-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Credit Supply Pipeline

US Treasury Auction Calendar

MNI US OPEN: Fed Hike Expectations Up Again Pre-Minutes

EXECUTIVE SUMMARY:

- YELLEN TO WARN WAR THREATENS "ENORMOUS ECONOMIC REPERCUSSIONS"

- GERMAN FACTORY ORDERS SLUMP; EUROZONE PPI AT RECORD

- CHINA STILL RISKS WAVE OF DEVELOPER DEFAULT: ADVISORS (MNI)

- RIKSBANK FLODEN: MUST HIKE MUCH SOONER THAN PLANNED

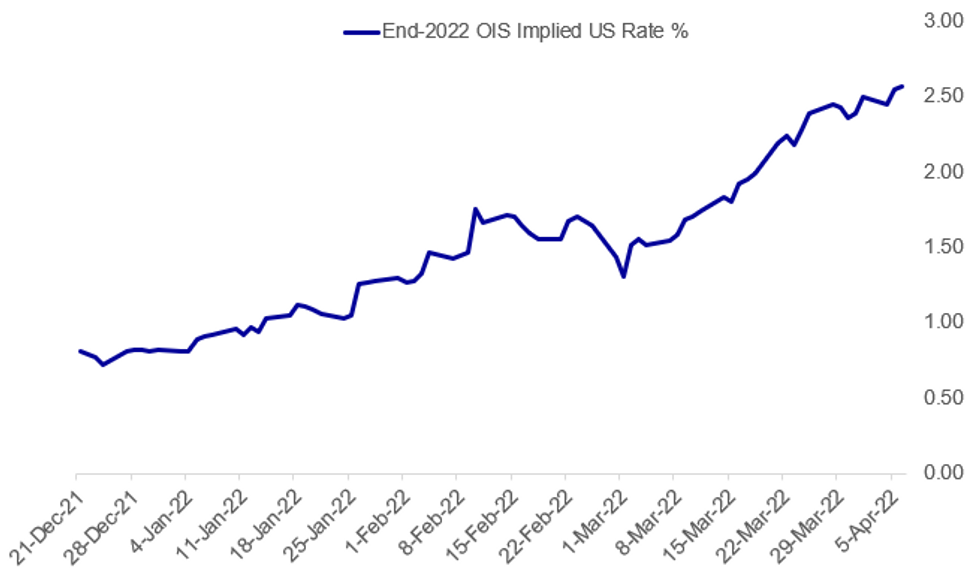

Fig. 1: Pricing In 225bp Of Further 2022 Fed Hikes

Source: BBG, MNI

Source: BBG, MNI

NEWS:

US (BBG): U.S. Treasury Secretary Janet Yellen will warn on Wednesday that the war in Ukraine threatens to inflict “enormous economic repercussions” globally, just as governments impose fresh sanctions on Russia and economists cut growth forecasts. “Russia’s actions, including the atrocities committed against innocent Ukrainians in Bucha, are reprehensible, represent an unacceptable affront to the rules-based global order, and will have enormous economic repercussions for the world,” Yellen will tell the House Financial Services Committee, according to a copy of her prepared remarks.

CHINA (MNI EXCLUSIVE): Moves by Chinese authorities to relax controls on the property market are proving insufficient to reverse a precipitous downturn, with a large chunk of the CNY680 billion in developers' maturing bonds this year at risk of default in the absence of further official measures to ease restrictions on their financing, policy advisors told MNI. For full article contact sales@marketnews.com

RIKSBANK: Riksbank Deputy Governor Martin Floden signalled Wednesday that he could back tightening as early as this month's policy meeting, arguing that it may avoid more substantial tightening later on. "We must raise the policy rate much earlier than previously planned," he said. Floden noted that the Riksbank's February forecast was obsolete, with core inflation hitting 3.4% that month compared to the 2.3% expected. It's "unavoidable that near-term inflation will remain high," but tightening "would likely support an appreciation of the krona and thereby mitigate the high prices of commodities and other imported goods," he said.

FRANCE POLITICS (BBG): Emmanuel Macron is spending the final week before France’s presidential election trying to connect with voters through campaign stops and media appearances as polls show the gap between him and far-right leader Marine Le Pen narrowing. The French leader went on a popular morning radio show on France Inter on Monday to explain his program, before traveling to western France where he spoke about road construction and European Union funding. He’s given interviews to two local papers. Up until now, Macron has been focusing on the crisis in Ukraine and while he benefited from an initial rally-around-the-flag effect, he’s under increasing criticism for not getting out and campaigning that much.

ECB (BBG): Leaving the European Central Bank to fight the current bout of energy-driven inflation alone would only work at a steep cost to society, according to Executive Board member Fabio Panetta. Because much of the surge in prices is down to geopolitical factors beyond the influence of monetary policy, central bankers would have to take strong action to slow the euro-area economy, Panetta said Wednesday in a speech in Cassino, Italy. “Asking monetary policy alone to bring down short-term inflation while inflation expectations remain well anchored would be extremely costly,” he said. “A monetary-policy tightening would not directly affect imported energy and food prices, which are driven by global factors and now by the war. We would instead have to massively suppress domestic demand to bring down inflation.”

ECB (BBG): The ECB is ready to use a wide range of tools to combat fragmentation, according to Executive Board Member Philip Lane. Flexibility will remain part of monetary policy when there are factors that threaten that policy and endanger price stability, the ECB’s chief economist says in interview with Greece’s Kathimerini newspaper published Wednesday.

GERMANY/BUNDESBANK (BBG): Germany’s property market is becoming “increasingly vulnerable” due to rising prices and regulators could take steps to restrict lending if more risks accumulate, Joachim Wuermeling, a member of the Bundesbank’s executive board, says in interview with Handelsblatt newspaper. “Loans with an initial fixed interest rate of more than ten years now account for half of household loans for house purchases”: Wuermeling to newspaper.

DATA:

MNI: EUROZONE MAR CONSTRUCTION PMI 52.8; FEB 56.3

*MNI: UK MAR CONSTRUCTION PMI 59.1; FEB 59.1

MNI: GERMANY FEB FACTORY ORDERS -2.2% M/M, +2.9% Y/Y; JAN +8.2%r Y/Y

February New Factory Orders Slump Below Forecasts

GERMANY FEB FACTORY ORDERS -2.2% M/M, +2.9% Y/Y; JAN +8.2%r Y/Y

- German new manufacturing orders were significantly below forecasts.

- Factory orders fell 4.5pp to a contractive -0.3% m/m and by 5.3pp to +2.9% y/y.

- Analysts were forecasting softer decreases of 2.6pp and 2.8pp respectively.

- Both January numbers were revised upwards, with the year-on-year growth revised up 0.9pp to +8.2%.

- The strong January growth was on the back of foreign demand growth, which slumped substantially in February.

- Foreign orders were responsible for the bulk of the decrease, falling -3.3% m/m. Eurozone orders also fell by -3.3% m/m.

- The data largely predates the 24/2 start of the Ukraine invasion and associated further inflationary pressures and worsening of supply-chain disruption.

MNI: EUROZONE FEB PPI +1.1% M/M, +31.4% Y/Y, JAN +30.6% Y/Y

Eurozone Factory-Gate Inflation at Record +31.4%

EUROZONE FEB PPI +1.1% M/M, +31.4% Y/Y, JAN +30.6% Y/Y

- Euro area PPI reached a fresh record high at +31.4% y/y in the February print.

- Core PPI rose 12.2% y/y from +11.8% in January.

- Eurozone factor-gate inflation was only slightly softer than the consensus forecast in February at +1.1% m/m (0.1pp below forecast) and by +31.4% y/y (0.2pp below forecast).

- On the month, intermediate goods rose 1.6%, with energy sector goods up 1.3%.

- Slovakia (+13.6%), Slovenia (+5.7%) and Greece (+4.8%) saw the greatest monthly accelerations, however, Ireland saw a substantial slowdown (-8.1%).

- This data at large predates further upwards pressures of the Ukraine invasion, which has seen energy prices soar further.

FIXED INCOME: USTs continue descent ahead of FOMC Minutes

- Treasuries have continued their slide after the hawkish comments from Brainard yesterday, and ahead of today's FOMC Minutes. The focus of the Minute will be on the language surrounding the pace and timing of tapering, and also on any language around the likelihood of 50bp hikes in upcoming FOMC meetings.

- Gilts have been dragged lower by Treasuries, too, with the German curve also lower but seeing smaller moves than gilts or USTs.

- Looking ahead we have more comments from ECB's Lane as he participates in a panel on inflation dynamics but there is little else on the calendar.

- There is still continued focus on le Pen moving up in the polls for the French election (albeit still at as a major underdog to Macron's reelection). OAT-Bund spreads are little changed today, but peripheral spreads are a little wider.

- TY1 futures are down -0-15+ today at 120-14 with 10y UST yields up 7.1bp at 2.620% and 2y yields up 3.9bp at 2.556%.

- Bund futures are down -0.48 today at 157.25 with 10y Bund yields up 3.8bp at 0.649% and Schatz yields up 1.5bp at -0.14%.

- Gilt futures are down -0.48 today at 120.34 with 10y yields up 6.1bp at 1.713% and 2y yields up 5.3bp at 1.501%.

FOREX: USD Backtracks Small Part of Post-Brainard Move

- The greenback is edging lower into the NY crossover, helping major pairs including EUR/USD and GBP/USD recover off the session lows. Despite the USD slipping lower over the past few hours, markets are yet to recover a major part of the post-Brainard moves posted yesterday, after the FOMC member argued in favour of a much faster, swifter QT process relative to post-Global Financial Crisis policy.

- There's a tentative sense of risk-off evident in equity markets, with most continental indices lower by 1% or more, with continued weakness evident in French names as the polling lead for incumbent Macron narrows over his right-wing contender Marine Le Pen.

- In contrast to stocks, haven currencies are weaker so far Wednesday, putting CHF and JPY at the bottom of the G10 pile. GBP and NZD are the firmest currencies so far, but recent ranges are largely being respected.

- Data is few and far between Wednesday, with no major G10 releases outside of the Canadian Ivey PMI due at 1500BST/1000ET. This should keep the central bank speaker docket in the spotlight, with ECB's Lane and Knot due, as well as Fed's Harker and the much-watched release of the Fed minutes.

EQUITIES: European Stocks Lower With Tech, Consumer Discretionary Underperforming

- Asian markets mostly closed lower: Japan's NIKKEI closed down 437.68 pts or -1.58% at 27350.3 and the TOPIX ended 26.21 pts lower or -1.34% at 1922.91. China's SHANGHAI closed up 0.709 pts or +0.02% at 3283.426 and the HANG SENG ended 421.79 pts lower or -1.87% at 22080.52.

- European stocks are weaker, with the German Dax down 161.5 pts or -1.12% at 14236.43, FTSE 100 down 44.58 pts or -0.59% at 7570.16, CAC 40 down 82.58 pts or -1.24% at 6563.46 and Euro Stoxx 50 down 49.88 pts or -1.27% at 3862.14.

- U.S. futures are a little lower, with the Dow Jones mini down 91 pts or -0.26% at 34458, S&P 500 mini down 14.75 pts or -0.33% at 4505.5, NASDAQ mini down 83.5 pts or -0.56% at 14743.

COMMODITIES: WTI Bounces Back From Sub-$100 Overnight Low

- WTI Crude up $1.31 or +1.28% at $103.17

- Natural Gas up $0.09 or +1.51% at $6.121

- Gold spot up $3.42 or +0.18% at $1925.81

- Copper down $1.65 or -0.34% at $477.65

- Silver up $0.04 or +0.18% at $24.3345

- Platinum up $0.35 or +0.04% at $971.73

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/04/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 06/04/2022 | 1145/1345 |  | EU | ECB Philip Lane panel appearance | |

| 06/04/2022 | 1330/0930 |  | US | Philadelphia Fed's Patrick Harker | |

| 06/04/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 06/04/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 06/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 06/04/2022 | 1800/1400 | * |  | US | FOMC Minutes |

| 07/04/2022 | 0130/1130 | ** |  | AU | Trade Balance |

| 07/04/2022 | 0545/0745 | ** |  | CH | unemployment |

| 07/04/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/04/2022 | 0900/1100 | ** |  | EU | retail sales |

| 07/04/2022 | 1130/1330 |  | EU | ECB March meet Accts published | |

| 07/04/2022 | 1215/1315 |  | UK | BOE Pill Opening at BOE Sovereign Bond Market Conference | |

| 07/04/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 07/04/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 07/04/2022 | 1300/0900 |  | US | St. Louis Fed's James Bullard | |

| 07/04/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 07/04/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 07/04/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 07/04/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 07/04/2022 | 1800/1400 |  | US | Atlanta Fed's Raphael Bostic, Chicago Fed's Charles Evans | |

| 07/04/2022 | 1900/1500 | * |  | US | Consumer Credit |

| 07/04/2022 | 2005/1605 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.