-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD Claws Back Lost Ground Pre-NY

HIGHLIGHTS:

- Dollar clawing back lost ground as yield curve fades prior flattening

- Fed enter media blackout, keeping speaker slate light

- EUR/CHF bounces off 2021 lows

US TSYS SUMMARY: Fading Previous Bull Flattening

Cash Treasury yields are a little higher to start the week, with some modest steepening in the curve as the short-end remains anchored.

- Early moves fading Friday's bull flattening: 2-Yr yield is unchanged at 0.4537%, 5-Yr is up 0.8bps at 1.2041%, 10-Yr is up 2bps at 1.6519%, and 30-Yr is up 2.6bps at 2.094%.

- Dec 10-Yr futures (TY) up 0.5/32 at 130-11.5 (L: 130-08.5 / H: 130-16.5).

- With little on the macro /events calendar (pre-FOMC blackout period also means no Fed speakers), most attention is the White House / Congressional Democrats attempting to get through spending bills this week. House and Senate in session, negotiations ongoing.

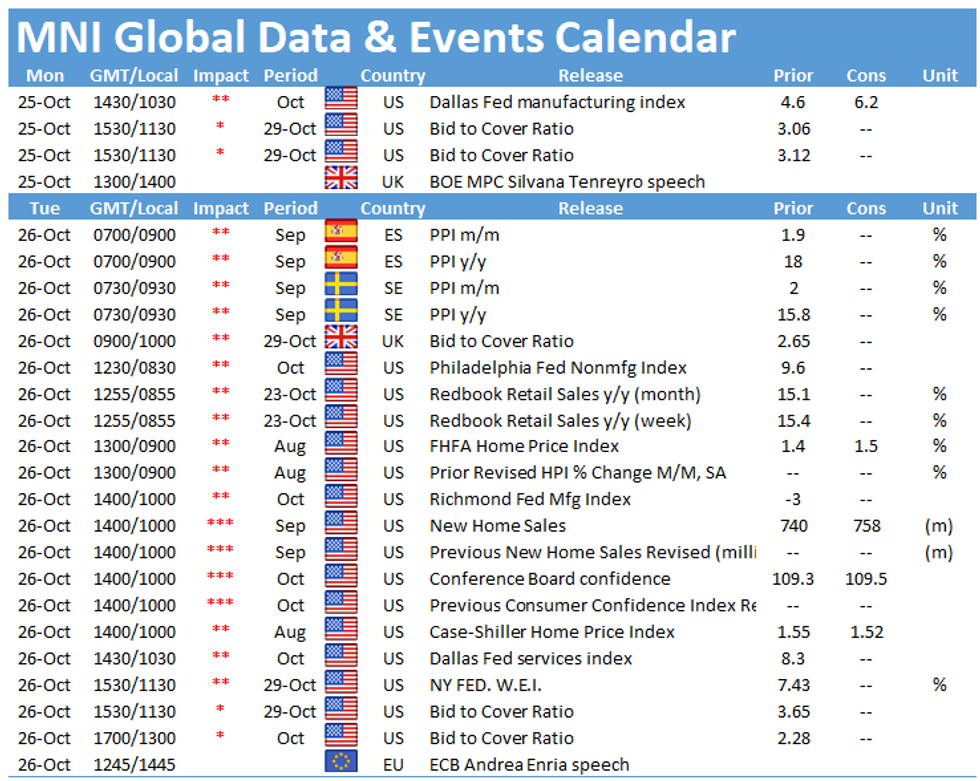

- A quiet day in terms of data, just Chicago Fed Nat'l Activity index (0830ET) and Dallas Fed manufacturing (1030ET).

- In supply, $102B combined in 13- and -26- week bills auction at 1130ET.

- NY Fed buys ~$2.025B of 22.5Y-30Y Tsys.

EGB/GILT SUMMARY: ECB & UK Autumn Budget In Focus This Week

European government bonds have traded mixed this morning, mirroring the uneven trading in FX.

- Gilts have traded a touch weaker with the belly of the curve marginally underperforming. Cash yields are broadly 1-2bp above the Friday close.

- The bund curve has steepened on the back of the short-end firming and longer end yields pushing higher. The 2s30s spread has widened by 5bp.

- Trading in OATs have played out in a similar fashion with the curve 3bp steeper.

- BTPs have inched higher with cash yields broadly 1bp lower.

- The German IFO report for October came in mixed with the current assessment reading coming in slightly better than expected while the expectations and business climate components were weaker than expected.

- Supply this morning came from Germany (Bubills, EUR2.03bn allotted) and the EU(NGEU , EUR2.497bn). Later today France will offer EUR5.4-6.6bn) of BTFs.

- Focus this week will be on the ECB GC meeting, which is not expected to produce any new policy decisions, but is likely to see President Lagarde push back against the recent hawkish shift in market rate expectations. Before then, the UK Autumn budget on Wednesday comes into focus with the better than expected economic performance providing the Chancellor of the Exchequer more room to manoeuvre.

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXZ1 170.5/171.5cs, bought for 11.5 in 2.5k

OEZ1 134.5/135/135.5c fly, bought for 8 in ~2.2k

OEZ1 134.50/75 with 134.50/135.00cs strip, bought for 22.5 in 1k

US:

TYZ1 130/129ps 1x2, bought for 1 in ~20k total

FOREX: EUR/CHF Recovers Off 2021 Lows

- The AUD trades favourably, prompting a recovery in AUD/USD back above $0.75 and toward Friday's highs of $0.7512. Decent gains are also noted against the JPY, with the AUD/JPY cross recovering off Friday's 84.61, eyeing initial resistance at 85.546 ahead of last week's high of 86.26.

- Haven currencies including CHF and JPY trade poorly, with CHF slipping against most others. This has prompted EUR/CHF to recover off YTD lows printed Friday at 1.0659 - which may raise some speculation over the SNB's willingness to intervene at current levels or lower.

- The USD Index is holding the middle ground, sitting in very minor negative territory and comfortably above the 50-dma support of 93.3088.

- The data slate is light Monday, with just the Chicago Fed National Activity Index for September on the docket. The Fed have entered their pre-decision media blackout, so no speeches due outside of an appearance from BoE's Tenreyro at 1400BST/0900ET. She speaks on supply chains and monetary policy.

FX OPTIONS: Expiries for Oct25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1600-15(E689mln), $1.1720-25(E638mln), $1.1883-00($1.2bln)

- USD/JPY: Y113.00($586mln), Y114.25-50($1.2bln)

- USD/CAD: C$1.2500($620mln)

- USD/CNY: Cny6.4000($631mln)

Price Signal Summary - Oil Starts The Week On A Firm Note

- In the equity space, S&P E-minis trend needle still points north and last week's fresh all-time highs confirm a resumption of the broader uptrend. This opens 4591.25, the 1.00 projection of the Jul 19 - Aug 16 - Aug 19 price swing. EUROSTOXX 50 futures broke out of their recent range Friday and have resumed the current upleg. The focus is on 4200.50, the Sep 24 high.

- In FX, EURUSD is consolidating and in pattern terms, the recent pause appears to be a bull flag. Last week's break of the 20-day EMA signals scope for a stronger short-term corrective bounce and the focus is on the 50-day EMA at 1.1694. Key short-term support is unchanged at 1.1572, Oct 18 low. GBPUSD is off its recent high however short-term bullish conditions remain intact. Sights are set on 1.3913, Sep 14 high and a key resistance. USDJPY maintains a bullish tone and the recent pullback is considered corrective. Scope is seen for a climb towards 114.99, 1.50 projection of the Apr 23 - Jul 2 - Aug 4 price swing. Initial support is at 112.81, the 20-day EMA.

- On the commodity front, Gold spiked higher Friday before retracing. The break of $1800.6, Oct 14 high is a positive short-term development and with the yellow metal pushing higher today, scope is seen for a recovery towards $1834.0, the Sep 3 high. WTI trend conditions are unchanged and remain bullish with sights on $85.01, 1.00 projection of the Sep 21 - Oct 6 - 7 price swing.

- In the FI space, trend conditions remain bearish and short-term gains are considered corrective. Bund futures sights are set on 167.79, 2.50 projection of the Sep 9 - 17 - 21 price swing. Key resistance is at 169.92, Oct 14 high. Gilt futures path of least resistance remains down and recent weakness has opened 123.27, 2.00 projection of the Aug 31 - Sep 17 - 21 price swing. Key resistance is unchanged at 125.27, the Oct 14 high.

EQUITIES: S&P Eminis Off Overnight Lows, Nearing Record High

- Asian equities closed mixed, with Japan's NIKKEI down 204.44 pts or -0.71% at 28600.41 and the TOPIX down 6.81 pts or -0.34% at 1995.42. China's SHANGHAI closed up 27.259 pts or +0.76% at 3609.863 and the HANG SENG ended 5.1 pts higher or +0.02% at 26132.03.

- European stocks are mostly higher, with the German Dax up 22.84 pts or +0.15% at 15564.16, FTSE 100 up 36.26 pts or +0.5% at 7220.26, CAC 40 down 6.45 pts or -0.1% at 6759.97 and Euro Stoxx 50 up 1.39 pts or +0.03% at 4197.15.

- U.S. futures are slightly positive, with the Dow Jones mini up 12 pts or +0.03% at 35569, S&P 500 mini up 5.25 pts or +0.12% at 4541.75, NASDAQ mini up 31.5 pts or +0.21% at 15372.5.

COMMODITIES: NatGas Resumes Its Climb

- WTI Crude up $0.9 or +1.07% at $82.95

- Natural Gas up $0.27 or +5.19% at $5.198

- Gold spot up $10.83 or +0.6% at $1791.83

- Copper up $4.2 or +0.93% at $447.8

- Silver up $0.17 or +0.69% at $24.319

- Platinum up $2.51 or +0.24% at $1046.66

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.