-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Morning FI Analysis: Awaiting Fiscal Clarity

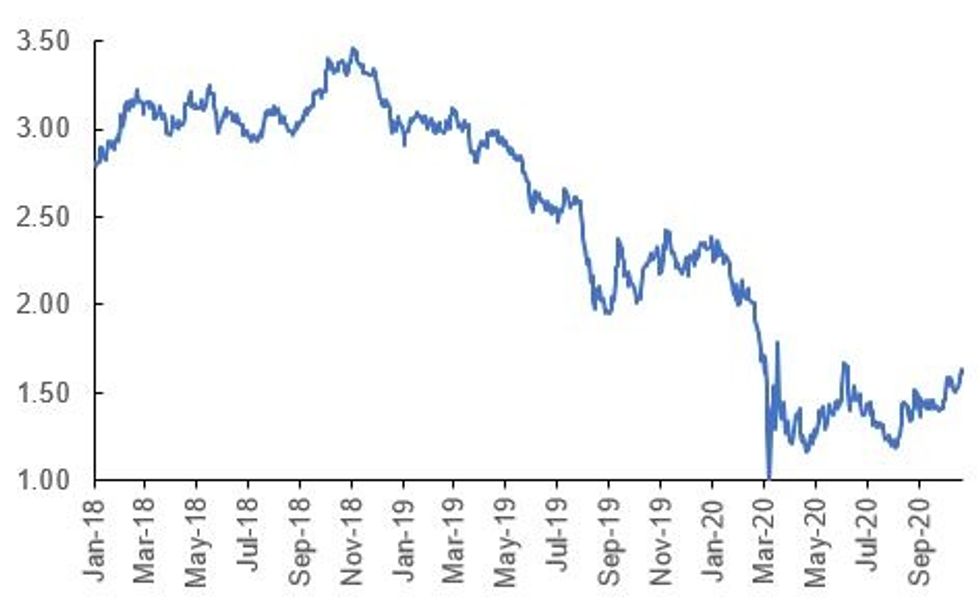

Fig 1 US 30_year Treasury Yield, %

Source: MNI/Bloomberg

US TSYS SUMMARY: Bull Flattening Amid Election Anxiety

A relatively quiet overnight session for Treasuries, with trading remaining within ranges, seemingly awaiting yet further clarity on the fiscal stimulus outlook, and perhaps in anticipation of tonight's final presidential debate.

- Some bull flattening began overnight on last night's reports of foreign efforts to interfere in the Nov election, continued in European hours despite (because of?) stock futures coming off the lows.

- The 2-Yr yield is unchanged at 0.1472%, 5-Yr is down 0.5bps at 0.3506%, 10-Yr is down 1.3bps at 0.8092%, and 30-Yr is down 2.3bps at 1.6127%. Dec 10-Yr futures (TY) down 0.5/32 at 138-18 (L: 138-15.5 / H: 138-19.5).

- Speaker Pelosi and Treas Sec Mnuchin to continue talking on stimulus deal today - Pelosi holds a press conference at 1045ET. The 2nd and final Trump-Biden debate is at 2100ET.

- We get weekly jobless claims at 0830ET, Sep existing home sales at 1000ET, KC Fed Mfg Index at 1100ET.

- A relative dearth of Fed speakers vs the standard of the past few days, as we wind toward the pre-FOMC blackout period: 1310ET sees Richmond's Barkin and SF's Daly, with Dallas' Kaplan speaking at 1800ET.

- 1130ET sees combined $65B sale of 4-/8-week bills, with 5-Yr TIPS auction for $17B at 1300ET. NY Fed buys ~$1.75B of 20-30Y Tsys.

BOND SUMMARY: EGB/Gilt

European sovereign curves have bear steepened this morning alongside weaker trading in equities and broad USD strength against the G10.

- Gilts have sold off with cash yields 1-3bp higher and the 2s30s spread 2bp wider.

- Price action in bunds has been more contained, albeit with longer end yields inching higher.

- It is a similar story for OATs. Last yields: 2-year -0.7075%, 5-year -0.6621%, 10-year -0.3054%, 30-year 0.3769%.

- BTPs have been anchored at the short end and have traded weaker at the longer end. The curve is 2-3bp steeper on the day.

- The DMO earlier sold GBP2.25bn of the 0.625% Jul-35 gilt and GBP1.75bn of the 0.625% Oct-50 gilt.

- UK Chancellor of the Exchequer Rishi Sunak is today presenting a statement to the House of Commons. This follows indications that the government will abandon its spending master plan intended to span the remainder of this parliament, in favour of a one-year review given the difficulties presented by the Covid crisis.

- UK CBI Trends Total Orders data was better than expected for October (-34 vs -50 survey), while French Business Confidence was a touch weaker (90 vs 92 survey).

DEBT SUPPLY

GILT AUCTION RESULTS: DMO sells GBP1.75bln nominal of 0.625% Oct-50 Gilt

- Avg yld 0.842% (0.826%), bid-to-cover 2.24x (2.22x), tail 0.2bps (0.3bps), price 94.266 (94.650).

- An additional GBP437.5mln will be available through the PAOF to successful bidders until 14:30BST.

GILT AUCTION RESULTS: DMO sells GBP2.25bln nominal of the 0.625% Jul-35 gilt

- Avg yield 0.618% (0.5697%), bid-to-cover 2.41x, tail 0.2bp, price 100.099 (100.789)

- Note brackets refer to price and yield from syndicated launch.

- Pre-auction mid-price 100.009

- An additional GBP562.5mln nominal will be available through the PAOF to successful bidders until 13:00BST.

OPTIONS

SHORT STERLING OPTIONS: Vol seller

LF1 100.00^, sold at 8.5 in 1k

SHORT STERLING OPTIONS: Bull flattener

0LM1/LM1 100.12/100.25cs, bought the mid for half in 4.5k

TECHS

US 5YR FUTURE TECHS: (Z0) Bearish Theme Remains Intact

- RES 4: 125-316 High Oct 5

- RES 3: 125-30+ 61.8% retracement of the Sep 30 - Oct 7 sell-off

- RES 2: 125-31 High Oct 15

- RES 1: 125-266 20-day EMA

- PRICE: 125-212 @ 11:17 BST Oct 22

- SUP 1: 125-19 Low Oct 21

- SUP 2: 125-18 Low Aug 28 (cont)

- SUP 3: 125-16+ 1.00 proj of Aug 4 - 13 sell-off from Sep 3 high

- SUP 4: 125-112 Low Jun 10 (cont)

5yr futures maintain a softer tone. The recent sell-off from 125-31, Oct 15 high extended lower yesterday resulting in a break of key support at 125-202,Oct 7 low. The break confirms a resumption of the downtrend that has been in place since early August. This paves the way for weakness towards 125-16+ next, a Fibonacci projection. Key short-term resistance is at 125-31.

US 10YR FUTURE TECHS: (Z0) Downside Risk

- RES 4: 139-25 High Oct 2

- RES 3: 139-17 76.4% retracement of the Sep 29 - Oct 7 sell-off

- RES 2: 139-14 High Oct 15

- RES 1: 139-02+ 20-day EMA

- PRICE: 138-13 @ 11:35 BST Oct 22

- SUP 1: 138-13+ Low Oct 21

- SUP 2: 138-12 61.8% retracement of the Jun - Aug rally (cont)

- SUP 3: 138-04+ 1.00 proj of Aug 4 - 28 decline from Sep 3 high

- SUP 4: 137-29 76.4% retracement of the Jun - Aug rally (cont)

Treasuries remain weaker following the strong reversal off 139-14, Oct 15 high. Futures traded sharply lower yesterday resulting in a break of the key support at 138-18+, Aug 28 low and the bear trigger. The move lower confirms a resumption of the broader reversal that occurred on Aug 4. This has opened 138-04+, a Fibonacci projection. Firm resistance is at 139-14, Oct 15 high with initial resistance at 139-01+.

US 30YR FUTURE TECHS: (Z0) Trend Conditions Remain Bearish

- RES 4: 177-00 High Oct 2

- RES 3: 176-10 High Oct 15

- RES 2: 175-15 Trendline resistance drawn off the Aug 6 high

- RES 1: 174-30 20-day EMA

- PRICE: 173-07 @ 11:47 BST Oct 22

- SUP 1: 172-17 Low Jun 5 (cont) and Low Oct 21

- SUP 2: 172-13 0.764 proj of Aug 6 - 28 downleg from Sep 3 high

- SUP 3: 172-00 Round number support

- SUP 4: 170-19 1.00 proj of Aug 6 - 28 downleg from Sep 3 high

30yr futures remain bearish having started the week on a softer note. Price traded below key support at 173-10 Oct 7 low yesterday. The break negates recent bullish developments and instead confirms a resumption of the downtrend that has been in place since the Aug 6 reversal. This opens 172-17, Jun 5 low (cont) and 172-13, a Fibonacci projection. 172-17 was tested briefly yesterday. Key resistance is at 176-10, Oct 15 high.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.