-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: EU Vaccine Rift Deepens

MNI US Open: EU Vaccine Rift Deepens

Executive Summary

- An EU crisis summit exposed the widening rift over vaccine suppiies

- US president doubles vaccine goal

- Suez blockage triggering rerouting and could fuel oil rally.

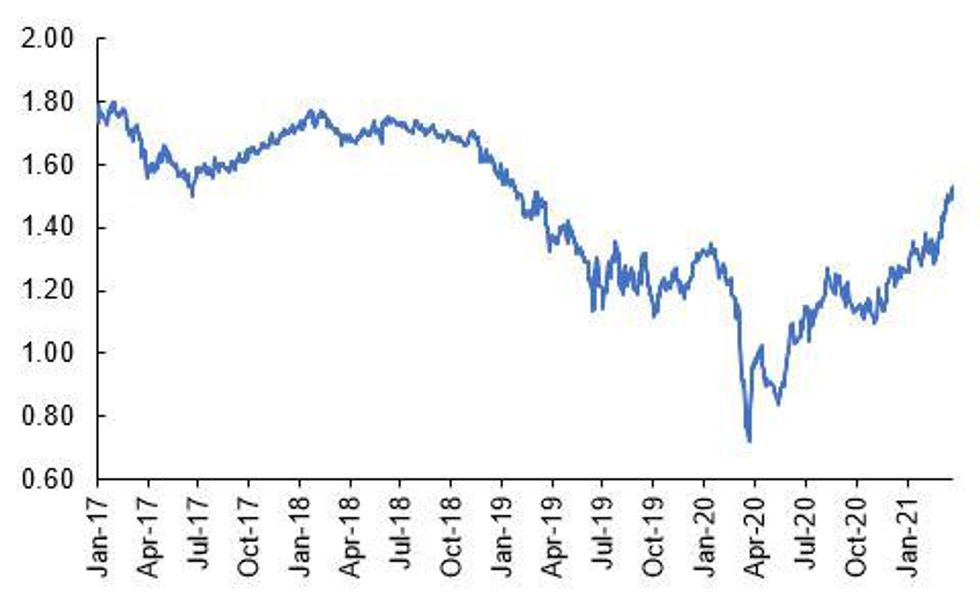

Source: MNI/Bloomberg

NEWS

EU/COVID (FT): EU divisions over vaccine distribution were laid bare at a summit on Thursday as governments failed to agree on how to provide additional jabs to member states in need of emergency supplies. Leaders clashed during a marathon videoconference which ended with no resolution to demands from predominantly poorer eastern member states for part of 10m in additional BioNTech/Pfizer vaccines. Tense and sometimes ill-tempered discussions broke down after demands from Austria's chancellor Sebastian Kurz for additional vaccine supplies for Vienna were rejected by leaders including Germany's Angela Merkel.

EU/COVID (BLOOMBERG): France extended a lockdown to three additional regions amid a surge in coronavirus cases, leading Germany to consider declaring the country a high-incidence virus area and requiring tests for entry. German Chancellor Angela Merkel told reporters Thursday that the decision to step up measures, which is expected imminently, wouldn't lead to border controls between the neighboring countries. European nations are struggling to contain the spread of Covid as a third wave of infections forces leaders to renew restrictions amid a lagging vaccination campaign. Any increased measures would likely raise concern in German-French border areas, where two-nation commuter and commercial traffic is part of everyday life.

US (FT): Joe Biden has doubled his goal for coronavirus vaccinations to 200m in his first 100 days in office, as he used to his first presidential press conference to claim progress against the pandemic and set the stage for battles with Republicans on immigration, the economy and voting rights.

OIL/SHIPPING (REUTERS): Reeling from the blockage in the Suez Canal, shipping rates for oil product tankers have nearly doubled this week, and several vessels were diverted away from the vital waterway as a giant container ship remained wedged between both banks. The 400 metres long Ever Given has been stuck in the canal since Tuesday and efforts are under way to free the vessel although the process may take weeks amid bad weather. The suspension of traffic through the narrow channel linking Europe and Asia has deepened problems for shipping lines that were already facing disruption and delays in supplying retail goods to consumers.

DATA

Italy Business Sentiment Inches Higher in March

- Mar SA manufacturing morale 101.2 vs Feb 99.5

- Mar SA Manufacturing morale second consecutive uptick--Istat says

- Mar composite business sentiment indicator 93.9 vs Feb 93.3

- Mar m/m intermed., capital gds ticked up; consumer gds down--Istat

- Manufacturing current orders -14.3 in Mar vs -18.5 in Feb

- 3-month manuf. output outlook +4.6 vs +3.8 in Feb

- Current manufacturing inventory levels +1.6, same as Feb

FIXED INCOME: Core FI under pressure after EU doesn't ban vaccine exports

Core fixed income has been under some pressure this morning after the EU didn't ban vaccine exports yesterday and President Biden announced a more ambitious target for vaccinations in the US.

- Gilts are marginally underperforming Bunds with the UK being seen as a beneficiary of the EU not going so far as banning exports. Note that although most of the press coverage has focused on the Oxford/AZ supply in the Eurozone, only 1 million doses of that vaccine were exported to the UK from the EU. The more significant exports from Europe to the UK have been in the form of the Pfizer vaccine.

- So far this morning, the German IFO data has come in better than expected, UK retail sales in line with expectations and the BOE Financial Policy Summary having no real surprises.

- Looking ahead, US personal income/spending data is likely to be the headline while trade data will also be closely watched.

- TY1 futures are down -0-9 today at 131-27+ with 10y UST yields up 2.1bp at 1.657% and 2y yields down -0.6bp at 0.134%.

- Bund futures are down -0.41 today at 172.17 with 10y Bund yields up 3.0bp at -0.355% and Schatz yields up 0.1bp at -0.721%.

- Gilt futures are down -0.27 today at 128.39 with 10y yields up 3.1bp at 0.759% and 2y yields up 1.4bp at 0.053%.

FOREX: Risk Bounces, Dragging USD Index Off Multi-Month High

- JPY is weaker early Friday as the recent risk-off theme unwinds somewhat. Equities are firmer headed into the final trading session of the week, with futures indicating a positive open later today.

- The bounce in risk sentiment is helping support antipodean currencies so far Friday, which bounce off the week's underperformance. AUD/USD is clear of the Thursday highs, opening 0.7636 for direction.

- The USD index is off the week's multi-month high printed yesterday (highest since November) but remains above the 200-dma at 92.605 which should keep the outlook positive.

- US data takes focus going forward, with US personal income/spending and PCE numbers for February crossing at 1230GMT/0830ET. Speeches from BoE's Saunders & Tenreyro also cross.

EQUITIES: Higher equities across the board as EU export ban fears fade

- Japan's NIKKEI up 446.82 pts or +1.56% at 29176.7 and the TOPIX up 28.61 pts or +1.46% at 1984.16

- China's SHANGHAI closed up 54.735 pts or +1.63% at 3418.327 and the HANG SENG ended 436.82 pts higher or +1.57% at 28336.43

- German Dax up 116.28 pts or +0.8% at 14730.47, FTSE 100 up 40.72 pts or +0.61% at 6715.07, CAC 40 up 21.35 pts or +0.36% at 5973.13 and Euro Stoxx 50 up 19.94 pts or +0.52% at 3851.74.

- Dow Jones mini up 82 pts or +0.25% at 32589, S&P 500 mini up 10.75 pts or +0.28% at 3910.75, NASDAQ mini up 31.25 pts or +0.24% at 12797.25.

LEVELS UPDATE: Oil and copper lead the moves higher

- WTI Crude up $1.1 or +1.88% at $59.48

- Natural Gas up $0.01 or +0.23% at $2.578

- Gold spot up $0.04 or +0% at $1727.58

- Copper up $7.45 or +1.87% at $404.25

- Silver up $0.07 or +0.28% at $25.1594

- Platinum up $4.88 or +0.42% at $1158.32

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.