-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: FI Drifts Higher

MNI US Open: FI Drifts Higher

EXECUTIVE SUMMARY:

- European fixed income has drifted higher alongside gains for equities

- The ECB's de Cos and Guindos will speak later today.

- Several BoE policymakers will be speaking in parliament.

.

NEWS

RUSSIA (REUTERS): Russian President Vladimir Putin said in an interview broadcast on Sunday that he had rejected a defence ministry proposal to hold snap Black Sea military drills in response to NATO activity because he did not want to escalate tensions in the region.

UK (COVID): The UK should expand eligibility for Covid-19 booster shots to people in their 40s in a bid to stave off waning immunity and reduce the risk of the NHS being overwhelmed this winter, the government's advisers have recommended. Children aged 16 and 17 years old should also be eligible for a second dose of a Covid jab 12 weeks or more after their first inoculation, following new guidance from the Joint Committee on Vaccination and Immunisation announced on Monday. The booster policy change follows the publication of new data from the Health Security Agency, which show that the risk of symptomatic Covid for booster shot recipients was cut by more than four-fifths compared with those who had only received two doses.

UK (BLOOMBERG). U.K. economists have become more hawkish over the past month and now expect the Bank of England to increase interest rates in December as concerns about inflation intensify. A month ago, economists predicted the central bank would maintain its benchmark rate at a record-low 0.1% until May. Now they expect an increase to 0.25% next month, according to a Bloomberg survey published Monday. That would make the U.K. the first major economy to lift borrowing costs since the pandemic.

AUSTRIA (BLOOMBERG): Austrian police have been ordered to stop and check individuals on the streets to enforce a lockdown on people who have refused a Covid-19 vaccine, part of a series of stricter curbs across Europe to counter a renewed surge in infections. Starting on Monday, people who can't show proof of vaccination and are caught going into cinemas, gyms or retail stores face fines starting at 500 euros ($573). Business owners could be tapped for 3,600 euros, the Interior Ministry announced on Sunday. Alexander Schallenberg speaks during a Covid-19 news conference in Vienna, on Nov. 14. The country needs to raise its "shamefully low vaccination rate," Chancellor Alexander Schallenberg said at a press conference in Vienna. "We are not taking this step lightly. But unfortunately it's necessary."

EUROPEAN ISSUANCE UPDATE

SLOVAKIA AUCTION RESULTS: 3/9/15-year SlovGBs

| 0% Jun-24 SlovGB | 1.00% Oct-30 SlovGB | 0.375% Apr-36 SlovGB | |

| ISIN | SK4000017398 | SK4000017059 | SK4000018958 |

| Amount | E156mln | E79mln | E100mln |

| Previous | E144mln | E76mln | E104mln |

| Avg yield | -0.7221% | -0.0707% | 0.3764% |

| Previous | -0.5719% | 0.0845% | 0.5353% |

| Bid-to-cover | 1.35x | 2.22x | 2.88x |

| Previous | 2.15x | 4.17x | 4.55x |

| Price | 101.8859 | 109.7820 | 99.9802 |

| Previous | 101.5359 | 108.3972 | 97.7684 |

| Pre-auction mid | 101.852 | 109.410 | 99.571 |

| Previous | 101.386 | 107.805 | 96.934 |

| Previous date | 18-Oct-21 | 18-Oct-21 | 18-Oct-21 |

FIXED INCOME: Focus on MPC speakers today

Core fixed income has drifted higher today with curves bull flattening. Futures have moved above the highs of both Thursday and Friday across Treasuries, Bunds and gilts.

- Against this backdrop, equities are moving higher and commodities and breakevens have generally fallen a little today.

- Looking ahead, the main event of the day will be the four MPC members testifying ahead of the TSC ahead of a big week for UK data (including both labour market and inflation data).

- ECB's Lagarde has been speaking to the ECON Committee of the European Parliament but has not really said anything new or market moving.

- TY1 futures are up 0-9 today at 130-26 with 10y UST yields down -1.9bp at 1.545% and 2y yields down -0.8bp at 0.506%.

- Bund futures are up 0.37 today at 171.22 with 10y Bund yields down -1.8bp at -0.278% and Schatz yields down -0.4bp at -0.823%.

- Gilt futures are up 0.28 today at 126.63 with 10y yields down -2.8bp at 0.883% and 2y yields down -2.4bp at 0.493%.

FOREX: CNH Shrugs Off Solid China Data as Xi Meets Biden

- China data crossed overnight and proved generally better than expected. Retail sales came in firmer than forecast, while industrial production also tipped ahead of expectations. CNH was little changed, however, with focus resting instead of the Xi-Biden virtual summit due to kick off at the tail-end of the session. The two Presidents are expected to discuss responsibility, with the US seen urging that China play by the rules on the international stage. No deliverables or progress on trade are seen emerging from the summit.

- Markets are little changed early Monday, with the greenback modestly on the backfoot, alongside the EUR and JPY in what's been a generally direction-less session so far.

- Equity markets are trading generally well, with the e-mini S&P higher by around 10 points and nearing the alltime highs posted on Nov5 at 4711.75.

- US Empire Manufacturing and Canadian manufacturing sales numbers are the Monday highlights, with a few speakers worth watching also: namely ECB's de Cos & de Guindos and BoE's Bailey, Pill, Mann and Saunders, who testify in front of Parliament.

FX OPTION EXPIRY

FX OPTION EXPIRY (closest ones)- EURUSD: 1.1400 (553mln), 1.1450 (352mln), 1.1525 (243mln)

- USDJPY: 113.95 (439mln), 114.25 (290mln)

- USDCNY: 6.38 (427mln)

COMMODITIES: Crude leading commodities a little lower

- WTI Crude down $0.85 or -1.05% at $79.98

- Natural Gas up $0 or +0.02% at $4.793

- Gold spot down $1.85 or -0.1% at $1862.32

- Copper down $1.15 or -0.26% at $443.95

- Silver down $0.1 or -0.39% at $25.2139

- Platinum down $7.07 or -0.65% at $1077.93

EQUITIES: Stocks generally drift higher

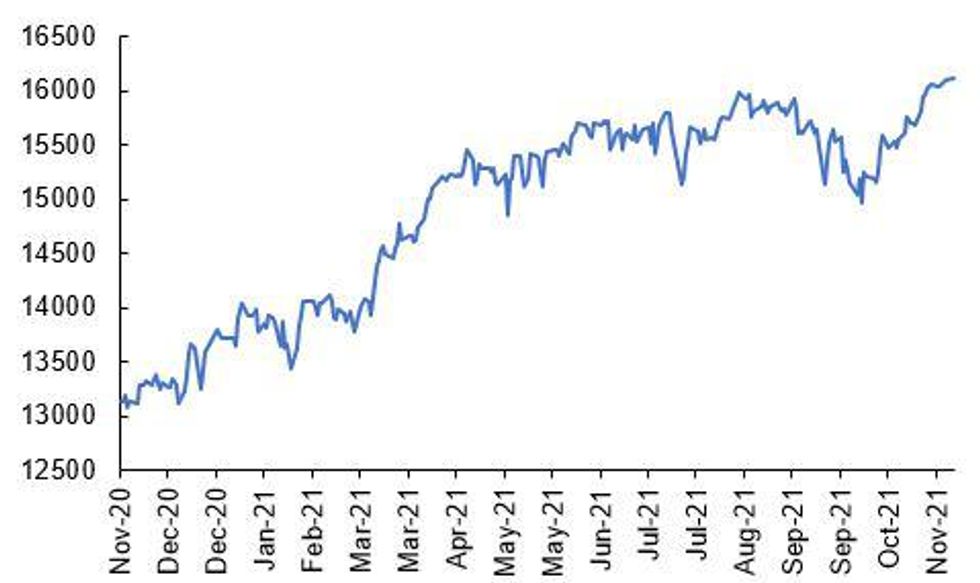

- Japan's NIKKEI up 166.83 pts or +0.56% at 29776.8 and the TOPIX up 7.92 pts or +0.39% at 2048.52

- China's SHANGHAI closed down 5.798 pts or -0.16% at 3533.302 and the HANG SENG ended 62.94 pts higher or +0.25% at 25390.91

- German Dax up 20.15 pts or +0.13% at 16116.35, FTSE 100 down 2.74 pts or -0.04% at 7345.65, CAC 40 up 17.77 pts or +0.25% at 7109.12 and Euro Stoxx 50 up 2.96 pts or +0.07% at 4373.88.

- Dow Jones mini up 76 pts or +0.21% at 36086, S&P 500 mini up 9 pts or +0.19% at 4687, NASDAQ mini up 35.25 pts or +0.22% at 16229.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.