-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI US MARKETS ANALYSIS - USD Softer as Biden Team Gets Greenlight

HIGHLIGHTS:

- USD reverses Monday strength as Biden transition jumps first hurdle

- Gold pressured to new multi-month lows, nears 200-dma support

- NZD strikes multi-year high as NZ consider house price growth in remit

US TSYS SUMMARY: Shrugging Off The Reflation Trade

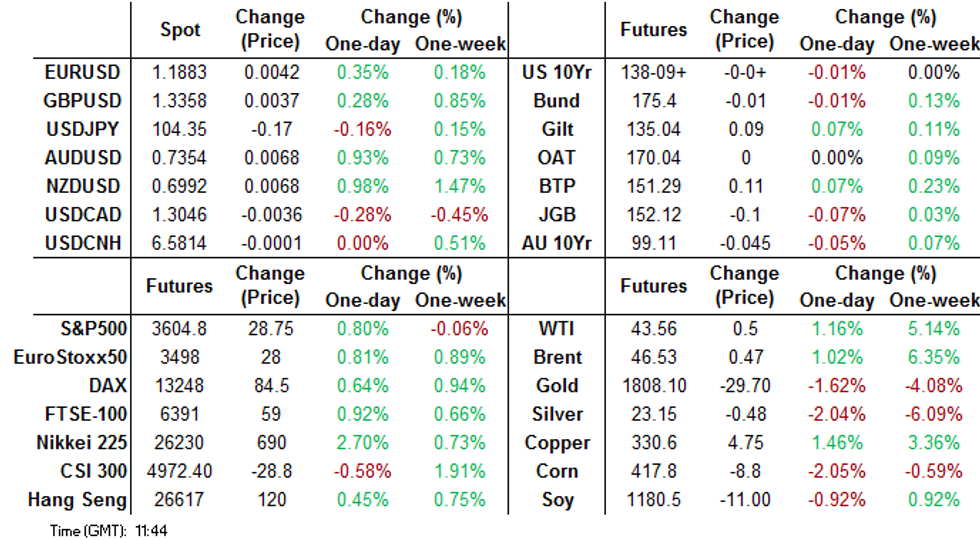

Treasuries are a little weaker overnight Tuesday, having edged higher from Asia-Pac lows. Most of the action has been outside the FI space in a facsimile of Monday's early reflation trade: equities are gaining (~eminis +0.8%), the dollar is weaker (-0.3%) and oil's broken higher.

- Yesterday's strong PMIs, news of the Biden transition proceeding, and optimism over COVID vaccines and Brexit negotiations all contributing to a risk-on tone.

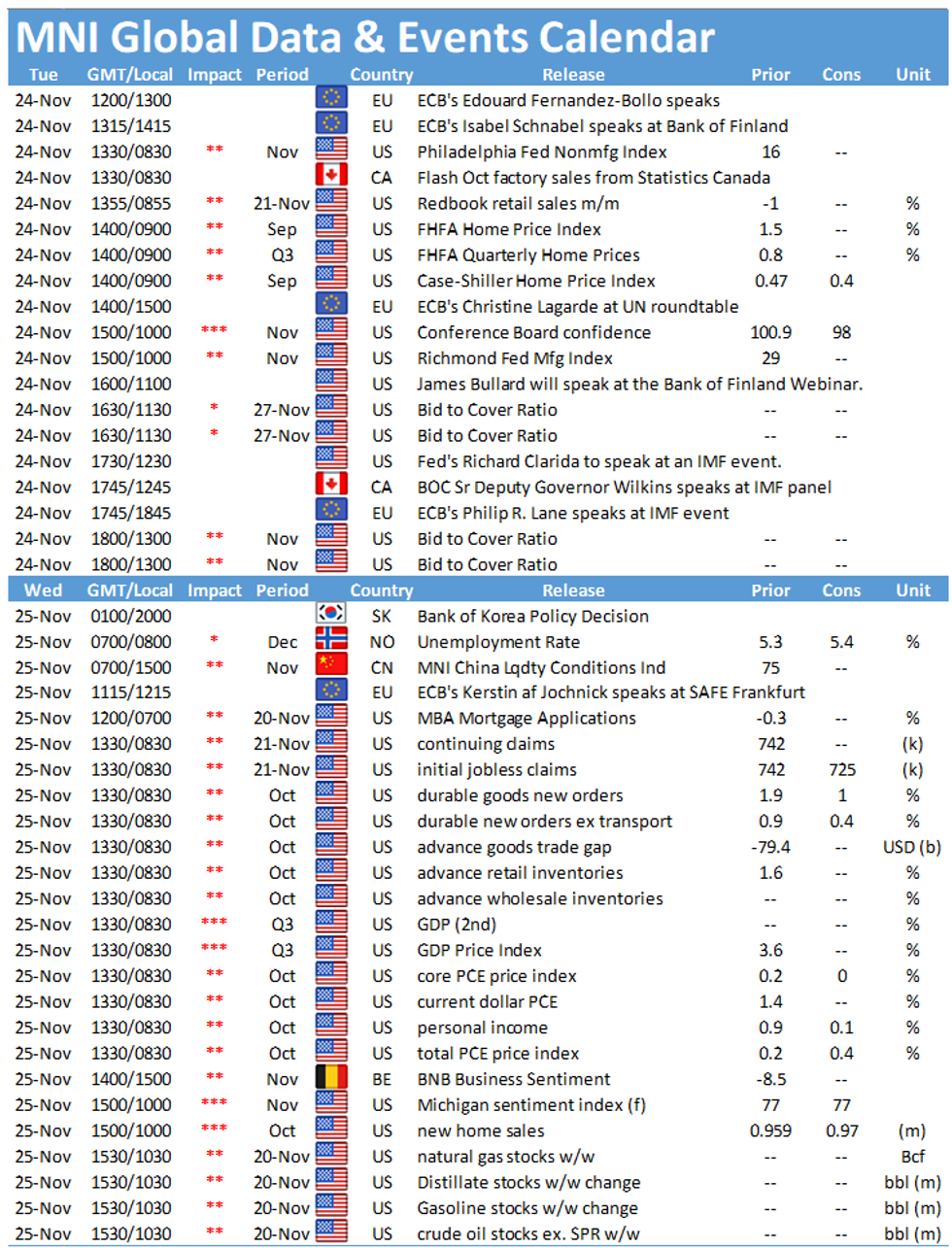

- Main data highlight is Nov Conference Board consumer confidence at 1000ET.

- We also get regional Fed indices. Nov Philly Fed nonmanuf. was supposed to be released at 0830ET but has been published on their website (general activity showed decline to 5.3 from 25.3 in Oct). Nov Richmond Fed at 1000ET.

- St Louis Fed Pres Bullard speaks at 1100ET, NY Fed's Williams at 1200ET, and Vice Chair Clarida at 1245ET.

- In supply, at 1130ET we get $60B of 41-/118-day bills, then at 1300ET: $24B 2-Yr FRN and $56B 7-Yr Note auctions.

- NY Fed to buy ~$2.425B of 1-7.5-Yr TIPS.

EGB/GILT SUMMARY: Core EGBs Sold as Periphery Gains

Markets are broadly trading in a risk-on fashion with G10 FX gaining against the dollar, equities pushing higher, oil rallying and core EGBs selling off alongside firmer trading in the periphery.

- Media reports that Donald Trump has instructed his government to facilitate the Biden transition have been well received and further dilutes the risk of significant frictions with respect to Trump's departure.

- Supply this morning came from the UK (Gilts, GBP4.0bn) and the Netherlands (DSL, EUR1.64bn). The final details of the new Jul-35 EU SURE bond have been published, with the issue size set at EUR8.5bn and books last above EUR90bn.

- The final estimate of Q3 GDP for Germany came in above the previous estimate (8.5% Q/Q vs 8.2%).

- Bunds traded weaker earlier into the session, but have since clawed back losses to now trade close to unch on the day.

- It is a similar story for OATs. Last yields: 2-year -0.691%, 5-year -0.6744%, 10-year -0.3463%, 30-year 0.3515%.

- BTPs have rallied with cash yields up to 2bp lower on the day. The curve is 1bp flatter overall.

- The gilt curve has bull flattened with yields at the longer end pushing down 3bp.

UK AUCTION RESULTS: DMO sells GBP2.75bln nominal of 1.25% Jul-27 Gilt

- Avg yld 0.125% (0.032%), bid-to-cover 1.99x (2.61x), tail 0.4bps (0.2bps), price 107.458 (108.328).

- Pre-auction mid-price 107.438

- An additional GBP687.5mln will be available through the PAOF to successful bidders until 13:00GMT.

The DMO sells GBP1.25bln nominal of the 1.75% Jul-57 Gilt

- Avg yield 0.860% (0.674%), bid-to-cover 2.49x (2.16x), tail 0.1bp (0.6bps),price 127.926 (135.138)

- Pre-auction mid-price 127.707

- An additional GBP312.5mln will be available through the PAOF to successful bidders until 14:30GMT.

DUTCH AUCTION RESULTS: The Netherlands Sells E1.64bn of the 0% Jan-27 DSL Vs E1.5-2.5bn Target

- Average yield -0.656%, Average price 104.12

ISSUANCE: EU SURE Social 15yr Benchmark - Final Terms

- Order book size in excess of EUR90bln excluding JLM's interests

- Spread set at MS -5bps (IPT had been MS-2bps area)

- Deal size will be EUR8.5bln

- Books to close at 10.30 am CET /9.30am GMT

- Citi is B&D and DM

- Today's business

OPTION FLOW SUMMARY

UK:

0LU1 99.75p, sold at 4.75 in 3k (ref 99.91)

EUROZONE:

RXF1 176.00/174.00ps vs 179.50c, bought the put spread for 5 in 5k

IKF1 150.50/147.50ps vs 152.5c, bought the put spread for 24 in 2k

SX7E 85c Dec, bought for 3.55 in 20k

FOREX: NZD Surges as House Prices Could Be Added to Policy Remit

After posting a decent rally on Monday, USD's role has reversed this morning, with the greenback the weakest currency in G10. Many are pinning the pullback in the dollar on news that Trump has granted Biden's team access to transition materials including briefings and initial protocols. While Trump is yet to formally concede and has vowed to continue to fight the election results, this is the clearest sign yet that a formal transition process could be underway.

EUR/USD is within range of yesterday's highs ahead of the NY crossover, but antipodean FX is where the USD weakness is most notable. NZD/USD topped out at a multi-year high of above $0.70, the highest level since mid-2018 on reports that the NZ government could add house prices to the RBNZ's policy remit. AUD is stronger in sympathy.

Datapoints are few and far between Tuesday, with no tier one releases on the docket. The speaker schedule should be of more interest, with BoE's Haskel, ECB's Lagarde & Lane, Fed's Bullard, Williams & Clarida and BoC's Wilkins all due.

OPTIONS: Expiries for Nov24 NY cut 1000ET (Source DTCC)

EUR/USD: $1.1700(E419mln-EUR puts)

USD/JPY: Y102.00($996mln-USD puts), Y105.00($1.5bln)

EUR/GBP: Gbp0.8800(E510mln-EUR puts)

USD/CAD: C$1.3170-80($523mln)

TECHS: Key Price Signal Summary

- Gold has cleared key support at $1848.8, Sep 28 low, resuming the bearish cycle that has been in place since Aug 7. Next stop, $1800.0.

- Brent is firmer and bulls target key resistance at $47.27/31, the Aug highs. WTI is approaching $44.59, Aug 26 high and the key bull trigger.

- In the FX space, EURUSD directional triggers at 1.1920, Nov 9 high and 1.1746, Nov 11 low remain intact. USDJPY key support lies at 103.18, Nov 11 low. Initial support to watch is 103.65, Nov 18 low. Sterling remains a key focus.

- EURGBP trendline resistance at 0.9016, drawn off the Sep 11 high remains intact. The bear trigger is 0.8861, Nov 12 low.

- The major hurdle for bulls in Cable is 1.3421, a multi-year trendline resistance drawn off the Nov 2007 high.

- Key FI resistance levels to watch: Bund fut: 176.08, 76.4% of the Nov 4 - 11 sell-off. Gilts: 135.52, its 50-day EMA and in Treasuries, 138-20+ is key near-term resistance, the 50-day EMA.

- E-Mini S&P futures continue to trade within the 3668.00, Nov 9 high and 3506.50, Oct 11, key parameters.

EQUITIES: European Markets Make Up For Lower Monday Close

European stocks trade firmer pre-NY hours, making up for the lost ground posted into the close on Monday. The Eurostoxx 50 sits just below yesterday's highs of 3506.24 and a move above here marks new multi-month, post-COVID highs. Markets across Europe are seeing broad-based gains, with Italy outperforming (up 1.5%) and UK's FTSE-100 lagging slightly (up 1.0%).

In Europe, energy and financials are outperforming, with consumer discretionary not far behind. Healthcare and real estate are the main laggards, although falls are shallow at this stage. Of note, the DAX Index number of constituents are to be increased to 40 from 30, partly in response to the Wirecard scandal some months ago.

COMMODITIES: Oil Makes Further Progress, Futures Curve Steepens

Energy markets trade higher again early Tuesday, with WTI crude futures adding over 1% to hit the best levels since early September. This narrows the gap with the next upside target at $44.59, the late August highs.

USD weakness and higher equities are the main drivers for oil at this stage, with the news that Biden's team will gain access to transition materials also helping support sentiment.

In precious metals, spot gold is lower for a second session, hitting new multi-month lows as equities continue to make progress. Spot gold is narrowing the gap with first key support at the 200-dma at $1,797.19. This level was last broken back in March.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.