-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD/JPY at New 2023 Highs on Debt Optimism

Highlights:

- Treasuries sit a touch cheaper on debt ceiling optimism

- Firming greenback puts USD/JPY at new 2023 highs

- Biden's trip to Japan could slow debt resolution progress into weekend

US TSYS: Mildly Cheaper Post Debt Optimism Hopes, Busy Docket Ahead

- Cash Tsys sit mildly cheaper across the curve, having reversed a mild rally in Asia hours with European markets continuing yesterday’s risk-on push with equities seeing a further pusher, seemingly in a continuation of debt ceiling optimism. Ahead, more emphasis than usual on initial jobless claims and Philly Fed plus Walmart earnings pre-market after shaker retailer reports, Fedspeak including VC nominee Jefferson and the 10Y TIPS auction.

- 2YY +1.3bps at 4.167%, 5YY +2.3bp at 3.607%, 10YY +2.7bp at 3.591% and 30YY +2.5bp at 3.878%.

- TYM3 trades 4 ticks lower at 114-14+ on cumulative volumes of 265k, higher than the recent average but still on the low side. The session low of 114-13 is close to support at 114-10 (May 1 low) after which lies the key support at 113-30+ (Apr 19 low).

- Data: Initial claims (0830ET) closely watched a) being a payrolls reference week and b) coming after Massachusetts fraud has been found to have played a large role in pushing claims higher in the past two weeks. The Philly Fed business survey for May (0830ET) is also watched after the typically volatile Empire survey slumped, with data finished off by existing home sales and the leading index at 1000ET.

- Fedspeak: Jefferson (0905ET), Barr (0930ET), Logan (1000ET).

- Issuance: US Tsy $15B 10Y TIPS auction (91282CGK1) – 1300ET

- Bills issuance: US Tsy $35B 4W, $35B 8W bill auctions – 1130ET

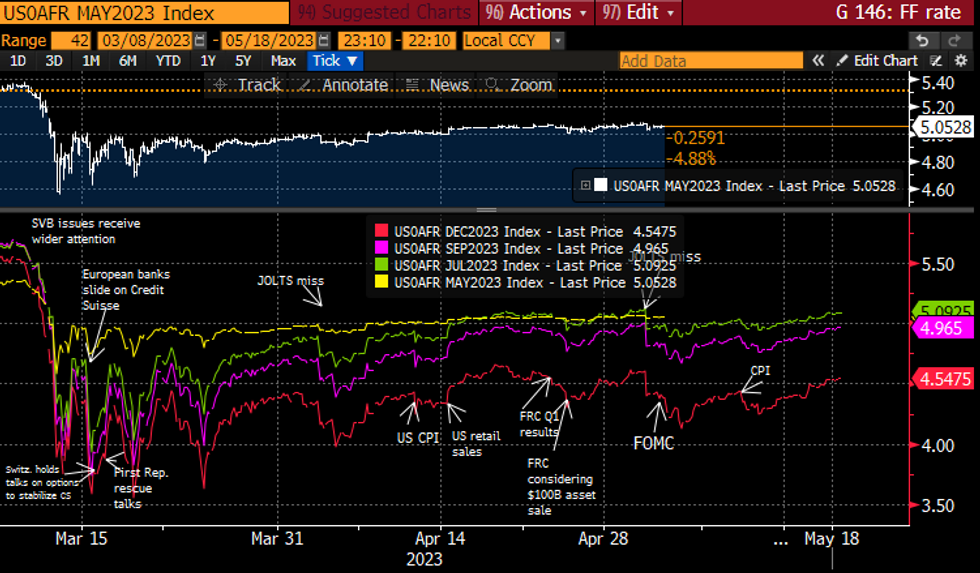

STIR FUTURES: Fed Rate Path Holds Climb On Debt Limit Optimism

- Fed Funds implied rates hold near yesterday’s highs after a sizeable lift following the US open which continued with debt ceiling resolution hopes after separate Biden and McCarthy comments.

- Cumulative change from 5.08% effective: +5.5bp Jun, +1.5bp Jul, -11.5bp Sep, -31bp Nov, -53bp Dec and -75bp Jan (all +0.5-1bp higher on the day). The Dec’23 rate of 4.55% is at highs since May 2.

- Fedspeak: Vice Chair nominee Jefferson discusses the economic outlook (just text) at 0905ET and Logan (’23 voter) speaks at the Texas Bankers Association (text, Q&A) at 1000ET. VC Supervision Barr lands in the middle at 0930ET at the Senate leg of banking hearings. Jefferson last spoke May 13 noting that inflation is still high with ‘mixed’ news this year and that tighter credit will only have a mild effect on growth.

EUROPE ISSUANCE UPDATE:

SPAIN AUCTION RESULTS: Slightly weak auction

- That was a relatively weak Spanish auction with the bid-to-cover falling across all four Bono/Oblis on offer, with all issues now trading below the stop price.

- The only minor positive to make the Spanish auction not quite so weak was the larger issue size - with E6.511bln allotted, the top of the target range.

FOREX: Greenback on Front Foot as Markets Favour Debt Ceiling Resolution

- The USD is firmer against all others in G10 early Thursday, adding to gains noted across Asia-Pac hours. Stock markets are on the up alongside the dollar, providing further evidence that markets see the dollar and equities firmer on any debt ceiling resolution ahead. President Biden is conducting G7-related meetings in Japan, meaning headlines may be more muted over next few days, ahead of a planned press conference on Sunday.

- USD/JPY is among the more notable market movers Thursday, tipping to a new 2023 high at 137.94 having shown above the mid-March highs. Mid-December highs sit just above at 138.17.

- NOK is the poorest performer across G10, putting NOK within range of 2023 lows against the USD. EUR/NOK is similarly higher, with the cross having rejected any test of 50-dma support of 11.5033 earlier this week. 11.7681 marks the next level of note, the 61.8% retracement for the Late-April / early-May downleg.

- The firming greenback (buoyed by renewed debt ceiling hopes) is weighing on emerging market currencies, however other idiosyncratic EM stories are adding additional pressure (China growth concerns, South African infrastructure issues/diplomatic spat with US). This led the MSCI EM FX index to shed the entirety of the early May gains and close at the lowest level since mid-March yesterday. The index broke a multi-month uptrendline posted off the mid-October lows.

- Weekly jobless claims data is the highlight Thursday, with existing home sales also on the docket. The central bank speaker slate should be of more interest, with BoE's Bailey and Fed's Jefferson, Barr and Logan all set to speak.

FX OPTIONS: Expiries for May18 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800-20(E2.3bln), $1.0860(E928mln), $1.0900-10(E1.3bln), $1.0935-45(E1.9bln)

- USD/JPY: Y133.40-60($1.4bln)

- USD/CAD: C$1.3700($880mln)

- USD/CNY: Cny7.00($1.2bln)

EQUITIES: Eurostoxx 50 Futures Trade to Fresh May Highs

- Eurostoxx 50 futures continue to trade above support at 4247.40, the 50-day EMA. The broader uptrend is intact and moving average studies remain in a bull mode position. A stronger resumption of gains would signal scope for a test of 4363.00, the Apr 21 high and a bull trigger. Clearance of this level would confirm a resumption of the uptrend. On the downside, a clear break of the 50-day EMA is required to signal a top.

- S&P E-minis traded higher Wednesday. Price remains above the 50-day EMA, which intersects at 4112.23. A continuation higher would open key resistance and the bull trigger at 4206.25, the May 1 high. Clearance of this level would confirm an extension of the bull trend that started Mar 13. Key support has been defined at 4062.25, the May 4 low. A move through this level would instead highlight a bearish threat.

COMMODITIES: Gold in Bearish Cycle and Trading Near Recent Lows

- WTI futures traded higher Wednesday. A short-term bearish threat remains present and initial resistance at $73.93, the Apr 28 low, is intact. A resumption of weakness and a break of $69.41, the May 15 low, would strengthen near-term bearish conditions. The recent print below $64.58, the Mar 20 low and a key support, is a medium-term bearish development. A clear break of it would resume the broader downtrend.

- Gold remains in a bearish cycle and is trading at its recent lows. Support to watch is $1977.0, the 50-day EMA and $1969.3, the Apr 19 low. A clear break of this support zone is required to highlight a stronger bearish threat. The medium-term trend condition remains bullish - moving average studies are in a bull-mode set-up and this highlights an uptrend. Key resistance and the bull trigger is at $2063.0, the May 4 high.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/05/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 19/05/2023 | 1245/0845 |  | US | New York Fed's John Williams | |

| 19/05/2023 | 1300/0900 |  | US | Fed Governor Michelle Bowman | |

| 19/05/2023 | 1400/1000 | * |  | US | Services Revenues |

| 19/05/2023 | 1455/1655 |  | EU | ECB Schnabel Speech at Conference on Financial Stability and Monetary Policy | |

| 19/05/2023 | 1500/1100 |  | US | Fed Chair Jerome Powell | |

| 19/05/2023 | 1600/1800 |  | EU | ECB Schnabel Panels Conference on Financial Stability and Monetary Policy | |

| 19/05/2023 | 1900/2100 |  | EU | ECB Lagarde Video Presentation at Banco Central Brasil |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.