-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: "Running Out Of Time" For Brexit Deal

EXECUTIVE SUMMARY:

- EQUITY FUTURES AND DOLLAR LOWER TO START THE WEEK

- BREXIT DEAL POSSIBLE, BUT NEEDS TO BE FINALISED THIS WEEK: IRELAND'S COVENEY

- UK-EU "REALLY ARE NOW RUNNING OUT OF TIME" TO CLINCH A DEAL: UK'S EUSTACE

- GERMAN M/M INFLATION SET TO COME IN SLIGHTLY WEAKER THAN EXPECTED (MNI)

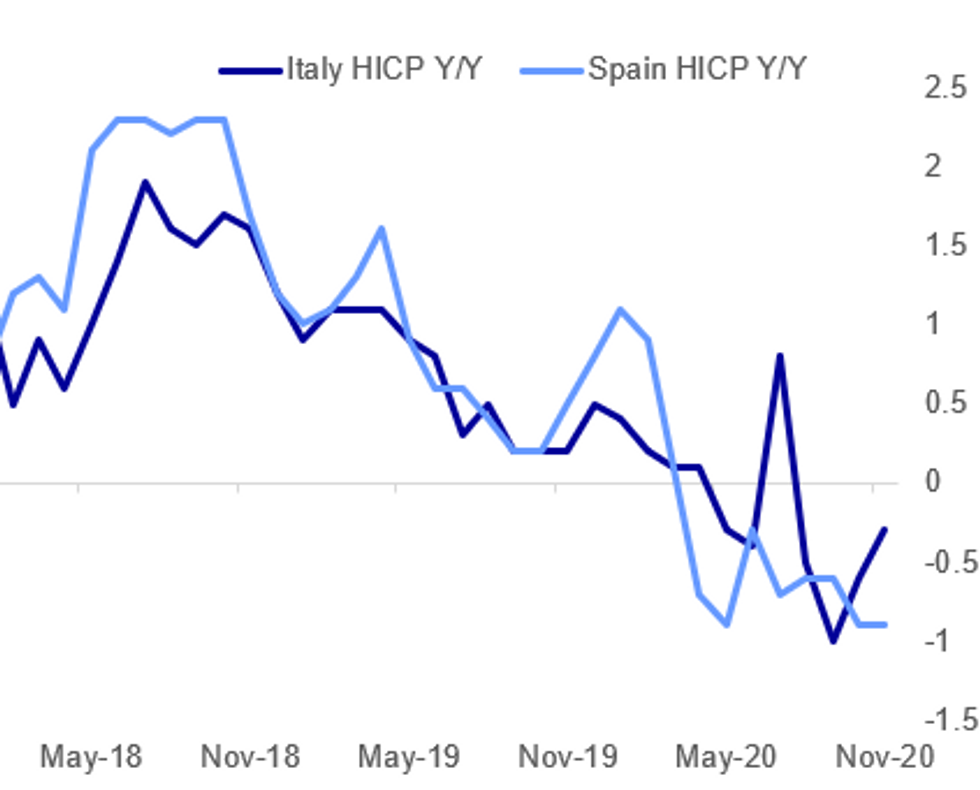

Fig.1: Nov. Prelim Data Shows Annual Deflation Continues In Europe

Eurostat, Istat, MNI

Eurostat, Istat, MNI

NEWS:

EU-UK: Nick Gutteridge of The Sun tweets: "Irish foreign minister Simon Coveney not pulling his punches on Brexit. 'The British Government was offered a much longer transition period and they turned it down, yet they're now blaming the EU for it. That's just ridiculous. The decision on the timelines is very much British'." "'I do think a deal is possible but it needs to be finalised this week. We really are running out of time. The consequences of No Deal are so costly and so disruptive. There's a big incentive.' It needs a 'compromise agreement' on fish/LPF 'that both sides can live with'. "'The EU side has been respectful and consistent but also firm. The truth of Brexit is now being exposed in terms of the challenges of it. This is something the UK & EU together have to find a way forward on as opposed to focus on a blame game as regards who's at fault'."

EU-UK (RTRS): Britain and the European Union are running out of time to clinch a Brexit trade deal, Environment Secretary George Eustice said on Monday. "We really are now running out of time, this is the crucial week, we need to get a breakthrough," Eustice told Sky. "I really do think we are now in to the final week or 10 days, of course if great progress were made this week and you're nearly there it's always possible to extend those negotiations," he said.

GERMAN DATA: MNI's analysis of state-level CPI data from the six states that have published so far (just above 67% of national total) suggests annual pan-German inflation will come as expected, while the monthly CPI is seen slightly weaker.

- Our estimate points to a CPI drop of 0.2% on an annual basis, while the monthly rate is seen at -0.8 in Nov* The y/y HICP decline by -0.5% in Oct, marking the third negative reading this year and and the lowest level since Jan 2015.

- Oct's downtick was mainly driven by the German VAT cut, which was implemented in July and has had a negative effect ever since.

- Energy prices showed another y/y decline in Oct and Destatis noted that prices would have risen 0.6% excluding energy prices

- Food inflation continued to increase modestly in Oct.

- Survey evidence also suggests a upside risk as well: The recently released flash composite PMI noted that prices charged for goods and services rose for the second month in a row, which was mainly driven by the mfg sector.

ECB: The European Central Bank is exploring the potential of a digital currency to ensure the euro remains fit for future purpose, President Christine Lagarde said Monday. In an interview with L'ENA hors les murs, she said "ensuring the euro meets the needs of European citizens is at the core of the ECB's mandate". According to Lagarde, a digital euro would "complement cash and ensure that consumers continue to have unrestricted access to central bank money in a form that meets their evolving digital payment needs".

ECB: The European Central Bank will recalibrate is main policy tools in December, focusing mainly on the Targeted Longer-tern refinancing operations (TLTRO) and the pandemic emergency purchase program (PEPP), Vice President Luis de Guindos said in an interview published over the weekend.

EU/POLAND (BBG): The Polish government is getting increasingly upset with European Union efforts to add conditions to budget funding, but the issue isn't enough for them to consider quitting the bloc, a deputy minister said. "Poles are wise and they don't blame the whole EU," Waldemar Buda, deputy minister in charge of EU funds, told TVN24 private television on Sunday. "They understand that it's only a group of leaders who are absolutely liberal and left-wing and impose their views on all countries."

UK DATA: The mortgage market remained strong in Oct with mortgage approvals increasing once again to the highest level since Sep 2007, while net mortgage borrowing was GBP4.3bn in Oct, down from GBP4.9bn recorded in Sep.Mortgage approvals in Oct were 33% higher than in Feb, while approvals for remortgages were 40% below Feb's level. Net consumer credit remained weak in Oct as consumers were making net repayments of GBP 0.59bn, unchanged from Sep. As a result the annual growth rate of of consumer credit dropped further to-5.6%, marking a new series low (began in 1994). The interest rate on overdrafts was 19.7% in Oct , while interest rates on new consumer credit increased 37 basis points to 5.15%, which is still low compared to 7% recorded in early 2020. The effective interest rate on mortgage borrowing ticked up to 1.78% in Oct, up from 1.74% seen in the previous month.

DATA:

MNI: SPAIN NOV FLASH HICP +0.1% M/M, -0.9% Y/Y; OCT -0.9% Y/Y

MNI: SAXONY NOV CPI -0.7% M/M, +0.1% Y/Y; OCT 0.0% Y/Y

MNI: BAVARIA NOV CPI -0.8% M/M, -0.2% Y/Y; OCT -0.1% Y/Y

MNI: BADEN-W NOV CPI -0.8% M/M, +0.1% Y/Y; SEP 0.0% Y/Y

MNI: BRANDENBURG NOV CPI +0.1% Y/Y, -0.1% M/M; OCT -0.1% Y/Y

HESSE NOV CPI -0.8% M/M, -0.6% Y/Y; OCT -0.6% Y/Y

FIXED INCOME: Volatile start to the last day of the month

It has been a fairly volatile European morning session (in contrast to the lack of movement seen in Treauries in the Asian session).

- There don't appear to be clear drivers explaining the moves, with some pointing to month end flows, but we have seen Bunds selloff at the open, spike higher, before selling off further and have now started to move higher again, leaving Bund futures not far from their where they closed Friday.

- Gilts have drifted higher with the curve flattening while Treasuries have drifted a little lower.

- There is not much on the calendar of note today other than European inflation data, but looking ahead we will receive ISM data, payrolls on Friday and negotiations will continue for the EU Budget and Brexit. Next week will see both the Fed and the ECB meet, so any comments from policymakers will be closely watched.

- TY1 futures are down -0-1+ today at 138-04+ with 10y UST yields up 0.2bp at 0.841% and 2y yields up 0.1bp at 0.154%.

- Bund futures are up 0.05 today at 175.55 with 10y Bund yields down -0.1bp at -0.590% and Schatz yields up 0.2bp at -0.760%.

- Gilt futures are up 0.28 today at 134.62 with 10y yields down -1.3bp at 0.270% and 2y yields down -0.4bp at -0.56%.

FOREX: Month End Flow on Market's Mind

EUR/USD continued to grind higher throughout European hours on Monday, with the pair cresting at new multi-month highs and narrowing the gap with 1.20 and the post Covid highs printed back in early September. As a result, the USD's been sold across the board, with the USD index hitting its lowest level mid-2018.

Month-end models continue to point to USD weakness into the November close, which markets remain focussed on headed into US hours.

Scandi FX is strongest, with USD at the bottom of the G10 pile along with AUD.

Focus turns to MNI Chicago PMI, pending home sales and Germany's CPI release. Speakers include BoE's Tenreyro and Fed's Barkin.

EQUITIES: Futures Dip At Month End

A decidedly mixed start to the week for stocks, with 3-session highs for S&P emini futures giving way to 4-session lows overnight. Month-end rebalancing a potential driver today.

- Asian markets closed lower, with Japan's NIKKEI down 211.09 pts or -0.79% at 26433.62 and the TOPIX down 31.6 pts or -1.77% at 1754.92. China's SHANGHAI closed down 16.552 pts or -0.49% at 3391.755 and the HANG SENG ended 553.19 pts lower or -2.06% at 26341.49.

- European equities are mixed, with the German Dax up 43.34 pts or +0.33% at 13346.47, FTSE 100 up 21.95 pts or +0.34% at 6387.99, CAC 40 down 10.59 pts or -0.19% at 5580.39 and Euro Stoxx 50 down 0.89 pts or -0.03% at 3519.99.

- U.S. futures are weaker (tech outperforming), with the Dow Jones mini down 163 pts or -0.55% at 29711, S&P 500 mini down 14.5 pts or -0.4% at 3622, NASDAQ mini down 5.5 pts or -0.04% at 12252.

COMMODITIES: Copper Continues To Head Higher

A mixed start to the week, with copper notably continuing to head higher on strong China PMI numbers overnight.

- WTI Crude down $0.77 or -1.69% at $44.86

- Natural Gas up $0.08 or +2.78% at $2.932

- Gold spot down $13.72 or -0.77% at $1777.1

- Copper up $5.3 or +1.55% at $347.55

- Silver down $0.42 or -1.87% at $22.1848

- Platinum down $9.18 or -0.95% at $961.9

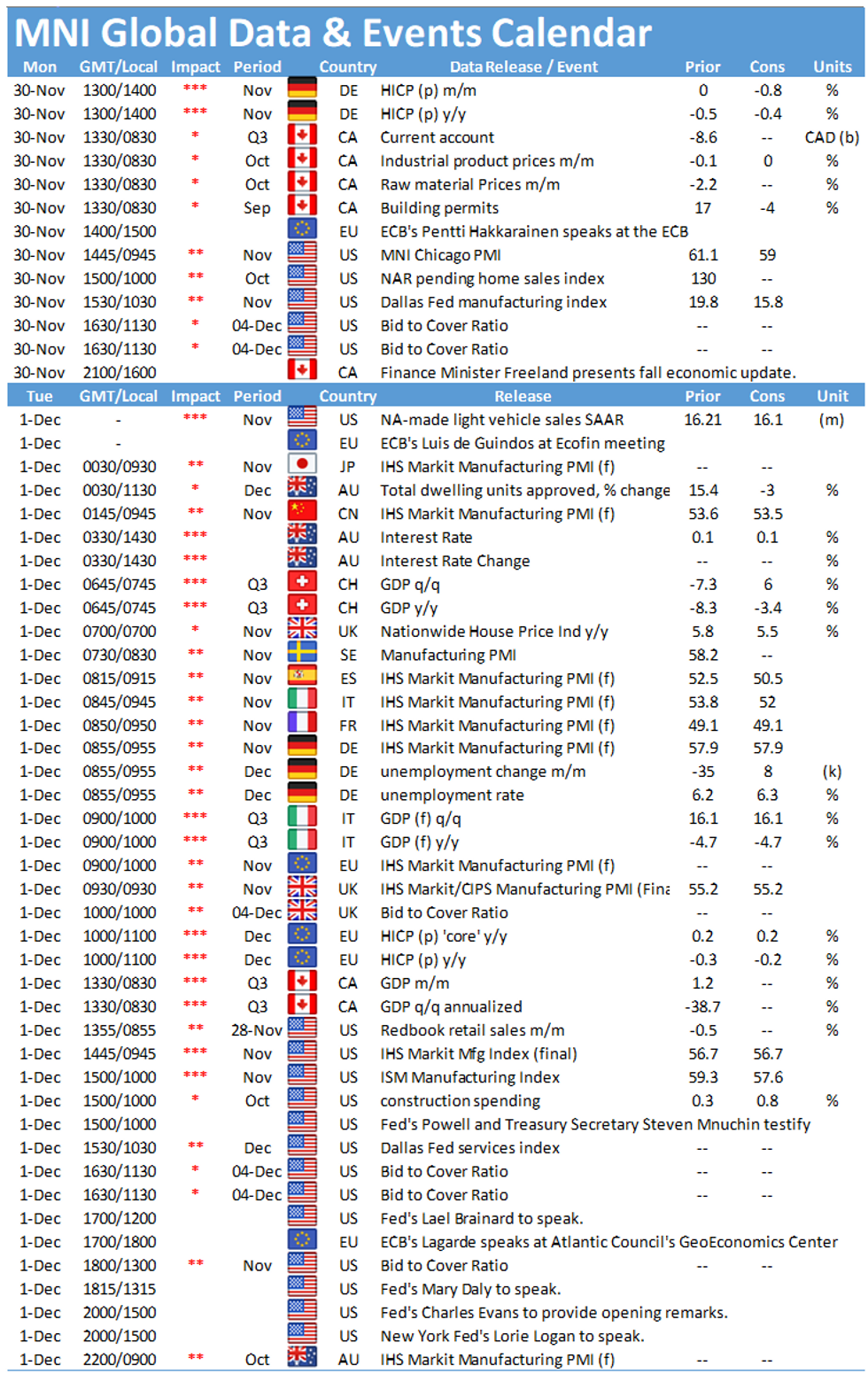

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.