-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRiEF: Riksbank Puts Neutral Rate In 1.5 To 3.0% Range

MNI: Japan Govt Keeps Economic Assessment, Ups Imports

MNI US MARKETS ANALYSIS - USD Backtracks Post-NFP Strength

Highlights:

- USD backtracks large part of post-NFP strength

- Fed rate path narrows in on pre-JOLTs level

- CB speak in focus, with Fed's Goolsbee, Harker up ahead of Weds CPI

US TSYS: Fedspeak And 3Y Supply Headline Whilst Waiting For CPI Tomorrow

- Cash Tsys trade richer after yesterday’s holiday thinned cheapening, and in doing so yields are back within the high end of Good Friday’s even more heavily thinned session post-payrolls (MNI’s Employment Insight found here).

- 2YY -4.2bp at 3.966%, 5YY -4.0bp at 3.480%, 10YY -3.2bp at 3.385% and 30YY -2.7bp at 3.602%.

- TYM3 trades 7+ ticks higher at 115-24. Resistance is seen close to yesterday’s high of 115-31+, after which lies 116-30 (Apr 5/6 high) with the key resistance at 117-01+ (Mar 24 high) still exposed. To the downside lies 115-02 (20-day EMA).

- Fedspeak: ’23 voters. Chicago Fed’s Goolsbee (1330ET) and Philly Fed’s Harker (1800ET) both with text and Q&A plus Minneapolis Fed’s Kashkari even later (1930ET) with a moderated Q&A.

- Data: The NFIB survey was the only data of the day and came in very slightly higher than expected at 90.1 (cons 89.8) after 90.9. Data focus firmly on tomorrow US CPI, with the MNI Preview to follow later today.

- Note/bond issuance: US Tsy $30B 3Y note auction (91282CGV7) – 1300ET

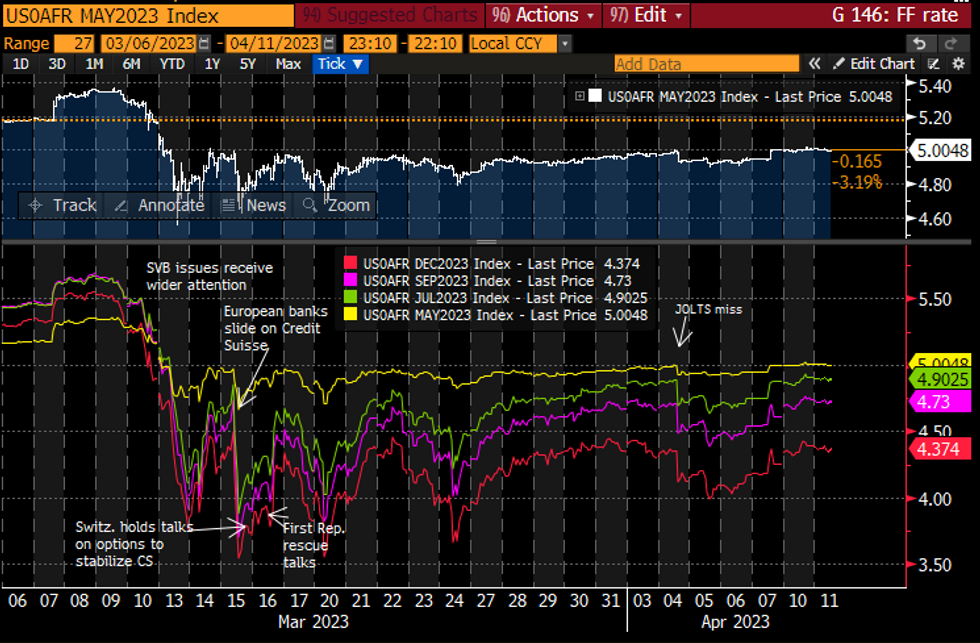

STIR FUTURES: Fed Rate Path Back Near Pre-JOLTS Level

- Fed Funds implied rates have pulled back slightly from yesterday’s further gain to broadly sit near levels reached after Friday’s payrolls report, with the year-end rate in turn back near pre-JOLTS levels.

- 17bp hike for the May FOMC, now only 10bp of cuts for Sept, the first full cut priced for Nov (-28bps) and 46bp of cuts to 4.37% for Dec.

- Fedspeak: Chicago Fed's Goolsbee (’23 voter) with text + Q&A at 1330ET watched closely for a rare steer on views, before Harker (’23) late at 1800ET also with text + Q&A.

Source: Bloomberg

Source: Bloomberg

MNI US Employment Insight, Apr'23: Broadly In Line, But Plenty Of Caveats

EXECUTIVE SUMMARY

- Seasonally-adjusted nonfarm payroll gains were about as close to expectations as they get, especially when combined with minimal downward revisions. But the headline figure was again boosted by the public sector plus a potentially favorable seasonal factor.

- The unemployment rate surprisingly fell back to 3.50% for close to multi-decade lows but participation again improved and both AHE growth and weekly hours worked broadly continued their downtrend.

- Increased labor supply should be welcomed by the Fed, but the still-solid jobs data against a recent backdrop of weaker market indicators saw a 5bp increase to 17bp priced for the May FOMC meeting and a year-end rate of circa 4.35% (going back to pre-JOLTS levels). CPI on Apr 12 will be the key determinant.

PLEASE FIND THE FULL REPORT HERE:

EUROPE ISSUANCE UPDATE:

German Auction Result

- It was a strong auction for the 2.20% Apr-28 Bobl with the lowest accepted price above the pre-auction mid-price and a strong bid-to-offer/bid-to-cover. However, despite the price moving higher immediately after the results were posted, the price has moved lower in the minutes after (in line with the wider moves seen in German bonds).

- E5bln (E4.07bln allotted) of the 2.20% Apr-28 Bobl. Avg yield 2.26% (bid-to-cover 1.29x).

FOREX: Greenback Steps Lower as Post-NFP Rally Fades

- The USD is comfortably the poorest performing currency in G10, stepping lower to wholly erase the post-NFP strength. The USD Index is close to 0.7% off the Friday high, with 101.987 the immediate support.

- Moves come as markets see relatively little read through from the jobs report to Fed monetary policy, with a 25bps step in early May likely marking the peak of this tightening cycle.

- NOK was in focus across early European hours, rallying on the back of a higher-than-expected CPI release, although an inline underlying inflation release reined in any broader rally and now the currency sits softer ahead of NY hours.

- CHF trades more firmly, keeping EUR/CHF within range of last week's lows at 0.9851. Slippage through here opens the 200-dma support at 0.9831.

- Focus for the week rests on tomorrow's inflation release, with markets coalescing around a step down for headline M/M and Y/Y releases, but persistent strength in ex-food and energy measures. Speakers today are made up of Fed's Goolsbee & Harker and ECB's Villeroy.

EQUITIES: E-Mini S&P, Eurostoxx 50 Futures Remain in Technical Uptrend

- Eurostoxx 50 futures maintain a firmer tone and the contract has traded to a fresh trend high today of 4299.00. Price has recently breached resistance at 4268.00, the Mar 6 high and a key hurdle for bulls. The break of this level strengthens bullish conditions with sights on 4300.00. Moving average studies are in a bull-mode set-up and this highlights a broader uptrend. Initial firm support lies at 4180.90, the 20-day EMA.

- S&P E-minis remain in an uptrend and the latest pullback is considered corrective. Price has recently breached resistance at 4119.50, the Mar 6 high, reinforcing a bullish theme. The move higher has also resulted in a break of 4148.48, 76.4% of the Feb 2 - Mar 13 downleg. This signals scope for an extension towards 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key M/T resistance. Firm support lies at 4050.52, the 50-day EMA.

COMMODITIES: WTI Futures Trade Close to Recent Highs

- WTI futures remain in a bull cycle and last week’s gain strengthens this current condition. The contract touched a high of $81.81 on Apr 4, above key resistance at $81.04, the Mar 7 high. A clear break of $81.04 would signal scope for a continuation higher and open $83.04, the Jan 23 high. Key support is seen at $75.72, the Mar 31 high and a gap low on the daily chart. A pullback, if seen, would be considered corrective.

- Trend conditions in Gold remain bullish and last week’s resumption of the uptrend reinforces current conditions - the yellow metal cleared former resistance at 2009.7, the Mar 20 high, to post fresh YTD highs and signal scope for a climb towards $2034.0 next, a Fibonacci projection. On the downside, key support has been defined at $1934.3, the Mar 22 low - a break would highlight a potential reversal.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/04/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 12/04/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 12/04/2023 | - |  | EU | ECB Lagarde and Panetta in IMF/World Bank, G20 Finance Ministers' Meetings | |

| 12/04/2023 | 1230/0830 | *** |  | US | CPI |

| 12/04/2023 | 1230/1430 |  | EU | ECB de Guindos at Asociacion para el Progreso de Direccion Event | |

| 12/04/2023 | 1300/1400 |  | UK | BOE Bailey Remarks at Institute of International Finance | |

| 12/04/2023 | 1300/0900 |  | US | Richmond Fed's Tom Barkin | |

| 12/04/2023 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 12/04/2023 | 1400/1000 |  | CA | Bank of Canada Monetary Policy Report | |

| 12/04/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 12/04/2023 | 1500/1100 |  | CA | Bank of Canada Governor press conference | |

| 12/04/2023 | 1600/1200 |  | US | San Francisco Fed's Mary Daly | |

| 12/04/2023 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/04/2023 | 1800/1400 | ** |  | US | Treasury Budget |

| 13/04/2023 | 0130/1130 | *** |  | AU | Labor force survey |

| 13/04/2023 | 0600/0700 | ** |  | UK | Index of Services |

| 13/04/2023 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 13/04/2023 | 0600/0700 | ** |  | UK | Trade Balance |

| 13/04/2023 | 0600/0700 | *** |  | UK | Index of Production |

| 13/04/2023 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 13/04/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 13/04/2023 | 0800/1000 | * |  | IT | Industrial Production |

| 13/04/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 13/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 13/04/2023 | - |  | EU | ECB Lagarde and Panetta in IMF/World Bank Spring Meetings | |

| 13/04/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 13/04/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 13/04/2023 | 1230/0830 | *** |  | US | PPI |

| 13/04/2023 | 1300/0900 |  | CA | Governor Macklem speaks at IMF | |

| 13/04/2023 | 1300/1400 |  | UK | BOE Pill Speaker at MNI Connect | |

| 13/04/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 13/04/2023 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.