-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Weekly Claims Due, But Activity Ebbs into Holiday Period

Highlights:

- Markets more muted as traders gear for holiday break

- USD Index remains within range of multi-month lows

- Tertiary Q3 US GDP and weekly jobless claims provide last look before year-end

US TSYS: Belly-Led Rally Ahead Of Revised GDP, Claims and 5Y TIPS Supply

- Cash Tsys have continued to rally after yesterday’s volatile but ultimately richer session, outperforming core EU FI which sees some cheapening impetus from De Guindos reiterating the ECB is poised for further tightening ahead. The belly leads the move richer today, ahead of further revisions to GDP in Q3 plus weekly jobless claims and the Kansas Fed manufacturing index.

- Supply from 5Y TIPS after yesterday’s consecutive 20Y stopping through, with the 5Y breakeven at 2.38% almost back to pre-CPI miss levels having dipped to 2.2% in days following the FOMC decision.

- 2YY -1.1bps at 4.202%, 5YY -1.9bps at 3.750%, 10YY -1.5bps at 3.647% and 30YY -0.1bps at 3.713%.

- TYH3 trades 7+ ticks higher at 113-25+, pulling further off yesterday’s low of 113-09+ (initial support). Resistance is seen at 114-23 (Dec 19 high). Volumes are notably softer heading into the Christmas break.

- Data: GDP/PCE Q3 third release (0830ET), Weekly claims (0830ET), Leading index (1000ET), KC Fed mfg (1100ET)

- Bond issuance: $19B 5-Year TIPS re-open (1300ET)

- Bill issuance: $45B 4W, $45B 8W bills (1130ET)

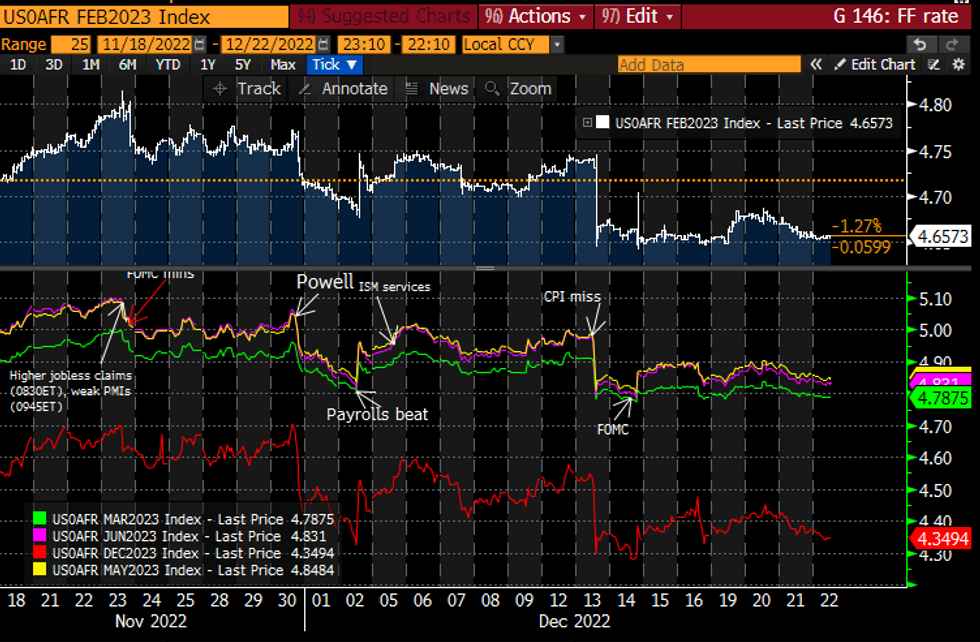

STIR: Fed Rate Path Continues Ebb Lower

- Fed Funds implied hikes sit at 32.5bp for Feb (unch), cumulative 46bp to 4.79% Mar (-1bp), terminal 4.85% May (-1bp) and 4.35% for Dec (-2.5bp).

- The terminal continues to slowly drift back to pre-FOMC levels of 4.80% having touched 4.9% in the interim, whilst sticking to 50bp of cuts to end-2023.

- No scheduled Fedspeak with docket headlined by third readings for Q3 GDP/PCE and weekly jobless claims, the latter after a surprising dip lower for initial claims to 211k.

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FOMC-dated Fed Funds futures implied ratesSource: Bloomberg

FOREX: USD Within Range of Multi-Month Lows

- The greenback sits lower ahead of the Thursday US open, with the USD Index through to new weekly lows to narrow the gap with 103.448, a key support. A break south of here opens the lowest levels for the USD since June.

- Macro drivers and newsflow has been expectedly muted so far Thursday, with ECB's de Guindos repeating the well worn line that ECB hikes are likely to be maintained at 50bps steps for the near future. GBP has carried through a part of the Wednesday weakness, boosting EUR/GBP north of Gbp0.88 for the first time since mid-November.

- Stronger oil markets are aiding commodity-tied currencies, with NOK the strongest performer in G10 at pixel time. This keeps USD/NOK within range of the mid-December multi-month lows at 9.6982. Weakness through here would be a bearish break and extend losses below the 9.8123 200-dma.

- Data and macro releases later today provide the last look at the US economy for 2022, with Tertiary Q3 US GDP due as well as weekly jobless claims.

FX OPTIONS: Expiries for Dec22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E614mln), $1.0550(E1.5bln), $1.0630(E575mln), $1.0675-80(E496mln)

- USD/JPY: Y130.00($1.9bln), Y132.50($1.9bln), Y134.30-50($750mln), Y137.00($560mln), Y137.50-60($1.0bln)

- AUD/USD: $0.6650-70(A$696mln), $0.6810(A$831mln)

- USD/CAD: C$1.3480-00($965mln), C$1.3660-75($903mln)

- USD/CNY: Cny6.9000($883mln), Cny6.9500($900mln), Cny7.0900($600mln), Cny7.2000($1.5bln), Cny7.2500($1.2bln)

EQUITIES: E-Mini S&P Targets 3946.36 50-Day EMA to Signal Stronger Recovery

EUROSTOXX 50 futures have recovered from recent lows and the contract is trading higher today. Price has arrived at the 20-day EMA, at 3886.10 - a key short-term resistance. A clear breach of this hurdle would suggest potential for a stronger recovery. Gains are considered corrective - for now. A reversal lower and a break of 3753.00, the Dec 20 low, would confirm a resumption of the recent downtrend. The bull trigger is at 4043.00, Dec 13 high. S&P E-Minis trend signals are bearish and this week’s low print reinforces this condition. The contract has recovered from its recent lows. The move higher is considered corrective and attention is on 3946.36, the 50-day EMA. A clear break of this hurdle is required to suggest potential for a stronger recovery. On the downside, a reversal lower and a break of 3803.50, the Dec 20 low, would confirm a resumption of the downtrend.

- Japan's NIKKEI closed higher by 120.15 pts or +0.46% at 26507.87 and the TOPIX ended 14.85 pts higher or +0.78% at 1908.17.

- Elsewhere, in China the SHANGHAI closed lower by 13.979 pts or -0.46% at 3054.431 and the HANG SENG ended 518.73 pts higher or +2.71% at 19679.22.

- Across Europe, Germany's DAX trades higher by 46.81 pts or +0.33% at 14144.57, FTSE 100 higher by 38.51 pts or +0.51% at 7528.66, CAC 40 up 26.24 pts or +0.4% at 6601.62 and Euro Stoxx 50 up 11.57 pts or +0.3% at 3883.42.

- Dow Jones mini up 42 pts or +0.13% at 33605, S&P 500 mini up 6.5 pts or +0.17% at 3912.5, NASDAQ mini up 24.25 pts or +0.21% at 11360.75.

COMMODITIES: Gold Remains Above 1810.0, Targets 1842.7 Retracement Next

Trend conditions in WTI futures remain bearish. However, recent gains have highlighted a bullish corrective cycle and this has resulted in break of the 20-day EMA, at $76.94. The move above this hurdle signals scope for an extension towards $79.73, the 50-day EMA and a key resistance. On the downside, a stronger reversal lower would refocus attention on the bear trigger which lies at $70.31, the Dec 9 low. Trend conditions in Gold remain bullish and the recent move lower is considered corrective. Key short-term support to watch is $1765.9, Dec 5 low. The yellow metal breached $1810.0 last week, Dec 5 high, to resume the uptrend. This maintains the positive price sequence of higher highs and higher lows and opens $1842.7, a Fibonacci retracement. On the downside, a break of $1765.9 would signal scope for a deeper pullback.

- WTI Crude up $0.81 or +1.03% at $78.83

- Natural Gas up $0.1 or +1.78% at $5.451

- Gold spot up $1.89 or +0.1% at $1817.26

- Copper up $0.3 or +0.08% at $381.1

- Silver down $0.12 or -0.51% at $23.8755

- Platinum up $2.21 or +0.22% at $1005.09

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/12/2022 | - |  | UK | House of Commons Recess Starts | |

| 22/12/2022 | 1330/0830 | * |  | CA | Payroll employment |

| 22/12/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 22/12/2022 | 1330/0830 | *** |  | US | GDP (3rd) |

| 22/12/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 22/12/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 22/12/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 22/12/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 22/12/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 23/12/2022 | 0745/0845 | ** |  | FR | PPI |

| 23/12/2022 | 0800/0900 | ** |  | ES | PPI |

| 23/12/2022 | 0800/0900 | *** |  | ES | GDP (f) |

| 23/12/2022 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 23/12/2022 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 23/12/2022 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 23/12/2022 | 1330/0830 | ** |  | US | durable goods new orders |

| 23/12/2022 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 23/12/2022 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 23/12/2022 | 1500/1000 | *** |  | US | New Home Sales |

| 23/12/2022 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.