-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD Sits Just Below Resistance Pre-Fedspeak

Highlights:

- USD sits just below resistance ahead of deluge of Fedspeak

- China's Ukraine peace plan falls on deaf ears

- US PCE, new homes sales and UMich revisions provide the data focus

US TSYS: Underperforming With Broad Cheapening Ahead Of PCE, Fedspeak

- Cash Tsys have underperformed as they’ve moved cheaper through European hours, with front yields pushing towards the top end of yesterday’s range but the longer end still at best mid-range after yesterday’s flattening. PCE and a heavy schedule for Fedspeak headline a solid docket.

- 2YY +1.9bp at 4.716%, 5YY +2.8bp at 4.134%, 10YY +2.5bp at 3.092% and 30YY +1.5bp at 3.900%. 2s10s -81bp vs Wed high of -73bp.

- TYH3 trades 6 ticks lower at 111-07+, remaining off support at yesterday’s low of 110-25+. There is reasonable room to the upside with resistance at 112-24 (20-day EMA).

- Data: PCE and personal incomes/spending (0830ET), New home sales (1000ET), U.Mich consumer survey Feb final (1000ET), KC Fed services Feb (1100ET)

- Fed: Mester CNBC (0800ET), Jefferson & Mester on disinflation paper (1015ET), Bullard (1130ET), Collins (1330ET), Waller (1330ET).

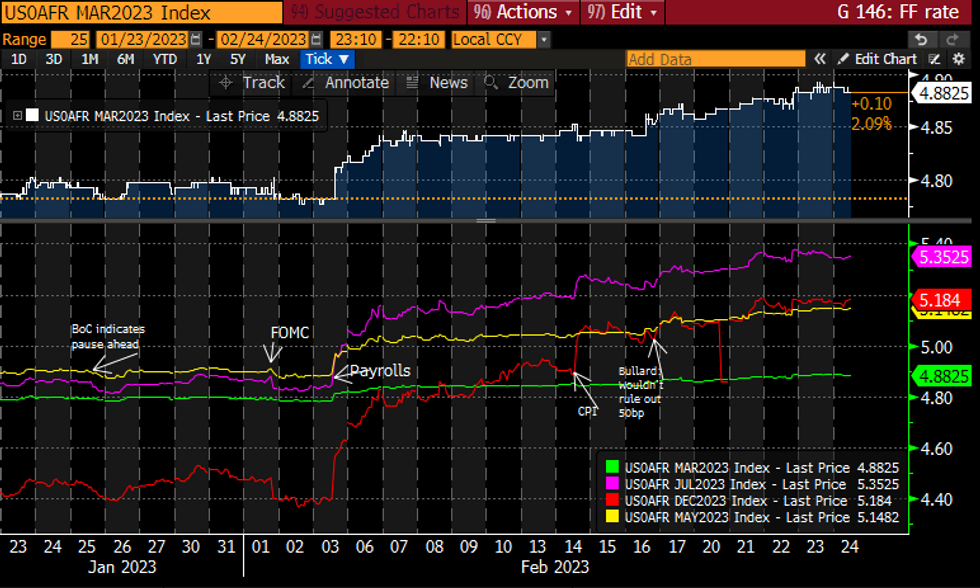

STIR FUTURES: Fed Rate Path Near Unchanged Ahead Of Plentiful Fedspeak

- Fed Funds implied hikes sit little changed from yesterday’s close having marginally pulled back off recent highs.

- 29.5bp for Mar (-0.5bp), cumulative 56bp for May, 77bp to 5.35% (+0.5bp) terminal in Jul before just 17bps of cuts to 5.18% in Dec (+1bp).

- Fedspeak, in voting order: Governors Jefferson and Waller, ’24 voter Mester (chance of ’23 if Goolsbee gets VC nod) and non-voters Bullard and Collins. Only Bullard and Mester have spoken since the Jan CPI on Feb 14, with Jefferson most interest having last spoken mid-Nov (and limited on growth inclusivity) plus Collins last on Jan 19.

Source: Bloomberg

Source: Bloomberg

RATINGS: Friday’s Sovereign Rating Slate

Sovereign rating reviews of note schedule for after hours on Friday include:

- Fitch on the Netherlands (current rating: AAA; Outlook Stable)

- Moody’s on Austria (current rating: Aa1; Outlook Stable) & Sweden (current rating: Aaa; Outlook Stable)

- S&P on Austria (current rating: AA+; Outlook Stable)

- DBRS Morningstar on Slovakia (current rating: A (high), Negative Trend)

HKD: HKMA Intervention, IPO Expectations Fuelling HKD Gyrations

- Some attention being paid to the notable move in HKD forward points this week, with 12m HKD forward points discount hitting 625 points yesterday, the largest discount since 2019.

- The move follows a retreat for USD/HKD from the upper-end of the trading band earlier this week, as well as a continued ratchet higher for the interbank rate, with O/N HIBOR rising to north of 3.00% on Monday, a considerable move off 0.75% the week previously.

- What is driving these moves? HKMA intervention to buy HKD is certainly partially responsible, but contracting interbank liquidity in Hong Kong is often also correlated with demand for sizeable IPOs. China's steps last week to loosen the regulations around Chinese firms listing overseas could juice the IPO pipeline for March in HK. Authorities will be considering new overseas IPO applications from March 3rd.

- Chinese firms including WeDoctor and Black Sesame Technologies are already reportedly considering an HK listing.

- Citi write that the reduction in carry could tilt USD/HKD toward the 7.82 level, although domestic equity strength could add further pressure toward 7.75.

FOREX: USD Index Sits Just Below Resistance Ahead of Friday Fedspeak

- Focus for Asia-Pac trade was on Ueda's appearance in front of Japan's Lower House lawmakers, who signaled a continuity for BoJ policy should he receive full backing to take over Kuroda at the helm of the central bank. Nonetheless, markets eyed Ueda's apparent acknowledgement of the side effects of ultra-easy monetary policy, suggesting more uncertainty over BoJ policy across the medium-term. JPY is among the poorest performers in G10 early Friday, although USD/JPY remains shy of the Thursday high at 143.51.

- AUD maintains its position as one of the poorest performing currencies in G10 this week, slipping alongside global equities as the e-mini S&P technical outlook tilts bearish. The move, initially triggered by Wednesday's Wage Price Index, has extended Friday, puting AUD/USD at the lowest levels since early January and further through the 200-dma at 0.6801.

- The USD Index is inching higher ahead of the NY crossover, and a move north of 104.779 for the USD Index would mark the highest level since early January. Fedspeak and incoming data could be key for any break of this level.

- US PCE data for January will take focus going forward, with new home sales also on the docket. The final reading for University of Michigan sentiment is set to cross, but markets see little change relative to the prelim release.

- The central bank speaker slate is relatively busy, with appearances from Fed's Jefferson, Mester, Bullard and Collins all due as well as BoE's Tenreyro.

FX OPTIONS: Expiries for Feb24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0535-50(E1.9bln), $1.0560(E548mln), $1.0600(E627mln), $1.0680-00(E2.7bln)

- USD/JPY: Y134.00($678mln), Y134.50($1.5bln)

- GBP/USD: $1.1950-52(Gbp510mln), $1.2200-10(Gbp644mln)

- AUD/USD: $0.6750(A$1.4bln), $0.6790-00(A$822mln)

- USD/CAD: C$1.3485-00($1.1bln)

- USD/CNY: Cny6.7000($1.6bln), Cny6.7180($1.4bln)

EQUITIES: E-Mini S&P Recovers From Thursday's Fresh February Low

- Dip buyers emerged in EUROSTOXX 50 futures again Wednesday, with prices rapidly bouncing off the 4211.00 lows. Momentum carried through to the Thursday close, to keep the very short-term view somewhat constructive. Nonetheless, prices remain just below first major resistance at 4303.20, the 2.382 proj of the Sep 29 - Oct 4 rise from Dec 20 low, but still above 4265.00, the Feb 3 high. Note that the trend is overbought. A pullback would represent a healthy correction. Key support lies at 4097.00, the Jan 19 low. Initial support is at 4231.1, the 20-day EMA.

- Further slippage Wednesday put the S&P E-Minis to fresh February lows, with weakness extending through the close. This puts prices below first support at the 50-day EMA at 4031.50 and tilts the near-term view lower. 3901.75 marks next support, the Jan 19 low, although vol band support at 3954.8 could slow any decline. For the outlook to improve, bulls look for a close above the mid-week high at 4034.25.

COMMODITIES: Gold Extends Losses, Drifting Lower to $1800 Handle

- WTI futures drifted lower into the Wednesday close, returning the outlook to neutral for now. Prices now sit back below the 50-day EMA, at $78.34, however the medium-term view remains unchanged. Key resistance remains at $82.66, the Jan 18 high. On the downside, initial firm support has been defined at $72.25, the Feb 6 low for the continuation contract.

- Trend conditions in Gold are bearish for now, with prices extending losses ahead of the Thursday close. This marks an extension of the pullback after the strong sell-off on Feb 2 / 3 as well as the break of support at the 50-day EMA. The clear break strengthens the bearish case and suggests scope for a deeper pullback. Vol band support (the 2.0% 10-dma envelope), successfully contained prices so far, keeping the focus on the level this week.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/02/2023 | - |  | EU | ECB Lagarde & Panetta at G20 Finance Minister Meet | |

| 24/02/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/02/2023 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 24/02/2023 | 1500/1000 | *** |  | US | New Home Sales |

| 24/02/2023 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 24/02/2023 | 1515/1015 |  | US | Fed Governor Philip Jefferson | |

| 24/02/2023 | 1515/1015 |  | US | Cleveland Fed's Loretta Mester | |

| 24/02/2023 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 24/02/2023 | 1630/1130 |  | US | St. Louis Fed's James Bullard | |

| 24/02/2023 | 1630/1630 |  | UK | BOE Tenreyro Panellist at NY Fed | |

| 24/02/2023 | 1830/1330 |  | US | Boston Fed's Susan Collins | |

| 24/02/2023 | 1830/1330 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.