-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Curve Continues to Bull Steepen

Highlights:

- Greenback holds close to cycle highs post-Fed minutes

- Treasury curve bull steeper

- Fedspeak the focus, with Bullard, Bostic and Evans due

US TSYS: Bull Steepening Post Minutes

- Cash Tsys have rallied on the day in a move that started after the initial sell-off on yesterday’s FOMC minutes, which laid out likely plans for a monthly cap on runoff rising to $95B ($60B Tsy, $35B MBS) phased in “over a period of three months or modestly longer.”

- 2YY -3.2bps at 2.439%, 5YY -2.7bps at 2.655%, 10YY -1.3bps at 2.585%, 30YY -0.1bps at 2.625%. The modest bull steepening sees 2s10s up to new recent highs of 15bps.

- TYM2 is up 8+ ticks at 120-30+ on average volumes. Despite the rise, the downtrend is seen intact with support at 120-04+ (continuation of the low from Dec 12/13, 2018) which it nearly tested yesterday, whilst resistance is at 122-10 (Apr 5 high) after large moves of late.

- Fedspeak: Bullard (2022 voter) with text + Q&A at 0900ET before Bostic (2024) & Evans (2023) on inclusive employment.

- Bill issuance: US Tsy $35B 4W, $30B 8W bill auctions at 1130ET.

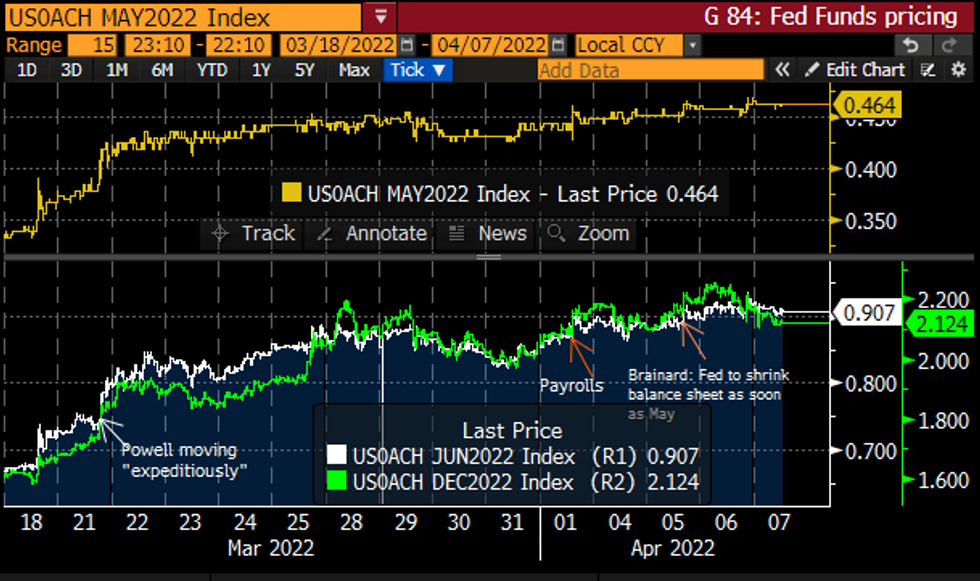

STIR FUTURES: Fed Hike Expectations Fade In 2H22

- Little impact for near-term meetings after the Mar 15-16 minutes said “many” participants noted that “one or more” 50bp hikes would be appropriate at upcoming meetings if inflation pressures remained elevated.

- May still sits at 46bps whilst June only dips slightly, back at the 91bps from before the minutes (60% chance of 100bps, 125bps more likely than 75bps).

- Year-end hike expectations softer overnight, at 212-213bps through the London session having bounced back to 222bps after the minutes. This is back where it was before Brainard indicated on Tue that the Fed may shrink the balance sheet as soon as May.

- Bullard (2022 voter) with text, Q&A at 0900ET -- repeated on Mar 29 that he favors the Fed rate above 3% by year-end. Followed by Bostic (2024) & Evans (2023) at 1400ET.

Stable this morning after moving higher post-FOMC Minutes

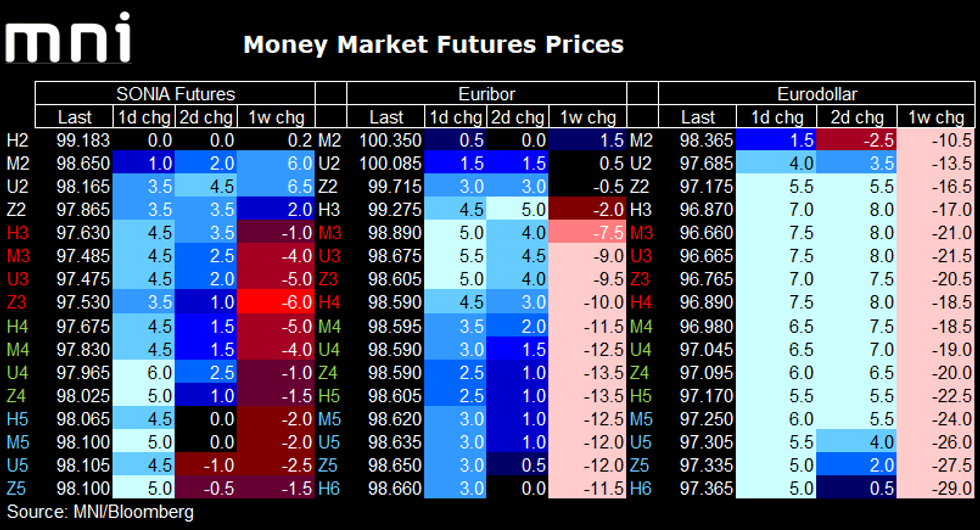

STIR futures have been relatively stable through European trading this morning. The Eurodollar and Euribor strips moved higher in response to yesterday's FOMC Minutes and the SONIA strip moved higher on the open. Despite some moves higher earlier this morning, we are back to levels consistent with the European open.

- Markets continue to price in 46bp for the May Fed meeting with 91bp priced by June and 129bp by July (3 meetings). Year-end pricing is now 212bp, down from a high of 226bp yesterday morning (the cycle high). Eurodollar futures are up to 7.5 ticks higher through the Reds.

- In the UK, markets price 28bp for May, a number that has been very gradually falling since the 35bp priced around 2 weeks ago. 53bp is priced for June with 102bp priced for September (4 meetings) and 136bp by year-end (6 meetings). The latter has been range-bound between 130-145bp for around 3 weeks now. SONIA futures are generally 4.5-5.0 ticks higher from Reds onwards.

- For the ECB, 27bp remains priced for September with 55bp priced for year-end, against this has remained farily stable for around 10 days now. The Euribor strip has seen the biggest moves in Reds (up to 5.0 ticks higher on the day).

EUROPE ISSUANCE UPDATE:

France sells 10/15/50-year OATs:

- E6.433bln 0% May-32 OAT, Avg yield 1.17% (Prev. 0.52%), Bid-to-cover 1.82x (Prev. 1.75x)

- E3.466bln 1.25% May-38 OAT, Avg yield 1.42% (Prev. 0.42%), Bid-to-cover 1.75x (Prev. 2.45x)

- E1.6bln 0.50% May-72 OAT, Avg yield 1.77% (Prev. 1.11%), Bid-to-cover 1.84x (Prev. 1.87x)

- E1.507bln 1.50% Apr-27 Obli, Avg yield 0.965% (Prev. -0.288%), Bid-to-cover 1.70x (Prev. 2.51x)

- E1.205bln 0.80% Jul-29 Obli, Avg yield 1.227% (Prev. 0.664%), Bid-to-cover 1.83x (Prev. 1.34x)

- E2.326bln 0.70% Apr-32 Obli, Avg yield 1.601% (Prev. 1.307%), Bid-to-cover 2.29x (Prev. 1.51x)

- E530mln 0.70% Nov-33 Obli-Ei, Avg yield -0.852% (Prev. -1.036%), Bid-to-cover 1.78x (Prev. 1.75x)

EUROPE OPTION FLOW SUMMARY

Eurozone:

RXM2 155.50/154.50/153.50p fly, bought for 7 in 1.25k

RXK2 159.50/161.50/163.50c fly, bought for 23 in 1k

RXK2 161.00c, bought for 29 in 2k

OEM2 127.5/127ps, bought for 14 in 5k

OEK2 128.25/127.25/126.50p ladder vs 129.75/131.25 cs, bought the ladder for 1 in 6.2k

SX7E 17th June 85/100cs 1x2, sold at 3.45 and 3.40 in 37k

US:

TYK2 120/119ps, bought for 11 in 2k.

FOREX: Greenback Holds Close to Cycle Highs as Fed Minutes Underpin

- The greenback remains solid following Wednesdays' Fed minutes release, which underlined the hawkish bias present among the FOMC. The USD Index touched a fresh cycle high at 99.769 following the release, putting the USD at the best levels since May 2020.

- The hawkish interpretation of the Fed minutes has been based on the Fed's speedy plans for the balance sheet roll-off, with the FOMC weighing a pace of reduction at $95bln per month, while accelerating the tightening cycle at a clip of 50bps at several rate decisions.

- GBP is among the strongest performers in G10 so far, with EUR/GBP extending the recent downtick to touch 0.8314. This narrows the gap with 0.8296, the next key support which marks the mid-March lows. Weakness through here opens 0.8276, the 76.4% retracement of the Mar 7 - 31 rally as well as 0.8203, the Low from March 7 and the current bear trigger.

- GBP, JPY are among the best performers in G10, while AUD, NZD are the weakest so far.

- Focus turns to the weekly US jobless clams release, as well as scheduled speeches from BoE's Pill, Fed's Bullard, Bostic and Evans.

FX OPTIONS: Expiries for Apr07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E1.5bln), $1.0875(E828mln), $1.0900-15(E3.1bln), $1.0920-36(E3.1bln), $1.0965-70(E556mln), $1.1000-10(E2.2bln), $1.1025(E2.0bln), $1.1100-10(E1.1bln)

- GBP/USD: $1.3200-15(Gbp544mln)

- EUR/GBP: Gbp0.8375-90(E519mln)

- EUR/JPY: Y134.50(E677mln), Y136.00(E521mln)

- AUD/USD: $0.7575-85(A$624mln)

- USD/CAD: C$1.2500($635mln), C$1.2535-45($540mln), C$1.2575-90($1.3bln)

Price Signal Summary - Oil Futures Test Support At The 50-Day EMA

- In the equity space, S&P E-Minis traded lower Wednesday. The contract has arrived at its key support area - the 50-day EMA. This average intersects at 4453.65 and marks a key pivot level. A clear break would strengthen a bearish case and allow for a deeper pullback that would open 4425.96 initially, 38.2% retracement of the Feb 24 - Mar 29 rally. Resistance is at 4588.75, the Apr 5 high. EUROSTOXX 50 futures also traded lower Wednesday. Price has moved below the 20- and 50-day EMAs and probed support at 3735.00, the Mar 18 low. The move lower undermines the recent bull theme and highlights a developing bearish threat. An extension lower would open 3626.50, 50.0% of the Ma r 7 - 29 rally. Key short-term resistance has been defined at 3944.00, the Mar 29 high.

- In FX,EURUSD is trading lower. The recent failure at 1.1185, Mar 31 high, and more importantly, the inability to remain above the 50-day EMA highlights a bearish threat. This week’s move lower has reinforced this theme and attention is on 1.0806, the Mar 7 low and a bear trigger. GBPUSD remains vulnerable and the focus is on 1.3000 next, the Mar 15 low and the near-term bear trigger. Key resistance is unchanged at the 50-day EMA - it intersects at 1.3269 today. USDJPY remains above last week’s low of 121.28 (Mar 31) and below its key resistance of 125.09, the Mar 28 trend high. A corrective cycle is still in play despite recent gains. A break of 121.28 would allow for an extension lower and open 120.95, Mar 24 low ahead of 120.00. For bulls, clearance of 125.09 would confirm a resumption of the primary uptrend.

- On the commodity front, Gold remains inside its range. The yellow metal recently found support at $1890.2, on Mar 29, and this level still represents the short-term bear trigger. Initial resistance is at $1966.1, Mar 24 high. In the Oil space, WTI futures traded lower Wednesday, resulting in a breach of the 50-day EMA. The print below the 50-day EMA suggests scope for a continuation lower near-term. The focus is on the next key support at $92.20, Mar 15 low. Initial firm resistance has been defined at $105.59, the Apr 5 high.

- In the FI space, the Bund futures traded lower yesterday. Key near-term resistance is seen at 159.79, the Apr 4 high. The focus is on the bear trigger at 156.05, Mar 29 low where a break would confirm a resumption of the downtrend. Gilts have found resistance this week at 122.35, Monday’s high. The broader trend direction is bearish and the bear trigger is at 119.86, Mar 28 low.

EQUITIES: Asia Closes Lower; Energy Names Lag In Europe

- Asian stocks closed lower: Japan's NIKKEI closed down 461.73 pts or -1.69% at 26888.57 and the TOPIX ended 30.01 pts lower or -1.56% at 1892.9. China's SHANGHAI closed down 46.731 pts or -1.42% at 3236.695 and the HANG SENG ended 271.54 pts lower or -1.23% at 21808.98.

- European futures are mixed, with the German Dax up 66.29 pts or +0.47% at 14207.28, FTSE 100 down 27.3 pts or -0.36% at 7584.37, CAC 40 up 19.07 pts or +0.29% at 6498.83 and Euro Stoxx 50 up 23.02 pts or +0.6% at 3848.57.

- U.S. futures are up slightly, led by tech: Dow Jones mini up 4 pts or +0.01% at 34403, S&P 500 mini up 9 pts or +0.2% at 4484.75, NASDAQ mini up 68.5 pts or +0.47% at 14573.75.

COMMODITIES: WTI Touches 3-Week Low

- WTI Crude up $0.25 or +0.26% at $97.69

- Natural Gas up $0.08 or +1.33% at $6.155

- Gold spot up $1.26 or +0.07% at $1925.42

- Copper down $5.35 or -1.13% at $472.55

- Silver down $0.09 or -0.36% at $24.3348

- Platinum down $7.12 or -0.74% at $951.25

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/04/2022 | 1130/1330 |  | EU | ECB March meet Accts published | |

| 07/04/2022 | 1215/1315 |  | UK | BOE Pill Opening at BOE Sovereign Bond Market Conference | |

| 07/04/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 07/04/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 07/04/2022 | 1300/0900 |  | US | St. Louis Fed's James Bullard | |

| 07/04/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 07/04/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 07/04/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 07/04/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 07/04/2022 | 1800/1400 |  | US | Atlanta Fed's Raphael Bostic, Chicago Fed's Charles Evans | |

| 07/04/2022 | 1900/1500 | * |  | US | Consumer Credit |

| 07/04/2022 | 2005/1605 |  | US | New York Fed's John Williams | |

| 08/04/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 08/04/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 08/04/2022 | 0900/1100 | ** |  | NO | Norway GDP |

| 08/04/2022 | 1115/1315 |  | EU | ECB Panetta at IESE Business School Conference | |

| 08/04/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 08/04/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/04/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.