-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS - Traders Row Back CB Hiking Bets

Highlights:

- Risk off pervades as Russian military column heads to Kyiv

- Interest rate futures price out chances of Fed, ECB, BoE policy 2022 tightening

- Commodities creep higher, with oil, iron ore and copper in the green

US TSYS SUMMARY: Bull Steepening As Rate Expectations Slashed

- Cash Treasuries firm significantly, led by the short-end and belly driving a sizeable bull steepening on the day as the rate expectations are cut heavily on the sixth day of the Russian invasion.

- 2YY -13.1bp at 1.303%, 5YY -11.9bp at 1.599%, 10YY -8.7bp at 1.736% and 30YY -7.2bp at 2.089%. 2YY sit 34bp below post US CPI highs of 1.636%.

- TYM2 sits 0-30+ higher at 128-12+ on extremely high volumes. It has blown through resistance levels and next eyes 128-17 (Jan 24 high).

- Biden gives his first State of the Union address at 2100ET.

- Fedspeak: Bostic (non-voter) speaks again with attention on whether he rows back from saying a 50bp hike in March is conditional on M/M CPI inflation trending higher in the upcoming Feb release (as per yesterday). Mester (2022) also gives opening remarks at an inflation conference at 1400ET.

- Data: Important manufacturing surveys scheduled with the final PMI and the new ISM for Feb, with the usual focus on price and employment components.

- NY Fed buy-op: TIPS 7.5Y-30Y, appr $0.625B vs. $1.225B prior (1120ET).

UST 2s10sSource: Bloomberg

UST 2s10sSource: Bloomberg

EGB/GILT SUMMARY: Safe Haven Flows Intensify

European government bonds have rallied sharply this morning with double digit moves in yields. Bilateral talks on the Belarusian border between Russian and Ukrainian officials failed to reach a resolution, with Moscow now stepping up its military bombardment.

- Following a slow start, gilts rallied through the morning with cash yields now down 12-14bp on the day.

- Bund yields are down 13-16bp.

- OAT yields are 10-20bp lower with the 5-year benchmark leading the charge.

- BTPs trade in line with OATs. Cash yields have fallen 10-20bp, with the belly of the curve outperforming.

- German regional CPI data for February show a broad acceleration from the previous month, with the national estimate due at 1300GMT. Italian CPI surprised higher in the same month (6.2% Y/Y vs 5.5% expected).

- Supply this morning came from Spain (Letras, EUR5.249bn) and Belgium (TCs, EUR2.4bn),

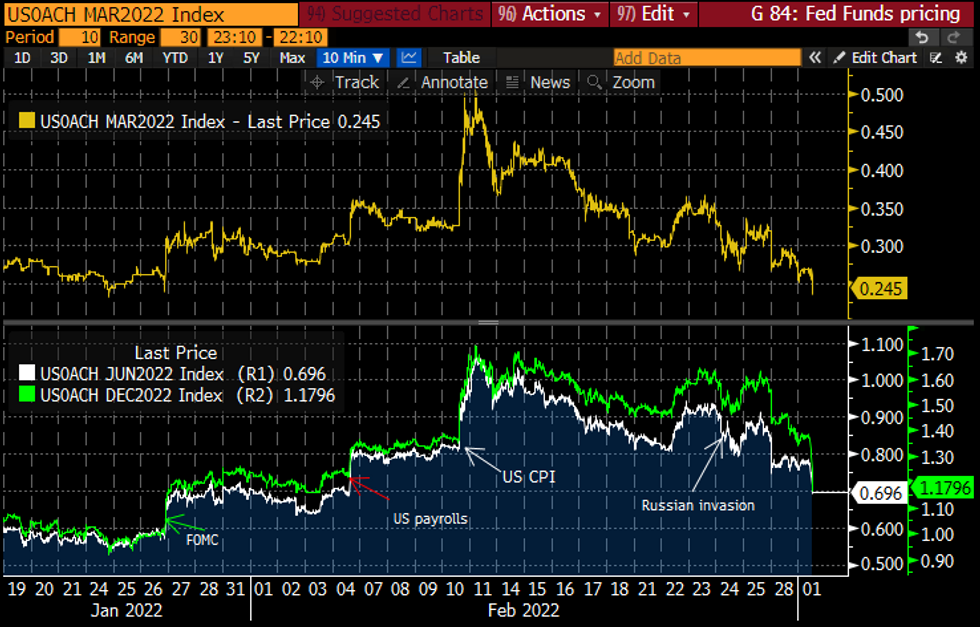

STIRS: Fed Funds Implied Hikes Slump

- Having initially proven resilient to medium term growth fears, Fed Funds futures implied hikes have tumbled on the sixth day of the Russian invasion.

- Pricing dips below a fully priced 25bp hike for March 16 (24.5bp, low of 23bp) and now calls into question three consecutive hikes through to June (70bp).

- The largest moves have been in Dec 14 pricing, now showing less than five hikes for 2022 (118bp) having seen ~160bp sustained the day after Russia’s initial invasion and 138bp earlier this morning.

- Putting this Dec'22 move into perspective, 118bps takes it back to seen immediately after Powell's surprisingly hawkish press conference on Jan 26, prior to the strong January payrolls and CPI reports.

Fed Funds futures for specific meetingsSource: Bloomberg

Fed Funds futures for specific meetingsSource: Bloomberg

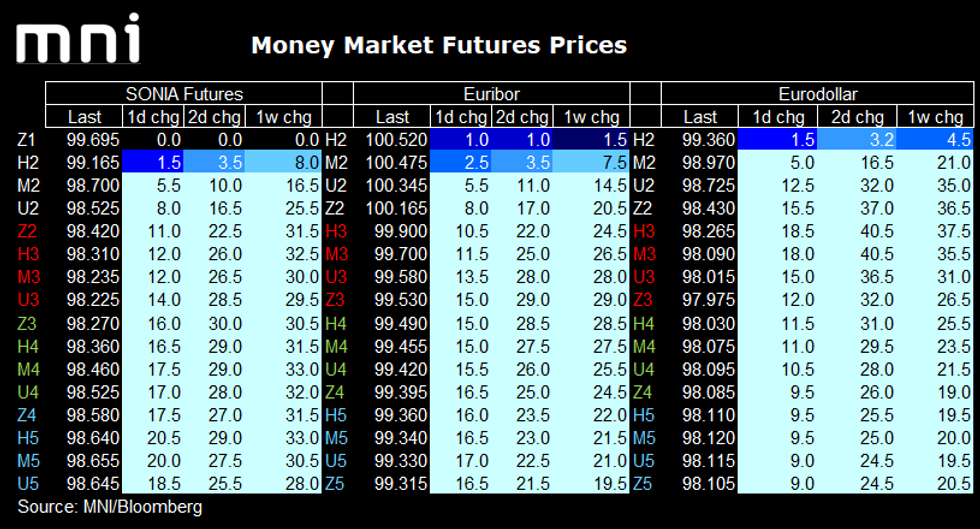

GLOBAL STIR FUTURES: Hiking paths being reassessed

Global STIR futures continue to move higher as markets reassess central bank hiking paths despite the higher than expected inflation prints from Italy and some German regions.

- Eurodollar futures the biggest G3 moves now, with Reds up to 18.5 ticks higher. Markets now pricing a little under 120bp of Fed hikes this year from around 135bp yesterday and highs of 170bps seen before the Ukrainian invasion.

- SONIA futures seeing Greens/Blues up 20 ticks with a flattening of the curve through Whites and Reds. Markets now price a further 110bp of hikes this year. 25bp hikes are fully priced for March, May and June, but two weeks ago we were pricing 45bp for March, now we are pricing 26bp. As recently as Friday, markets were pricing 130bp of hikes in 2022 and saw a peak of 167bp priced on 15 February. The MNI Markets team continues to look for 25bp hikes in both March and May, but the outlook beyond then continues to remain uncertain. We may be getting closer to a place where the risk/reward of being long is starting to look less attractive given the over 50bp move so far this year.

- For Euribor futures, ahead of the release of the MNI sources piece yesterday, around 31bp of hikes were priced for 2022, now 18.4bp is priced at the time of writing. Reds/Greens/Blues up 15-17 ticks on the day, too.

EUROPE ISSUANCE UPDATE:

GERMAN SYNDICATION: German 30-year tap: Launched- Maturity: 15 August 2052

- Size: €4bln Will Not Grow (no retention)

- Spread set previously at 0% Aug-50 Bund + 3.5bps (Guidance was +4bps area)

- Books in excess of E21bln (inc E2.9bln JLM)

Russia Swaps Signal 65% Chance of Default as War Widens

- RUSSIA SWAPS SIGNAL RECORD 65% CHANCE OF DEFAULT AS WAR WIDENS

- Contracts insuring $10 million of the country’s bonds for five years were quoted at about $4.6 million upfront and $100,000 annually, signaling around 65% likelihood of default: ICE data

- The upfront cost that protection sellers demanded on Tuesday rose from around $4 million on Monday

- The price of protecting Russia’s debt is no longer being quoted in basis points, as protection sellers have been demanding payment in advance, signaling perceptions that default risk might be imminent.

FOREX: Buoyant Commodities Tilt AUD Higher Despite Dovish RBA

- Markets trade in a broadly risk-off fashion, with European equities sitting in negative territory (EuroStoxx50 off 2%, Germany's DAX off 2.3%) as traders watch the progress of sizeable military units headed toward Kyiv. The Russian defense minister further stressed that the Ukraine operation is to continue until Russia's goals are met. Russian capital markets remain largely closed for business throughout the Tuesday session, leaving markets to bid commodities higher alongside haven FX including CHF and JPY.

- USD/JPY is making headway on a move through the Y115.00 handle, and is narrowing the gap with next key support layered between last week's low at 114.41 and the 100-dma of 114.42.

- Elsewhere, AUD trades most solidly following the RBA rate decision overnight. While the bank kept policy rates unchanged (alongside expectations) and stressed that the current Ukraine crisis provides a major new source of uncertainty, buoyant commodity markets continue to underpin the currency, with oil futures and iron ore both on the front foot headed into the NY crossover.

- Regional German CPI data is followed by the national read at 1300GMT/0800ET today, with focus then turning to Canadian GDP for Q4 and the February ISM manufacturing release. CB speakers of note include BoE's Saunders & Mann and Fed's Bostic & Mester.

FX OPTIONS: Expiries for Mar01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1100-10(E572mln), $1.1200-10(E844mln), $1.1264-75(E1.2bln), $1.1345-60(E1.4bln)

- USD/JPY: Y114.70($507mln), Y115.70-80($581mln)

- AUD/USD: $0.7150-60(A$521mln), $0.7190-05(A$682mln)

Price Signal Summary - Bunds Trade Through The 50-Day EMA

- In the equity space, the S&P E-minis have found resistance this morning ahead of the 20-day EMA that intersects at 4408.26. This represents an important intraday resistance. Recent gains are likely part of a corrective cycle that is allowing a recent oversold condition to unwind. A deeper sell-off would signal a resumption of the downtrend and refocus attention on 4101.75, the Feb 24 low and bear trigger. EUROSTOXX 50 futures remain in a downtrend. Recent weakness confirmed a resumption of the bear cycle and futures have recently cleared a number of key support levels. This signals scope for 3727.00, the Mar 25 2021 low on the continuation chart. The bear trigger is 3749.50, Feb 24 low. Resistance to watch is at 4049.50, the Feb 23 high.

- In FX, EURUSD continues to trade above recent lows but remains vulnerable. The trigger for a resumption of weakness is 1.1106, Feb 24 low. Clearance of this level would open 1.1040, 76.4% retracement of the Jan ‘21 - Mar ‘21 bull phase. Resistance is unchanged at 1.1280, Feb 14 low. The GBPUSD outlook remains bearish following a sharp sell-off last week that resulted in the break of a number of support levels. A resumption of bearish pressure would open 1.3163, Dec 8 low and a key support. USDJPY is lower this morning. Key short-term support at 114.16, the Feb 2 low, remains intact. The trend outlook remains bullish above this support. A move higher would refocus attention on the bull trigger at 116.35, this year’s high on Jan 4. Sub 114.16 levels would alter the picture.

- On the commodity front, Gold remains inside its bull channel, drawn from the Aug 9 low of last year. The top of the channel intersects at $1940.9 and represents a firm short-term resistance, ahead of last week’s Feb 24 high of $1974.3. Trend signals remain bullish but watch support at $1878.4, the Feb 24 low. A break of this level would instead suggest potential for a deeper pullback within the channel. Oil markets remain in an uptrend. WTI futures are pushing higher once again and scope is seen for a climb towards $102.01 - 3.382 projection of the Dec 2 - 9 - 20 price swing.

- In the FI space, Bund futures are firmer this morning and importantly, have traded above the 50-day EMA at 168.44. The EMA represents a firm area of resistance. A clear break though could suggest scope for a stronger corrective recovery - this would open 169.68, 50.0% retracement of the Dec 8 - Feb 16 downleg. Gilts have broken out of the recent range signalling potential for a stronger short-term recovery. This opens 124.47 next and 125.04, 1.00 and 1.236 projections of the Feb 16 - 18 - 23 price swing.

EQUITIES: European stocks under pressure despite resiliance in Asian markets

- Japan's NIKKEI up 317.9 pts or +1.2% at 26844.72 and the TOPIX up 10.24 pts or +0.54% at 1897.17

- China's SHANGHAI closed up 26.529 pts or +0.77% at 3488.835 and the HANG SENG ended 48.69 pts higher or +0.21% at 22761.71

- German Dax down 325.9 pts or -2.25% at 14136.72, FTSE 100 down 53.08 pts or -0.71% at 7401.49, CAC 40 down 154.95 pts or -2.33% at 6503.06 and Euro Stoxx 50 down 94.38 pts or -2.41% at 3830.07.

- Dow Jones mini down 213 pts or -0.63% at 33623, S&P 500 mini down 25.75 pts or -0.59% at 4342.75, NASDAQ mini down 106.25 pts or -0.75% at 14120.25.

COMMODITIES: European natgas fades early weakness and up 10% on the day

- WTI Crude up $3.31 or +3.46% at $98.67

- Natural Gas (NYM) up $0.07 or +1.68% at $4.476

- Natural Gas (ICE Dutch TTF) up $10.41 or +10.55% at $109.5

- Gold spot up $9.21 or +0.48% at $1917.95

- Copper up $5.45 or +1.22% at $452.15

- Silver up $0.07 or +0.27% at $24.5173

- Platinum up $8.92 or +0.85% at $1056.7

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/03/2022 | - |  | EU | ECB Panetta at G7 Finance Ministers/CB Governors Meeting | |

| 01/03/2022 | - | *** |  | US | domestic made vehicle sales |

| 01/03/2022 | 1300/1400 | *** |  | DE | HICP (p) |

| 01/03/2022 | 1300/1400 |  | EU | ECB Lagarde visits Chancellor Scholz | |

| 01/03/2022 | 1330/0830 | * |  | US | construction spending |

| 01/03/2022 | 1330/0830 | *** |  | CA | GDP - Canadian Economic Accounts |

| 01/03/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 01/03/2022 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/03/2022 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/03/2022 | 1830/1830 |  | UK | BOE Saunders speech at East Anglia University | |

| 01/03/2022 | 1900/1400 |  | US | Atlanta Fed's Raphael Bostic | |

| 01/03/2022 | 1900/1900 |  | UK | BOE Mann panels Cleveland Fed discussion | |

| 01/03/2022 | 1900/1400 |  | US | Cleveland Fed's Loretta Mester | |

| 02/03/2022 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 02/03/2022 | 0700/0700 | * |  | UK | Nationwide House Price Index |

| 02/03/2022 | 0855/0955 | ** |  | DE | unemployment |

| 02/03/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 02/03/2022 | 1000/1100 | ** |  | EU | PPI |

| 02/03/2022 | 1000/1100 | *** |  | EU | HICP (p) |

| 02/03/2022 | 1000/1100 |  | EU | ECB Schnabel at BMAS roundtable | |

| 02/03/2022 | 1100/1200 |  | EU | ECB de Guindos Q&A at Universidad Carlos III | |

| 02/03/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 02/03/2022 | 1315/0815 | *** |  | US | ADP Employment Report |

| 02/03/2022 | 1400/0900 |  | US | Chicago Fed's Charles Evans | |

| 02/03/2022 | 1430/0930 |  | US | St. Louis Fed's James Bullard | |

| 02/03/2022 | 1500/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 02/03/2022 | 1500/1000 |  | US | Fed Chair Pro Tempore Jerome Powell | |

| 02/03/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 02/03/2022 | 1600/1700 |  | EU | ECB Lane lecture at Hertie School Berlin | |

| 02/03/2022 | 1830/1830 |  | UK | BOE Tenreyro speech to Economic Research Council | |

| 02/03/2022 | 1900/1400 |  | US | Fed Beige Book | |

| 02/03/2022 | 2000/2000 |  | UK | BOE Cunliffe speech at Oxford Union | |

| 02/03/2022 | 2130/1630 |  | US | New York Fed's Lorie Logan | |

| 03/03/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.