-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Japan Q3 GDP To Be Slightly Revised Down

MNI US MARKETS ANALYSIS - USD Erases Early Gains

HIGHLIGHTS:

- USD erases early gains, stocks on a firmer footing

- Fed meeting begins, uneventful decision expected Wednesday

- Earnings in view, with Microsoft the largest

US TSYS SUMMARY: A Little Weaker As FOMC Meeting Gets Underway

Tsys are slightly lower, alongside equities reversing overnight weakness - but TYfutures remain well above the week's opening levels.

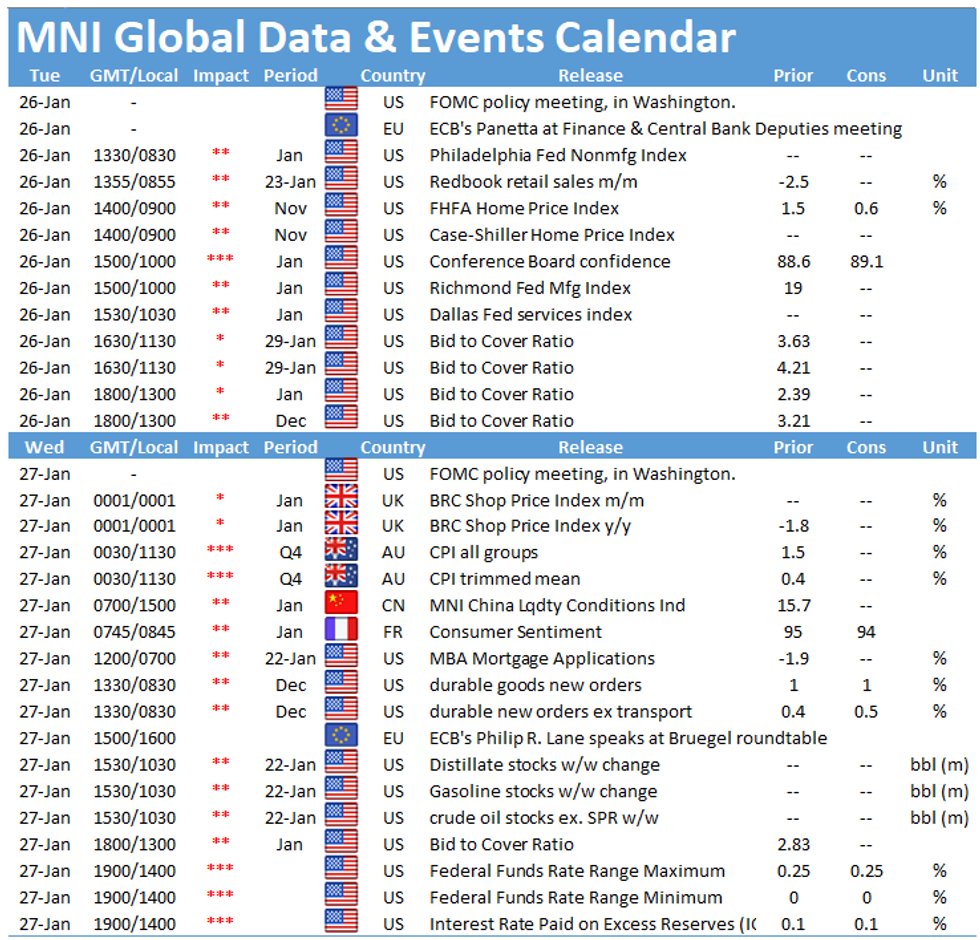

- 5-Year supply the highlight of the U.S. calendar, while 2-day FOMC meeting kicks off today, with decision tomorrow; our preview went out Monday.

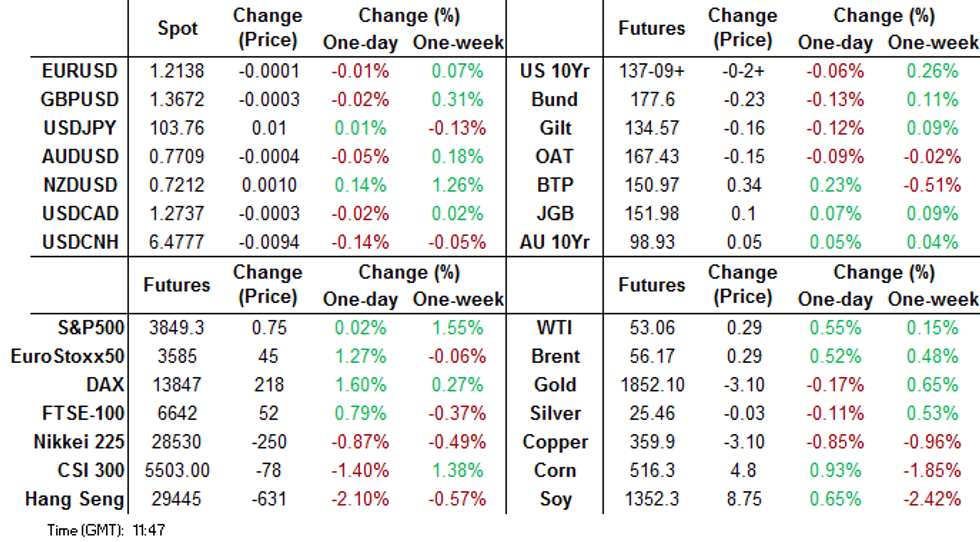

- Mar 10-Yr futures (TY) down 3/32 at 137-09 (L: 137-09 / H: 137-14.5), with the curve a little steeper: 2-Yr yield is up 0.6bps at 0.1211%, 5-Yr is up 1.3bps at 0.4151%, 10-Yr is up 1.9bps at 1.0482%, and 30-Yr is up 2bps at 1.8122%.

- Main data is Jan consumer confidence at 1000ET; at the same time we also get Jan Richmond Fed Manufacturing.

- Corporate earnings of interest: Microsoft, J&J, Verizon, Texas Instruments.

- In supply: $60B of 42-/119-day bills at 1130ET, with 1300ET seeing $61B 5-Yr Tsy note auction, as well as sale of $34B in 52-week bills.

- NY Fed buys ~$1.75B of 20-30Y Tsys.

EGB/GILT SUMMARY: Core EGB Curves Bear Steeper

Core European sovereign curves have bear steepened this morning while periphery EGBs and equities have broadly rallied.

- Gilt yields are 1-2bp higher on the day with the longer end of the curve marginally underperforming.

- It is a similar story for bunds with the 2s30s spread trading up 2bp.

- BTPs have rallied with yields 2-3bp lower and the belly slightly outperforming on the day.

- UK labour market data came in better than expected with the 3m/3m employment change for November reading -88k vs -104k survey, while weekly earnings (ex bonus) increased by 3.6% Y/Y vs 3.2% expected

- Supply this morning came from the UK (Gilts, GBP4.25bn), Italy (CTZ/BTPEi, EUR4.00bn) and the Netherlands (DSL, EUR2.705bn).

- The German health ministry appears to have questioned the accuracy of local media reports that suggest the AstraZeneca and Oxford covid vaccines are less effective in those aged over 65 years. This comes amid some acrimony between the UK and EU over the export of vaccines.

EUROPE OPTIONS FLOW SUMMARY

Eurozone:

RXH1 177/175.50/172p fly, sold at 18 in 1k

OEH1 134.5/134ps, bought for 1.5 in 2k

DUH1 112.30/112.40cs vs 112.20/112.10ps, sold the cs at 2 in 5k

DUH1 112.30/40/50/60c condor vs 112.20/112.10ps, sold at 2 in 20k

UK:

LM1 100.25c, bought for 1 in 2.5k (ref 100.035)

EUROPEAN AUCTION RESULTS

UK DMO sells GBP1.75bln nominal of 0.625% Oct-50 Gilt

- Avg yld 0.837% (0.842%)

- Bid-to-cover 2.38x (2.64x)

- Tail 0.3bps (0.4bps)

- Price 94.442 (94.283)

UK DMO sells GBP2.50bln nominal of the 0.625% Jul-35 gilt

- Avg yield 0.614% (0.612%)

- Bid-to-cover 2.66x (2.95x)~

- Tail 0.2bp (0.0bp)

- Price 100.154 (100.183)

Italy sells CTZ/BTPEi:

E3.00bln of the Sep-22 CTZ:

- Average yield -0.277% (-0.369%)

- Bid-to-cover 1.46x (1.77x)

- Price 100.463 (100.681)

- Target volume: E2.5-3.0bln

E1.00bln of the new 0.65% May-26 BTPEi:

- Average yield -0.62% (-0.15%)

- Bid-to-cover 1.65x (1.55x)

- Price 106.85 (104.48)

- Target volume: E0.75-1.00bln

Dutch DSTA Sold E2.705bln 0.25% Jul-25 DSL vs target E2-E3bln

- Average yield: -0.721%

- Price: 104.42

FOREX: USD Creeping Higher, But Progress is Slow

The greenback is the strongest performer in G10 early Tuesday, but progress is slow. EUR/USD came under early pressure, touching new weekly lows of $1.2108, but the pair has recovered since. Italian political wrangling continues to garner focus, with the Italian PM Conte today handing in his resignation in an attempt to kickstart the process of negotiating support for a new coalition.

Despite the Italian uncertainty, EUR is faring well, rising against most others. NZD also trades well, with the currency seeing some support on the back of an MNI interview with RBNZ former Chief Economist, who said he sees the RBNZ tapering their QE programme this year.

Focus today turns to US consumer confidence numbers for January and speeches scheduled from ECB's Centeno and de Cos. Earnings season resumes, with Johnson & Johnson, 3M, Microsoft and Verizon.

FX OPTIONS: Expiries for Jan26 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2100(E727mln), $1.2230-50(E625mln), $1.2300(E514mln)

USD/JPY: Y105.00($510mln)

AUD/USD: $0.7700-15(A$873mln-AUD puts)

USD/CNY: Cny6.4600($500mln)

TECHS: Price Signal Summary - Bunds Test Key Resistance

- E-mini S&P futures are consolidating. The trend outlook is unchanged and remains bullish. The focus is on 3900.00 next. Support lies at 3788.50, Jan 25 low.

- EUROSTOXX50 key support is at 3524.63, Jan 5 low and 3521.84, the 50-day EMA

- In FX, recent gains in EURUSD are still considered corrective. Key levels to watch are:

- 1.2054 support, Jan 18 low and trigger for 1.2011, Sep 1 high.

- Resistance at 1.2230, Jan 11 high.

- USDJPY focus is still on the bear channel top drawn off the Mar 24 high at 103.99 today. A break is required to signal a reversal.

- EURGBP remains bearish. Last week's breach of 0.8867 and 0.8861, the Nov 23 and Nov 11 lows reinforces this theme. Resistance to watch is 0.8925, Jan 18 high. Scope is seen for a move to 0.8808, May 13, 2020 low.

- On the commodity front, levels to watch in Gold are resistance at $1875.2, Jan 21 high and support at $1832.6, Jan 20 low. Oil contracts remain above support. Brent (H1) support to watch is $54.45, the 20-day EMA and WTI (H1) support lies at $51.30, also the 20-day EMA.

- In the FI space:

- Bunds (H1) tested key resistance earlier at 177.96, Jan 14 high. This level has so far offered resistance. A break would trigger stronger gains and open 178.37, Jan 4 high.

- Key resistance in Gilts (H1) at the 20- and 50-day EMAs was breached yesterday. Futures are lower this morning. A return higher though would open 135.04, 61.8% retracement of the Jan 4 - 12 downleg

EQUITIES: Stocks Solid, But Short of Weekly Highs

Equity indices in Europe are on a firm footing, with core continental markets higher by 1.0-1.5%. Nonetheless, core markets are still shy of weekly highs, keeping a breakout contained for now.

US futures are mixed, with the Dow slightly outperforming while NASDAQ, S&P 500 futures lag, sitting in minor negative territory. All time highs for the e-mini S&P sit well within reach at 3859.75.

US earnings season continues, with reports from Microsoft, Johnson & Johnson, Verizon and Texas Instruments among the largest firms to report.

COMMODITIES: WTI, Brent North of Monday's Highs

Both WTI and Brent crude futures are in positive territory ahead of the Tuesday open, with gains of around 0.7% apiece. Monday's highs gave way with little resistance, opening last week's highs of $53.79/56.64 for WTI and Brent respectively. Better equity markets are helping flatter energy products, with the modestly stronger dollar keeping some pressure on prices.

Spot gold has been non-directional so far, with prices inside the Monday range. A similar story for silver so far Tuesday, with 50-dma providing some support at $25.05 today.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.