-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Inflation Remains The Focus

EXECUTIVE SUMMARY:

- ECB'S LAGARDE: INFLATION DRIVERS WILL EASE GRADUALLY IN 2022

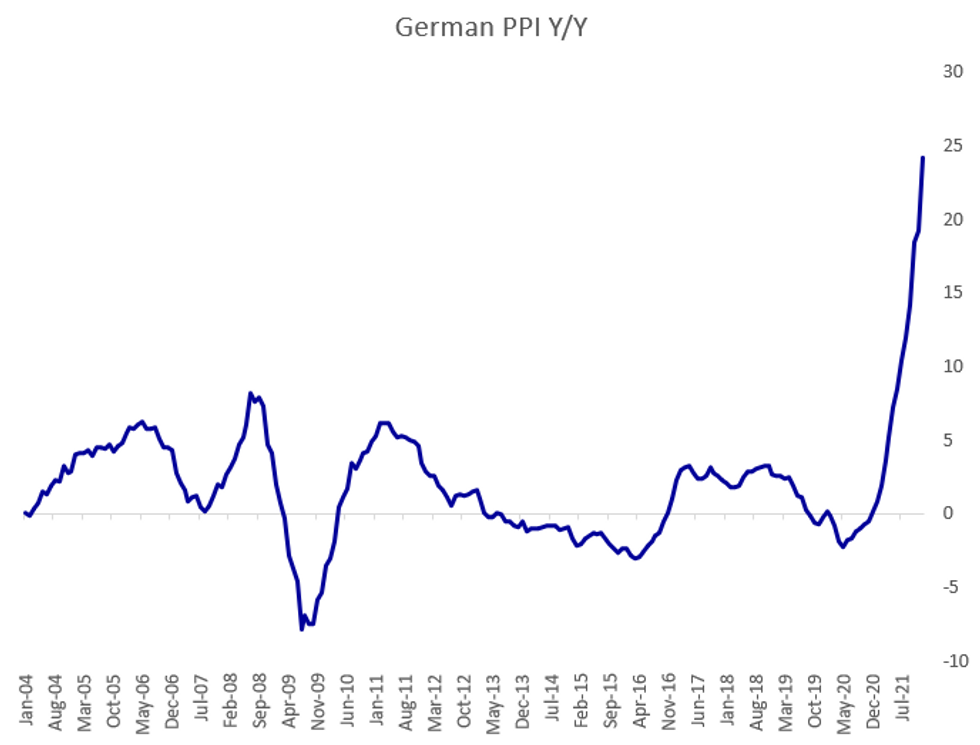

- GERMAN PRODUCER PRICE INFLATION BEATS EXPECTATIONS, ALL-TIME HIGH

- NORGES BANK HOLDS, SAYS MARCH HIKE LIKELY

- UKRAINE BRUSHES OFF BIDEN COMMENTS, WELCOMES WEST'S COORDINATION ON RUSSIA

Fig. 1: German PPI Soars To Record High

Source: DeStatis, MNI

Source: DeStatis, MNI

NEWS:

ECB (RTRS): Inflation in the euro zone will decrease gradually over the year as its main drivers, such as surging energy prices and supply bottlenecks, are expected to ease, European Central Bank (ECB) head Christine Lagarde told France Inter radio. "This will stabilise and ease gradually in the course of 2022," she said. Asked on her policy to counter price pressures, Lagarde reiterated that the ECB did not need to act as boldly as the U.S. Federal Reserve because of a different economic situation.

NORGES BANK: Norges Bank left its policy rate on hold at 0.5% Thursday and restated its guidance that the rate "will most likely be raised in March." The Monetary Policy and Financial Stability Committee's decision, at Governor Oystein Olsen's final meeting, was widely expected with Norges Bank on the tightening path but with the January meeting only an interim one and policy changes taking place in the quarterly forecast round meetings, the next one of which is in March.

UKRAINE / RUSSIA / U.S. (RTRS): Ukraine does not see comments by U.S. President Joe Biden, when he said Russia could carry a lower cost for an "incursion" rather than an "invasion" of Ukraine, as deviating from U.S. policy, a senior Ukrainian adviser told Reuters on Thursday. Mykhailo Podolyak, an adviser to President Volodymyr Zelenskiy's office, said Ukraine welcomed that Biden had signalled a coordinated Western response in case Russia made a move on Ukraine. "It is definitely not worth evaluating the words spoken the day before as something separate from the integral policy of the American administration," he wrote in a message.

UK POLITICS (BBG): A U.K. Conservative lawmaker accused Boris Johnson’s parliamentary fixers of “intimidation” and “blackmail” as they tried to fend off a challenge to the prime minister’s leadership, and urged members of Parliament to report the matter to the police.“In recent days a number of MPs have faced pressures and intimidation from members of the government because of their declared or assumed desire for a vote of confidence in the party leadership of the prime minister,” William Wragg, who chairs Parliament’s influential Public Administration and Constitutional Affairs Committee, said at a hearing on Thursday.

UK POLITICS (RTRS): Six in 10 people in Britain now have an unfavourable opinion of Prime Minister Boris Johnson following revelations of parties held at his residence during COVID-19 lockdowns, pollster Ipsos Mori said on Thursday. Ipsos also said that 57% believe Johnson is a bad prime minister, up 6 percentage points since last week. Finance minister Rishi Sunak was the only senior minister to get a net positive score when respondents were asked.

GERMAN ISSUANCE (RTRS): Issuing ultra-long debt may be a bit more challenging in an environment of rising bond yields, an official at Germany's debt management office said on Thursday. "We are a continuous issuer so we have to deal with the market we are faced with but we can play with the portfolio," said Christian Wellner, head of strategy at Germany's Finanzagentur. "So, we can listen to what they (markets) are asking, so maybe issuing ultras maybe be a bit more challenging," he said during an OMFIF debate on the outlook for European sovereign borrowing.

MALAYSIA (MNI STATE OF PLAY): Bank Negara Malaysia on Thursday kept its monetary policy powder dry on setting the stage for a rate hike this year, citing both a rebound in economic activity but warning that the outlook remains "tilted to the downside." The central bank today left its Overnight Policy Rate unchanged at the record low of 1.75%, the level it has been since the last cut in July 2020, and its accompanying statement - which had expected to hint at a rate rise later this year - was instead neutral in tone.

INDONESIA: Indonesia's central bank kept its benchmark rate unchanged at 3.5% at the Board of Governors' meeting on Thursday. Bank Indonesia also maintained other key interest rates unchanged, with the Overnight Deposit Facility at 2.75% and the Overnight Lending Facility at 4.25

DATA:

MNI: GERMANY DEC PPI +5.0% M/M, +24.2% Y/Y, NOV +19.2% Y/Y

German PPI beats expectations, at all time high

GERMANY DEC PPI +5.0% M/M, +24.2% Y/Y, NOV +19.2% Y/Y

- German factory gate inflation came in far above market expectations, hitting +24.2% y/y, up five points from 19.2% y/y in November.

- On the month PPI grew +5.0%, far outpacing a forecasted +0.8%.

- This is the highest reading since the begin of the data set in 1949.

- Surging energy costs remain the key inflationary pressure.

- December's core PPI remained elevated at 10.4% y/y due to high input goods inflation.

EZ DEC HICP +0.4% M/M; +5.0% Y/Y; NOV +4.9% Y/Y

Eurozone Inflation Confirmed at Euro-Era High

EZ DEC HICP +0.4% M/M; +5.0% Y/Y; NOV +4.9% Y/Y

EZ DEC FLASH CORE HICP +0.4% M/M; +2.6% Y/Y; NOV +2.6% Y/Y

- Eurozone headline final inflation prints were unchanged from flash estimates.

- Annual Eurozone inflation hit +5.0% y/y and +2.6% on the core reading.

- The highest reading were recorded in Estonia (12.0%), Lithuania (10.7%) and Poland (8.0%).

- Energy was once again the largest contributor, accounting for +2.46%, followed by services at +1.02%.

FIXED INCOME: German curve leads core FI higher

The German curve has led core fixed income higher today. Lagarde has spoken and not said much that is new while we have had some relatively weak French confidence data alongside much higher than expected German PPI. The move away from 0% 10-year Bund yields (and back into negative territory) is also seen as a driver.

- Looking ahead we have the release of ECB accounts, and US existing home sales leading the schedule.

- TY1 futures are up 0-0+ today at 127-22 with 10y UST yields down -3.3bp at 1.833% and 2y yields down -2.1bp at 1.038%.

- Bund futures are up 0.36 today at 169.74 with 10y Bund yields down -1.7bp at -0.31% and Schatz yields down -0.6bp at -0.585%.

- Gilt futures are up 0.33 today at 122.61 with 10y yields down -2.7bp at 1.228% and 2y yields down -0.6bp at 0.892%.

FOREX: USD trends in the red in early Europe

- A steady start for FX during the morning European session.

- USD is overall offered and a touch in the red against most G10s.

- The Greenback is holding onto small gains versus the NOK and NZD.

- Most pairs trade with this week's ranges, EUR and GBP were underpinned earlier, a function of the USD, and Omicron outlook for Europe and the UK, with countries starting to fully re-open, is keeping the EUR and the Pound underpinned.

- Nonetheless, EUR still trades in a 28 pip range and has lost some of the upside momentum, after a Dovish comments from ECB Lagarde during a French radio interview, pouring cold water on a 2022 hike.

- AUD is the best early performer versus the USD in G10, albeit just up 0.37%, after pairing overnight gains.

- AUD tested another session high against the Yen.

- Resistance in the latter is seen at this week's high at 82.963.

- Looking ahead, we have no tier 1 data left for the session.

- Worth an option expiry note, with EURUSD seeing 5.84bn between 1.1300/1.1400 for today.

EQUITIES: Energy, Financial Stocks Lagging

- Asian markets closed mostly higher: Japan's NIKKEI closed up 305.7 pts or +1.11% at 27772.93 and the TOPIX ended 18.81 pts higher or +0.98% at 1938.53. China's SHANGHAI closed down 3.117 pts or -0.09% at 3555.063 and the HANG SENG ended 824.5 pts higher or +3.42% at 24952.35.

- European equities are a little weaker, with the German Dax down 26.25 pts or -0.17% at 15809.72, FTSE 100 down 13.18 pts or -0.17% at 7589.66, CAC 40 down 30.75 pts or -0.43% at 7172.98 and Euro Stoxx 50 down 8.19 pts or -0.19% at 4268.28.

- U.S. futures have edged higher overnight, with the Dow Jones mini up 104 pts or +0.3% at 35013, S&P 500 mini up 16.5 pts or +0.36% at 4540.5, NASDAQ mini up 89.5 pts or +0.6% at 15122.75.

COMMODITIES: Industrial Metals Gaining

- WTI Crude down $0.44 or -0.51% at $86.95

- Natural Gas down $0.02 or -0.6% at $3.999

- Gold spot down $1.73 or -0.09% at $1840.27

- Copper up $3.9 or +0.87% at $449.6

- Silver up $0.06 or +0.23% at $24.1552

- Platinum up $21.65 or +2.11% at $1033.1

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/01/2022 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 20/01/2022 | 1230/1330 |  | EU | ECB publishes Dec meet accounts | |

| 20/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 20/01/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 20/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/01/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 20/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 20/01/2022 | 1600/1100 | ** |  | US | DOE weekly crude oil stocks |

| 20/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 20/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 20/01/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 21/01/2022 | 2330/0830 | *** |  | JP | CPI |

| 21/01/2022 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 21/01/2022 | 0700/0700 | *** |  | UK | Retail Sales |

| 21/01/2022 | 1230/1330 |  | EU | ECB Lagarde on Global Economic Outlook at WEF | |

| 21/01/2022 | 1300/1300 |  | UK | BOE Mann speaks at OMFIF | |

| 21/01/2022 | 1330/0830 | ** |  | CA | Retail Trade |

| 21/01/2022 | 1500/1600 | ** |  | EU | consumer confidence indicator (p) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.