-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Hot UK Inflation Underpins Gilt Selling

Highlights:

- Equities stabilise, underpinning pullback in dollar

- Gilt curve rallies as UK inflation surges

- Focus turns to US housing, Canadian CPI data

US TSYS SUMMARY: Modest Bear Flattening After Yesterday's Rout

- Cash Tsys have seen a modest bear flattening after yesterday’s rout, with 2Y, 5Y and 10Y yields all seeing new post-pandemic highs.

- 2Y yields +1.3bps at 1.053%, 5Y +0.9bps at 1.666%, 10Y +0.6bps at 1.879% and 30Y +0.7bps at 2.195%.

- TYH2 trades in a narrow range this morning at 127-08+ on another day of solid volumes (485k) after yesterday cleared 2M. It earlier cleared 127-07 (the 2.236 proj of the Dec 20-29-31 price swing) before retracing, with next support seen at 127-00.

- Data: Housing starts/building permits for Dec (0830ET).

- NY Fed buy-op: Tsy 4.5Y-7Y, appr $6.025B vs. $4.525B prior (1030ET).

- Issuance: $40B 119D-Bill auction (1120ET) before $20B 20Y Bond auction reopen (1300ET).

EGB/GILT SUMMARY: UK Inflation Surprise Underpins Gilt Selling

European government bonds have traded weaker this morning with gilts underperforming EGBs. Oil continues to push higher, further stoking inflationary pressure, while the US dollar has been on the back foot against G10 FX.

- UK inflation surprised higher in December, coming in at 5.4% Y/Y vs 5.2% survey - the highest level in 30-years.

- Gilts have sold off with cash yields up 4-5bp and the shorter end of the curve slightly underperforming.

- Bunds have traded weaker with the curve bear steepening, although some of the earlier losses have been reclaimed. Yields are now up 1-3bp on the day with the 2s30s spread widening 2bp.

- OATs have similarly pushed lower with the belly of the curve underperforming.

- BTPs sold off sharply earlier in the session before recovering lost ground with yields now 1-2bp above yesterday's close.

- Supply this morning came from Germany (Bund, EUR1.326bn allotted), Portugal (BT, EUR1.5bn) and the Eurozone (Bills, EUR2bn). In addition there have been syndicated issues from Greece (10-year) and Austria (7-year, 20-year, 50-year).

EUROPE ISSUANCE UPDATE

Germany allots E1.326bln 0% May-36 Bund, Avg yield 0.15% (Prev. -0.06%), Bid-to-cover 1.01x (Prev. 0.54x), Buba cover 1.15x (Prev. 1.10x)

Austria triple tranche syndication:

A new Oct-28 RAGB (short 7-year). No size set. MNI expects E3-5bln

Spread set at MS-21bp (Guidance was MS-19bps area)

Books above E10bln (including JLM interest)

0% Oct-40 RAGB (20-year launched in 2020). Expected size E1.5bln

Spread set at MS+1bp (Guidance was MS + 2bps area)

Books above E6.2bln (including JLM interest)

0.70% Apr-71 RAGB (50-year launched in 2021). Expected size E1.0bln

Spread set at MS+62bp (Guidance was MS + 63bps area)

Books above E4bln (including JLM interest)

Greek 10-year syndication:

Size: Benchmark (MNI expects E2.5-3.5bln)

Spread set at MS+140bps (Guidance was MS+145bps area)

Books are in excess of E11bln (inc E875mln JLM trading)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXH2 157p, bought for 2 in ~9.3k

OEH2 133.25/133.50cs, bought for 5 in 1kOEH2 132p, sold at 20 in 4.5k

ERZ2 100.12/100ps, bought for 2.5 in 2.5k

SX7E 102 put, bought for 2.15 and 2.20 in 50k total.SX7E 18/03/22 110c, sold at 3.25 in 12k

US:

TYH2 126p, bought for 24 in ~12.1k

FOREX: Dollar Giving Back Small Part of Week's Rally

- The dollar is giving back a small part of the Tuesday rally ahead of Wednesday's NY open, with EUR/USD recovering to test the 1.1350 level. Similarly, GBP/USD is back comfortably above 1.36 as price action mimics that seen in stock markets. The e-mini S&P has stabilised, having bottomed out at the 4535.50 low in Asia hours, to sit in minor positive territory at the crossover.

- Outperformers so far Wednesday are commodity- and growth-tied currencies, with NOK bouncing ahead of tomorrow's Norges Bank decision (no change to rates expected) and CAD on the front foot ahead of today's CPI read. USD/CAD sits below the 200-dma, with bears eyeing the 2022 low of 1.2454 for direction.

- The Fed remain in their media blackout period, keeping the speaker schedule relatively light and keeping focus on US housing starts/building permits data as well as Canadian CPI. Bailey and Cunliffe of the Bank of England testify on financial stability, while ECB's Holzmann also makes an appearance.

FX OPTIONS: Expiries for Jan19 NY cut 1000ET (Source DTCC)

- USD/JPY: Y114.50-55($585mln), Y115.00($512mln)

- AUD/USD: $0.7245-50(A$535mln)

Price Signal Summary - S&P E-Minis Bear Threat Still Present

- In the equity space, S&P E-minis have traded lower again. This week’s sell-off has resulted in a break of support at 4572.75, the Jan 10 low. This once again highlights the developing bearish risk and exposes 4520.25, the Dec 20 low and the next key support at 4485.75, Dec 3 low. EUROSTOXX 50 futures tested and briefly probed support at 4216.50, Jan 10 low. This level has held for now and support has again surfaced below the 50-day EMA. Weakness below today’s intraday low of 4212.00 would trigger a resumption of bearish pressure. However, also watch resistance at 4324.50, Jan 13 high. A break would reinstate a bullish theme.

- In FX, yesterday’s sell-off in EURUSD resulted in a breach of the 20-day EMA, currently at 1.1355. This week’s price action threatens the recent bullish theme and suggests that at this stage, last week’s range and bear channel breakout appears to have been a false one. Further weakness would expose 1.1272, the Jan 4 low. GBPUSD trend conditions remain bullish. Attention is on the 200-dma, at 1.3736. This average has been probed, a clear break would open 1.3835, Oct 20 high. Support to watch is at 1.3547, the 20-day EMA. USDJPY remains above Friday's low of 113.49. Friday’s doji candle pattern continues to highlight a reversal and signals the end of the recent corrective pullback. A resumption of gains would open 115.68, Jan 11 high. Sub 113.49 levels would be bearish.

- On the commodity front, Gold remains below recent highs. The outlook is bullish and attention is on resistance at $1831.9, Jan 3 high. A break would open $1849.1, Nov 22 high. The base of the bull channel drawn from the Aug 9, 2021 low intersects at $1789.1 and is a key support. WTI futures remain in an uptrend and the contract has traded higher once again today. The focus is on $87.86, 2.00 projection of the Dec 2 - 9 - 20 price swing.

- In the FI space, Bund futures remain vulnerable and have today traded below 169.34, Oct 29 low. This strengthens bearish conditions and opens 168.84, 3.764 projection of the Dec 8 - 20 price swing. 171.00 is the key short-term resistance, Jan 13 high. Gilts remain in a downtrend. Yesterday’s move lower resulted in a break of former support at 122.78, Jan 10 low. This confirms a resumption of the underlying downtrend and today’s weakness reinforces current conditions. The focus is 121.61, Nov 13 2018 low on the continuation chart.

EQUITIES: Bouncing From Overnight Lows

- Asian markets closed mostly weaker: Japan's NIKKEI closed down 790.02 pts or -2.8% at 27467.23 and the TOPIX ended 58.66 pts lower or -2.97% at 1919.72. China's SHANGHAI closed down 11.734 pts or -0.33% at 3558.18 and the HANG SENG ended 15.07 pts higher or +0.06% at 24127.85.

- European stocks are a little higher, with the German Dax up 27.82 pts or +0.18% at 15779.27, FTSE 100 up 1.01 pts or +0.01% at 7558.35, CAC 40 up 37.98 pts or +0.53% at 7152.78 and Euro Stoxx 50 up 22.49 pts or +0.53% at 4273.37.

- U.S. futures have bounced a little, with the Dow Jones mini up 35 pts or +0.1% at 35294, S&P 500 mini up 7.5 pts or +0.16% at 4578.75, NASDAQ mini up 44.25 pts or +0.29% at 15250.25.

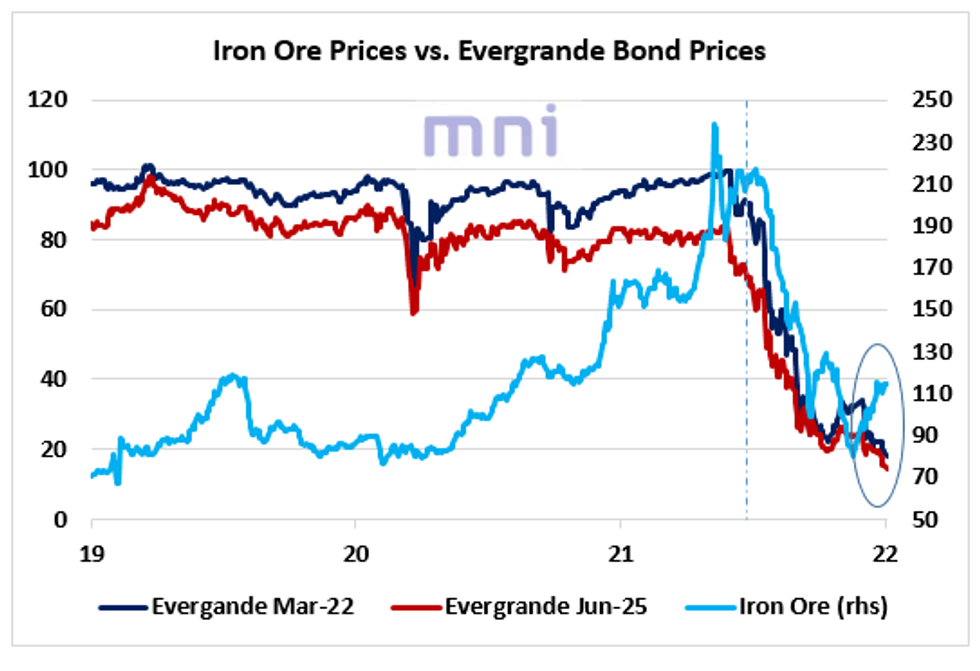

COMMODITIES: Iron Ore Up Nearly 50% Since November Despite Crashing Chinese Property Sector

- While the Chinese property sector continues to suffer significant losses, with Evergrande crisis spreading to other developers such as Country Garden (the country’s largest developer by contracted sales), iron ore prices have been gradually recovering since their low reached in the end of November.

- The chart below shows that while Evergrande June 2025 bond has fallen below 12cents on the dollar, iron ore prices are up nearly 50%.

- We previously saw that part of the plunge in iron ore prices in H2 2021 was linked to the government crackdown on the real estate market, which has been a strong buyer of steel.

- Investors’ growing concerns over the property market combined with the strong deceleration in the economic activity have ‘pushed’ China officials to start easing financial conditions.

- The PBoC decided to lower its 1Y medium term Lending Facility Rate by 10bps to 2.85% this week, the first reduction since April 2020.

- This move follows the two 50bps cuts in the RRR in 2021 in attempt to stimulate the economic activity and domestic risky assets (i.e. equities) and potentially weaken the CNY, which has been constantly strengthening against all the major crosses in the past 18 months.

- Is the divergence set to continue in the near term?

Source: Bloomberg/MNI

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/01/2022 | 1200/0700 | ** |  | US | MBA weekly applications index |

| 19/01/2022 | 1330/0830 | *** |  | CA | CPI |

| 19/01/2022 | 1330/0830 | ** |  | CA | Wholesale Trade |

| 19/01/2022 | 1330/0830 | *** |  | US | housing starts |

| 19/01/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 19/01/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 19/01/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 20/01/2022 | 0130/1230 | *** |  | AU | Labor force survey |

| 20/01/2022 | 0700/0800 | ** |  | DE | PPI |

| 20/01/2022 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 20/01/2022 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 20/01/2022 | 1000/1100 | *** |  | EU | HICP (f) |

| 20/01/2022 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 20/01/2022 | 1230/1330 |  | EU | ECB publishes Dec meet accounts | |

| 20/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 20/01/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 20/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/01/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 20/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 20/01/2022 | 1600/1100 | ** |  | US | DOE weekly crude oil stocks |

| 20/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 20/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 20/01/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 21/01/2022 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.