-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USDJPY, Equities Drift Off Highs

Highlights:

- USDJPY drifts off multi-year highs

- Mild bull flattening evident in the Treasury curve

- Fed minutes take focus, ADP Employment also due

US TSYS SUMMARY: Mild Bull Flattening After Recent Sell-Offs

- Cash Tsys have been relatively subdued after yesterday’s further bear steepening, prior to the US coming in and FOMC minutes later at 1400ET/1900GMT.

- 2Y yields are unch at 0.760%, 5Y unch at 1.357%, 10Y -0.5% at 1.642% and 30Y -1.9bps at 2.046%.

- TYH2 is in the middle of the morning’s tight range at 129-12 after recovering yesterday from a low of 129-04. Further declines could open 128-30+ (Nov 26 low) and then a key support of 128-22+ (Now 22 low). Relatively low volumes at just above 240k.

- ADP for Dec (cons 410k after 534k), final Dec Markit PMIs for services/composite with likely a renewed focus on prices paid, and then the aforementioned FOMC minutes.

- The focus for the minutes will be discussions hinting to the feasibility of the March meeting being live for a rate hike (timing between taper conclusion and liftoff) and balance sheet normalisation timing.

- NY Fed buy-ops: 7Y-10Y, appr $2.425B (1030ET) and 22.5Y-30Y, appr $1.825B (1120ET).

- Issuance: $40B 119D-bill auction (1130ET).

EGB/GILT SUMMARY: Mixed Start

European sovereign bonds trade mixed this morning with gilts/core EGBs broadly firming alongside relatively uneven trading in periphery EGBs.

- Gilts have edged higher with cash yields 1bp lower on the day and the curve marginally bull flattening following yesterday's steep sell-off.

- Bunds are similarly slightly firming with the curve 1bp flatter.

- BTPs have sold off with yields broadly 1-3bp higher and the curve a touch steeper.

- The SPGB curve has steepened slightly on the back of the short end firming and longer end yields inching higher. The 2s30s spread widening by 1bp.

- Italian and Spanish PMI data for December came in weaker than expected, while Italian CPI data for the same month was in line with expectations (4.2% Y/Y).

- Supply this morning came from Germany (Bund, EUR3.13bn allotted), Spain (Bono/Obli/ObliEi, EUR5.68bn) and the EU (Bills, EUR2.999bn). Slovenia is auctioning 4- and 40-year bonds with books last seen above EUR4.6bn for the former and EUR1.5bn for the latter.

EUROPE ISSUANCE UPDATE

Germany sells €3.13bln 0% Feb-32 Bund, Avg yield -0.09% (Prev. -0.38%), Bid-to-cover 1.14x (Prev. 1.11x), Buba cover 1.46x (Prev. 1.33x)

Spain sells 3-year Bono / 7/15-year Obli / Nov-27 ObliEi

E1.39bln 0% May-24 Bono, Avg yield -0.392% (Prev. -0.513% 0.044% 0.942% -1.383%), Bid-to-cover 2.14x (Prev. 1.91x)

E1.7bln 0% Jan-28 Obli, Avg yield 0.122% (Prev. -0.513% 0.044% 0.942% -1.383%), Bid-to-cover 1.66x (Prev. 1.39x)

E2.032bln 0.85% Jul-37 Obli, Avg yield 1.042% (Prev. -0.513% 0.044% 0.942% -1.383%), Bid-to-cover 1.28x (Prev. 1.42x)

E558mln 0.65% Nov-27 Obli-Ei, Avg yield -1.704% (Prev. -0.513% 0.044% 0.942% -1.383%), Bid-to-cover 1.99x (Prev. 1.74x)

ITALY SYNDICATION: 30-year BTP spread set

Total books are in excess of E43bln (including E2.75bn of JLM)

Spread is set at 1.70% Sep-51 BTP +6bps (from initial guidance of +8bpsarea)

SLOVENIA SYNDICATION: 4/40-year update

4-year: Guidance revised to MS-20bps area (from MS-15bps area)

Books >E4.6bln excl JLM interest

40-year: Guidance revised to MS+77bps area (from MS+80bps area), Books >E1.5bln excl JLM interest

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXH2 170/169ps,1x1.5 bought for 1 in 3k

RXH2 170/169ps,1x1.5 bought for 1.5 in 1k

2RH2 100.50c, bought for 0.25 in 4k

SX5E 18th March 2500/1900ps 1x2, bought for 1.30 in 5k

FOREX: USDJPY Fades Off Multiyear High

- Markets are largely in consolidation mode Wednesday, with USD/JPY fading slightly off the multi-year high posted yesterday at 116.35, with prices now either side of the 116.00 handle. The pair has re-correlated with equity indices, following the e-mini S&P off the alltime high, with the index around 25 points off Tuesday's 4808 at typing.

- A modest souring in sentiment follows a generally risk-off session in Asia, with the Hang Seng Index retreating over 1.5% as further cases of omicron are found clustering across Hong Kong. Tighter activity restrictions have been rolled out, including restaurant capacity limits and forced closures for certain outlets this weekend.

- USDJPY's pullback has worked against the USD Index, with the greenback lower against most others in G10. JPY is firmest, with NOK and SEK both posting minor gains.

- Fed minutes take focus later today, with ADP Employment Change for December also on the docket.

FX OPTIONS: Expiries for Jan05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1190-00(E673mln), $1.1285-90(E539mln)

- USD/JPY: Y113.45-55($960mln)

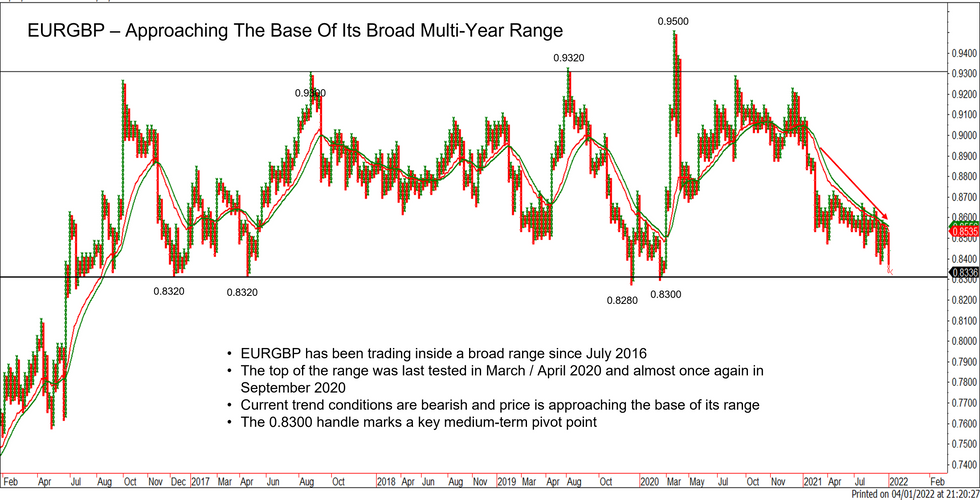

Price Signal Summary - EURGBP Approaches Its Multi-Year Range Base

- In the equity space, the S&P E-minis trend condition remains bullish and the contract traded above the 4800.00 handle yesterday. Despite not being able to hold onto levels above 4800.00, further gains are seen likely and the current consolidation represents a pause in the uptrend. The focus is on 4854.19, 0.764 projection of the Oct 1 - Nov 22 - Dec 3 price swing. EUROSTOXX 50 futures remain in an uptrend and continue to push higher. Attention is on the key resistance at 4392.50, the Nov 18 high.

- In FX, EURUSD remains below the key resistance of 1.1383/86, the Nov 30 and Dec 31 high. The pair continues to consolidate inside December’s range. A deeper pullback would expose support at 1.1222, Dec 15 low ahead of the bear trigger at 1.1185, Jul 1, 2020. A clear breach of 1.13783/86 is required to suggest scope for a stronger rally. GBPUSD remains in an uptrend and above its 50-day EMA at 1.3431 - the recent breach of this average reinforced bullish conditions. The focus is on 1.3578, 61.8% of the Oct - Dec sell-off and 1.3607, the Nov 9 high. EURGBP remains vulnerable. The recent move lower has opened the major support and bear trigger at 0.8282/77, the Feb’20 / Dec’19 low and key bear trigger. Note too that the 0.8300 area is the base of a broad multi-year range and is a key pivot level. Initial firm resistance is at 0.8419, Monday’s high. USDJPY cleared key resistance at 115.52 yesterday, the Nov 24 high. The break confirms a resumption of both the short and medium-term trends, paving the way for a climb towards 116.09 next, 1.764 projection of Apr 23 - Jul 2 - Aug 4 price swing.

- On the commodity front, Monday’s high in Gold of $1831.9 (resistance) plus 1780.6, the channel base drawn from the Aug 9 low (support), mark the key short-term directional triggers. For now, the trend remains up and it remains to be seen whether a bearish engulfing candle pattern on Monday will result in a deeper sell-off below the channel base. WTI futures remain in an uptrend. Recent weakness proved to be corrective and Monday’s low of $74.27 represents a key short-term support. Scope is seen for a climb towards $78.59, Nov 24 high.

- In the FI space, Bund futures started the year on a soft note. The contract remains vulnerable. Last week’s breach of support at 171.77, Nov 24 low strengthened the bearish case, paving the way for a move towards 170.19, Nov 2 low ahead of the major support at 169.34, the Oct 29 low. Gilts remain in a downtrend. The contract has cleared support at 124.17, Nov 24 low. The break of this level strengthens bearish conditions and opens 123.48, the 3.00 projection of the Dec 8 - 16 - 20 price swing.

EQUITIES: Europe Higher; Tech Weighs In Asia, US

- Asian markets closed mixed: Japan's NIKKEI closed up 30.37 pts or +0.1% at 29332.16 and the TOPIX ended 9.05 pts higher or +0.45% at 2039.27. China's SHANGHAI closed down 37.153 pts or -1.02% at 3595.176 and the HANG SENG ended 382.59 pts lower or -1.64% at 22907.25.

- European stocks are gaining again, with the German Dax up 94.14 pts or +0.58% at 16245.88, FTSE 100 up 15.61 pts or +0.21% at 7522.28, CAC 40 up 24.62 pts or +0.34% at 7342.69 and Euro Stoxx 50 up 22.21 pts or +0.51% at 4389.24.

- U.S. futures are flat/mixed, with the Dow Jones mini up 42 pts or +0.11% at 36717, S&P 500 mini up 1.5 pts or +0.03% at 4785.75, NASDAQ mini down 30.5 pts or -0.19% at 16245.75.

COMMODITIES: Precious Metals Edge Higher With Dollar Lower

- WTI Crude down $0.07 or -0.09% at $76.81

- Natural Gas up $0.06 or +1.53% at $3.774

- Gold spot up $4 or +0.22% at $1818.93

- Copper down $3.8 or -0.85% at $443.65

- Silver up $0.01 or +0.04% at $23.0717

- Platinum up $9.13 or +0.94% at $984.63

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/01/2022 | 1200/0700 | ** |  | US | MBA weekly applications index |

| 05/01/2022 | 1315/0815 | *** |  | US | ADP Employment Report |

| 05/01/2022 | 1330/0830 | * |  | CA | Building Permits |

| 05/01/2022 | 1445/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/01/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 05/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 05/01/2022 | 1900/1400 | * |  | US | FOMC Minutes |

| 06/01/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 06/01/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 06/01/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 06/01/2022 | 0700/0800 | ** |  | DE | manufacturing orders |

| 06/01/2022 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/01/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 06/01/2022 | 1300/1400 | *** |  | DE | HICP (p) |

| 06/01/2022 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 06/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 06/01/2022 | 1330/0830 | ** |  | US | trade balance |

| 06/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 06/01/2022 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 06/01/2022 | 1500/1000 | ** |  | US | factory new orders |

| 06/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 06/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 06/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 06/01/2022 | 1630/1130 |  | US | San Francisco Fed's Mary Daly | |

| 06/01/2022 | 1815/1315 |  | US | St. Louis Fed's James Bullard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.