-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Markets Enter War Mode

EXECUTIVE SUMMARY:

- UKRAINE FOREIGN MINISTER SAYS RUSSIA IS CARRYING OUT FULL-SCALE ATTACK

- PUTIN ALLY SAYS UKRAINE'S DEMILITARIZATION ONLY WAY TO PREVENT WAR IN EUROPE

- NATO: RUSSIA’S ACTIONS WILL HAVE GEOSTRATEGIC CONSEQUENCES

- EU ENVOYS AGREE TO FINALISE NEW RUSSIA SANCTIONS, DIPLOMAT SAYS

- BOE'S PILL: SEEKING TO COMBAT INFLATION IN `MEASURED WAY'

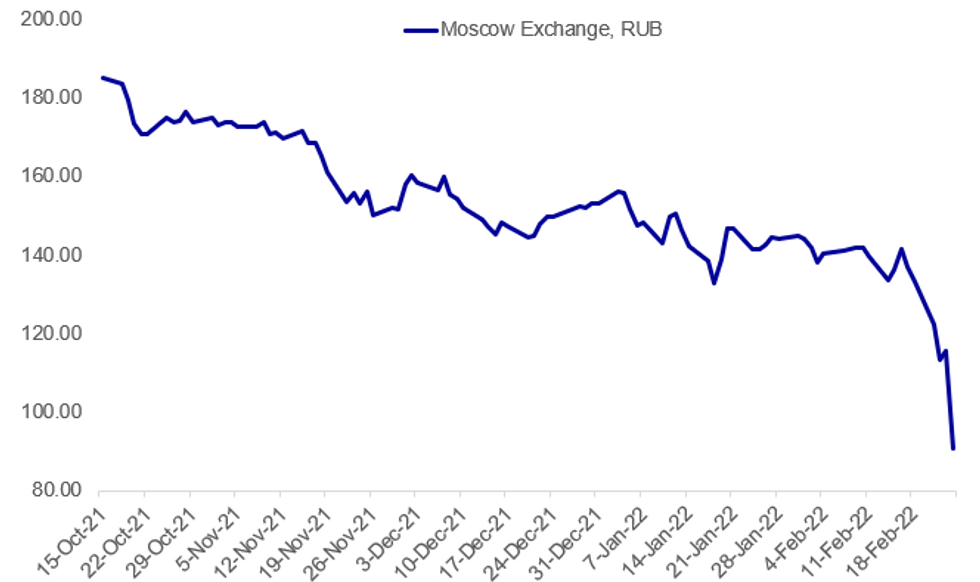

Fig. 1: Russian Stocks Collapse

Source: BBG, MNI

Source: BBG, MNI

NEWS:

RUSSIA-UKRAINE (RTRS): Ukrainian Foreign Minister Dmytro Kuleba said on Thursday Russia was carrying out a full-scale offensive from multiple directions and that Ukrainian forces were resisting the attack. "No, this is not a Russian invasion only in the east of Ukraine, but a full-scale attack from multiple directions," Kuleba said on Twitter.

RUSSIA-UKRAINE (RTRS): The speaker of Russia's lower house of parliament said on Thursday that the only way to prevent war in Europe was for Ukraine to be "demilitarised", the RIA news agency reported. Vyacheslav Volodin, a senior lawmaker, is a close ally of President Vladimir Putin. Russia on Thursday launched a massive military operation against Ukraine.

NATO-RUSSIA (BBG):North Atlantic Treaty Organization has held consultations under Article 4 of the Washington Treaty and has decided to take additional steps to further strengthen deterrence and defence across the Alliance, according to statement: We are deploying additional defensive land and air forces to the eastern part of the Alliance, as well as additional maritime assets.We have increased the readiness of our forces to respond to all contingencies

ECB (MNI): The European Central Bank is 'closely monitoring the implications' of overnight events in the Ukraine, an official spokesperson said Thursday. At present, policymakers are set to 'conduct a comprehensive assessment of the economic outlook when they meet on March 10. This, the spokesperson added, 'includes the recent developments in the geopolitical area.' As for sanctions, the central bank said 'they are decided by the EU and the European governments. The Eurosystem will implement them.' ECB Governing Council members are also due to meet in Paris later Thursday, where they are gathering for the EU finance and economy ministers meeting on Friday, with current events certain to top the agenda.

UK-RUSSIA-NATO (BBG): U.K. Prime Minister Boris Johnson says he will speak to fellow G-7 leaders and is calling for an “urgent meeting of all NATO leaders as soon as possible,” according to a tweet.Says “this is a catastrophe for our continent”

EU-UKRAINE: Reuters reporting that Lithuanian President Gitanas Nausda has stated that at this evening's emergency European Council summit of member state leaders, there will be a discussion on offering EU candidate status to Ukraine.

RUSSIA (RTRS): The European Union is unlikely at this stage to take steps to cut Russia off from the SWIFT global interbank payments system as it works on a new package of sanctions against Moscow for its action against Ukraine, several EU sources said. The foreign ministers of the Baltic states, once ruled from Moscow but now members of NATO and the EU, called on Thursday to stop Russia's access to SWIFT. Other EU member states are reluctant to make such a move because, while it would hit Russian banks hard, it would make it tough for European creditors to get their money back and Russia has in any case been building up an alternative payment system.

ECB (BBG):The crisis over Ukraine probably won’t keep the European Central Bank from agreeing on a faster wind-down of asset purchases at its next policy meeting, though the prospects for an interest-rate hike are less clear, Governing Council member Gabriel Makhlouf said. It’s too early to estimate the impact that the conflict will have on the economy, Makhlouf said in an interview in Paris on Wednesday. At the same time, the euro area is recovering from coronavirus restrictions, with consumption increasing and the labor market “in a much more positive state of health,” he said. “It’s entirely possible that in March we can make decisions as to what happens to the asset purchase program,” he said. “I don’t personally feel that I could tell you what’s going to happen to interest rates, and when. I’d prefer to have a bit more options open to me as we go.”

BOE (BBG): Bank of England Chief Economist Huw Pill said policy makers aim to move in a “measured way” that doesn’t hurt the rest of the economy as they seek to rein in inflation.“Inflation is uncomfortably high,” Pill said in an interview published by the Southern Daily Echo on Thursday after a visit to Southampton, England. “I think unfortunately in the coming few months, inflation may be set to go a little higher because some of the impact of energy price increases that we’ve seen are still to feed through to utility prices.”The central bank has lifted interest rates twice since December, and investors expect another move as early as next month. Pill said the aim is to protect “growth and employment in a way that’s unnecessarily costly.”

DATA:

FIXED INCOME: A fast market session for Global Markets

- A fast market session across the Globe, after Russian forces attacked targets across Ukraine, after Russian President Putin announced a special military operation to demilitarise Ukraine.

- Bund traded inn a massive 200 ticks range overnight, but saw selling interest on the cash open, with desks favouring selling into the strength.

- ECB Gabriel Makhlouf, a voter Dove, came with some hawkish headline during a Bloomberg interview, noting that the ECB may still decide on end of QE despite Ukraine.

- Periheral spread are all wider, with Greece in the lead, wider by 5.1bps.

- Gilt has rallied with Europe, and the 10yr yield slipped over 10bps, with yield now at 1.374%.

- Similar story for Treasuries, with safer haven Bonds favoured by investors.

- Looking ahead, there were no tier 1 EU data of note, and out of the US, sees 2nd reading for GDP and Core PCE.

- Speakers for today, BoE Bailey, Broadbent, Pill, ECB Schnabel, and US Fed Barkin, Bostic, Mester and Daly.

- All eyes remains on Russia.

FOREX: Regional Currencies Dive, Havens Surge as Russia Commits to Invasion

- The severe escalation of the Ukraine Crisis into an Russian invasion into Ukraine has unsettled global markets, with equities diving (the e-mini S&P touches new YTD lows of 4101.75), havens rallying (gold surging to $1960, highest since mid-2020) and bond yields diving.

- Haven currencies have received a solid tailwind, with the greenback, JPY and CHF at the top of the G10 table, while growth and commodity proxies are under pressure - putting AUD and NZD on the backfoot.

- The hardest hit currencies rest in those territories with the closest proximity to Ukraine and Russia, putting the likes of NOK and SEK at the bottom of the pile in G10. The move puts USD/SEK at the highest levels since mid-2020, with USD/NOK creeping toward first resistance at 9.0286.

- Data highlights Thursday include weekly jobless claims and secondary GDP figures for Q4, but these will likely take a backseat with the Ukraine crisis escalating considerably. The central bank speakers slate is also busy, with BoE's Bailey, Broadbent and Pill on the docket as well as Bostic, Mester, Barkin and Daly of the Fed.

COMMODITIES: Energy And Precious Metals Surge

- WTI Crude up $5.86 or +6.36% at $97.95

- Natural Gas up $0.26 or +5.6% at $4.882

- Gold spot up $39.14 or +2.05% at $1948.2

- Copper up $4.05 or +0.9% at $453

- Silver up $0.69 or +2.83% at $25.2397

- Platinum up $22.84 or +2.09% at $1117.52

EQUITIES: Sharply Lower, But Off Session's Worst Levels

- Asian markets closed lower: Japan's NIKKEI closed down 478.79 pts or -1.81% at 25970.82 and the TOPIX ended 23.5 pts lower or -1.25% at 1857.58. China's SHANGHAI closed down 59.19 pts or -1.7% at 3429.956 and the HANG SENG ended 758.72 pts lower or -3.21% at 22901.56

- European futures are down sharply, with the German Dax down 503.86 pts or -3.44% at 14121.25, FTSE 100 down 169.62 pts or -2.26% at 7328.46, CAC 40 down 196.84 pts or -2.9% at 6581.01 and Euro Stoxx 50 down 141.59 pts or -3.56% at 3833.13.

- U.S. futures continue to slide, with the Dow Jones mini down 571 pts or -1.73% at 32494, S&P 500 mini down 72.75 pts or -1.72% at 4149.25, NASDAQ mini down 309.75 pts or -2.29% at 13196.75.

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/02/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 24/02/2022 | 1315/1315 |  | UK | BOE Bailey Intro at BEAR Research Conference | |

| 24/02/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 24/02/2022 | 1330/0830 | *** |  | US | GDP (2nd) |

| 24/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 24/02/2022 | 1330/0830 | * |  | CA | Payroll employment |

| 24/02/2022 | 1500/1000 | *** |  | US | new home sales |

| 24/02/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 24/02/2022 | 1600/1100 | ** |  | US | DOE weekly crude oil stocks |

| 24/02/2022 | 1600/1700 |  | EU | ECB Schnabel panels BOE BEAR conference on Unwinding QE | |

| 24/02/2022 | 1600/1600 |  | UK | BOE Broadbent moderates panel at BEAR Conference on QE | |

| 24/02/2022 | 1600/1100 |  | US | San Francisco Fed's Mary Daly | |

| 24/02/2022 | 1610/1110 |  | US | Atlanta Fed's Raphael Bostic | |

| 24/02/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 24/02/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 24/02/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 24/02/2022 | 1700/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 24/02/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 25/02/2022 | 2330/0830 | ** |  | JP | Tokyo CPI |

| 25/02/2022 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 24/02/2022 | 0100/2000 |  | US | Fed Governor Christopher Waller | |

| 25/02/2022 | 0700/0800 | ** |  | SE | PPI |

| 25/02/2022 | 0745/0845 | *** |  | FR | HICP (p) |

| 25/02/2022 | 0745/0845 | ** |  | FR | Consumer Spending |

| 25/02/2022 | 0745/0845 | *** |  | FR | GDP (f) |

| 25/02/2022 | 0745/0845 | ** |  | FR | PPI |

| 25/02/2022 | 0800/0900 | ** |  | ES | PPI |

| 25/02/2022 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 25/02/2022 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 25/02/2022 | 0900/1000 | ** |  | EU | M3 |

| 25/02/2022 | 0900/1000 | * |  | NO | Norway Unemployment Rate |

| 25/02/2022 | 1000/1100 | * |  | EU | Business Climate Indicator |

| 25/02/2022 | 1000/1100 | ** |  | EU | Economic Sentiment Indicator |

| 25/02/2022 | 1000/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 25/02/2022 | 1115/1215 |  | EU | ECB Lagarde at Eurogroup Press Conference | |

| 25/02/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup meeting | |

| 25/02/2022 | - |  | EU | ECB Lagarde & de Guindos at ECOFIN meeting | |

| 25/02/2022 | 1330/0830 | ** |  | US | durable goods new orders |

| 25/02/2022 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 25/02/2022 | 1330/0830 | * |  | CA | Capital and repair expenditure survey |

| 25/02/2022 | 1500/1000 | ** |  | US | NAR pending home sales |

| 25/02/2022 | 1500/1000 | *** |  | US | Final Michigan Sentiment Index |

| 25/02/2022 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 25/02/2022 | 1800/1800 |  | UK | BOE Pill unwinding QE remarks at BEAR Conference |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.