-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD Index Approaching Key Levels

Highlights:

- Dollar nearing two key levels as rally persists

- Sell-side bring forward Fed rate hike expectations following Powell presser

- Advance US GDP seen reaching 5.5%

TSYS SUMMARY: Treasuries Flatten Further As Short End Sold

- Cash Tsys have twist flattened this morning following a hawkish Fed, seeing the 2s10s spread narrow to just 65bps for the flattest since Nov-2020.

- 2Y yields are +2.2bps at 1.172% (following +13bps yesterday), 5Y -2.0bps at 1.665%, 10Y -4.1bps at 1.823% and 30Y -5.2bps at 2.113%.

- Whilst moving higher recently to 127-17+, TYH2 has largely consolidated yesterday’s slide. It earlier cleared support at 127-13+ (Jan 26 low) which could open the bear trigger of 127-02 (Jan 19 low).

- Data: Heavy day of which the highlights are the advanced Q4 GDP print and durable goods orders for Dec (0830ET).

- NY Fed buy-op: Tsy 22.5Y-30Y, appr $1.825B steady (1030ET).

- Issuance: US Tsy $50B 4W, $40B 8W bill auctions (1130ET) followed by US Tsy $53B 7Y Note auction (1300ET).

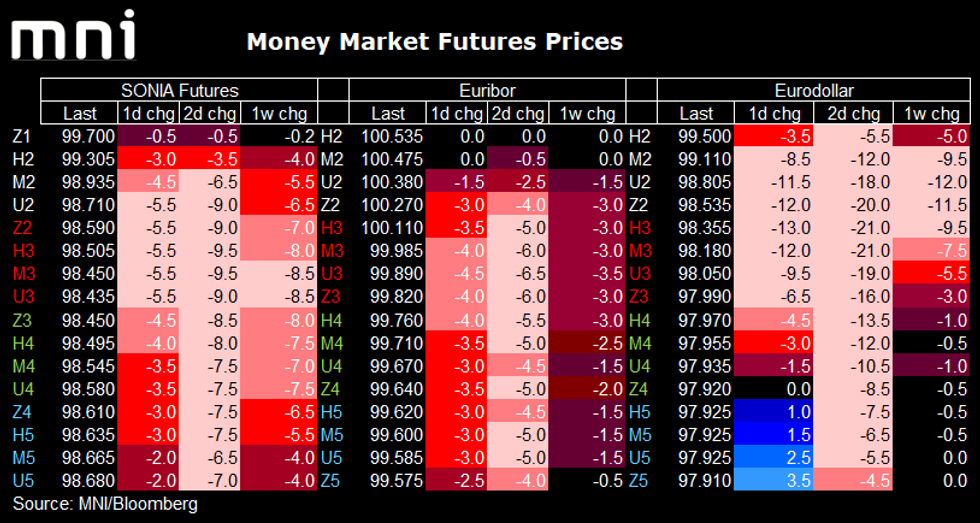

STIR FUTURES: Back to the lows of the day

After a bit of a bounce as Europeans got to their desks, STIR futures are moving back to their lows of the day as North Americans start to get into the office.

- The Eurodollar curve is back to pricing a 120% probability of a 25bp hike in March (i.e. 20% probability of a 50bp hike with a 25bp hike fully priced). 4.75 priced in this year (unchanged from the European open).

- The SONIA strip sees a 95% probability of a February hike, up from 90% yesterday and down from 104% at today's open. 4 hikes now fully priced by September (yesterday by November).

- The Euribor strip now fuly pricing the first 10bp hike in October (90% priced for September) but we have moved off the highs and no longer fully pricing 20bp for 2022.

EUROPE OPTION FLOW SUMMARY

Eurozone:

IKH2 144/142ps 1x1.5, bought for 34 in 1k

ERZ2 100/99.75/99.50p fly, bought for 1.75 in 2k

0RM2 99.875/99.75 ps vs 100.125/100.25 cs, bought the ps for flat in 6.4k

US:

TYH2 265.5/125.5/124.5p fly, bought for 8 in 1k

FOREX: Dollar Remains Solid as Post-Fed Buying Persists Through Europe

- The greenback continues to trade from strength to strength, and is outstripping all others in G10 early Thursday as the Fed-induced wave of buying persisted across Asia-Pac hours. The USD Index trades within range of two key resistance levels (96.906 and 96.938) which, if broken, put the dollar at the best levels since mid-2020.

- The hawkish interpretation of the Fed press conference yesterday continues to underpin a tightening of financial conditions, with the front-end of the US yield curve pricing in much tighter policy front March onwards. STIR markets now price in close to 5 hikes across 2022.

- Outside of the greenback, the single currency is suffering, with the stark perceived policy divergence between the ECB and Fed driving EUR/USD to fresh 2022 lows. Similarly, EUR/GBP is under pressure and lower for a third session. This puts the cross on track to test key support of 0.8305 should weakness persist.

- The NOK trades well, second to just the USD as oil prices remain well elevated. Brent crude futures topped $90/bbl yesterday for the first time since 2014, with prices holding above that key psychological level at the NY crossover.

- Advance US Q4 GDP data takes focus going forward, with weekly jobless claims data also due as well as prelim December durables data.

FX OPTIONS: Expiries for Jan27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1100(E524mln), $1.1150(E687mln), $1.1200-05(E692mln), $1.1250(E552mln)

- USD/JPY: Y113.00($761mln), Y113.50-60($867mln), Y114.80-00($1.1bln)

- GBP/USD: $1.3285-03(Gbp576mln), $1.3548-70(Gbp795mln)

- EUR/JPY: Y127.00(E1.1bln)

- AUD/USD: $0.7220(A$640mln)

- USD/CAD: C$1.2560-65($927mln)

- USD/CNY: Cny6.3450($560mln), Cny6.3500($1.3bln)

Price Signal Summary - USD Rally Extends

- In the equity space, S&P E-minis remain volatile and continue to trade above Monday’s low of 4212.75. This week’s price action is allowing the recent oversold reading to unwind. Initial resistance to watch is yesterday’s high of 4446.25, Jan 26 high. The trigger for a resumption of bearish activity is 4212.75 low. EUROSTOXX 50 futures have recovered from overnight lows and activity remains volatile. Price continues to trade above Monday’s low of 3990.50 which is the trigger for a resumption of the recent bearish threat. Resistance is seen 4215.50, Jan 24 high.

- In FX, the EURUSD move lower has accelerated and the pair has traded below support at 1.1222, Dec 15 low. This reinforces the current bearish threat and attention turns to the key support handle of 1.1186/85, the Nov 24 and Jul 1 2020 lows. A breach of this support would confirm a resumption of the broader downtrend. GBPUSD remains vulnerable and has traded lower again today. Short-term conditions remain bearish and the focus is on 1.3387, 61.8% retracement of the Dec 8 - Jan 13 bull phase. Recent USDJPY price action has defined a new key short-term support at Monday’s low of 113.47. The pair is trading higher once again today and has probed resistance at 115.06, the Jan 18 high. A clear break of this hurdle would reinstate a bullish theme and open 115.85/116.35, the Jan 10 / Jan 4 high . The latter is the bull trigger.

- On the commodity front, the Gold rally has stalled. Yesterday’s sharp sell-off exposes support at $1805.9, Jan 18 low and the base of the bull channel at $1794.1 - the channel is drawn off the Aug 9 low. For now, the move lower is considered corrective, however a break of the channel base would alter the picture and highlight a more significant reversal. Resistance to watch is $1853.9, Jan 25 high. WTI futures resumed their uptrend yesterday, trading through $87.10, the Jan 20 high. This confirms a resumption of the uptrend and the focus is on the psychological $90.00 handle.

- In the FI space, Bund futures traded higher Monday and probed key short-term resistance at 171.00, the Jan 13 high. A clear break of this hurdle would signal potential for a stronger short-term corrective bounce and open the 50-day EMA at 171.55. The trend remains down, a resumption of weakness would refocus attention on the bear trigger at 168.95, Jan 19 low. Gilts remain in a downtrend and below resistance at 123.79, Jan 13 high. A break of this hurdle is required to highlight a short-term base. The bear trigger is unchanged at 121.93, Jan 19 low.

EQUITIES: Mixed Reception for Powell Across European Equities

- European cash markets are mixed ahead of the Thursday NY crossover, with peripheral markets (Spanish, Italian) seeing solid gains of 0.5 - 0.8% while the core EuroStoxx50 as well as German and French markets sit slightly lower.

- Europe's financials sector is propping up broader sentiment, mimicking stronger US bank stocks after the hawkish Fed decision yesterday, with solid earnings from the likes of Banco Sabadell and Deutsche Bank. This sentiment is mirrored in the outperformance for peripheral bond markets this morning, with both Spanish and Italian spreads tighter against the German benchmark.

- Across futures, the e-mini S&P has recovered off the pullback lows of 4263.25, but is yet to make any headway on yesterday's highs of 4446.25. Earnings remain a key focus, with McDonald's, Mastercard and Apple among the larger reports due Thursday.

- S&P E-minis remain vulnerable and price action is volatile. The contract sold off sharply Monday but recovered from the day low. Price has reversed sharply lower from yesterday's high and attention is on the key short-term support and bear trigger at 4212.75. The outlook is bearish and a break of this support would resume the trend.

COMMODITIES: WTI, Brent Hold Ground Despite Ukraine Ceasefire

- Both WTI and Brent crude futures hold in minor positive territory early Thursday, shrugging off the firmer greenback as well as the general risk-off sentiment seen across equities. Market focus remains on Russia-West tensions, with prices seeing scant relief from the commitment to a ceasefire in eastern Ukraine made at the four-way Normandy talks late yesterday.

- Focus turns to further discussions to be held between Russia and Ukraine in two weeks' time, which may hold off the risk of near-term aggression. Nonetheless, Western powers continue to send troops and equipment to the borders of eastern Europe.

- The uptrend in WTI futures has resumed following yesterday's break of resistance at $87.10, Jan 20 high. This maintains the bullish price sequence of higher or higher highs and higher lows and moving average conditions remain in a bull mode.

- The rally in gold has stalled. Yesterday's sharp sell-off exposes support at $1805.9, Jan 18 low and the base of the bull channel at $1794.1 - the channel is drawn off the Aug 9 low. For now, the move lower is considered corrective, however a break of the channel base will likely alter the picture and highlight a more significant reversal.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/01/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 27/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 27/01/2022 | 1330/0830 | ** |  | US | durable goods new orders |

| 27/01/2022 | 1330/0830 | *** |  | US | GDP (adv) |

| 27/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 27/01/2022 | 1330/0830 | * |  | CA | Payroll employment |

| 27/01/2022 | 1500/1000 | ** |  | US | NAR pending home sales |

| 27/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 27/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 27/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 27/01/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 28/01/2022 | 0630/0730 | ** |  | FR | Consumer Spending |

| 28/01/2022 | 0630/0730 | *** |  | FR | GDP (p) |

| 28/01/2022 | 0700/0800 | ** |  | SE | Unemployment |

| 28/01/2022 | 0700/0800 | ** |  | SE | Retail Sales |

| 28/01/2022 | 0700/0800 | *** |  | SE | GDP |

| 28/01/2022 | 0700/0800 | * |  | NO | Norway Unemployment Rate |

| 28/01/2022 | 0700/0800 | ** |  | DE | Import/Export Prices |

| 28/01/2022 | 0745/0845 | ** |  | FR | PPI |

| 28/01/2022 | 0800/0900 | *** |  | ES | GDP (p) |

| 28/01/2022 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 28/01/2022 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 28/01/2022 | 0900/1000 | *** |  | DE | GDP (p) |

| 28/01/2022 | 1000/1100 | ** |  | EU | Economic Sentiment Indicator |

| 28/01/2022 | 1000/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 28/01/2022 | 1000/1100 | * |  | EU | Business Climate Indicator |

| 28/01/2022 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 28/01/2022 | 1330/0830 | ** |  | US | Employment Cost Index |

| 28/01/2022 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 28/01/2022 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.