-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASI OPEN: Fed Bostic Still Confident of Waning Inflation

MNI ASIA MARKETS ANALYSIS: Tsy Curves Twist Flatter

PIPELINE: $2.2B Nigeria 2Pt Kicks Off December Issuance

MNI US OPEN: Dollar Continues To Retrace

EXECUTIVE SUMMARY:

- EUROZONE MANUFACTURING PMIS WEAKER IN JANUARY

- FRENCH FLASH INFLATION OVERSHOOTS FORECAST

- RUSSIA YET TO DELIVER RESPONSE TO U.S., NATO

- RBA STAYS FIRM ON CASH RATE VIEW, DROPS QE (MNI STATE OF PLAY)

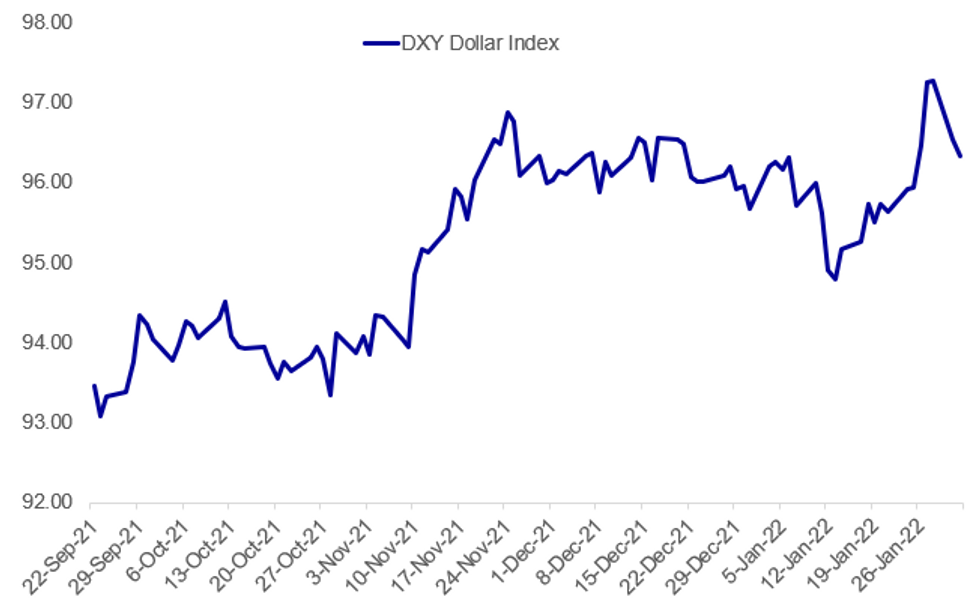

Fig. 1: Dollar Continues To Pull Back From Highs

Source: BBG, MNI

Source: BBG, MNI

NEWS:

RBA (MNI STATE OF PLAY): The Reserve Bank of Australia is maintaining its dovish stance relative to other developed market central banks and declined to update its interest rate guidance despite recent bullish data on employment and more importantly inflation. At Tuesday's first board meeting for 2022, the RBA did however announce an end to its bond buying programme, which will continue at the rate of AUD4 billion per week and end on Feb 10. For full article, contact sales@marketnews.com

RUSSIA-EUROPE (BBG): Russia said it has yet to respond to written proposals delivered last week by the U.S. and NATO, as Western countries continue their diplomatic press to deter Moscow from attacking Ukraine.President Vladimir Putin meets Tuesday with Hungarian leader Viktor Orban, his closest friend in the European Union, while U.S. Secretary of State Antony Blinken will speak by phone with Russian Foreign Minister Sergei Lavrov. U.K. Prime Minister Boris Johnson and Netherlands Prime Minister Mark Rutte are also both expected in Ukraine to meet with its president. In parallel, the U.S. and European Union are finalizing a package of potential Russian sanctions, with the U.K. looking at targeting “any company or individual of direct interest to the Russian state” if Moscow were to invade Ukraine. The U.S. and U.K. said that would include sanctions on oligarchs close to Putin.

RIKSBANK (RTRS): The fast pace of inflation in Sweden is mainly due to high energy prices and should ease further ahead, central bank governor Stefan Ingves said on Tuesday. "If you remove energy prices, you land a bit under 2%," Ingves said in regular testimony to parliament. "Our view, we talked about this in December, is that inflation is going to go down further ahead, even if it high currently."

AUSTRIA / COVID (BBG): Austria is embarking on a dramatic public health experiment from Tuesday, with a controversial new law that makes Covid-19 vaccines mandatory for everyone. Multiple European countries have stigmatized people who refuse a vaccine, but Chancellor Karl Nehammer’s government is going further and will start criminalizing holdouts. Police will begin checking the vaccination status of people on the street and during traffic stops. Beginning in mid-March, offenders who haven’t had a shot will face fines rising to as much as 3,600 euros ($4,050). The law, which received a record number of public comments before being passed, runs through 2024 and has catalyzed a broad sweep of protesters.

EUROPE ENERGY (BBG): European natural gas prices plunged after Russian shipments via a key route crossing Ukraine rebounded.Futures slumped as much as 9.1% as deliveries into Slovakia through the Velke Kapusany interconnection point on the border with Ukraine returned to normal levels, according to data from grid operator Eustream. Additional Russian supplies are pressuring prices just as mild weather curbs demand and several cargoes of liquefied natural gas arrive at European shores.

DATA:

MNI: FRANCE FLASH JAN HICP +0.1% M/M, +3.3% Y/Y; DEC +3.4% Y/Y

French Flash Inflation Overshoots Forecast

MNI: FRANCE FLASH JAN HICP +0.1% M/M, +3.3% Y/Y; DEC +3.4% Y/Y

FRANCE FLASH JAN CPI +0.3% M/M, +2.9% Y/Y; DEC +2.8% Y/Y

- Flash numbers for French headline inflation overshot forecasts across the board.

- CPI came in at +2.9% y/y, up by 0.1% from the December print and outpacing the consensus forecast of +2.5%. On the month, flash CPI grew by +0.3% m/m, beating the expected contraction of -0.2%.

- The harmonised inflation print came in 0.4% above forecasts at +3.3%, only edging down slightly from +3.4% in December.

Eurozone Manufacturing PMIs Weaker in Jan

MNI: GERMANY FINAL JAN MFG PMI 59.8r; DEC 57.4

MNI: EUROZONE FINAL JAN MFG PMI 58.7r; DEC 58.0

MNI: FRANCE FINAL JAN MFG PMI 55.5; DEC 55.6

MNI: ITALY JAN MFG PMI 58.3; DEC 62.0

MNI: SPAIN JAN MFG PMI 56.2; DEC 56.2

- Manufacturing PMIs across the Eurozone all saw weaker prints in January as anticipated by the flash readings.

- Eurozone and German final readings dipped below preliminary estimates by 0.3 points and 0.7 points respectively.

- Across the board, fast rising output and new orders accounted for strong readings.

- Input cost inflation began to see some relief as supply chain disruptions began to ease

MNI: SPAIN JAN MFG PMI 56.2; DEC 56.2

SPAIN PMI: Input prices falling, but output prices record increase

The key part of the Spanish PMI print was regarding inflation. From the press release:

- "Price pressures remained strong. Costs related to many raw materials, energy and freight services continued to rise. Although extremely high, input price inflation dropped to a five-month low. Nonetheless, output charges increased for a fourteenth successive survey period as firms sought to protect their margins. Moreover, the rate of increase was the sharpest recorded in the survey to date."

MNI: ITALY JAN MFG PMI 58.3; DEC 62.0

ITALY PMI: Input price inflation falling but output prices record rise

Similar to in the Spanish data, input price inflation has fallen but output prices have recorded a record rise. However, Italian growth also "cooled noticeably". Highlights from the press release:

- "Growth momentum cooled noticeably, as output rose at the weakest pace for 12 months amid a much slower expansion in new work and reports of staff shortages and COVID-19 related disruptions."

- "The rate of [input price] inflation slowed to a ten-month low, but was still rapid. As a result, companies raised their selling prices at a survey record rate in January."

MNI: GERMANY FINAL JAN MFG PMI 59.8r; DEC 57.4

MNI: EUROZONE FINAL JAN MFG PMI 58.7r; DEC 58.0

MNI: UK FINAL JAN MFG PMI 57.3; DEC 57.9

MNI: BOE DEC MORTGAGE APPROVALS 71,015

MNI: GERMANY JAN UE RATE (SA) 5.1%; DEC 5.2%

MNI: EZ DEC UNEMPLOYMENT RATE 7.0%; NOV 7.1r%

Eurozone Unemployment Lower than Expected

EZ DEC UNEMPLOYMENT RATE 7.0%; NOV 7.1r%

- Eurozone unemployment edged down to 7.0% in December, from 7.1% (revised down from 7.2%) in November. This is lower than the forecasted 7.1% for the region and below pre-pandemic levels.

- EU unemployment stepped down to 6.4% in December from 6.5%, 1.1% below the December 2020 rate of 7.5%.

- Female and youth unemployment saw stronger reductions compared to the previous month. Youth unemployment fell to 14.9% in December, down half a point from the previous month, whilst female unemployment decreased 0.2% to 7.3% in December.

FIXED INCOME: Core fixed income moving higher

Core fixed income is lurching higher, reversing some of the downside seen over the past few days, initially on market-positive European election results and then higher-than-expected HICP prints across Spain, Germany and, to a lesser extent, France. There is no real headline driver of the reversal, although it seems to be driven by Bunds, and we note that yields have dropped back into negative territory on the 10-year Bund - a psychological move. PMI data this morning may have helped contribute a little with input prices falling back to less extreme levels (despite output prices seeing near-record increases). This underlines that there may still be some transitory nature to the inflation move.

- Looking ahead we have the ISM manufacturing survey and JOLTS both released at 15:00GMT / 10:00ET. The prices component of the ISM survey will be in focus, as will JOLTS which has been mentioned numerous times by FOMC members as a key indicator to watch.

- TY1 futures are up 0-8 today at 128-07 with 10y UST yields down -2.3bp at 1.755% and 2y yields down -1.8bp at 1.162%.

- Bund futures are up 0.33 today at 169.44 with 10y Bund yields down -2.1bp at -0.12% and Schatz yields down -1.9bp at -0.508%.

- Gilt futures are up 0.28 today at 122.24 with 10y yields down -2.9bp at 1.272% and 2y yields down -1.9bp at 1.018%.

FOREX: Greenback Lower for Second Session, Nearing First Support

- The greenback trades poorly early Tuesday, slipping against all others in G10 as currencies follow yields lower. The 10y yield is lower for a fourth consecutive session, edging toward 1.75% and the lowest level since Jan25. The USD Index is lower for a second session, with the 50-dma the next downside level at 96.11.

- AUD traded volatile overnight, with AUD/USD dropping to 0.7034 as the RBA concluded their QE programme, but stressed that an end to asset purchases does not equate to a near-term increase in interest rates. Into the NY crossover, however, AUD/USD trades positively, with the bias toward USD sales working in favour of the pair. 0.7121, the Jan27 high, marks the first upside level.

- Elsewhere, the EUR has added to the week's gains, with EUR/USD climbing to touch 1.1269 as positive short-term technical signals begins to emerge - yesterday’s daily close highlights a 3-day Japanese candle reversal known as a morning star. This suggests scope for a stronger short-term corrective bounce toward 1.1293, the 20-day EMA and the first upside level.

- Canadian GDP and the US January ISM Manufacturing data cross later today, with particular attention to be paid to the price paid subcomponent, with markets expecting a deceleration to 67.0 from 68.2.

EQUITIES: Fading Overnight Gains

- Japanese markets closed a little stronger (Chinese markets are closed for holidays): Japan's NIKKEI closed up 76.5 pts or +0.28% at 27078.48 and the TOPIX ended 0.13 pts higher or +0.01% at 1896.06

- European equities are on the front foot, but off morning highs, with the German Dax up 98.44 pts or +0.64% at 15660.3, FTSE 100 up 45.1 pts or +0.6% at 7533.08, CAC 40 up 41.47 pts or +0.59% at 7072.76 and Euro Stoxx 50 up 29.29 pts or +0.7% at 4225.09.

- U.S. futures are fading overnight gains, with the Dow Jones mini down 80 pts or -0.23% at 34920, S&P 500 mini down 14 pts or -0.31% at 4490.75, NASDAQ mini down 30.25 pts or -0.2% at 14874.5.

COMMODITIES: Metals Gain As Dollar Retraces

- WTI Crude down $0.93 or -1.06% at $88.22

- Natural Gas down $0.09 or -1.85% at $4.841

- Gold spot up $9.24 or +0.51% at $1803.07

- Copper up $3.3 or +0.76% at $437.15

- Silver up $0.27 or +1.21% at $22.5993

- Platinum up $16.75 or +1.64% at $1038.25

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/02/2022 | - | *** |  | US | domestic made vehicle sales |

| 01/02/2022 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 01/02/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 01/02/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/02/2022 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/02/2022 | 1500/1000 | * |  | US | construction spending |

| 01/02/2022 | 1500/1000 | ** |  | US | JOLTS jobs opening level |

| 01/02/2022 | 1500/1000 | ** |  | US | JOLTS quits Rate |

| 01/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 02/02/2022 | 1000/1100 | *** |  | IT | HICP (p) |

| 02/02/2022 | 1000/1100 | *** |  | EU | HICP (p) |

| 02/02/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 02/02/2022 | 1315/0815 | *** |  | US | ADP Employment Report |

| 02/02/2022 | 1330/0830 | * |  | CA | Building Permits |

| 02/02/2022 | 1500/1000 | ** |  | US | housing vacancies |

| 02/02/2022 | 1500/1000 |  | CA | BOC Deputy Gravelle speaks on swaps panel | |

| 02/02/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 02/02/2022 | 2000/1500 |  | CA | BOC Gov Macklem testifies at parliamentary committee | |

| 03/02/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.