-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Equities Gain As Dollar, Yields Retrace

EXECUTIVE SUMMARY:

- BUNDESBANK'S NAGEL STRESSES INFLATION TO "SIGNIFICANTLY" TOP 4% THIS YEAR

- MACRON LEAD OVER PECRESSE NARROWS IN ELECTION RUNOFF POLL

- GERMAN TRADE BALANCE SLUMPS BELOW FORECAST

- ICELAND MAKES BIGGEST RATE HIKE SINCE 2008

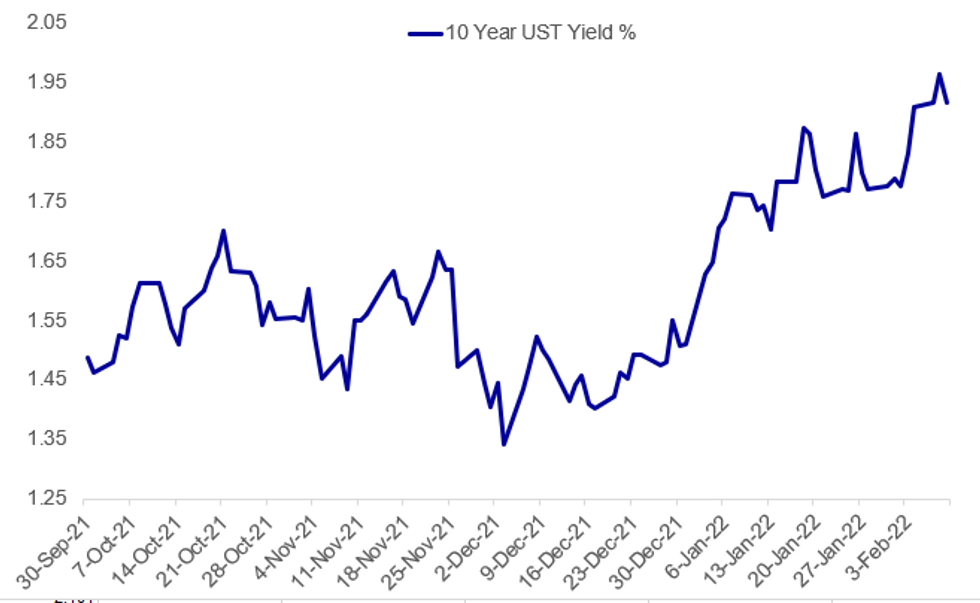

Fig. 1: 10Y Yield Pulls Back Just Below 2.00% Ahead Of Today's Auction

Source: BBG, MNI

Source: BBG, MNI

NEWS:

BUNDESBANK/ECB (MNI / DIE ZEIT): In an interview with Die Zeit, new Bundesbank chief Nagel stated that he expects German inflation to rise "significantly" above 4% this year, and if the inflation picture does not change by March, he will advocate for a normalization of monetary policy. Nagel again stressed that the economic costs of acting too late are significantly higher than acting early. Full Nagel appearance in Die Zeit here: https://www.zeit.de/2022/07/joachim-nagel-infation...FRANCE POLITICS (BBG): Emmanuel Macron would win first round of French presidential election with 26%, up 1 point, according to Elabe poll of voting intentions for BFM TV, L’Express and SFR published on Wednesday. Far-right National Rally candidate Marine Le Pen would get 15.5% in first round, down 1 point, and Republicans candidate Valerie Pecresse would get 15%, down 1 point, according to poll. Macron would beat Pecresse 54%-46% in runoff; lead narrows by 1.5 points. Macron would beat Le Pen 56%-44% in runoff, unchanged.

ICELAND (BBG): Iceland’s central bank delivered its biggest interest-rate hike since the 2008 crisis, trying to quell inflation spurred by a rampant housing market.The Monetary Policy Committee in Reykjavik lifted the seven-day term deposit rate by 75 basis points to 2.75%, the highest level in almost two years. The increase was forecast by the nation’s two biggest banks, Landsbankinn and Islandsbanki, while market participants surveyed last week by the central bank predicted 50 basis points. “The inflation outlook has deteriorated markedly,” officials said in a statement. “The MPC reiterates that it will apply the tools at its disposal to ensure that inflation eases back to the target within an acceptable time frame.”

NATO: UK PM Johnson to Meet w/Stoltenberg 10 Feb: UK Prime Minister Boris Johnson will visit Brussels on Thursday 10 February for talks with NATO Secretary-General Jens Stoltenberg. There will be a joint press conference streamed on the NATO website at 1045CET (0945GMT).

RUSSIA-US: Russia's state-owned RIA reporting comments from Russian Deputy Foreign Minister Sergei Ryabkov stating that talk of the deployment of US THAAD missile systems in Ukraine is 'provocation'. Terminal High Altitude Area Defense (THAAD) missiles are anti-ballistic missile defence systems intended to shoot down short-, medium-, and intermediate-range ballistic missiles.

ABNAMRO/BANKS (BBG): ABN Amro Bank NV said it will start a 500 million-euro share buyback ($571 million) after fourth quarter profit jumped, joining European peers in pledging higher returns as the industry rebounds from the pandemic.Net income soared to 552 million euros in the period, exceeding the 426 million euros that analysts surveyed by Bloomberg had expected on average, boosted by fee income and the sale of the bank’s head office. Provisions for loan losses fell to 121 million euros from 220 million euros.

AMUNDI / ASSET MANAGEMENT (BBG): Amundi SA, Europe’s largest asset manager, brought in 65.6 billion euros ($74.9 billion) of client cash in the fourth quarter, smashing analysts’ expectations.The inflows -- which analysts expected to total 16.9 billion euros, according to a Bloomberg survey -- were driven by the firm’s and its joint ventures’ medium- and long-term products, which attracted 51.7 billion euros in the quarter. Those additions, combined with the completion of the acquisition of Lyxor late last year, helped Amundi’s assets under management rise to 2.06 trillion euros at the end of December, up 14% from the previous quarter.

HONG KONG / COVID (BBG): Hong Kong urged residents who suspect they might be infected with coronavirus to avoid emergency rooms after cases topped four figures for the first time, with the worsening outbreak crippling its health-care resources. The city announced a record 1,161 cases on Wednesday, up from 625 just a day earlier, along with about 800 preliminary infections. Officials asked anyone with mild Covid-like symptoms to go to a private doctor to get tested, rather than go to emergency departments in public hospitals, which are being overwhelmed.

DATA:

MNI: GERMANY DEC IMPORTS +4.7% M/M, NOV +3.4%r

German trade balance slumps below forecast

GERMANY DEC IMPORTS +4.7% M/M, NOV +3.4%r

GERMANY DEC EXPORTS +0.9% M/M, NOV +1.8%r

DEC TRADE BALANCE SA 6.8BLN, NPV 11.6BLNr

- German trade data missed estimates, with exports growing by +0.9% m/m, down from +1.8%r m/m in November albeit substantially stronger than the contraction of -0.5% forecast.

- On the other side of the balance sheet, imports jumped +4.7% m/m in December, beating expectations by about seven points which saw a dip to -2.1% m/m. Imports increased on the month from November's revised reading of +3.4%.

- Compared with December 2020, exports were up +15.6 y/y, whilst imports were up a significant +27.8% y/y.

- This leaves the trade balance at 7.0b for December, dipping 4.6bln from November and approximately 4.0b below the consensus forecast.

- Exports and imports within the EU both grew by about +23% y/y.

FIXED INCOME: Yields Ease From Recent Highs With 10Y UST Supply In Focus

Core bonds have been gaining throughout the European morning with yields retracing from recent highs and modest bull flattening across curves.

- It's been a risk-on session, with the pullback in yields (and a retracement in the dollar) seen as a factor benefiting equities.

- The US will again be a global focus: the 10Y Treasury auction today will be a key test of appetite around current levels just shy of 2.00%, while tomorrow's CPI is a milestone ahead of a crucial Fed hiking decision next month.

- Long-end supply a continuing theme in Europe as well, with Spain syndicating 30Y, and Germany selling 50Y Bund.

- Not much remains on today's calendar though, with appearances BoE's Pill, Fed's Bowman/Mester, ECB's Schnabel. Latest levels:

- Mar 10-Yr Tsy futures (TY) up 8/32 at 126-26.5 (L: 126-13.5 / H: 126-29)

- Mar Bund futures (RX) up 61 ticks at 165.79 (L: 165.33 / H: 166.01)

- Mar Gilt futures (G) up 54 ticks at 120.82 (L: 120.64 / H: 120.94)

FOREX: Favourable Equity Backdrop Tilts Greenback Lower

- Following the positive close across Wall Street yesterday, markets in Asia and Europe are seen similarly higher, reinforcing a positive backdrop for risk assets at the NY crossover. As a result, the USD trades slightly lower, reversing a small part of yesterday's gains across the DXY. the 100-dma continues to trend higher, emphasizing the more positive medium-term outlook, but for now it marks first major support at 95.264.

- The EUR saw some modest support on the back of an interview from the new Bundesbank chief Nagel with German press, in which he said that he expects German inflation to rise "significantly" above 4% this year, and if the inflation picture does not change by March, he will advocate for a normalization of monetary policy.

- The main beneficiaries of the modest risk-on backdrop are AUD and NZD, helping AUD/USD rise north of the 50-dma to narrow the gap with major resistance at 0.7250. NZD/USD eyes 0.6684 for direction.

- Data releases are few and far between Wednesday, keeping focus on speeches from BoE's Pill, ECB's Schnabel, BoC's Macklem and Fed's Bowman & Mester.

EQUITIES: Stronger On Positive Earnings, Bond Yield Pullback

- Asian markets closed higher: Japan's NIKKEI closed up 295.35 pts or +1.08% at 27579.87 and the TOPIX ended 18.16 pts higher or +0.94% at 1952.22. China's SHANGHAI closed up 27.317 pts or +0.79% at 3479.946 and the HANG SENG ended 500.5 pts higher or +2.06% at 24829.99

- European stocks are posting strong gains, with the German Dax up 224.2 pts or +1.47% at 15242.38, FTSE 100 up 52.04 pts or +0.69% at 7567.07, CAC 40 up 100.32 pts or +1.43% at 7028.41 and Euro Stoxx 50 up 65.94 pts or +1.6% at 4129.25.

- U.S. futures are higher, with the Dow Jones mini up 187 pts or +0.53% at 35528, S&P 500 mini up 29.25 pts or +0.65% at 4541.5, NASDAQ mini up 115 pts or +0.78% at 14848.5.

COMMODITIES: Precious Metals Outperform Energy As Dollar Weakens

- WTI Crude down $0.19 or -0.21% at $89.19

- Natural Gas down $0.09 or -2.07% at $4.232

- Gold spot up $2.03 or +0.11% at $1827.02

- Copper down $1.85 or -0.41% at $443.75

- Silver up $0.04 or +0.15% at $23.2034

- Platinum up $2.79 or +0.27% at $1033.38

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/02/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 09/02/2022 | 1310/1310 |  | UK | BOE Pill at UK Monetary Policy outlook conference | |

| 09/02/2022 | 1500/1000 | ** |  | US | wholesale trade |

| 09/02/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 09/02/2022 | 1530/1030 |  | US | Fed Governor Michelle Bowman | |

| 09/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 09/02/2022 | 1700/1200 |  | CA | BOC Governor Macklem speaks to Chamber of Commerce | |

| 09/02/2022 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 09/02/2022 | 1700/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 09/02/2022 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 10/02/2022 | 0001/0001 | * |  | UK | RICS House Prices |

| 10/02/2022 | 0101/0101 | ** |  | UK | IHS Markit/REC Jobs Report |

| 10/02/2022 | 0700/0800 | * |  | NO | CPI Norway |

| 10/02/2022 | 0830/0930 | ** |  | SE | Riksbank Interest Rate |

| 10/02/2022 | 1000/1100 |  | EU | European Commission Winter Economic Forecasts | |

| 10/02/2022 | 1200/1300 |  | EU | ECB de Guindos on Europe post-covid at LSE | |

| 10/02/2022 | 1315/1415 |  | EU | ECB Lane on supply chain disruptions panel discussion | |

| 10/02/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 10/02/2022 | 1330/0830 | *** |  | US | CPI |

| 10/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 10/02/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 10/02/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 10/02/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 10/02/2022 | 1700/1700 |  | UK | BOE Bailey speech at TheCityUK Dinner | |

| 10/02/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 10/02/2022 | 1900/1400 | ** |  | US | Treasury Budget |

| 10/02/2022 | 1900/1400 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.