-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Focus On ECB, Russia & JJ Vaccine This Week

MNI US Open: Focus On ECB, Russia & JJ Vaccine This Week

EXECUTIVE SUMMARY:

- G10 sovereign bonds have broadly firmed this morning with curves bull flattening

- The EU has exercised its option for an additional 100mn Pfizer/BioNTech vaccines

- Washington warns of consequences if Russian opposition politician Alexei Navalny dies in prison.

- UK PM Boris Johnson cancels trip to India as Covid infections in that country rise.

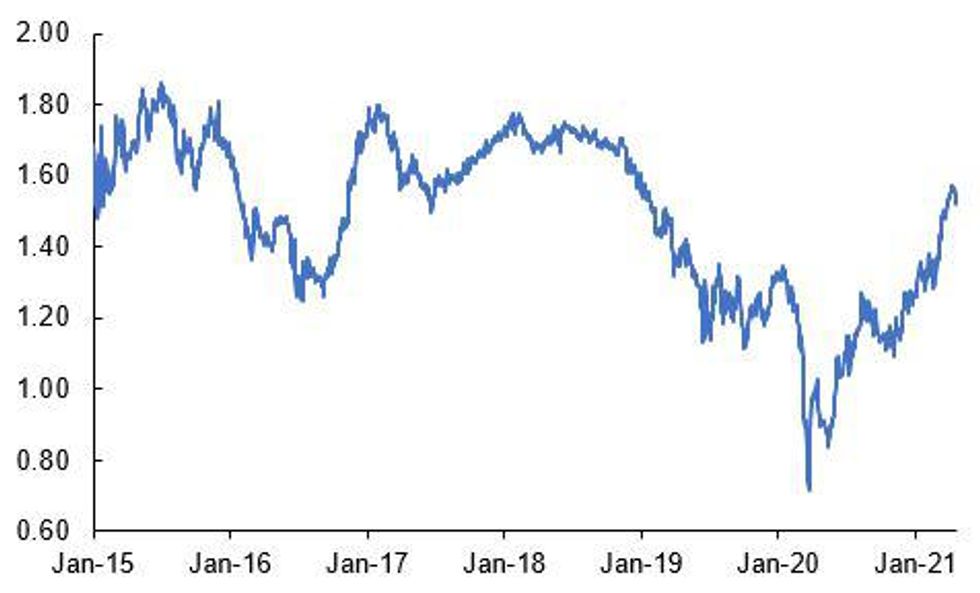

Source: MNI/Bloomberg

NEWS

EU/COVID (BLOOMBERG): The European Union exercised its option for a further 100 million doses of Pfizer Inc. and BioNTech SE's Covid-19 vaccine, raising its order from the companies to 600 million doses. The boost makes the EU deal the partners' biggest yet, and they'll aim to deliver all the doses this year, Sean Marett, BioNTech's chief business and commercial officer, said in a statement. The option to buy an extra 100 million doses was part of a purchase agreement the 27-nation bloc signed with Pfizer and BioNTech in February.

RUSSIA/US (WSJ): Growing concerns over the health of jailed opposition politician Alexei Navalny have sparked calls for mass protests this week in cities across Russia to demand his release as well as a warning on Sunday from the U.S. that there will be consequences if he dies. Supporters of Mr. Navalny called Sunday for large-scale demonstrations to demand his release amid fears about his deteriorating medical condition, setting the stage for an escalation in the standoff between Russian President Vladimir Putin and an opposition movement that has struggled to break his hold on power.

UK/INDIA (GUARDIAN): Boris Johnson has cancelled his planned trip to India. No 10 has just released this joint statement from the British and Indian governments: "In the light of the current coronavirus situation, Prime Minister Boris Johnson will not be able to travel to India next week. Instead, Prime Ministers Modi and Johnson will speak later this month to agree and launch their ambitious plans for the future partnership between the UK and India. They will remain in regular contact beyond this, and look forward to meeting in person later this year." India has now recorded more than 15m coronavirus cases. This would have been Johnson's first major trip overseas since becoming PM.

WORLD (FT): Consumers around the world have stockpiled an extra $5.4tn of savings since the coronavirus pandemic began and are becoming increasingly confident about the economic outlook, paving the way for a strong rebound in spending as businesses reopen. Households around the globe accumulated the excess — defined as the additional savings compared with the 2019 spending pattern and equating to more than 6 per cent of global gross domestic product — by the end of the first quarter of this year, according to estimates by credit rating agency Moody's.

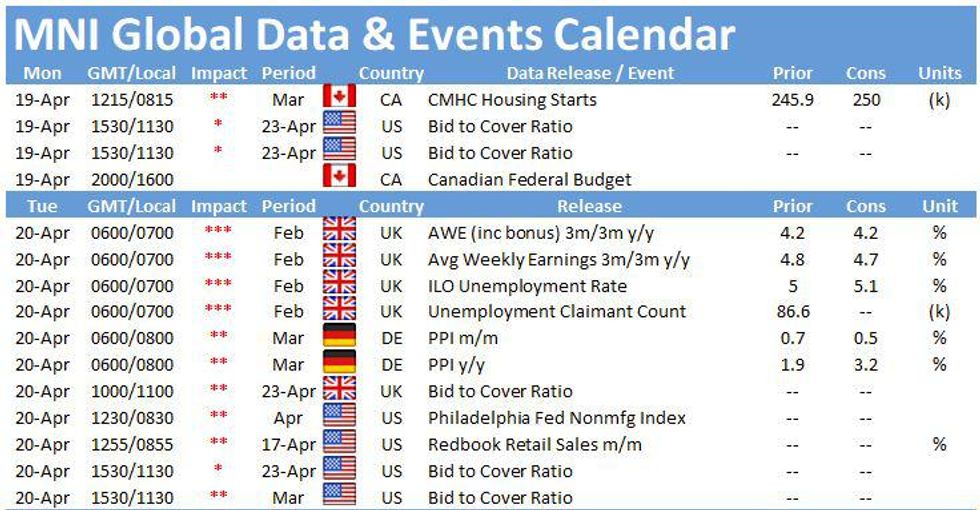

DATA:

FIXED INCOME: Steady start for the week

EGBs are trading mixed in the European morning session, as investors turn their attention to the ECB on Thursday.

- German Bund is just off the lows on small short cover, with risk slightly better offered on the margin,

- The curve trades flat, while peripheral spreads are generally tighter, with Greece leading at 2.8bps.

- Gilts are outperforming, up 20 ticks at the time of typing.

- The contract looks to close the gap to 128.71, now at 128.67.

- US treasuries have traded inline with EGBs, on a light volume session. Looking ahead, no tier 1 data are schedule, nor Central Bank speakers, with the ECB and now the Fed on blackouts.

- Some small attention this afternoon on US Joe Biden meeting lawmakers to discuss his jobs plan.

- Bund futures are up 0.07 today at 170.98 with 10y Bund yields down -0.7bp at -0.271% and Schatz yields unch at -0.696%.

- BTP futures are up 0.23 today at 148.56 with 10y yields down -1.7bp at 0.729% and 2y yields down -0.5bp at -0.365%.

- OAT futures are up 0.10 today at 161.63 with 10y yields down -1.0bp at -0.21% and 2y yields unch at -0.664%

- Gilt futures are up 0.23 today at 128.67 with 10y yields down -2.1bp at 0.742% and 2y yields down -1.0bp at 0.026%.

- TY1 futures are up 0-4+ today at 132-16+ with 10y UST yields down -2.6bp at 1.556% and 2y yields down -0.4bp at 0.158%.

FOREX: Dollar Starts Week Poorly, EUR/USD Highest Since Early March

- The greenback underwent a short, sharp bout of selling pressure in early European hours, with EUR/USD rallying through key resistance at 1.1990 to hit the highest levels since early March and sit comfortably back above 1.20.

- There was no major headline or flow catalyst behind the greenback weakness, with a pick-up in volumes after light overnight trade likely the underlying driver. EUR buoyancy was also helped by Pfizer announcing the shipment of a further 100mln vaccine doses to the European Union in 2021, bringing the total shipment to 600mln.

- USD is the weakest, alongside CAD, while JPY, CHF and NOK are the firmest in G10.

- Tier one data is few and far between Monday, with focus on risk events later in the week - most notably the ECB rate decision on Thursday. There are no central bank speakers of note after the Fed entered their pre-decision media blackout period over the weekend.

EQUITIES: Mixed Picture, Spanish Stocks Outperform While German Stocks Retreat

- European equity markets are inconsistent early Monday, with Spanish and French indices outperforming while German, Italian stocks sit in minor negative territory.

- Across Europe's Stoxx 600, health care and real estate names are in the green, highlighting a somewhat defensive theme, while energy and consumer staples are in retreat.

- The moves follow a wholly positive Wall Street close on Friday, although US futures are rolling off recent highs early Monday, with the e-mini S&P inching off Friday's record high of 4,183.50.

COMMODITIES: WTI, Brent Trade Heavy Despite Dollar Pullback

- Oil markets are soft, with both WTI and Brent crude futures sitting lower by 0.2-0.3% ahead of NY hours. The moves come despite greenback weakness in currency markets, underpinning the underlying weakness in commodities.

- That said, WTI and Brent crude sit inside last week's range, oscillating either side of the $63/bbl mark.

- Greenback weakness is, however, helping buoy precious metals to keep both spot gold and silver higher by 0.5% apiece in early Monday trade. Spot gold eyes the 100-dma at $1804.08 for direction, a level not topped since early January.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.