-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - Dip Erased as Stocks Hit Weekly Highs

EXECUTIVE SUMMARY:

- ECB'S LANE SAYS 2022 HIKE IS HIGHLY UNLIKELY

- DUTCH CPI ROSE TO ALLTIME HIGH IN DECEMBER

- US STOCK FUTURES AT NEW WEEKLY HIGHS, ERASING MONDAY DIP

Figure 1: Dutch CPI surged to a new series high of 6.4% in December

NEWS

EUROZONE (MNI): Bottlenecks To Hit EA Manufacturing Through 2022

The negative effects of supply chain bottlenecks on euro area manufacturing could continue throughout much of this year, having already depressed euro area GDP growth by at least 0.5% in 2021, the ECB's latest Economic Bulletin reports. "The semiconductor shortages, negative pandemic developments in Asia and current congestion at container ports are unlikely to ease very much, suggesting that the euro area economy is expected to continue to be affected by these shocks over the coming months," the authors conclude.

ECB (MNI): ECB Hike Unlikely In '22 Despite Solid Growth - Lane

ECB policymakers are keeping a close watch on household and firm decision and wage behaviour as they assess whether euro area headline inflation will remain above-target into the medium-term, chief economist Philip Lane said in an interview published Tuesday, but he dismissed the chances of a 2022 rate hike as "unlikely." Lane was clear regarding the sequence for exiting extraordinary monetary policy, with net asset purchases stopping before the first interest rate increase, "and only well after the first increase in interest rates will the central bank think about shrinking its balance sheet."

ECB (MNI): Energy A Concern For Price Stability - Lindner

Germany's government shares ECB Executive Board member Isabel Schnabel's recently expressed opinion that central banks may not be able to look through rising energy prices in order to ensure medium-term price stability, finance minister Christian Lindner said Tuesday.

UK (BBG): Boris Johnson is facing opposition calls for his resignation over an alleged drinks party in his Downing Street office while pandemic curbs were in place, renewing a sense of crisis around the U.K. premier. The prime minister’s hopes of a reset after a torrid end to 2021 were ruined after it emerged officials in his team were invited to a drinks party in his office garden in May 2020, when such gatherings were banned during the first wave of Covid-19 infections, according to an email seen by ITV News.

UK (The Times): Boris Johnson puts pressure on scientists to cut Covid isolation period

The UK Health Security Agency has acknowledged it was wrong to claim that the US five-day isolation period started “some days” later than the British seven-day rule.

FED (BBG): Federal Reserve Vice Chair Richard Clarida said Monday he will resign two weeks before his term expires, following new revelations about his stock trading on the eve of a major central bank announcement in early 2020. Clarida, 64, will leave the Fed’s Board of Governors on Jan. 14, ahead of the expiration of his term as governor on Jan. 31, according to a letter to President Joe Biden, who picked Fed Governor Lael Brainard as vice chair in November. The missive made no mention of Clarida’s trading.

DATA

BOJ (MNI): Japan Dec Sentiment Rises; Price Outlook Up

Household sentiment in Japan rose in December and the outlook index gained for the first time in three quarters, the Bank of Japan's quarterly consumer survey released on Tuesday showed. The BOJ's diffusion index to gauge households' sentiment on current economic conditions rose 9.5 points to -45.8 in December. The consumer sentiment outlook index projecting conditions a year ahead was up 24.8 points to +5.0 in December from -19.8 in September.

NETHERLANDS (BBG): Netherlands' consumer prices rose 5.7% y/y in December versus +5.2% in November, according to the Dutch Statistics Office. Consumer prices rose 0.7% m/m versus +0.9% in November. EU Harmonized CPI rose 0.9% m/m versus +0.8% in November, rose 6.4% y/y versus +5.9% in November

FOREX: Equity Dip Proves Short-Lived, Driving JPY Lower

- The buy-the-dip strategy in US equity markets reigned supreme Monday, with the e-mini S&P rallying sharply off the days lows to put prices at new weekly highs ahead of the Tuesday open. The return to risk has weighed on haven currencies, pressing the JPY, USD and CHF toward the bottom of the pile, while favouring growth proxies and commodity-tied FX including NOK and AUD.

- USD/JPY's Monday weakness put the pair to 115.05, but the recovery alongside global stock markets has prompted a rally toward 113.50. Strength through here opens the Monday highs at 115.85 ahead of 116 and above.

- USD/NOK continues to oscillate either side of the 50-dma, with the relative strength/weakness of oil the primary driver. Weakness through 8.8134 opens losses toward 8.7857 and key support at late December's 8.7597.

- Tier one datapoints are few and far between Tuesday, with just the US NFIB Small Business Optimism data. This keeps focus on the busier CB speaker slate, with the formal handover ceremony for Nagel to take over at the Bundesbank as well as speeches from ECB's Kazaks, Fed's Mester and George as well as the Senate hearing for Powell's renomination as head of the Federal Reserve.

BOND SUMMARY: Waiting for tomorrow's US CPI

Core fixed income has drifted higher with European peripheral spreads also moving a little wider. However, all of these moves are within the ranges seen on Friday, and we are unlikely to see any real breakout moves ahead of tomorrow's US CPI data. Gilts are the outperformers today, but they were the weakest of the core fixed income futures yesterday.

- Powell's Senate hearing is likely to be the most watched event today with a rather sparse data calendar, while there are a number of other ECB and Fed speakers scheduled.

- TY1 futures are up 0-4+ today at 128-09 with 10y UST yields down -0.6bp at 1.755% and 2y yields up 1.4bp at 0.910%.

- Bund futures are down -0.02 today at 169.94 with 10y Bund yields down -0.4bp at -0.80% and Schatz yields up 0.5bp at -0.589%.

- Gilt futures are up 0.15 today at 123.06 with 10y yields down -1.8bp at 1.171% and 2y yields down -0.4bp at 0.827%.

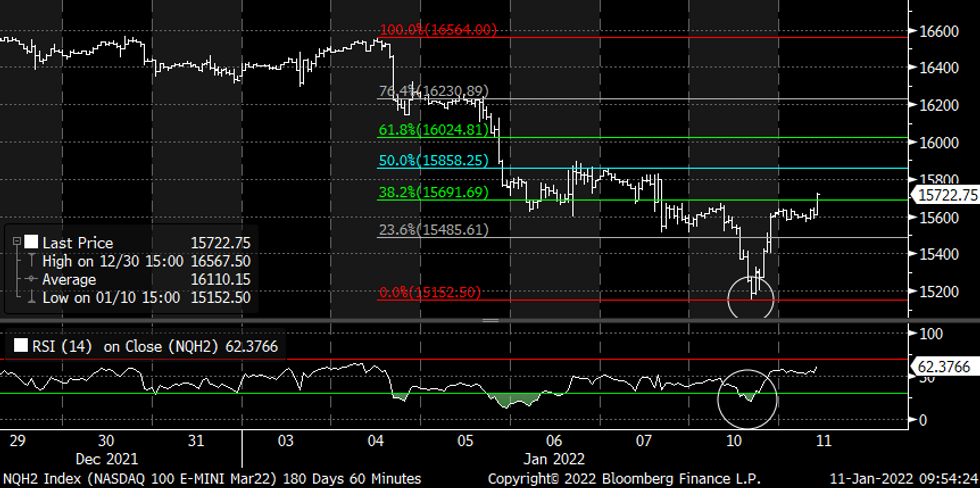

EQUITIES: Tech stocks recover

- Estoxx has now gained 1.73% from yesterday's low, most desks have been fading after all the contracts traded into oversold territory.

- VGH2 has recovered over half of yesterday's sell off.

- Next upside resistance comes at 4298.8, which is the 50% retrace of the January fall, from the 5th January.

- NQA (Nasdaq) is through yesterday's high, and next resistance here, is seen at 15,858.25.

- Tech stocks in Stoxx600 are up 2.53%

Chart source: Bloomberg

COMMODITIES: Metals and oil higher but natgas lower

- WTI Crude up $1.25 or +1.6% at $79.52

- Natural Gas (NYM) down $0.04 or -1.01% at $4.038

- Natural Gas (ICE Dutch TTF) down $1.31 or -1.54% at $83.3

- Gold spot up $4.86 or +0.27% at $1806.38

- Copper up $2.65 or +0.61% at $438.15

- Silver up $0.09 or +0.39% at $22.549

- Platinum up $2.75 or +0.29% at $946.07

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/01/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 11/01/2022 | 1020/1120 |  | EU | ECB Lagarde at Bundesbank Ceremony | |

| 11/01/2022 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 11/01/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 11/01/2022 | 1430/0930 |  | US | Kansas City Fed's Esther George | |

| 11/01/2022 | 1500/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 11/01/2022 | 1500/1000 |  | US | Fed Chair Powell's Senate nomination hearing | |

| 11/01/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 11/01/2022 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 12/01/2022 | 1000/1100 | ** |  | EU | industrial production |

| 12/01/2022 | 1200/0700 | ** |  | US | MBA weekly applications index |

| 12/01/2022 | 1330/0830 | *** |  | US | CPI |

| 12/01/2022 | 1415/1415 |  | UK | BOE Cunliffe at Crypto Fin Conference | |

| 12/01/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 12/01/2022 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/01/2022 | 1700/1200 | ** |  | US | USDA GrainStock - NASS |

| 12/01/2022 | 1700/1200 | *** |  | US | USDA Winter Wheat |

| 12/01/2022 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/01/2022 | 1800/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 12/01/2022 | 1900/1400 | ** |  | US | Treasury Budget |

| 12/01/2022 | 1900/1400 |  | US | Fed Beige Book |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.