-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: RBA Details Hypothetical Monetary Policy Paths

MNI: PBOC Net Injects CNY14.2 Bln via OMO Friday

MNI US MARKETS ANALYSIS - USD on Front Foot Ahead of the Fed

HIGHLIGHTS:

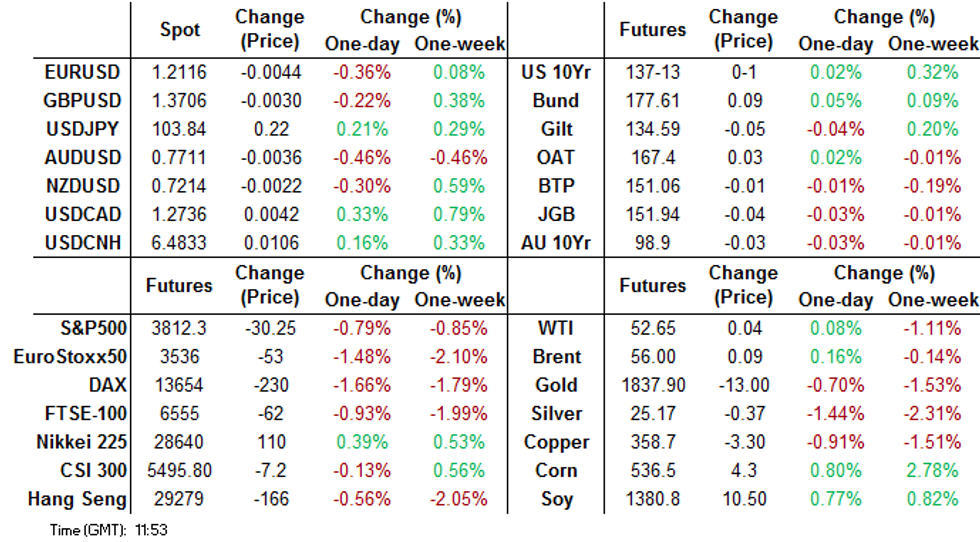

- USD on the front foot ahead of the Fed, with Powell's presser the focus

- US equity futures open gap with all time highs

- European government bonds mixed amid supply from UK, Germany and Italy

US TSYS SUMMARY: Flat Ahead Of Durable Goods, FOMC

Treasuries have drifted slightly lower within Tuesday's ranges overnight, with the belly underperforming ahead of durable goods data and the Fed decision.

- The 2-Yr yield is down 0.2bps at 0.1191%, 5-Yr is up 1.7bps at 0.4256%, 10-Yr is up 0.9bps at 1.0432%, and 30-Yr is up 1.3bps at 1.8039%.

- Mar 10-Yr futures (TY) down 1/32 at 137-11 (L: 137-09 / H: 137-13.5).

- S&P futures testing Tuesday's session lows with the dollar heading higher, but Tsys have not seen a concomitant move.

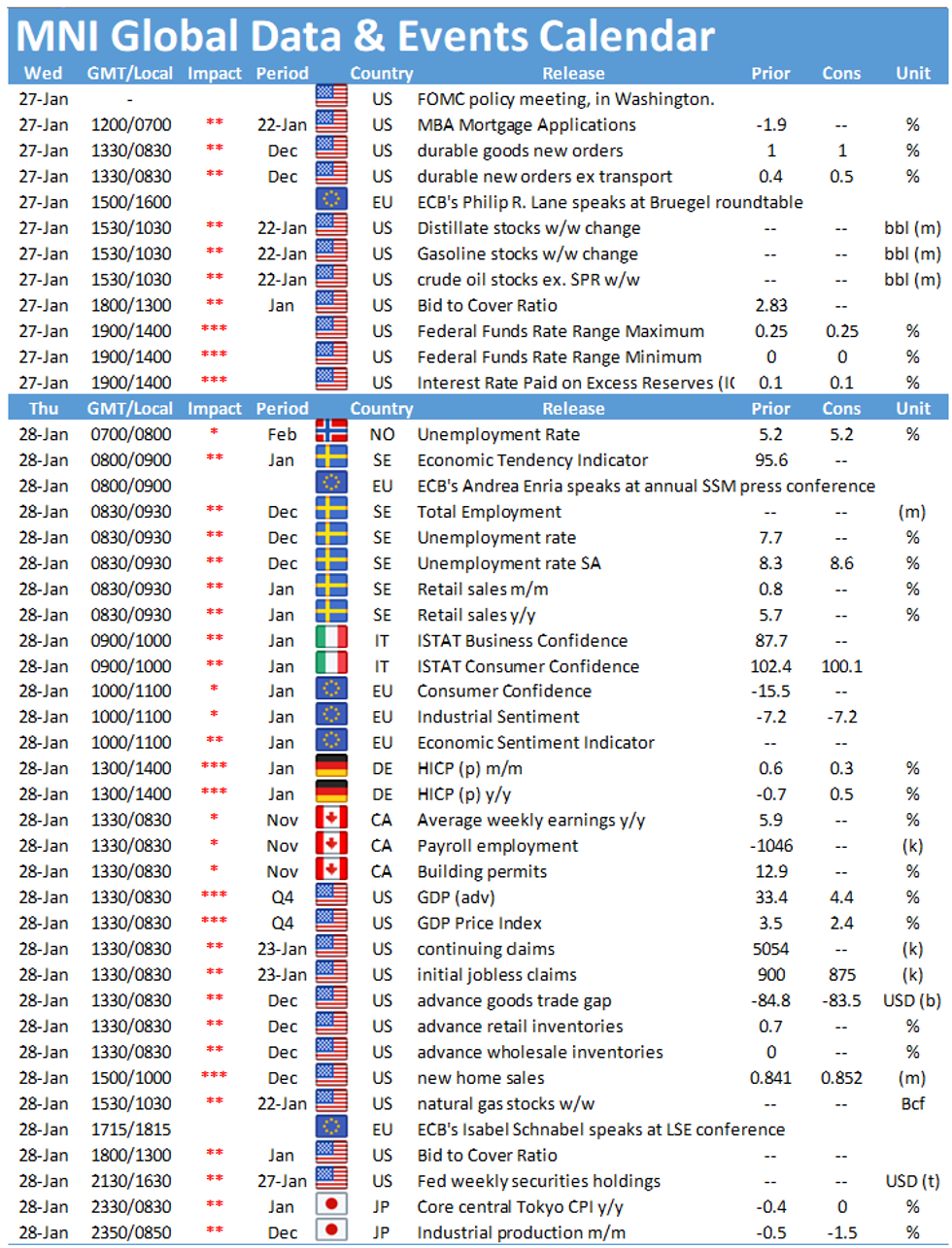

- Data highlight is durable goods at 0830ET, not much else on the docket.

- Later, all eyes on the FOMC - while the decision (1400ET) is unlikely to move the needle much, Powell's press conference (1430ET) likely to be more interesting.

- In supply, $55B of 105-/154-day bills sell at 1130ET; $28B 2-Yr FRN auction at 1300ET. No NY Fed operational purchases today.

EGB/GILT SUMMARY: EGBs Mixed With USD on the Front Foot

European government bonds trade mixed this morning with the US dollar on the front food and equities broadly inching lower.

- Gilts have traded weaker with yields 2bp higher on the day and the curve close to flat.

- The bund curve has steepened slightly with the 2s30s spread 1bp wider on the back of the longer end underperforming.

- The OAT curve is similarly 1-2bp steeper on the day.

- BTPs have firmed with yields edging down 1bp.

- Supply this morning came from the UK (Linker, GBP1.0bn), Germany (Bund, EUR3.307bn), Italy (BOTs, EUR7.0bn) and Greece (Bills, EUR812.5mn).

- The European data calendar was relatively light this morning.

- French Finance Minister Bruno Le Maire has urged a faster disbursement from the EU recovery fund. Any delays in disbursing funds could undermine the regional recovery. Le Maire's comments follow the growing tension around vaccine rollout across the EU.

- Focus shifts to the FOMC meeting later today.

AUCTION RESULTS

GERMAN AUCTION RESULTS: Germany Allots E3.307bln of the 0% Feb-31 Bund

- Average yield -0.54% (-0.52%)

- Buba cover 2.0x (1.64x)

- Bid-to-cover 1.63x (1.35x)

- Price 105.54 (105.36)

- Pre-auction mid-price 105.49

- Total E4bn issued

UK DMO sells GBP1.0bln nominal of the new 0.125% Aug-31 Linker

- Avg real yield -2.820% (-2.950%)

- Bid-to-cover 3.05x (2.57x)

- Price 136.420

EUROPE OPTIONS FLOW SUMMARY

Eurozone:

RXH1 176.00/174.50ps, sold at 12.5 in 1k

RXH1 177/176ps 1x1.5, bought for 16 in 1.8k

ERM2 100.25/99.75/99.25p fly, bought for 0.75 in 1k

ERH2 100.25/100.00/99.75p fly, bought for 0.5 in 1k

UK:

LM1 100.12/100.25c strip, bought for 3.5 in 4k

2LU1 99.75/99.50ps with 99.62/99.37ps, bought for 8.25 in 5k

3LZ1 99.50/99.12ps vs 2LZ1 99.62p, bought the blue for half in 2k

FOREX: Stock Markets Slightly Underwater Pre-Fed

Continental stock markets are in minor negative territory early Wednesday, with German and Italian firms underperforming - both the DAX and FTSE-MIB sit lower by 0.6%, while Spanish firms are broadly flat, outperforming slightly today.

US futures trade just off the all time highs printed yesterday, with the index around 10 points off the 3862.25 levels seen Tuesday. There remains plenty of attention on the drama surrounding some of the most shorted stocks in the US, with in-vogue Gamestop shares higher by well over 100% ahead of the opening bell.

Earnings in focus today include Apple, Tesla, Boeing and Facebook in a busy session for reports.

TECHS: Price Signal Summary - EURGBP Edges Lower

- In equities, E-mini S&P futures pushed higher yesterday to a fresh all-time high of 3862.25. The uptrend remains intact and the focus is on 3900.00. Support is at 3788.50, Jan 25 low.

- EUROSTOXX50 key support is at 3524.63, Jan 5 low and the 50-day EMA

- In the FX space, recent gains in EURUSD are still considered corrective. Key levels to watch are:

- 1.2054 support, Jan 18 low and trigger for 1.2011, Sep 1 high.

- Resistance is at 1.2230, Jan 11 high.

- USDJPY focus is still on the bear channel top drawn off the Mar 24 high at 103.95 today. A break is required to signal a reversal. Also watch resistance at 104.40, the Nov 11 high.

- EURGBP is softer this morning and remains bearish. Last week's breach of 0.8867 and 0.8861, the Nov 23 and Nov 11 lows reinforces this theme. Scope is seen for a move to 0.8808, May 13, 2020 low.

- On the commodity front, levels to watch in Gold are resistance at $1875.2, Jan 21 high and support at $1832.6, Jan 20 low. Oil contracts remain above support. Brent (H1) support to watch is $54.48, Jan 22 low and WTI (H1) support lies at $51.44, the low from Jan 22.

- In the FI space:

- Bunds (H1) tested key resistance yesterday at 177.96, Jan 14 high. A break opens 178.37, Jan 4 high.

- Key resistance in Gilts (H1) at the 20- and 50-day EMAs has been breached. A resumption of gains would open 135.04, 61.8% retracement of the Jan 4 - 12 downleg.

OPTIONS: Expiries for Jan27 NY cut 1000ET (Source DTCC)

EUR/USD: $1.2000(E594mln), $1.2100(E714mln), $1.2150(E612mln), $1.2190-00(E1.4bln), $1.2250(E1.45bln), $1.2285-00(E715mln)

USD/JPY: Y102.00-05($596mln), Y103.25-45($625mln), Y103.95-10($819mln), Y104.50-65($922mln)

GBP/USD: $1.3690-1.3700(Gbp383mln-GBP puts)

AUD/USD: $0.7500(A$1.2bln), $0.7640-50(A$543mln), $0.7750-65(A$612mln-AUD puts)

AUD/NZD: N$1.0665(A$530mln)

USD/CAD: C$1.2600($940mln-USD puts), C$1.2750-65($845mln-USD puts), C$1.2850-60($925mln)

USD/CNY: Cny6.42($1.0bln), Cny6.4960($880mln), Cny6.55($525mln)

USD/MXN: Mxn19.77($635mln)

EQUITIES: Stock Markets Slightly Underwater Pre-Fed

Continental stock markets are in minor negative territory early Wednesday, with German and Italian firms underperforming - both the DAX and FTSE-MIB sit lower by 0.6%, while Spanish firms are broadly flat, outperforming slightly today.

US futures trade just off the all time highs printed yesterday, with the index around 10 points off the 3862.25 levels seen Tuesday. There remains plenty of attention on the drama surrounding some of the most shorted stocks in the US, with in-vogue Gamestop shares higher by well over 100% ahead of the opening bell.

Earnings in focus today include Apple, Tesla, Boeing and Facebook in a busy session for reports.

COMMODITIES: Oil Rangebound - WTI Capped, But Brent Hits New Weekly Highs

Both WTI and Brent crude futures sit in positive territory early Wednesday despite a firmer greenback ahead of the NY open. Brent futures outperform somewhat, with markets hitting new weekly highs and the best level since Jan20. Focus turns to the weekly DoE crude oil inventories numbers, as markets expected a build of just shy of 400,000 bbls today.

Gold is under pressure ahead of the COMEX open, with broad based USD buying largely responsible. Spot gold now trades below the 200-dma support of 1849.38, with Jan22 low at 1837.46 now in view.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.