-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - US Yields at New Highs Pre-Housing

Highlights:

- US 10y yields hits a new cycle high, with focus on housing data

- GBP recovery fades further as inflation hits new 40 year high

- German swap spreads narrow as authorities provide repo relief

US TSYS: Treasuries See New 10YY Cycle High, Housing Data In Focus First

- Cash Tsys have extended a cheapening seen through Asia hours that had been led by Minneapolis Fed’s Kashkari (’23 voter) along with block sales. The move continued with a small beat for UK CPI before yields largely plateaued with the 10YY hitting a new cycle high of 4.079%, surpassing the post-CPI 4.075%.

- 2YY +5.5bps at 4.484%, 5YY +6bps at 4.282%, 10YY +6bps at 4.067%, and 30YY +3.6bps at 4.066%.

- TYZ2 remains vulnerable, trading 16+ ticks lower at 110-12+ on average volumes, through yesterday’s low and approaching support at 110-00 with the post-CPI low of 110-02 just above.

- Data: Housing firmly in focus after yesterday’s NAHB slide, with weekly mortgage applications plus permits/starts for Sept.

- Fed: Beige Book (1400ET), plus Kashkari (1300ET), Evans (1800ET) and Bullard (1830ET).

- Bond issuance: US Tsy $12B 20Y Bond auction re-open (912810TK4) – 1300ET

- Bill issuance: US Tsy $33B 17W bill auction – 1130ET

- Earnings: Notable earnings today Procter & Gamble pre-market, IBM & Tesla after market.

STIR FUTURES: Fed Terminal Pushes Back Towards Cycle High

- Fed Funds implied hikes unwind yesterday’s dip, in part taking a cue from a small beat for UK CPI.* 77.5bp for Nov (unch), 141.5bp to 4.5% Dec (+2bp), terminal 4.94% Mar’23 (+4bp) and 4.58% Dec’23 (+4.5bp).

- Kashkari (’23) yesterday: “If we don’t see progress in underlying inflation, or core inflation, I don’t see why I would advocate stopping at 4.5, or 4.75, or something like that.”

- Back-loaded Fedspeak: Beige Book plus no text from repeat Kashkari, Evans ('23) and Bullard (’22) welcome remarks.

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

UK: What bucket sizes could the BOE use for active gilt sales?

- The Bank of England confirmed in a statement at 18:00BST yesterday evening that it would commence active gilt sales on 1 November.

- The prior official guidance from the Bank (announced at the same time as the temporary purchases were launched) had been that gilt sales would begin the W/C 31 October.

- Under the original plans we would have seen three operations each fortnight with GBP580mln of sales of each of shorts (3-7 year), mediums (7-20 year) and longs (20+ years).

- The Bank has confirmed that there will be no sales of long-dated gilts in Q4-22.

- It stated that sales would be "a similar size and frequency as had been previously announced, with any shortfall as a result of the earlier postponement relative to its previous sales plan incorporated into sales in subsequent quarters."

- To us this reads as though the bucket size will be between the originally-proposed GBP580mln but below GBP870mln.

- Based on yesterday's closing prices and the average discount to the initial purchase price in both the short-dated and medium-dated buckets, GBP580mln buckets for 24 operations (i.e. a whole year) would see the Bank's balance sheet fall by GBP35bln. This is only slightly smaller than the GBP40-45bln total reduction in the balance sheet set out by the MPC through active gilt sales.

- The MNI Markets team would expect that given the communication surrounding similar sizes and catch up in subsequent quarters, that bucket sizes will be set between GBP580mln-750mln (with the latter consistent with a GBP45bln reduction in the balance sheet through active gilt sales).

- The BOE will announce the full details of this quarter's sales tomorrow at 18:00BST.

UK: PM Truss Informed 15% Of Party Has Submitted No Confidence Letters

Dan Hodges at the Mail on Sunday: "Understand Liz Truss has been informed by Graham Brady the traditional threshold of letters for a leadership challenge has been breached. But he is insisting on a threshold of half the parliamentary party before acting."

- The threshold for triggering a leadership election is 15% of sitting Conservative MPs, which at present would equate to 54 members. However, under current leadership rules, Truss cannot be challenged for her first year as leader.

- If half of the party (178 MPs) submit letters of no confidence then it appears Chair of the 1922 Committee of backbench Conservatives would view this as significant enough to push for a change in rules (which are decided by the 1922 executive). Still no guarantee of a 'unity candidate' being agreed to that would avoid another divisive and lengthy members vote (presuming MPs allow members to decide leader again).

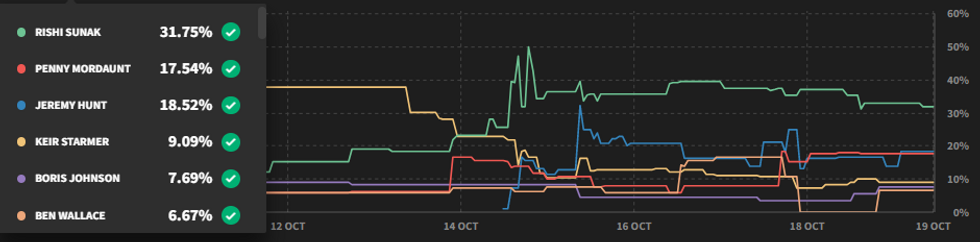

- Betting markets see former Chancellor Rishi Sunak as the strong favourite to be the next PM, with a 31.8% implied probability according to Smarkets, with new Chancellor Jeremy Hunt second with an 18.5% chance. Notably, bettors do not believe there is a strong likelihood of Truss leading the Conservatives into the next election, with Labour leader Sir Keir Starmer given a 9.1% implied probability of being the next PM.

Source: Smarkets

Source: Smarkets

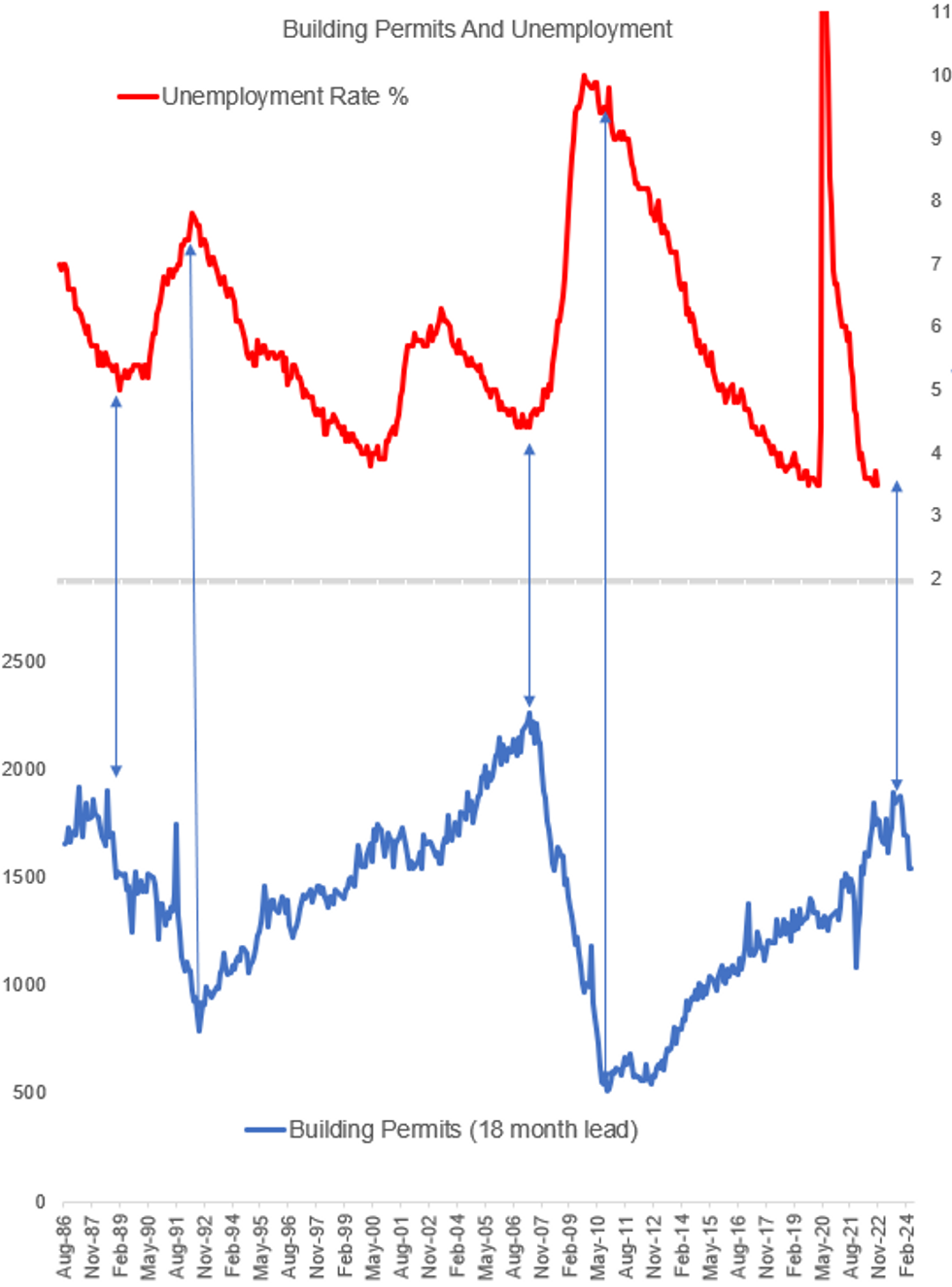

US: Housing Deterioration Bears Close Attention

Incoming US housing market data bears increasingly close attention over the next few months, including today's release for September (0830ET: Housing Starts seen at 1.461mln vs 1.575mln prior; Building Permits 1.530mln vs 1.517mln prior).

- While most coincident US data has remained strong in recent months, the housing sector is a major leading indicator in the economic cycle.

- The NAHB Homebuilder Sentiment index, which fell for the 10th straight month in October per data out yesterday amid soaring mortgage rates, typically leads Building Permits by a few months (which in turn leads Starts by a few months) .

- And in turn, major turns in Building Permits leads turning points in the unemployment rate by around 1.5 years (see chart). For context, Permits peaked at 1.9mln in December 2021, putting a labor market turn sometime in mid-2023.

- Chair Powell notably said last month that "the housing market may have to go through a correction" to improve buyer affordability and - as with many other aspects of the economy - bring supply and demand into better balance. And a deterioration in housing activity from multi-year peaks has previously presaged Fed cutting cycles by a year or two.

Source: Census Bureau, BLS, MNI

Source: Census Bureau, BLS, MNI

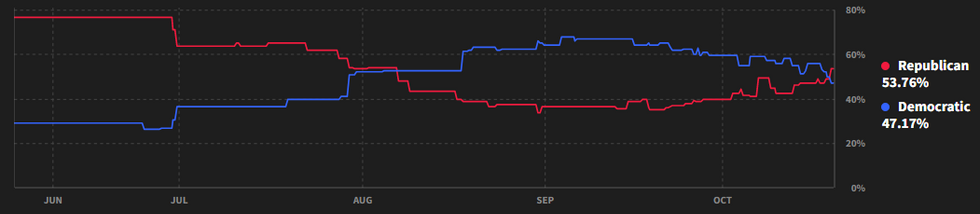

US: GOP Favourites For The Senate In Betting Markets For First Time Since August

Data from Smarkets shows the Republicans as favourites to take control of the Senate in the 8 November midterm elections among political betting markets. This is the first time the GOP have stood as favourites over the Democrats since early August.

- At the time of writing, the Republicans are given a 53.8% implied probability of gaining control of the Senate, with the Democrats afforded a 47.2% chance of retaining control (sum adds to more than 100% due to bookmaker's margin).

- The betting markets shifting towards the Republicans stands in contrast to some political pollsters and forecasters. Nate Silver's 538.com's forecasting model has the Democrats with an implied probability of 63% of retaining the Senate, compared to 37% for the GOP taking control of the chamber.

Source: Smarkets

Source: Smarkets

FOREX: GBP Recovery Fading as CPI Tops Expectations

- The greenback is making furtive gains early Wednesday, with EUR/USD faltering on the approach to Tuesday's $0.9876 high during the Asia-Pac session, and drifting lower through the European morning.

- GBP is among the session's poorest performers as markets further bake-in the likelihood of a protracted stagflationary phase in the UK, as CPI came in ahead of expectations at 10.1%. GBP/USD shed around 30 pips following the release, as has traded sluggishly since, touching pullback lows of 1.1247. Key short-term support has been defined at 1.0924, the Oct 12 low.

- NZD is extending the week's outperformance, trading higher against all others in G10 on an extension of the post-CPI move earlier in the week. NZD/USD looks to $0.5719 for direction, a break above which would open $0.5814 and above.

- USD/CHF, meanwhile, has bounced back to parity, with the pair erasing the Monday/Tuesday losses to narrow the gap with the cycle best at 1.0074.

- Canadian inflation data takes focus going forward, wit markets expecting Y/Y CPI to drift to 6.7% from 7.0% prior. US housing starts and building permits are also on the docket. Markets also await speeches from BoE's Cunliffe & Mann, ECB's Visco & Centeno and Fed's Kashkari, Evans and Bullard.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/10/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 19/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 19/10/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 19/10/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 19/10/2022 | 1230/0830 | *** |  | CA | CPI |

| 19/10/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/10/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 19/10/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 19/10/2022 | 1500/1600 |  | UK | BOE Mann Panels Webinar on ERM Crisis | |

| 19/10/2022 | 1700/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 19/10/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 19/10/2022 | 1800/1400 |  | US | Fed Beige Book | |

| 19/10/2022 | 2230/1830 |  | US | St. Louis Fed's James Bullard | |

| 19/10/2022 | 2230/1830 |  | US | Chicago Fed's Charles Evans | |

| 20/10/2022 | 0030/1130 | *** |  | AU | Labor force survey |

| 20/10/2022 | 0600/0800 | ** |  | DE | PPI |

| 20/10/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 20/10/2022 | 0720/0320 |  | ID | Bank of Indonesia Rate Decision | |

| 20/10/2022 | 0800/1000 | ** |  | EU | EZ Current Account |

| 20/10/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 20/10/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 20/10/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 20/10/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/10/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 20/10/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 20/10/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 20/10/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 20/10/2022 | 1600/1200 |  | US | Philadelphia Fed's Patrick Harker | |

| 20/10/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 20/10/2022 | 1730/1330 |  | US | Fed Governor Philip Jefferson | |

| 20/10/2022 | 1745/1345 |  | US | Fed Governor Lisa Cook | |

| 20/10/2022 | 1805/1405 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.