-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: No Sign Of A Brexit Deal On Black Friday

EXECUTIVE SUMMARY:

- BARNIER TELLS E.U. ENVOYS HE CANNOT SAY IF DEAL WITH U.K. POSSIBLE AT THIS STAGE

- U.K. P.M. JOHNSON SAYS SUBSTANTIAL AND IMPORTANT DIFFERENCES REMAIN W E.U. ON DEAL

- E.C.B. HAS FIREPOWER TO ACHIEVE GOALS: PANETTA

- EUROZONE ECONOMIC SENTIMENT FALLS IN NOVEMBER AFTER 6 MONTHS OF INCREASES

- U.S. MARKETS TO CLOSE EARLY ON BLACK FRIDAY

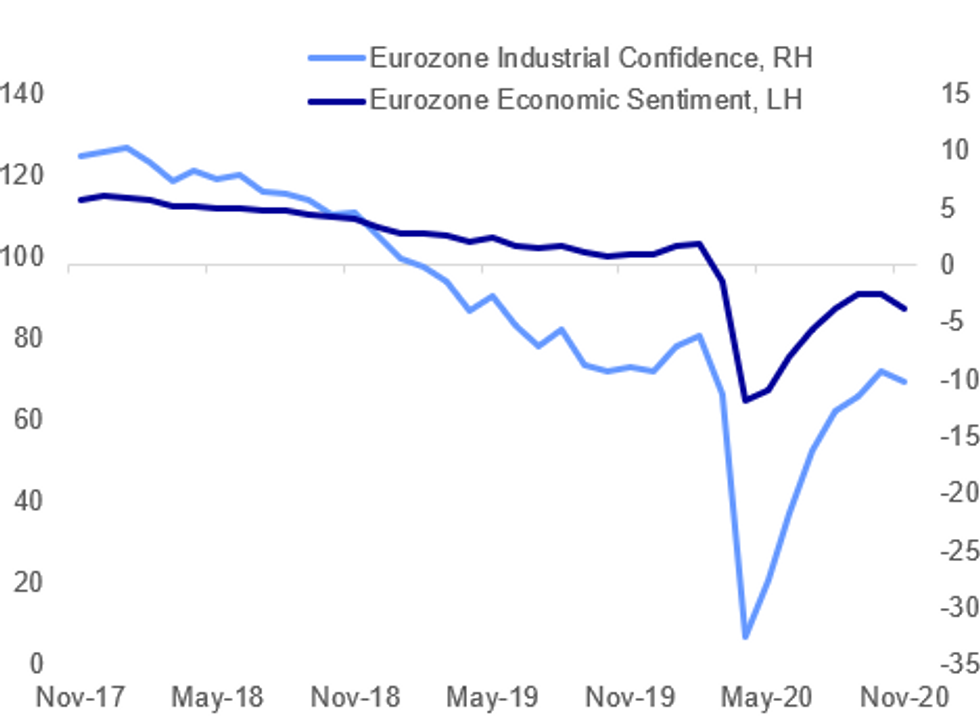

Fig.1: Eurozone Sentiment Dips In November

EC, MNI

EC, MNI

NEWS:

EU-UK: Social media reporting comments from an unnamed EU diplomat stating that the EU's chief negotiator with the UK Michel Barnier told them in this morning's meeting that he cannot say at this stage whether a deal with the UK is possible. Mirrors much of the language of this week that indicates little movement towards a deal. However, it emerged last night that Barnier had called an urgent meeting of some EU fisheries ministers, seen by some as a signal of potential movement on the issue.

EU-UK (BBG): Michel Barnier on Twitter: "In line with Belgian rules, my team and I are no longer in quarantine. Physical negotiations can continue. I am briefing Member States & @Europarl_EN today. Same significant divergences persist. Travelling to London this evening to continue Flag of European UnionFlag of United Kingdom talks w/ @DavidGHFrost + team."

EU-UK: @GuyReuters: "British Prime Minister Boris Johnson said substantial and important differences remained with the European Union on a Brexit trade deal."

E.C.B.: The European Central Bank will need to recalibrate its policy tools in December as it is clear "stimulus so far has not been sufficient to make progress towards our aim in a sustained way," Executive Board member Fabio Panetta said in an interview with Expresso. published Friday, noting that dealing with the second wave of Covid infections needs the correct policy mix - with health and fiscal measures key. Panetta said there is still plenty the ECB can do through asset purchases and financing support, noting there should be no doubt as to its commitment to "bring inflation back to our aim" when the recovery gets underway. Asked whether the ECB should consider debt forgiveness, an idea floated by Italian politicians amongst others, Panetta said "doing so would contravene the Treaties". "Only growth can protect us from debt," he added.

E.C.B. (BBG): European Central Bank policy makers are getting behind the idea of cautiously removing the ban on dividend payments by banks next year. Bank of France Governor Francois Villeroy de Galhau said Friday that while it was right to put all profits into reserves in 2020, there are now arguments in favor of resuming payouts. Executive Board member Fabio Panetta said banks should be prudent, but it would be reasonable to take a case-by-case approach.

EUROZONE DATA: The EZ Economic Sentiment Index declined to 87.6 in Nov, coming slightly stronger than markets expected.

- The index decreased for the first time after six consecutive months of gains with all sectors recording monthly falls.

- Consumer sentiment registered in line with the flash result, showing a downtick to the lowest level since May amid the resurgence of infection rates.

- Industrial confidence eased 0.9pt in Nov, while sentiment in the construction sector ticked down 1pt.

- The service and retail trade sector saw the largest declines in Nov as the lockdown measures are weighing heavily on these sectors.

- Service sentiment fell 5.2pt to its , while retail trade slipped 5.8pt with both indices showing the lowest level since July.

- The employment expectations index fell for the second successive month, dropping to 86.6 which is the lowest level since June.

CHINA (MNI EXCLUSIVE): The yuan may test its five-year peaks against the dollar in 2021 as authorities adopt a hands-off approach to management of a currency used increasingly for international settlement and for foreign reserves, a former chief economist at a major state-owned Chinese bank told MNI. For full article contact sales@marketnews.com

B.O.J.: The Bank of Japan said Friday it would keep the frequency and scale of JGB buying operations in December unchanged from November. Purchases will be conducted in a flexible manner, taking account of market conditions, aiming to achieve the target level of a long-term interest rate specified by the guideline for market operations. Depending on conditions, purchase size per auction could be set at a fixed amount or to an unlimited amount, the BOJ added.

B.O.J. (RTRS/JIJI): The Bank of Japan will consider extending beyond March a range of measures aimed at easing corporate funding strains, Jiji news agency reported on Friday. An extension has been widely viewed by markets as a done deal as the measures were put in place to ease the impact of the coronavirus pandemic, which is still ravaging the economy. The BOJ is expected to reach a decision on extending the measures at a rate review in either December or January.

US: Holiday Market Information: The Thanksgiving trading schedules for the major U.S. exchanges are available via the below links. To summarize: Tsys/rates/equity trading see an early close (1300ET for the most part) Friday.

* CME: https://www.cmegroup.com/tools-information/holiday...

* ICE: https://www.theice.com/holiday-hours

* NASDAQ: https://www.nasdaq.com/solutions/nasdaq-canada-hol...

* NYSE: https://www.nyse.com/markets/hours-calendars * SIFMA: https://www.sifma.org/resources/general/holiday-sc...

DATA:

EZ ESI Dropped Amid Second Wave

Economic Sentiment Indicator (ESI): 87.6; Prev (Oct): 91.1

Consumer: -17.6(Oct: -15.5); Industry: -10.1(Oct: -9.2); Services: -17.3 (Oct: -12.1); Retail: -12.7 (Oct: -6.9); Construction: -9.3 (Oct: -8.3)

ITALY NOV BUSINESS CONFIDENCE INDEX 82.8; OCT 92.2

MNI: ITALY NOV CONSUMER CONFIDENCE INDEX 98.1; OCT 101.7

MNI: FRANCE NOV FLASH HICP +0.2% M/M, 0.2 Y/Y; OCT +0.1% Y/Y

MNI: FRANCE OCT PPI +0.1% M/M, -2.0% Y/Y; SEP -2.3% Y/Y

FRANCE Q3 FINAL REAL SA GDP +18.7% Q/Q, -3.9% Y/Y

MNI: FRANCE OCT CONSUMER SPENDING +3.7% M/M, +2.7% Y/Y

FOREX: Defensive Feel Bleeds Into Second Session

For a second session, USD/JPY is inching lower, helping keep JPY close to the top of the G10 pile in early trade. This helps cement the modest risk-off theme amid holiday-thinned markets - the US sees only a partial day of trade as Thanksgiving celebrations extend into Friday. The greenback is generally weaker, but moves are modest after the first few hours of European trade.

This is mirrored in muted European equity markets this morning, although most indices have been spared any further declines. The UK's FTSE-100 underperforms, down around 0.75% at pixel time.

There remains the risk of Brexit headlines crossing later today, as EU's Barnier concludes meetings with EU ambassadors this morning and heads back to London later today to continue negotiations.

The calendar ahead is quiet, with no tier one releases or central bank speakers of note.

FIXED INCOME: A steady session

EGBs and Bund have traded in a tight range during the morning European session.

- Futures contract have stayed underpinned, despite some better buying interest in Equity.

- Covid, vaccine and Brexit remains at the forefront. Astarzeneca reported that they will do an additional Global trial in an effort to clear the results of the last study.

- Peripheral have traded in tandem with Germany, albeit Greece 1.6bp tighter, while Spain sits 0.8bp wider.

- Gilts has traded in a tight range (134.29-134.48), but remains underpinned somewhat as PM Johnson says that "If we leave with on Australian term, we will a great success of it"

- Barnier is now heading to the UK for face to face talks.

- US Treasury curve is bull flatter, with the long end outperforming, on Covid spike's concerns.

- Bund futures are up 0.08 today at 175.59 with 10y Bund yields down -0.3bp at -0.592% and Schatz yields down -0.3bp at -0.767%.

- BTP futures are up 0.09 today at 151.49 with 10y yields down -0.5bp at 0.595% and 2y yields down -0.4bp at -0.419%.

- OAT futures are up 0.06 today at 170.21 with 10y yields down -0.2bp at -0.354% and 2y yields down -0.3bp at -0.696%.

EQUITIES: Black Friday Is Green So Far

U.S. stocks are pointing higher on Black Friday as trade resumes from the Thanksgiving holiday (albeit a half-session today). Our tech analyst points out a bullish technical setup for S&P eminis, with key resistance at 3668.00.

- Asian stocks closed the week on a high note, with Japan's NIKKEI up 107.4 pts or +0.4% at 26644.71 and the TOPIX up 8.27 pts or +0.47% at 1786.52. China's SHANGHAI closed up 38.574 pts or +1.14% at 3408.307 and the HANG SENG ended 75.23 pts higher or +0.28% at 26894.68.

- European equities are mixed, with the German Dax up 20.81 pts or +0.16% at 13314.72, FTSE 100 down 43.62 pts or -0.69% at 6306.58, CAC 40 up 16.34 pts or +0.29% at 5575.24 and Euro Stoxx 50 up 7.54 pts or +0.21% at 3520.19.

- U.S. futures are slightly higher, with the Dow Jones mini up 58 pts or +0.19% at 29886, S&P 500 mini up 6.5 pts or +0.18% at 3633.75, NASDAQ mini up 37.75 pts or +0.31% at 12190.25.

COMMODITIES: Copper Soaring

Copper is up sharply early Friday with the 1st future trading at 7-year highs as optimism on global demand continues to grow and China stockpiles dwindle.

- WTI Crude down $0.42 or -0.92% at $44.96

- Natural Gas down $0.03 or -1.15% at $2.93

- Gold spot down $6.79 or -0.37% at $1809.88

- Copper up $7.7 or +2.31% at $340.75

- Silver down $0.16 or -0.66% at $23.2971

- Platinum down $1.8 or -0.19% at $962.96

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.