-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI US Open: ECB Loses Hawk as Weidmann Submits Resignation

EXECUTIVE SUMMARY:

- WEIDMANN RESIGNS AS BUNDESBANK PRESIDENT, TO LEAVE DEC 31

- ECB POLICY MUST BE VIGILANT, BUT CAN STAY PATIENT: VILLEROY

- UK CPI EASES, BUT PIPELINE INFLATION AT DECADE HIGH

- PBOC'S PAN SAYS PROPERTY SECTOR FINANCING BECOMING NORMAL; YUAN TO KEEP STABLE

- UK RULES OUT ANOTHER LOCKDOWN EVEN WITH COVID CASES ON THE RISE

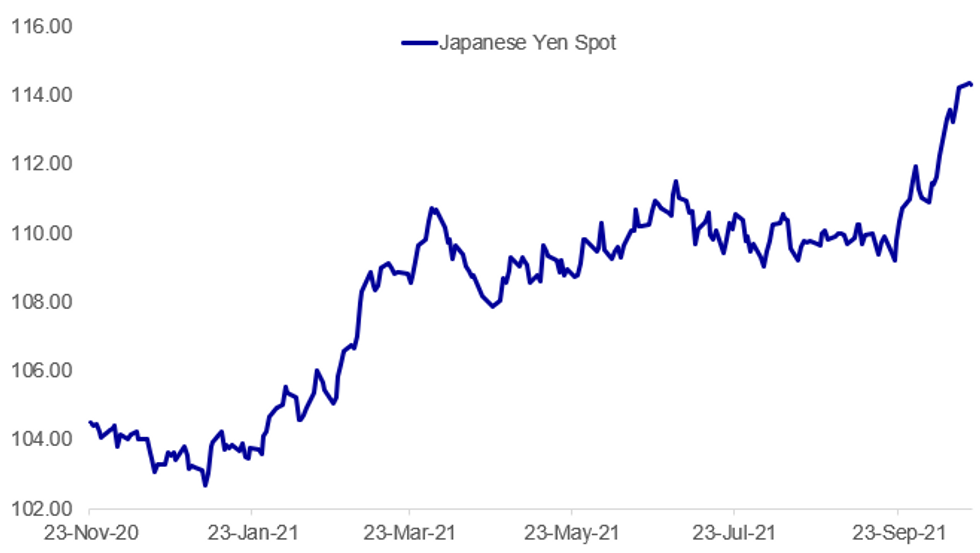

Fig. 1: JPY Touches Another Low Vs USD Overnight

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ECB (MNI): Bundesbank President Jens Weidmann submits resignation from his position,with intent to depart by December 31st. He cites personal reasons, but his statement adds: "monetary policy [must] not get caught in the wake offiscal policy or the financial markets." Rotation of voting rights means Weidmann will still be a voter at the final two ECB rate decisions of the year, on Oct 28th and Dec 16th, before departing on Dec31. First meeting with new Buba head in place would be Feb 3rd.

ECB (BBG): The recovery in France and in Europe "remains very strong," Bank of France Governor Francois Villeroy de Galhau says on Wednesday during a National Assembly finance committee hearing. The spike in inflation should be temporary and come back down below 2% by the end of next year, Villeroy says. ECB policy must be vigilant but "can stay patient". Villeroy adds that France still faces labor shortages.

ECB: European legislators should commit explicitly to introducing a legally binding requirement for banks to have Paris Agreement-compatible climate and environmental risk transition plans, ECB Executive Board member Frank Elderson said in a speech Wednesday.

P.B.O.C. (BBG/CHINA BUSINESS NEWS): PBOC Deputy Governor Pan Gongsheng says financial activities by China's property sector and financial market prices are gradually becoming normal, China Business News reports, citing a speech at a forum in Beijing. Financial and housing authorities will work with local governments to "firmly" safeguard healthy property market development and interests of home buyers. Pan vows to prevent cross-border flow risks; yuan to keep basically stable.

U.K. (BBG):: Business Secretary Kwasi Kwarteng said there won't be a fresh lockdown of the U.K. economy even as Covid-19 cases tick upwards and Prime Minister Boris Johnson warns of a difficult winter ahead. In a bullish round of interviews with U.K. broadcasters, Kwarteng said the government is monitoring coronavirus data by the hour, and pointed out that while case levels are high, hospitalizations and deaths are much lower than at the start of the year due to the country's successful vaccination program. He told LBC radio "I categorically rule out" new lockdown measures.

NORGES BANK: Key takeaways from a speech today by Norges Bank Governor Oystein Olsen: Inflation targeting has proved robust; Flexible approach passed test of major shocks - most notably COVID; As long as inflation expectations are firmly anchored, near-term deviations from the inflation target do not entail substantial econ costs

DATA:

MNI: UK Sep CPI +0.3% M/M, +3.1% Y/Y

UK SEP CORE CPI +0.4% M/M, +2.9.% Y/Y

MNI: UK Sep OUTPUT PPI +0.5% M/M, +6.7% Y/Y

MNI BRIEF: UK Sep CPI Eases, Pipeline Inflation At Decade High

Consumer price inflation fell modestly to an annual rate of 3.1% in September, from 3.2% in August, with prices restaurant and hotel sector preventing inflation from rising last month. Prices paid in the catering sector shaved 0.38 percentage points from the change in CPI, reflecting the one-off effect of the Eat Out to Help Out scheme, which reduced levies on food and drink in August of 2020.

However, inflation rose in eight of the 12 major categories, suggestion wider-ranging inflation. Core CPI moderated slightly to an annual rate of 2.9% from 3.0% in August. Inflation fell slight short of analysts' forecasts of 3.2%, presenting a conundrum for the Bank of England. Governor Andrew Bailey declined to push back on market expectations of a near-term rise in interest rates in a speech over the weekend.

Pipeline pressures continued to accelerate. Output PPI jumped to an annual rate of 6.7% last month, from 6.0% in August, the quickest pace since November of 2011. Input PPI rose to 11.4% from 11.2% in August.

Source: ONS

MNI: EZ SEP FINAL HICP +0.5% M/M, +3.4% Y/Y; AUG +3.0% Y/Y

MNI: EZ SEP FINAL CORE HICP +0.5% M/M; +1.9% Y/Y; AUG +1.6% Y/Y

BOND SUMMARY: Green bonds to be issued by Italy and Germany

- Gilts again garnering a great deal of attention in core FI despite some subdued moves this morning. Gilt futures hit their lowest levels in just over a week shortly after the open despite some marginally softer than expected CPI data released pre-market. However, they have since recovered and have been trending gradually higher in line with Bunds and Treasuries.

- There has been some curve flattening across core FI but, nothing really huge (particularly in light of the moves seen in recent sessions). The Eurodollar strip is largely unch on the day, the Euribor strip unch to 0.5 ticks higher and the short sterling strip is continuing to see some consolidation in the Whites and Reds in particular with the Jun22 and Sep22 leading the way, moving 4.5 ticks higher on the day.

- There is some decent green issuance in the Eurozone today with a E5bln WNG tap of the 25-year Green BTP and a E3.0bln reopening of the 10-year Green Bund. We also have a 10-year gilt auction and a 20-year UST auction today.

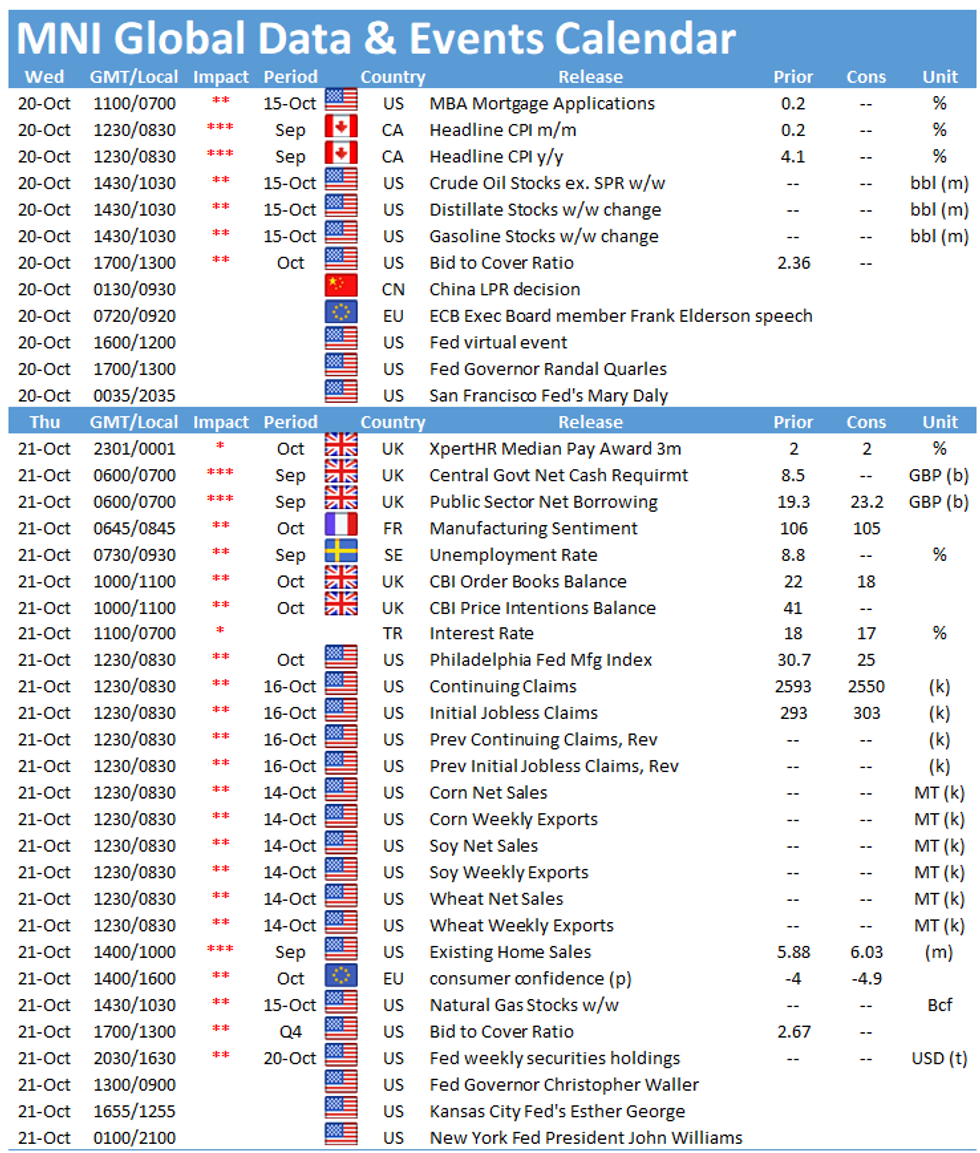

- The data calendar is pretty light today with most scheduled ECB speakers due to speak on regulation and the only Fed speaker due to speak on the economy is Quarles. The Beige Book is due for release later.

- TY1 futures are up 0-0+ today at 130-18+ with 10y UST yields down -0.1bp at 1.638% and 2y yields down -0.7bp at 0.390%.

- Bund futures are up 0.11 today at 168.65 with 10y Bund yields down -1.3bp at -0.120% and Schatz yields down -1.5bp at -0.672%.

- Gilt futures are up 0.07 today at 124.08 with 10y yields down -1.8bp at 1.149% and 2y yields down -2.0bp at 0.705%.

FOREX: AUD, NZD Solid, NOK Drops Off Firmest Level in Two Years

- Growth proxies and antipodean currencies are faring most firmly, with AUD and NZD at the top of the G10 pile. AUD/USD is extending the Tuesday rally (spurred by a somewhat hawkish set of RBA minutes), allowing the pair to narrow in on key resistance at the 0.7566 200-dma.

- GBP edged lower through the European open, with GBP/USD trading south of the 1.38 handle ahead of NY hours. Price action seems more reminiscent of consolidation and profit-taking following sharp strength seen since the beginning of the week rather than a direct market response to the slightly softer-than-expected CPI data - although that will be supporting.

- A failure to sustain gains in GBP/USD at these levels will mean the pair failed to break the 200-dma at 1.3848 which becomes an important level ahead of any progress on the mid-September high at 1.3913.

- NOK is the poorest performing currency in G10, knocked back by a modest reversal in oil prices (WTI and Brent crude futures are both lower by circa 1%) and some profit-taking on yesterday's strength in the currency. EUR/NOK bounced off yesterday's 9.7063, which marked a new two-year low for the cross, but the outlook remains resolutely bearish below resistance at 9.9417 - the 23.6% retracement of the July-Oct downleg.

- Canadian CPI data is the sole release on the data schedule, with focus turning to the Fed's Beige Book and speeches from ECB's Holzmann, Villeroy and Visco as well as Fed's Bostic, Quarles, Kashkari, Evans and Bullard.

EQUITIES: US Futures Point to Mixed Open Wednesday

- Japan's NIKKEI up 40.03 pts or +0.14% at 29255.55 and the TOPIX up 1.1 pts or +0.05% at 2027.67

- China's SHANGHAI closed down 6.152 pts or -0.17% at 3587.001 and the HANG SENG ended 348.81 pts higher or +1.35% at 26136.02.

- The German Dax up 18.81 pts or +0.12% at 15541.63, FTSE 100 down 5.83 pts or -0.08% at 7209.67, CAC 40 down 14.84 pts or -0.22% at 6661.07 and Euro Stoxx 50 up 1.44 pts or +0.03% at 4168.34.

- Dow Jones mini up 4 pts or +0.01% at 35338, S&P 500 mini down 1.5 pts or -0.03% at 4508.75, NASDAQ mini down 9 pts or -0.06% at 15397.

COMMODITIES: Silver Gaining Again

- WTI Crude down $0.7 or -0.84% at $82.33

- Natural Gas down $0.01 or -0.2% at $5.078

- Gold spot up $10.01 or +0.57% at $1776.32

- Copper down $4.3 or -0.91% at $464.25

- Silver up $0.28 or +1.18% at $23.8756

- Platinum up $2.95 or +0.28% at $1049.38

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.