-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI US MARKETS ANALYSIS - USD Index Eases Off Multi-month High

HIGHLIGHTS:

- Risk-off theme moderates Friday; futures indicate higher Friday open

- USD index eases off multi-month high

- Personal income/spending and Fedspeak the calendar highlight

US TSYS SUMMARY: Weaker But Bracing For Weak Feb Income/Spending Data

Tsys are touching session lows, with 10-Yrs underperforming on the curve amid bear steepening.

- Jun 10-Yr futures (TY) down 13/32 at 131-23.5 (L: 131-23.5 / H: 132-04), giving up Weds and Thurs's gains. 2-Yr yield is down 0.2bps at 0.1348%, 5-Yr is up 1.8bps at 0.8524%, 10-Yr is up 3.6bps at 1.6689%, and 30-Yr is up 2.9bps at 2.386%.

- Risk appetite has been positive overnight, with core FI weakening - upbeat vaccine news from Thurs (EU not banning exports, Pres Biden doubling vaccination targets) seen driving. Stock futures higher but off session's best levels; conversely USD weaker but off lows.

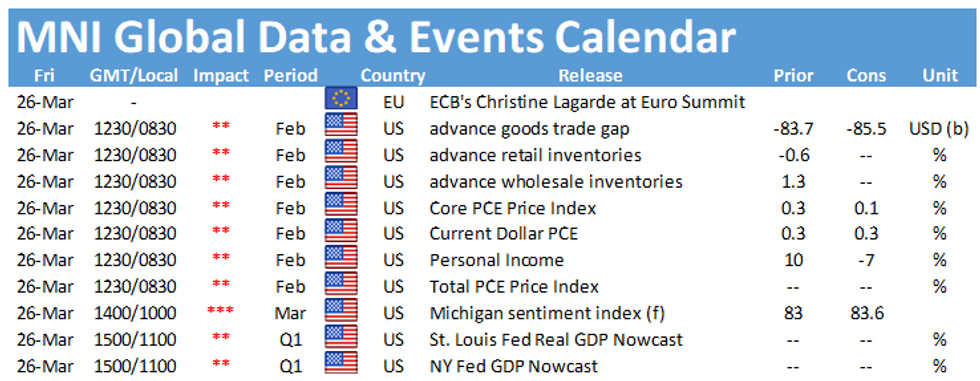

- Feb personal income/spending data at 0830ET is the calendar highlight, including the PCE price deflator reading. A sharp decline in both income and spending is expected, with consensus reflecting the fact that Feb was between months with stimulus checks (in Jan and Mar).

- This comes alongside trade balance and retail inventories at the same time. UMich sentiment at 1000ET is final reading.

- Philadelphia Fed Pres Harker appears on Bloomberg TV at 0830ET.

- Other than that, neither supply nor NY Fed operational purchases.

EGB/GILT SUMMARY: Still No Resolution To Vaccine Supply Issues

Markets have shifted to a risk-on position this morning following several days of sovereign bonds trading firmer and equities selling off.

- Gilts have sold off and the curve has bear steepened. Cash yields are 2-5bp higher and the curve 3bp steeper.

- Bunds traded weaker from the open with the long end of the curve similarly underperforming. The 2s30s spread is 5bp wider on the day.

- It is a similar story for OATs where long end yields have pushed up around 5bp.

- Yesterday's EU summit to tackle the bloc's sluggish vaccine roll out failed to establish a clear strategy for accelerating vaccinations. The EC's most contentious proposal - banning exports of doses to certain countries - received mixed support.

- The German IFO survey for March surprised to the upside with the expectations component reading 100.4 vs 95.0 consensus.

- Supply this morning came from Italy (BOTs, EUR6bn).

EUROPE OPTION FLOW SUMMARY

Eurozone:

3RM1 100.7/100.50/100.62c fly, sold at 3 in 5k

UK:

2LU1 99.00p, bought for 4 in 12.5k

FOREX: Risk Bounces, Dragging USD Index Off Multi-Month High

- JPY is weaker early Friday as the recent risk-off theme unwinds somewhat. Equities are firmer headed into the final trading session of the week, with futures indicating a positive open later today.

- The bounce in risk sentiment is helping support antipodean currencies so far Friday, which bounce off the week's underperformance. AUD/USD is clear of the Thursday highs, opening 0.7636 for direction.

- The USD index is off the week's multi-month high printed yesterday (highest since November) but remains above the 200-dma at 92.605 which should keep the outlook positive.

- US data takes focus going forward, with US personal income/spending and PCE numbers for February crossing at 1230GMT/0830ET. Speeches from BoE's Saunders & Tenreyro also cross.

FX OPTIONS: Expiries for Mar26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E487mln-EUR puts), $1.1900(E749mln)

- USD/JPY: Y108.75-80($680mln)

- EUR/GBP: Gbp0.8600(E416mln-EUR puts)

- AUD/USD: $0.7500(A$539mln), $0.7765(A$1.7bln)

- USD/CAD: C$1.2900($520mln)

- USD/CNY: Cny6.40($1.1bln)

TECHS: Price Signal Summary - USDJPY At Fresh 2021 Highs

- In the equity space, S&P E-minis found support yesterday at 3843.25, yesterday's low. The recovery means the 50-day EMA at 3842.85 remains intact. A breach of the average is required to suggest scope for a deeper pullback. Initial resistance to watch is 3944.50, Mar 22 high.

- In the FX space, EURUSD maintains a weaker tone and yesterday cleared the 1.1800 handle. This reinforces current bearish conditions with the focus on 1.1752 next, 1.236 projection of the Jan 6 - Feb 5 - Feb 25 price swing. The GBPUSD outlook remains bearish. The pair has this week cleared 1.3779, Mar 5 low and a bear trigger. Note this has also confirmed a breach of the 50-day EMA and a bull channel base drawn off the Nov 2 low. The focus is on 1.3641, 38.2% of the Sep 23 - Feb 24 bull cycle. Short-term gains are considered corrective. USDJPY is firmer and has traded to a fresh 2021 high. The pair is approaching 109.56, 76.4% of the Mar 2020 - Jan downleg and an important pivot resistance. A clear break would open 109.70/85, Jun 8 and 5 , 2020 highs respectively.

- On the commodity front, Gold is consolidating with support at $1719.3, Mar 18 low. A break above $1755.50 is needed to trigger a fresh round of gains. This would open the 50-day EMA at $1775.6. Recent weakness in Brent (K1) opens $58.56, 38.2% of the Nov 2 - Mar 8 rally. Resistance is at $65.12, Mar 22 high. In WTI (K1), scope is for a move to $55.65, also 38.2% of the Nov 2 - Mar 8 rally. Resistance is at $62.04, Mar 22 high.

- In the FI space:

- Bunds (M1) are lower this morning however recent gains suggest scope for an extension higher. The next resistance is at 172.78, 0.764 projection of the Feb 25 - Mar 11 - Mar 18 price swing.

- Gilts (M1) have this week cleared resistance at 128.33, Mar 16 high, suggesting scope for an extension higher. The next key resistance is at 129.27, Mar 2 high.

- Treasuries (M1) remain in a downtrend and gains are considered corrective. Resistance is at 132-09+, Mar 25 high.

EQUITIES: Higher equities across the board as EU export ban fears fade

- Japan's NIKKEI up 446.82 pts or +1.56% at 29176.7 and the TOPIX up 28.61 pts or +1.46% at 1984.16

- China's SHANGHAI closed up 54.735 pts or +1.63% at 3418.327 and the HANG SENG ended 436.82 pts higher or +1.57% at 28336.43

- German Dax up 116.28 pts or +0.8% at 14730.47, FTSE 100 up 40.72 pts or +0.61% at 6715.07, CAC 40 up 21.35 pts or +0.36% at 5973.13 and Euro Stoxx 50 up 19.94 pts or +0.52% at 3851.74.

- Dow Jones mini up 82 pts or +0.25% at 32589, S&P 500 mini up 10.75 pts or +0.28% at 3910.75, NASDAQ mini up 31.25 pts or +0.24% at 12797.25.

COMMODITIES: Oil and copper lead the moves higher

- WTI Crude up $1.1 or +1.88% at $59.48

- Natural Gas up $0.01 or +0.23% at $2.578

- Gold spot up $0.04 or +0% at $1727.58

- Copper up $7.45 or +1.87% at $404.25

- Silver up $0.07 or +0.28% at $25.1594

- Platinum up $4.88 or +0.42% at $1158.32

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.