-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: European Inflation Keeps Rising

EXECUTIVE SUMMARY:

- WAR WILL BE IN ACTIVE PHASE FOR ANOTHER WEEK: UKRAINE PRESIDENTIAL ADVISER

- SPANISH CPI HITS HIGHEST SINCE 1985, GERMAN STATE CPI UP SHARPLY

- EUROZONE ECONOMIC SENTIMENT FALLS SHARPLY

- MNI CHINA LIQUIDITY INDEX JUMPS TO 63.3 IN MARCH

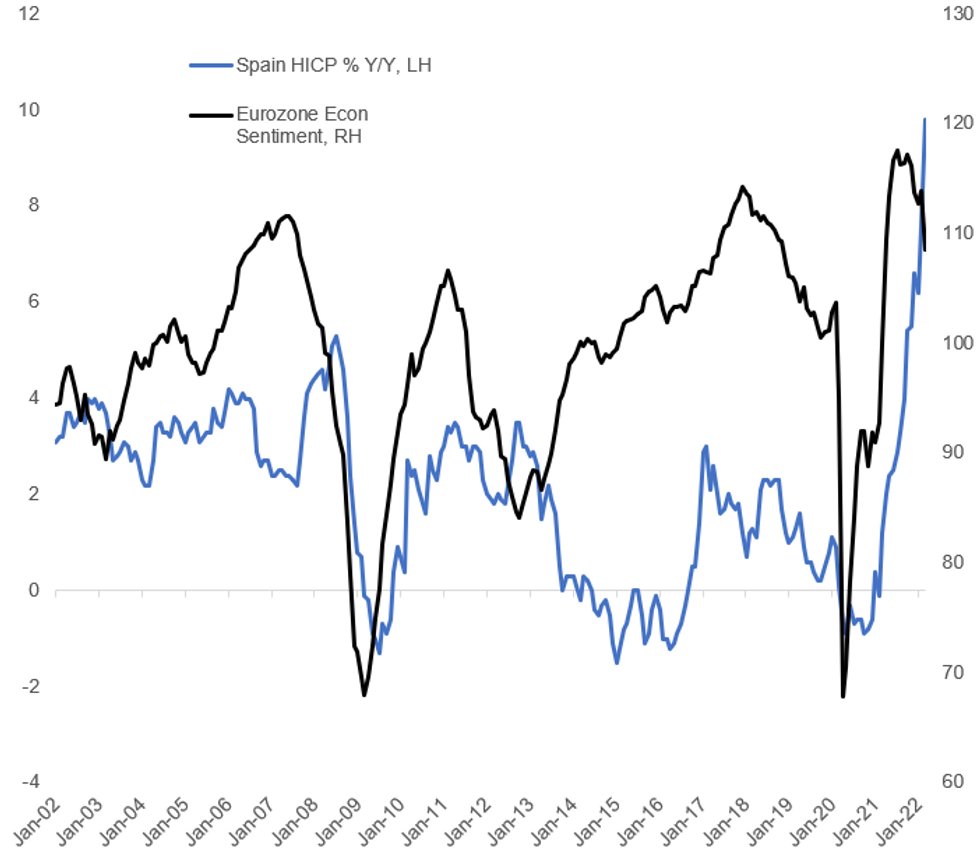

Fig. 1: Eurozone Econ Sentiment Falters As Inflation Rises

Source: EC, INE, MNI

Source: EC, INE, MNI

NEWS:

UKRAINE/RUSSIA: Reuters reporting that a Ukrainian presidential adviser has stated that the war in Ukraine will be in an 'active phase' for another week.

- Comes as air raid sirens continued to sound overnight in the capital Kyiv. This follows announcements yesterday that following talks in Turkey between Ukrainian and Russian negotiators, enough progress had been made to potentially facilitate an in-person meeting between Presidents Zelensky and Putin. This also saw the Russian deputy foreign minister state that Russia would 'fundamentally cut back' its advances on Kyiv and Chernihiv.

- Adviser says that Russia is transferring troops from the north of Ukraine to the east to encircle Ukrainian troops in the Donbas. Adds that some Russian troops remain around Kyiv in an effort to prevent the Ukrainian gov't sending more of its forces to the east.

- Says that in negotiations 'in all respects, Ukraine has improved its position'.

ECB: The best way for monetary policy to navigate the uncertainty caused by the war in Ukraine, rising energy and food prices and ongoing supply bottlenecks is to emphasise the principles of optionality, gradualism and flexibility, ECB president Christine Lagarde said Thursday. “Optionality means that we are prepared to react to a range of scenarios, and the course we take will depend on the incoming data,” she said. “Gradualism means that we will move carefully and adjust our policy as we receive feedback on our actions. Flexibility means that we will use our toolkit to ensure that our policy is transmitted evenly across all parts of the euro area,” she said.

ECB (BBG): The European Central Bank may raise interest rates this year, provided the war in Ukraine doesn’t escalate significantly, according to Governing Council member Peter Kazimir. The outcome of March’s meeting meant the ECB “freed its hands” to react with rates in the coming quarters, Kazimir, who heads Slovakia’s central bank, tells news conference in Bratislava. “Unless there’s a dramatic escalation of the war, unless it becomes a global conflict, then I think the first increase could happen near the end of this year”. “I personally wish that we exit the territory of negative rates within a year at the latest”.

U.S. / UKRAINE: Members of the US House of Representatives and Senate will recieve separate classified briefings this afternoon on the state of play in Ukraine from the State Dep't, Pentagon, and Joint Chiefs.

- The Senate briefing takes place at 1500ET (2000BST, 2100CET), and the House's at 1645ET (2145BST, 2245CET).

- Public pronouncements by Biden administration officials in the wake of yesterday's pronouncement of progress from the Russia-Ukraine talks in Tureky have been notably downbeat. Secretary of State Anthony Blinken stated yesterday that "I would leave it to our Ukrainian partners to characterize whether there is any genuine progress and whether Russia is engaging meaningfully,"

BOE (MNI): BoE's Broadbent speech concluded - nothing immediately market moving. He makes the point that he doesn't set interest rates in the future, so there's not much point in him committing to a rate path (like the Riksbank/Norges Bank) as there are bigger risks than benefits (1: that the market doesn't fully understand the conditionality of the forecast. 2: That it would be hard to pin down with 9 members in a democratic format).

- He also says that if central banks overcommunicate then markets pay too much attention to CBer's comments and not enough attention to the economic data - and it is the economic data that should be guiding markets not CB speeches.

- The final pullout point is that he thinks that CBs don't need to steer guidance over for the next meeting. If something changes and it is appropriate to change/not change policy then having to have communicated that to the market previously only slows down the CB's ability to act fast.

- So all in all, he was making the point markets should pay more attention to economic data and possibly central bankers should speak less!

DATA:

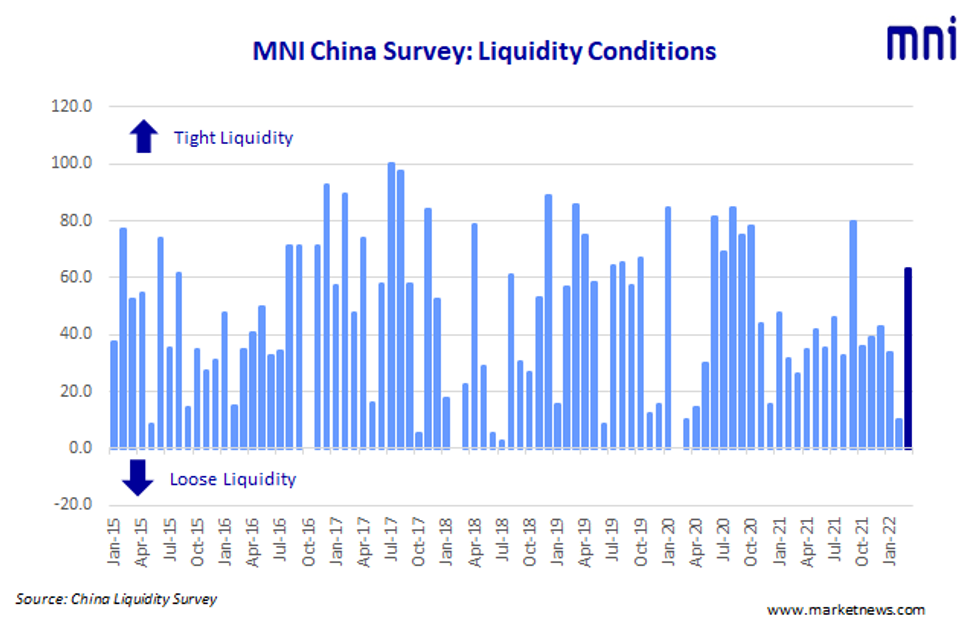

MNI China Liquidity Index™– Jumps To 63.3 in March

Liquidity across China’s interbank markets tightened in March, with banks’ more cautious as they look to keep their books healthy ahead of the quarter-end Macro Prudential Assessment (MPA), the latest MNI Liquidity Conditions Index shows.

The Liquidity Condition Index jumped to 63.3 in March, up sharply from 10.0 in February, with a third of traders reporting condition as “tighter than last month”. The higher the index reading, the tighter liquidity appears to survey participants.

- The Economy Condition Index stood at 21.7, sliding from the 8-month high seen in February, as regional Covid outbreaks weigh on sentiment.

- The PBOC Policy Bias Index remained below 50 for an 9th consecutive month.

- The Guidance Clarity Index was little changed, as respondents again claim to understand the signals from the PBOC.

The MNI survey collected the opinions of 30 traders with financial institutions operating in China's interbank market, the country's main platform for trading fixed income and currency instruments, and the main funding source for financial institutions.

Interviews were conducted Mar 14 – Mar 25.

Click below for the full press release:

MNI China Liquidity Index March 2022.pdf

For full database history and full report on the MNI China Liquidity Index™, please contact:sales@marketnews.com

MNI: SPAIN FLASH HICP MAR +3.9% M/M , +9.8% Y/Y; FEB 7.6% Y/Y

Flash CPI Highest Since 1985

FLASH HICP MAR +3.9% M/M , +9.8% Y/Y; FEB 7.6% Y/Y

FLASH CPI MAR +3.0% M/M, +9.8% Y/Y; FEB +7.6% Y/Y

FLASH CORE CPI +3.4% Y/Y; FEB +3.0% Y/Y

- Spanish CPI reached the highest level since 1985 at +9.8% Y/Y in the March flash print, rising 2.2 points on-the-year and 0.7pp on-the-month in the harmonised reading.

- This is a new euro-area high for Spain.

- With core inflation at +3.4% y/y, these numbers are unlikely to be of great surprise for policymakers as energy continues to account for the majority of upwards price pressure following the invasion of Ukraine.

Source: INE

MNI: BAVARIA MAR CPI +2.8% M/M, +7.8% Y/Y; FEB +5.3% Y/Y

Bavarian Inflation Hits +7.8%

BAVARIA MAR CPI +2.8% M/M, +7.8% Y/Y; FEB +5.3% Y/Y

- German state CPI numbers for March are seeing jumps of around 2.5 points on both the month-on-month and year-on-year prints. These are fresh euro-era highs.

- Bavarian inflation rose +2.8% m/m (+1.2% Feb) and +7.8% y/y (+5.3% Feb),. Underlying core inflation was up +1.0% m/m and +5.0% y/y, quickening from +4.3% y/y seen last month.

- NRW saw CPI up 2.7% m/m (1.0% Feb) and 7.6% y/y (5.3% Feb)

- The flash aggregate headline print for Germany is due at 1300 BST. A 1.1-point acceleration to 6.2% y/y is the consensus forecast, however following this morning's state prints, upwards of an additional 1pp on this reading cannot be ruled out.

MNI: EZ MAR ECONOMIC SENTIMENT INDICATOR 108.5; FEB 113.9r

Economic Sentiment Slumps Due to Future Expectations

MAR ECONOMIC SENTIMENT INDICATOR 108.5; FEB 113.9r

MAR INDUSTRIAL CONFIDENCE 10.4; FEB 14.1r

MAR CONSUMER CONFIDENCE -18.7; FEB -8.8

MAR EMPLOYMENT EXPECTATIONS 115.5; FEB 116.4r

- Economic sentiment saw a significant 5.4-point drop to 108.5 in March, coming in at a 12-month low on the back of significant declines in consumer confidence. Despite the substantial fall, this is 0.5pp above analysts' expectations, likely due to services improving slightly and constructions remaining stable.

- Economic sentiment saw the largest decline in France (-7.1) followed by Spain (-6.5) and Germany (-4.3).

- Consumer confidence confirmed the lowest reading since May 2020, falling 9.4 points as households due to both a dive in their assessment of the general economic situation and historically low future financial expectations. Consumer uncertainty hit a record high.

- Substantial falls were also seen in retail trade and industry confidence.

- Expectations were the key downwards drivers across these indexes, with industry confidence seeing a 12-month low.

Source: EC

FIXED INCOME: Inflation drives German curve, but yields didn't hit yesterday's highs

The big talking point of the European morning session has been inflation with the German state CPIs coming in higher than expected by around 1ppt and the Spanish HICP print beating expectations by 1.4ppt. This has led to the Euribor strip underperforming SONIA and Eurodollars while Bunds under perform gilts and Treasuries.

- Bunds and Treasuries both drifted higher through the Asian session and Treasury futures are now back pretty much unchanged to yesterday's close, albeit with an almost 5bp fall in 2-year yields leading to a decent bull steepening of the curve.

- The German curve has seen a bear flattening with Schatz yields up 7.6bp at 0.014% and 10y Bund yields up 4.4bp, with bigger moves seen in Euribor futures as markets price in a more aggressive rate path. Despite this Schatz yields reached a high of 0.036% today, below yesterday's high of 0.039% while 10-year Bund yields have only reached a high of 0.682% today, 5.0bp below the 0.732% peak seen yesterday.

- Gilts have seen a parallel 2bp shift, with yields moving higher.

- TY1 futures are up 0-0+ today at 122-11 with 10y UST yields up 0.8bp at 2.405% and 2y yields down -4.8bp at 2.320%.

- Bund futures are down -0.47 today at 156.90 with 10y Bund yields up 4.4bp at 0.674% and Schatz yields up 7.6bp at 0.014%.

- Gilt futures are down -0.14 today at 120.79 with 10y yields up 2.1bp at 1.662% and 2y yields up 2.0bp at 1.364%.

FOREX: Dollar Pulls Back for Second Session

- The greenback is among the poorest performers in G10 Wednesday, slipping for a second session and putting the USD Index through the 98.00 handle to touch levels not seen since March 17th.

- The JPY is the strongest performer, extending the bounce off the multi-year cycle lows printed earlier in the week. This puts USD/JPY solidly back below the Y122.00 handle. The move is considered corrective and is beginning to allow a recent extreme overbought condition to unwind. An extension lower would open 120.95, the Mar 24 low ahead of the 120.00 handle. Key resistance and the bull trigger has been defined at 125.09.

- Equities across Europe and futures in the US are modestly lower, indicating a negative open on Wall Street later today. Nonetheless, any reports of further progress made between Kyiv and Moscow could continue to support underlying sentiment, with yesterday's 4631.00 print the highest level seen since mid-January.

- ADP Employment Change data crosses later today, with markets expecting the survey to show job gains of 450k, which will be followed shortly afterward by the final revision for Q4 2021 GDP data. The speaker slate should be of more interest, with ECB's Wunsch, Makhlouf and Panetta on the docket as well as Fed's Barkin and George.

EQUITIES: Energy The Only Sector In Green

- Asian markets closed mixed: Japan's NIKKEI closed down 225.17 pts or -0.8% at 28027.25 and the TOPIX ended 24.06 pts lower or -1.21% at 1967.6. China's SHANGHAI closed up 62.657 pts or +1.96% at 3266.596 and the HANG SENG ended 304.4 pts higher or +1.39% at 22232.03

- European stocks are lower, with the German Dax down 191.42 pts or -1.29% at 14614.16, FTSE 100 down 10.69 pts or -0.14% at 7529.07, CAC 40 down 78.72 pts or -1.16% at 6707.44 and Euro Stoxx 50 down 41.47 pts or -1.04% at 3955.72.

- U.S. futures are down slightly, with the Dow Jones mini down 111 pts or -0.32% at 35079, S&P 500 mini down 17.25 pts or -0.37% at 4608.25, NASDAQ mini down 75.25 pts or -0.49% at 15162.5.

COMMODITIES: WTI, Copper Regain Ground

- WTI Crude up $2.29 or +2.2% at $106.29

- Natural Gas up $0.03 or +0.6% at $5.358

- Gold spot down $0 or 0% at $1920.94

- Copper up $5 or +1.06% at $478.05

- Silver up $0.03 or +0.13% at $24.8069

- Platinum down $2.35 or -0.24% at $984.29

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/03/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 30/03/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 30/03/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 30/03/2022 | 1230/0830 | *** |  | US | GDP (3rd) |

| 30/03/2022 | 1315/0915 |  | US | Richmond Fed's Tom Barkin | |

| 30/03/2022 | 1415/1615 |  | EU | ECB Panetta Hearing on Digital Euro at ECON | |

| 30/03/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 30/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 30/03/2022 | 1700/1300 |  | US | Kansas City Fed's Esther George | |

| 31/03/2022 | 2350/0850 | ** |  | JP | Industrial production |

| 31/03/2022 | 0030/1130 | * |  | AU | Building Approvals |

| 31/03/2022 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 31/03/2022 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 31/03/2022 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 31/03/2022 | 0630/0730 |  | UK | DMO Gilt Operations Calendar April-June | |

| 31/03/2022 | 0630/0830 | ** |  | CH | retail sales |

| 31/03/2022 | 0645/0845 | ** |  | FR | Consumer Spending |

| 31/03/2022 | 0645/0845 | ** |  | FR | PPI |

| 31/03/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 31/03/2022 | 0755/0955 | ** |  | DE | unemployment |

| 31/03/2022 | 0800/1000 |  | EU | ECB Lane Lecture at Paris School of Economics | |

| 31/03/2022 | 0900/1100 | ** |  | EU | unemployment |

| 31/03/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 31/03/2022 | 1000/1200 |  | EU | ECB de Guindos at Discussion at University of Amsterdam | |

| 31/03/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 31/03/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 31/03/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 31/03/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/03/2022 | 1300/0900 |  | US | New York Fed's John Williams | |

| 31/03/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 31/03/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 31/03/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 31/03/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 31/03/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 31/03/2022 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 31/03/2022 | 1600/1200 | *** |  | US | USDA PROSPECTIVE PLANTINGS - NASS |

| 01/04/2022 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.