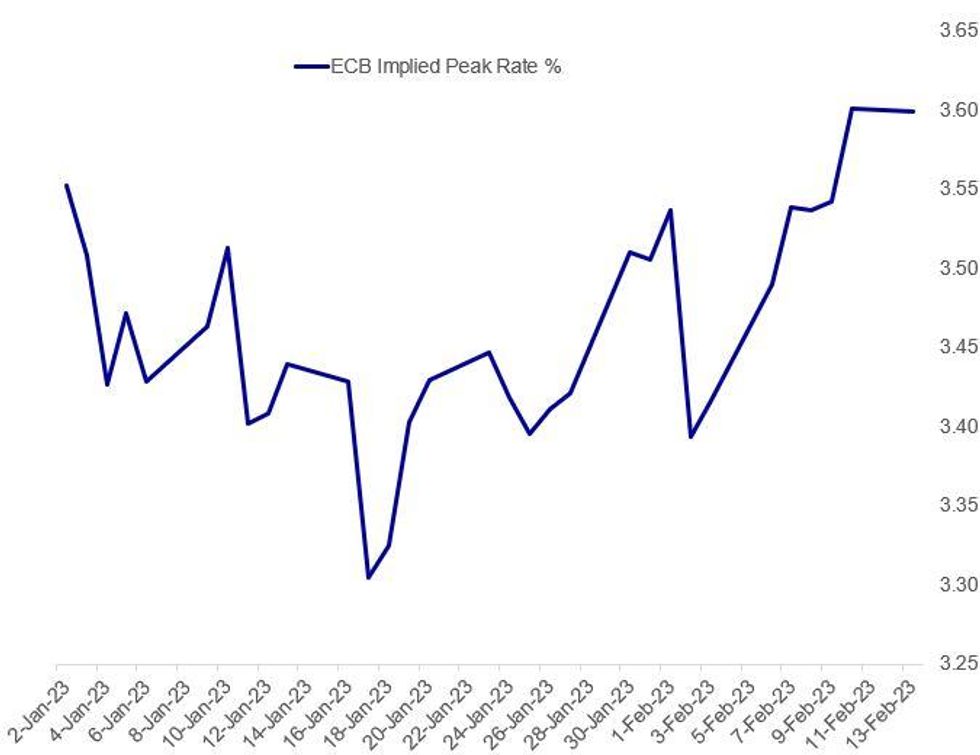

ECB Peak Pricing Splits The Hawk-Dove Divide

ECB rates are priced to rise 110bp from here, to an implied 3.60% depo rate peak in Jul / Sep - that's roughly where it closed Friday, and represents the 2023 high (just below the cycle peak set in late December). That includes a 50bp hike almost fully priced for the March meeting.

- MNI reported last week citing Eurosystem sources that hawkish ECB officials want to push rates higher than 4% this year, but doves see the cycle peak as much as 1 percentage point lower, and are preparing to argue for a slowdown in hikes in May. Current pricing more or less splits the difference.

- There are still modest cuts priced in (~5bp) by year-end, but that's well off the 20-25bp in cuts priced at one point in late Dec / early Jan.

- This is mirroring moves in the US curve which have seen 2023 Fed easing prospects fade alongside the stronger-than-expected January payrolls report.

Source: MNI, BBG, on OIS pricing

Source: MNI, BBG, on OIS pricing

FOREX: JPY Slides Ahead of Formal Ueda Nomination

- JPY is sliding early Monday, with the currency weaker against all others in G10 just a few days out from the formal nomination of Ueda as the new BoJ governor. His nomination is expected to be presented to parliament tomorrow, ahead of which EUR/JPY sits back above the 50-dma at 141.55 and USD/JPY just shy of the Y133.00 handle.

- Currencies are more mixed elsewhere, with the greenback solidly mixed. The USD Index closed back above the 50-dma on Friday, opening gains toward 103.964. A break above here puts the USD at the strongest level since early January.

- NZD is modestly the best performer ahead of the NY crossover, however recent ranges are being largely respected. Next target for NZD/JPY sits at 84.21, a break above which opens 84.92 in the medium-term.

- The schedule is less busy Monday, with few datapoints or risk events on the docket. Fed's Bowman, ECB's Knot and Centeno are scheduled to speak, while Lagarde and Panetta attend a Eurogroup meeting.

- Markets look to Tuesday for direction, with the January CPI report in focus. Analysts look for CPI to slow to 6.2% Y/Y, and 5.5% for the core metric.

FX OPTIONS: Expiries for Feb13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E1.0bln), $1.0809-10(E592mln), $1.0930(E842mln), $1.1000(E1.5bln)

- USD/JPY: Y130.00-15($1.4bln), Y130.50-60($595mln), Y132.10-12($743mln)

- GBP/USD: $1.2275-90(Gbp786mln)

EQUITIES: Eurostoxx Futures Trade Higher Monday, Resuming Uptrend

- The EUROSTOXX 50 futures traded higher Thursday and breached 4265.00, Feb 3 high. Despite the pullback from last week’s best levels, the fresh cycle high confirms a resumption of the uptrend and opens 4303.20, the 2.382 projection of the Sep 29 - Oct 4 rise from the Dec 20 low. Note that the trend is overbought. A pullback would represent a healthy correction. Key support lies at 4097.00, the Jan 19 low. Initial support is at 4167.50, the 20-day EMA.

- The S&P E-Minis trend condition is bullish and the latest pullback is considered corrective. The contract has pierced initial support at 4069.52, the 20-day EMA. Firmer support lies at the 50-day EMA, at 4006.63. A clear break of this average would signal scope for a deeper pullback and potentially highlight a reversal. Key resistance and the bull trigger intersect at 4208.50, the Feb 2 high. A breach would resume the uptrend.

COMMODITIES: Friday Rally Strengthens WTI Bull Cycle

- WTI futures rallied Friday, marking an extension of the recovery from $72.25, the Feb 6 low. The rally has confirmed a break of the 50-day EMA, at $78.34, strengthening the current bull cycle and note that price has pierced $80.22, 76.4% of the Jan 18 - Feb 6 bear leg. A clear break of this level would expose the key resistance at $82.66, the Jan 18 high. On the downside, initial firm support has been defined at $76.52, the Feb 9 low.

- Trend conditions in Gold are bearish for now, and the yellow metal remains in a corrective cycle. This follows the strong sell-off on Feb 2 / 3 and sights are on the 50-day EMA, at $1855.5. The average represents a key support and has been pierced. A clear break would strengthen a bearish case and suggest scope for a deeper pullback - towards $1825.2, the Jan 5 low. On the upside, key resistance and the bull trigger is at $1959.7, the Feb 2 high.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/02/2023 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 13/02/2023 | 1300/0800 |  | US | Fed Governor Michelle Bowman | |

| 13/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 13/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 14/02/2023 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 14/02/2023 | 0700/0800 | ** |  | NO | Norway GDP |

| 14/02/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 14/02/2023 | 1000/1100 | *** |  | EU | GDP (p) |

| 14/02/2023 | 1000/1100 | * |  | EU | Employment |

| 14/02/2023 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 14/02/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 14/02/2023 | 1330/0830 | *** |  | US | CPI |

| 14/02/2023 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 14/02/2023 | 1600/1100 |  | US | Dallas Fed's Lorie Logan | |

| 14/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 14/02/2023 | 1800/1300 |  | US | Philadelphia Fed's Patrick Harker | |

| 14/02/2023 | 1905/1405 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.