-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: 2nd COVID Wave Concerns Rising In Europe

EXECUTIVE SUMMARY:

- SPAIN HEALTH MINISTER: EUROPE 2ND COVID WAVE "NO LONGER A THREAT, BUT RATHER A REALITY"

- "VERY SERIOUS" COVID SITUATION IN GERMANY: RKI

- B.O.J. FSR WARNS ON IMPACT OF PROLONGED ECON SLOWDOWN

- U.K. SEES SHARP INCREASE IN WORKING FROM HOME IN LATEST WEEK

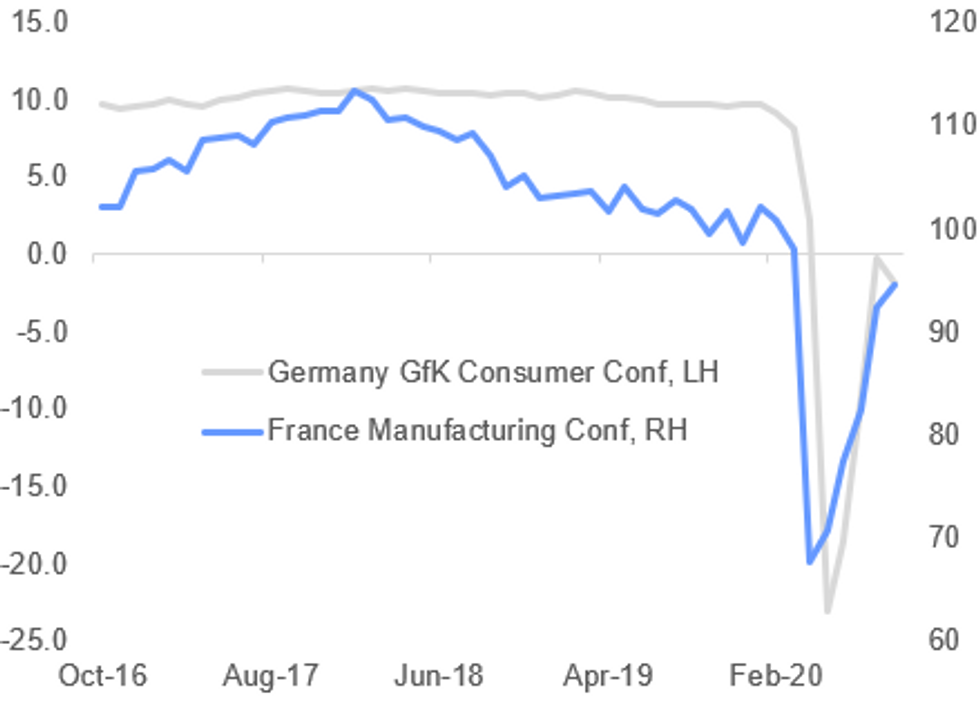

Fig. 1: Mixed European Confidence

BBG, MNI

BBG, MNI

NEWS:

GERMANY/COVID (BBG): Germany should brace for a continued rapid spread of the coronavirus and the number of serious infections and deaths is sure to rise, the nation's RKI public health institute warned Thursday.Europe's biggest economy registered a record 12,331 new infections in the 24 hours through Thursday morning, according to data from Johns Hopkins University. That's the first time daily infections have exceeded 10,000 and took the total to 397,922."The general situation has become very serious," RKI President Lothar Wieler said at a news conference in Berlin, reiterating an appeal to citizens to respect distancing and hygiene rules.

SPAIN/COVID (BBG): The spread of coronavirus is out of control in certain parts of Spain, according to Health Minister Salvador Illa."We are in the middle of a second wave, it's no longer a threat but rather a reality," Illa said in an interview on Madrid-based Onda Cero radio. "In some parts of our country the epidemic isn't under control, so we need to take more drastic measures."Spain on Wednesday became the first country in Western Europe to surpass 1 million coronavirus infections, as authorities struggle to control fresh outbreaks and contemplate a curfew for the capital Madrid and its surrounding area.

BOJ: Japan's financial system is likely to remain highly robust, even under the scenario of a moderate economic recovery, the Bank of Japan's latest Financial System Report said. However, the FSR, published Thursday warned that the spread of Covid-19 and their "impact on the domestic and overseas economies are subject to considerable uncertainty" and that could lead to significant adjustments in financial markets and a "deterioration in financial firms' financial soundness".

BTPS: Bloomberg reporting that the final spread on the 30-year BTP syndication is now BTP+5bp (down from last update of BTP+7bp and IPT of BTP+10bp). Also reporting that books are over EUR80bln including EUR5bln of JLM interest.

UK DATA: As the level of 'lockdown' heightens across the UK, an not unsurprising trend was picked up in the latest Opinions and Lifestyles Survey for the Office For National Statistics, showing an increase in the number of people again working from home. The proportion of adults who travelled to work decreased by 5 percentage points, to 60%, according to the survey covering the period 14 to 18 October. Conversely, the proportion who worked from home increased to 25%, the highest since the beginning of August.

ECB: A digital euro could become a necessity if people become reluctant to use cash, other electronic payment methods become disabled or if foreign digital means of payments threatened to largely displace domestic money, European Central Bank Executive Board member Fabio Panetta said Thursday.

CHINA: China will release its upcoming export control list in a timely manner, Ministry of Commerce spokesman Gao Feng said Thursday, following passage of the new Export Control Law last week. The new law clearly stipulates the scope of export control, the control system and measures, as well as the strengthening of international cooperation, said Gao, without giving further details.

CHINA: Technology decoupling may deepen but economic decoupling from China will not be easy as the country has such strong manufacturing capabilities, said Ba Shusong, the chief China economist of Hong Kong Exchanges and Clearing (HKEX) and the chief economist of the China Banking Association at the Financial Street Forum 2020 on Thursday.

SWEDEN: Swedish businesses see activity increasing six months down the line, on balance, and they are investing in technology and research in anticipation of a 'new normal', the Riksbank's latest business survey found, as they are perhaps more upbeat than senior officials at the central bank.

DATA:

**MNI: FRANCE OCT BUS CLIM INDICATOR 90; SEP 92

FRANCE OCT MFG SENTIMENT 93; SEP 94

FRANCE OCT SERVICES SENTIMENT 89; SEP 94

FIXED INCOME: Gilts underperform in a less volatile day

- After a couple of relatively volatile days in core fixed income markets, today has been a lot more stable. Equities have generally moved lower but both Treasuries and Bunds have also moved a little lower while peripheral spreads are generally unchanged.

- The one outlier has been gilts - downside momentum has continued despite little news on the Brexit front. Our technical analyst notes that we are approaching another support level - the 76.4% retracement of the Oct 7-16 rally which comes in at 135.51.

- With a fairly light data calendar, any Brexit or US fiscal developments will be closely watched.

- TY1 futures are down -0-1 today at 138-17+ with 10y UST yields down -1.2bp at 0.812% and 2y yields down -0.1bp at 0.148%.

- Bund futures are down -0.17 today at 175.54 with 10y Bund yields up 0.3bp at -0.586% and Schatz yields down -0.4bp at -0.783%.

- Gilt futures are down -0.39 today at 135.56 with 10y yields up 2.7bp at 0.267% and 2y yields up 1.5bp at -0.39%.

FOREX: Markets Consolidating After Wednesday's Volatility

Markets are far more stable Thursday after yesterday's cross-market volatility. GBP is softer as markets take profit on one of the strongest sessions for the currency in months. GBP/USD has inched back below 1.31, but losses are muted at this stage. UK/EU negotiating teams meet in London later today.

Equities are softer in Europe as well as futures in the US, with the e-mini S&P hitting new weekly lows in Asia-Pacific hours. The final Presidential debate between Trump and Biden takes place after the close Thursday, with polling averages still leaning heavily in favour of a blue wave at November's election.

The USD is clawing back some of the recent losses, with NZD and CAD also stronger. GBP, SEK and AUD are the poorest performers so far today.

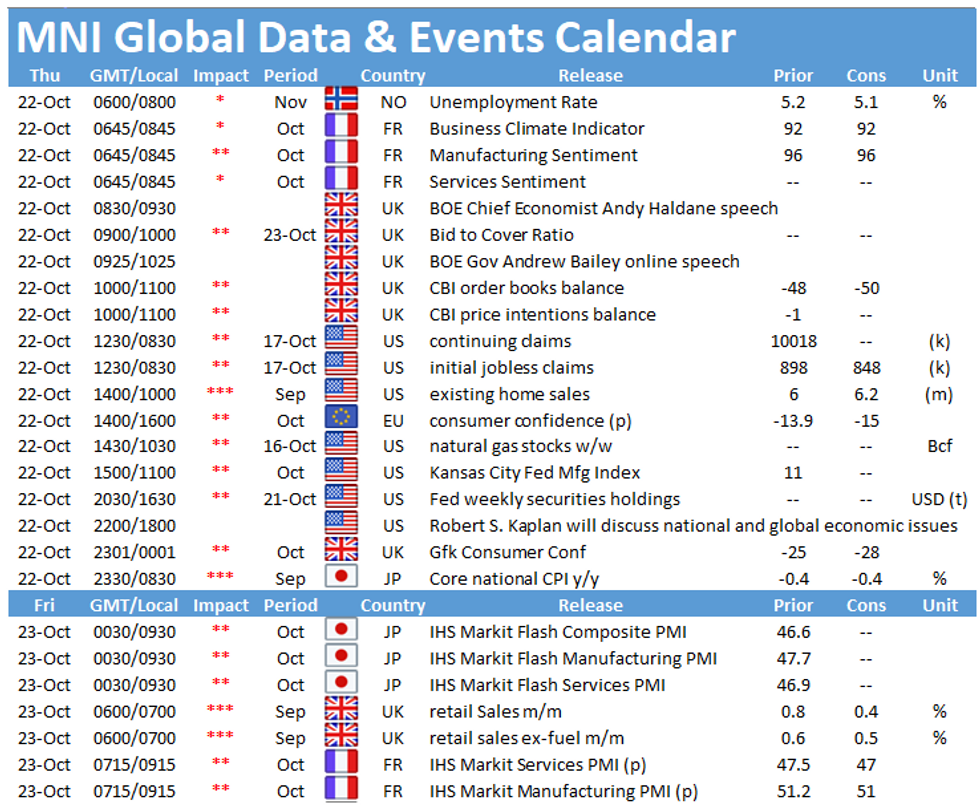

Weekly US jobless claims and existing home sales data are the calendar highlights, with advance Eurozone consumer confidence also due. Speeches from BoE's Bailey, Fed's Barkin, Daly and Kaplan may draw focus.

EQUITIES: Weak Start

A weak start for the space, with rising COVID numbers in Europe, continued uncertainty over US stimulus and ahead of tonight's presidential debate.

- Asian stocks closed broadly weaker, with Japan's NIKKEI down 165.19 pts or -0.7% at 23474.27 and the TOPIX down 17.81 pts or -1.09% at 1619.79. China's SHANGHAI closed down 12.525 pts or -0.38% at 3312.5 and the HANG SENG ended 31.71 pts higher or +0.13% at 24786.13.

- European stocks are off, with the German Dax down 93.08 pts or -0.74% at 12422.51, FTSE 100 down 16.23 pts or -0.28% at 5734.99, CAC 40 down 24.48 pts or -0.5% at 4808.6 and Euro Stoxx 50 down 24.03 pts or -0.76% at 3149.13.

- U.S. futures are weaker, with the Dow Jones mini down 86 pts or -0.31% at 28048, S&P 500 mini down 10 pts or -0.29% at 3422.75, NASDAQ mini down 34.75 pts or -0.3% at 11656.25.

COMMODITIES: Weaker Amid Broader Risk-Off Tone

Commodities are weaker early Thursday for the most part (crude excepted), in tandem with overall weaker risk appetite (equities lower, dollar stronger).

- WTI Crude up $0.17 or +0.42% at $40.05

- Natural Gas down $0.02 or -0.63% at $3.007

- Gold spot down $7.15 or -0.37% at $1919.54

- Copper down $2.25 or -0.7% at $318.1

- Silver down $0.21 or -0.86% at $24.9527

- Platinum down $0.08 or -0.01% at $892.5

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.