-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

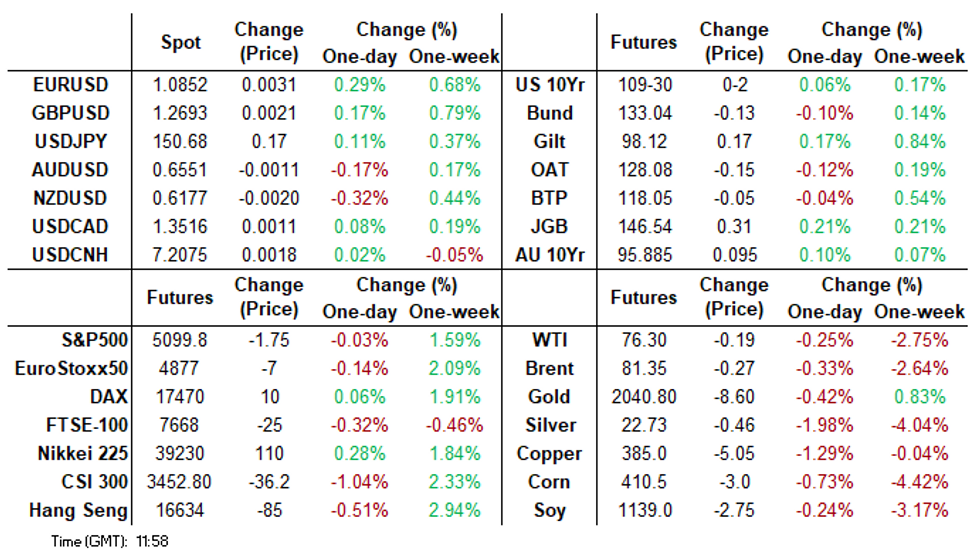

Free AccessMNI US MARKETS ANALYSIS: USD On Defensive, Bonds Off Highs

- Core global bonds off best levels as IG issuance pipeline builds.

- Broader USD lower, month-end models titled towards greenback selling.

- Global calendar light on Monday, most focus on double coupon issuance from the U.S. Tsy.

US TSYS: Off Highs As Double Note Issuance Looms Ahead

Cash Tsys trade just 0-0.5bp richer from Friday’s close, pulling back off highs but keeping to relatively narrow ranges.

- Today’s data is light and sole Fedspeak comes after the close, but front-loaded issuance including today’s double 2Y and 5Y supply is likely weighing on activity.

- TYH4 at 109-30 (+ 01+) is off highs of 110-04, with roll activity dominating volumes. Resistance is seen at 110-16 (20-day EMA) but a bear threat remains with support at 109-10 (Feb 22 low).

- Data: New home sales Jan (1000ET), Dallas Fed mfg Feb (1030ET)

- Fedspeak: KC Fed Schmid (’25 voter) on economic/policy outlook (1940ET, incl text)

- Note/bond issuance: US Tsy $63B 2Y note (1130ET), US Tsy $64B 5Y Note (1300ET) – front-loaded due to need for settlement by month-end

- Bill issuance: US Tsy $70B 26W bill auctions (1130ET), US Tsy $79B 13W bills auctions (1300ET)

STIR: Fed Rate Path Holds Last Week’s Climb, Rare Schmid Appearance Late On

Fed Funds implied rates are little changed from Friday’s close, and in doing so keep to last week’s push to no longer fully pricing a first cut at the June FOMC after hawkish jobless claims data and pushback from Fed Gov. Waller.

- Cumulative cuts from 5.33% effective: 1bp Mar, 5.5bp May, 20bp June and 83bp Dec.

- The latter saw a low of 77.5bp cuts priced for 2024 early on Friday in a further step towards the 75bp of cuts pencilled in by the median FOMC participant at the Dec SEP.

- KC Fed’s Schmid (’25 voter) is the sole scheduled speaker today, late on at 1940ET on the economic and policy outlook incl text. These should be the first mon pol relevant remarks since his appointment in August.

STIR: OI Points To Mix Of SOFR Positioning Swings On Friday

Friday's twist flattening of the SOFR futures strip and preliminary open interest data points to the following positioning swings ahead of the weekend:

- Whites: A mix of net long cover (SFRH4) and net long setting {SFRU4). It is hard to be certain with SFRZ3 & SFRM4 positioning swings given their unchanged price status at settlement.

- Reds: An apparent mix of net long setting and net short cover, with the former dominating.

- Greens: An apparent mix of net long setting and net short cover, with the latter dominating.

- Blues: An apparent mix of net long setting and net short cover, with the former dominating.

| 23-Feb-24 | 22-Feb-24 | Daily OI Change | Daily OI Change In Packs | ||

| SFRZ3 | 1,125,839 | 1,127,119 | -1,280 | Whites | -5,797 |

| SFRH4 | 1,105,473 | 1,129,226 | -23,753 | Reds | +7,156 |

| SFRM4 | 1,097,628 | 1,082,150 | +15,478 | Greens | -18,059 |

| SFRU4 | 852,469 | 848,711 | +3,758 | Blues | +23,000 |

| SFRZ4 | 1,131,800 | 1,118,990 | +12,810 | ||

| SFRH5 | 673,574 | 671,949 | +1,625 | ||

| SFRM5 | 707,914 | 708,160 | -246 | ||

| SFRU5 | 643,476 | 650,509 | -7,033 | ||

| SFRZ5 | 760,032 | 757,618 | +2,414 | ||

| SFRH6 | 490,236 | 514,006 | -23,770 | ||

| SFRM6 | 511,197 | 505,441 | +5,756 | ||

| SFRU6 | 311,434 | 313,893 | -2,459 | ||

| SFRZ6 | 306,878 | 305,823 | +1,055 | ||

| SFRH7 | 178,742 | 173,625 | +5,117 | ||

| SFRM7 | 181,857 | 163,385 | +18,472 | ||

| SFRU7 | 152,193 | 153,837 | -1,644 |

FOREX: EUR In The Green Against Most G10 Peers

A mix start for the Dollar ahead of a really busy week, with European CPIs, US PCE, Speakers, Rolling Bond positions for UK and US Govies, and Month End.

- The SEK still leads in early trade and has extended some small early gains, helped by an underlying bid in US Equities, Emini edges to session high.

- The Kiwi is still at the other end of the spectrum, as market participants turn their attention to the RNBZ rate decision on Wednesday, with the latter expected to stay unchanged.

- NZD has paired some of its losses, now down 0.32% vs 0.48% going into the European session.

- The EUR is underpinned and in the green against all G10, as the street await for the European CPIs this week.

- The Currency had edged higher against the USD, JPY, CNH, CAD, AUD, NOK.

- The Yen has seen broader selling interest vs GBP, USD, EUR and AUD.

- Immediate initial resistance in USDJPY is still at 150.89 High Feb 13.

- Looking ahead, there's no Tier 1 data for the session, speakers include, ECB Lagarde

FX OPTIONS: Expiries for Feb23 NY cut 1000ET (Source DTCC)

- USDJPY: 150.00 (392mln)

- USDCAD: 1.3490 (822mln), 1.3515 (556mln), 1.3550 (280mln)

EUROPEAN ISSUANCE UPDATE

France 30-year mandate

- France has announced a mandate for a new 30-year OAT, due 25th May 2055.

- "The transaction will be launched by syndication in the near future, subject to market conditions."

- We pencil in a E5.0bln transaction tomorrow with risks of a larger size.

- MNI had been expecting the France 30-year later in the year, noting that recent 30-year OATs have seen over E30bln issued before the next issue is launched, and at the time of writing only E26.0bln of the current 3.00% May-54 benchmark is outstanding.

- However, France will be looking to take advantage of some of the E31.0bln maturing from the formerly 3-year OAT (along with E22.1bln of a maturing formerly 10-year BTP). In total, there is E53.4bln of EGBs due to mature this week, and with auctions of just E14.5bln there is a very large negative cash flow this week.

6-year BTP Valore Books At E3.4bln

- Books for the MEF's 6-year Mar-30 BTP Valore (ISIN: IT0005583478) opened this morning, currently totalling E3.41bln.

- The bond has a step-up coupon with a 3.25% rate for years 1-3 and 4.00% for years 4-6 with a bonus of 0.7% for those who hold from the initial issue through to maturity.

- The previous 5-year BTP Valore saw E4.77bln of take-up on day 1 and saw a total of E17.19bln sold across the week.

- Unless there is an early close, books are due to close at 13:00CET on Friday 1 March.

- "The Slovak Republic has mandated J.P. Morgan, Slovenska sporitelna (Erste Group), Tatra banka (Raiffeisen Bank International Group) and UniCredit as Joint Lead Managers and Joint Bookrunners. A new RegS Bearer EUR benchmark offering, with a 10 year maturity, will follow in the near future subject to market conditions." From market source.

- MNI expect the transaction to take place tomorrow and pencil in E1-2bln.

- Slovakia often leaves its first syndication of the year until April. However, in 2023 it held a dual-tranche 12/20-year syndication in February – but last year also saw a E3.0bln redemption in February while this year does not see the first redemption until June. We had thought this might see the first syndication of the year return to April (particularly given the launch of the 2/4-year SlovGBs via the special auction).

EQUITIES: EUROSTOXX 50 Futures Bull Cycle Remains In Play

The trend condition in S&P E-Minis remains bullish, with the upside trigger at 5066.50 giving way to new highs at 5123.50 last week. This erases the initial pullback last week and continues to highlight the fact that corrections remain shallow - a bullish signal. Support to watch is 4992.55, the 20-day EMA. A resumption of gains would open a vol-band based resistance at 5133.43.

- The bull cycle in EUROSTOXX 50 futures remains firmly intact and the contract is holding on to its recent gains. Moving average studies are in a bull-mode position too, highlighting positive market sentiment. Sights are on 4904.40 next, a Fibonacci projection. Further out, a bull channel top at 4955.20, marks an objective. The channel is drawn from the Oct 27 low. Initial firm support lies at 4734.40, the 20-day EMA.

COMMODITIES: Key WTI Resistance Remains Intact

- Recent price activity in Gold has defined key resistance at $2065.5, the Feb 1 high, and key support at $1984.3, the Feb 14 low. Both levels represent important short-term directional triggers. A clear break of the Feb 1 high would highlight a short-term reversal and open $2088.5, the Dec 28 high. For bears, clearance of $1984.3 would expose an important support and bear trigger at $1973.2, the Dec 13 low.

- Recent gains in WTI futures still appear corrective at these levels and key short-term resistance at $79.09, the Jan 29 high, remains intact. Clearance of this level would be a bullish development. On the downside, support to watch lies at $71.49, the Feb 5 low. A break of this level would reinstate the recent bearish theme and pave the way for a move towards $69.79, the Jan 3 low. Initial support lies at $75.48, the 50-day EMA.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/02/2024 | 1500/1000 | *** |  | US | New Home Sales |

| 26/02/2024 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 26/02/2024 | 1600/1700 |  | EU | ECB's Lagarde participates in debate on ECB 2022 Report | |

| 26/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 26/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 26/02/2024 | 1800/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 26/02/2024 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 27/02/2024 | 2330/0830 | *** |  | JP | CPI |

| 27/02/2024 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 26/02/2024 | 0040/1940 |  | US | Kansas City Fed's Jeff Schmid | |

| 27/02/2024 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 27/02/2024 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 27/02/2024 | 0900/1000 | ** |  | EU | M3 |

| 27/02/2024 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 27/02/2024 | 1330/0830 | * |  | CA | Capital and repair expenditure survey |

| 27/02/2024 | 1330/0830 | ** |  | US | Durable Goods New Orders |

| 27/02/2024 | 1340/1340 |  | UK | BOE's Ramsden at Association for Financial Markets | |

| 27/02/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 27/02/2024 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 27/02/2024 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 27/02/2024 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 27/02/2024 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 27/02/2024 | 1400/0900 | ** |  | US | FHFA Quarterly Price Index |

| 27/02/2024 | 1405/0905 |  | US | Fed Vice Chair Michael Barr | |

| 27/02/2024 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 27/02/2024 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 27/02/2024 | 1530/1030 | ** |  | US | Dallas Fed Services Survey |

| 27/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 27/02/2024 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.