-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: USTs Sell-Off Following FOMC

MNI US Open: USTs Sell-Off Following FOMC

EXECUTIVE SUMMARY:

- Sovereign bonds trade weaker and equities push higher following yesterday's FOMC meeting.

- European PMI data has disappointed

- Evergrande Group pledges to help retail investors redeem investment products

- The Norges Bank raised rates by 25bps to 0.25%, exiting their emergency pandemic policy stance

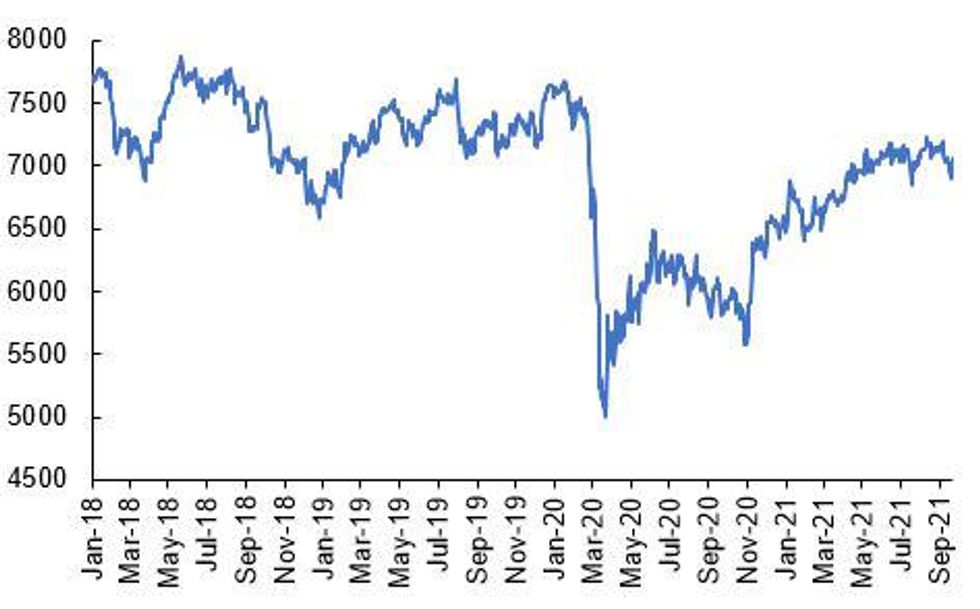

Source: MNI/Bloomberg

NEWS

EVERGRANDE (REUTERS): China Evergrande Group will make it a top priority to help retail investors redeem their investment products sold by the indebted property giant, its chairman said, as uncertainty looms over interest payment due for a dollar bond on Thursday.

AUKUS (DAILY TELEGRAPH): Boris Johnson and Joe Biden privately expressed astonishment at France's heated reaction to the Aukus pact, as the Prime Minister urged Emmanuel Macron, the French president, to "get a grip". Mr Johnson and the US president are understood to have discussed their surprise at the fury from Paris when they met for talks at the White House on Tuesday.

COVID (THE TIMES): The new coronavirus is unlikely to mutate into a variant that can evade vaccines because there "aren't very many places for the virus to go", the creator of the Oxford jab has said. Dame Sarah Gilbert, speaking yesterday in a Royal Society of Medicine webinar, played down fears of a more deadly new variant. "We normally see that viruses become less virulent as they circulate more easily and there is no reason to think we will have a more virulent version of Sars-CoV-2," she said.

SPAIN (BLOOMBERG): Spain said the economy grew at less than half the pace previously estimated in the second quarter, raising questions about the strength of one western Europe's leading recoveries and ignited the ire of analysts. Spain's official statistics agency said gross domestic product grew 1.1% between April and June, down from the 2.8% pace previously estimated. It cited difficulties in measuring output during the Covid-19 pandemic.

EUROPEAN DATA

EUROZONE DATA: PMIs disappoint

Eurozone PMIs this morning have disappointed as peaking demand in Q2, supply chain issues and Delta concerns are all taking their toll. Highlights from the Markit press releases:

- "Firms' costs meanwhile rose at the fastest rate in 21 years as demand again outstripped supply, with price rises increasingly feeding through from manufacturing to services."

- "Robust but slowing growth was recorded across both manufacturing and services, with the latter outperforming modestly. Whereas the service sector merely saw growth slip to the weakest since May, manufacturers reported the smallest production gain since January."

- "Measured overall, inflows of new orders rose at the slowest pace since April, with demand growing at reduced rates in both manufacturing and services after exceptionally strong gains seen in prior months. "

- "Growth slowed especially sharply in Germany, down to its lowest since February, with marked coolings seen in both manufacturing and services, the former in particular hit by supply constraints"

- "Growth also moderated in France, slipping further from June's peak to the lowest since April. The service sector showed more resilience than manufacturing, the latter seeing output increase only modestly as shortages continued to bite."

- "Growth in the rest of the eurozone as a whole outpaced that seen in Germany and France, though eased to the slowest since April, led by a softer services expansion and some waning of growth in manufacturing. "

FIXED INCOME: Big day: USTs digest the Fed, Bunds outperform on PMIs, gilts look to the BOE

It has been a busy morning, as markets continue to digest yesterday's FOMC decision, we have seen the release of PMIs across Europe and as we await the BOE MPC decision later today.

- Treasuries have been under pressure throughout the European morning session, falling through yesterday's lows but remains within the week's trading range. The FOMC meeting saw a more hawkish dot plot than expected and also saw tapering announced at the hawkish end of expectations. The 2s10s curve has re-steepened back to roughly where it was prior to the meeting.

- PMI data this morning has been disappointing with input price rises, supply shortages and a cooling of demand for earlier in the summer all weighing on the data. Bunds hit their lows of the day around the time of the French release but have since recovered somewhat and are now outperforming Treasuries. Against this backdrop, peripheral spreads have tightened today.

- Gilts are awaiting the BOE policy decision at midday BST / 7am ET. No new policy is expected with an 8-1 vote to continue with QE until mid-December (rather than end QE early). There is a risk of another member joining Saunders to curtail QE early. The main focus is likely to on the new Chief Economist Huw Pill and whether by joining the MPC, there is now a majority on the Committee who believe that the necessary (but not sufficient) conditions for a hike have been met.

- TY1 futures are down -0-5 today at 132-26+ with 10y UST yields up 4.1bp at 1.344% and 2y yields up 1.1bp at 0.248%.

- Bund futures are down -0.41 today at 171.33 with 10y Bund yields up 2.4bp at -0.301% and Schatz yields up 1.0bp at -0.712%.

- Gilt futures are down -0.24 today at 127.26 with 10y yields up 2.0bp at 0.818% and 2y yields up 1.9bp at 0.295%.

FOREX: NOK on Top as Norges Bank Drop Emergency Policy Stance

- The Norges Bank raised rates by 25bps to 0.25%, exiting their emergency pandemic policy stance. While the rate hike was expected, the bank also name-checked December as the next likely month to see a raise in rates, and also steepened the longer-end of the rate path projections - boosting the terminal rate to 1.68% from 1.56%.

- This worked in favour of NOK, pressuring EUR/NOK to new monthly lows and narrowing the gap with the bear trigger at the late April lows of 9.8998.

- Equities again trade firmer - following the lead of a solid Asia-Pacific session. Equity strength is working against haven currencies, pressing JPY to the bottom of the G10 pile. The greenback also trades weaker, despite the USD Index briefly showing above the Wednesday high in early trade.

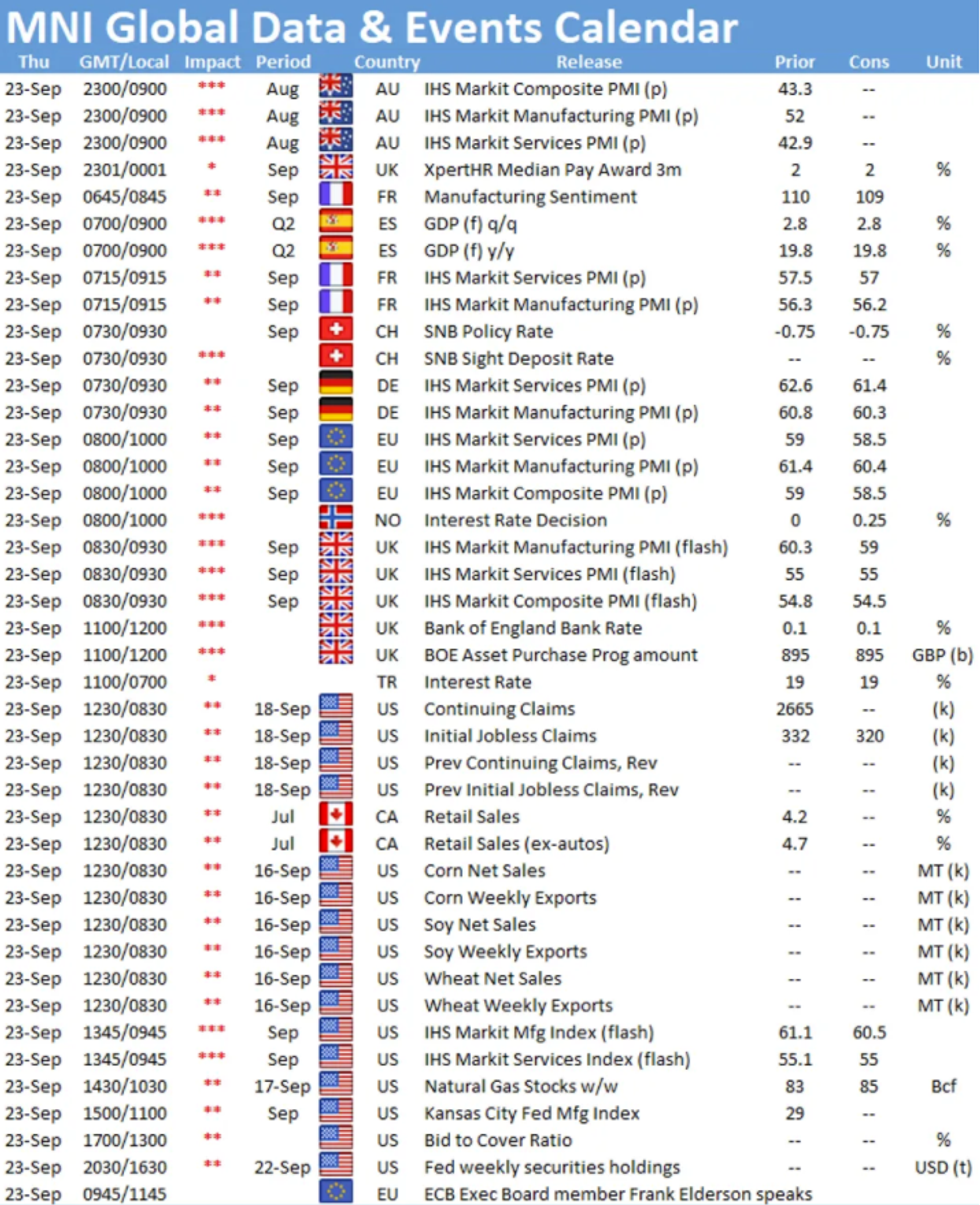

- The Bank of England rate decision is up next, as well as rate decisions from the Turkish and South African central banks. Weekly US jobless claims and Canada's retail sales release for July are also due.

EQUITIES: Higher as near-term Evergrande default looks less likely

- China's SHANGHAI closed up 13.73 pts or +0.38% at 3642.22 and the HANG SENG ended 289.44 pts higher or +1.2% at 24510.98.

- German Dax up 168.76 pts or +1.09% at 15674.54, FTSE 100 up 32.83 pts or +0.46% at 7115.67, CAC 40 up 73.36 pts or +1.11% at 6709.9 and Euro Stoxx 50 up 51.87 pts or +1.25% at 4201.84.

- Dow Jones mini up 264 pts or +0.77% at 34388, S&P 500 mini up 37.5 pts or +0.86% at 4420.75, NASDAQ mini up 132.5 pts or +0.87% at 15296.5.

COMMODITIES: Platinum outperforming

- WTI Crude down $0.07 or -0.1% at $72.2

- Natural Gas down $0.02 or -0.46% at $4.779

- Gold spot up $2.98 or +0.17% at $1771.55

- Copper up $2.05 or +0.48% at $427.85

- Silver up $0.13 or +0.56% at $22.8469

- Platinum up $13.36 or +1.34% at $1013.25

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.