-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Global Yields Hit Fresh Highs Again

EXECUTIVE SUMMARY:

- MACRON IMPLIED WIN PROBABILITY RISES AFTER 1ST FRENCH ELECTION ROUND

- UK FEB GDP UP, BUT SHORT OF EXPECTATIONS

- IRAN: NUCLEAR DEAL IS IN 'EMERGENCY ROOM', FATE UNCLEAR

- CHINA'S CREDIT GROWTH REBOUNDS AFTER LUNAR NEW YEAR BREAK

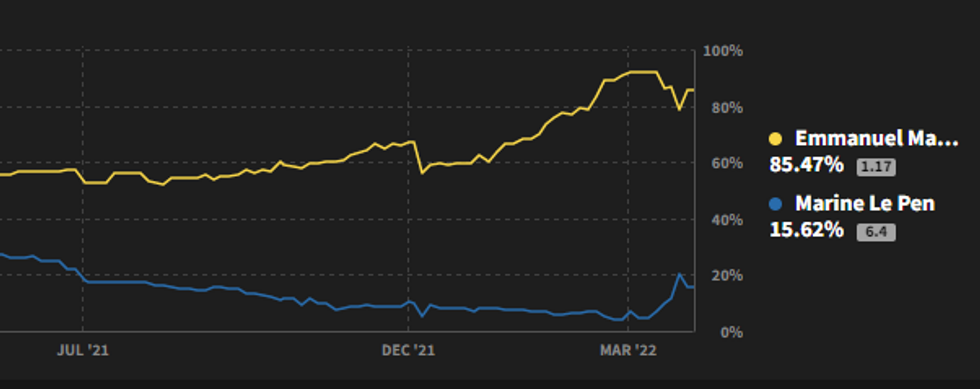

Fig. 1: Implied Probability of Winning French Presidential Election, %

Source: Smarkets

Source: Smarkets

NEWS:

FRANCE POLITICS: The implied probability of incumbent President Emmanuel Macron winning re-election in the 24 April run-off has spiked following his strong performance in the 10 April fist round election. Data from Smarkets shows the implied probability of him remaining in office according to betting markets has risen from 72.5% on 10 April ahead of the release of results to 86.2% at the time of writing. Macron outperformed polls, winning 27.6% of the vote. This compares to the 24.0% he won in the 2017 first round. Right-wing Rassemblement National leader Marine Le Pen came in second with 23.4%, a marginal improvement on her 21.3% secured in the 2017 first round. Le Pen's implied probability of winning has fallen from a peak of 26.3% on 10 April to 14.7% at the time of writing.

FRANCE POLITICS (BBG): Emmanuel Macron would beat far-right National Rally candidate Marine Le Pen 54.5%-45.5% in the French presidential runoff, according to Odoxa poll of voting intentions released Monday for L’Obs newspaper and Mascaret.

IRAN-NUCLEAR DEAL (BBG): Iran said the 2015 nuclear deal is alive but lingering in the “emergency room,” with its fate resting on a decision by the U.S. that could lift sanctions on Tehran’s economy and oil exports. Saeed Khatibzadeh, Iran’s foreign ministry spokesman, told reporters the Islamic Republic had finalized all the details needed to revive the landmark accord with other world powers involved in stalled negotiations in Vienna. But he said the U.S. had yet to take a decision on the latest Iranian proposal for how to resolve the standoff over remaining issues between the two countries, which include a Trump-era terrorism designation for Iran’s Islamic Revolutionary Guard Corps.

CHINA STOCKS (BBG): Chinese authorities were seeking to put a floor under the nation’s slumping stock market by limiting share sales by some mutual funds, people familiar with the matter said. The market regulator gave window guidance to some big mutual fund houses, telling them to refrain from selling A-shares on a net basis on Monday, according to the people who asked not to be identified discussing private information. The verbal request, which has been a regular operation to prevent panic selling, was valid for the day, said the people.

EU-UKRAINE (BBG): The European Union’s top diplomat is urging member states to quickly provide Kyiv with the weapons it has asked for, as Ukraine braces for Russia to step up its campaign in the country’s east, according to people familiar with weekend discussions.Josep Borrell told EU diplomats a decision is needed in days and not weeks, and the bloc must do whatever it takes to help Ukraine, the people said.

BOJ: Eight out of the nine regions in Japan lowered their economic assessments from three months ago, hit by Covid-19 and supply-side restrictions, although many said there are signs of a pick up, the Bank of Japan's quarterly regional economic report said on Monday. The regional report will likely prompt the BOJ board to assess its economic outlook at the April 27-28 meeting.

RBNZ (MNI): A former Reserve Bank of New Zealand official has urged the central bank to hike interest rates by 50 basis points at its meeting this week, saying that inflation is at a "tipping point" and strong action is needed. For full article contact sales@marketnews.com

TWITTER/EQUITIES (BBG): Twitter shares slide 8% in premarket trading, on course for a fourth straight session of declines, after Elon Musk decided not to join the social media firm’s board.

DATA:

MNI: UK FEB GDP +0.1% M/M, +1% 3MM, +8.8% 3M Y/Y

MNI: UK FEB SERVICES INDEX +0.2% M/M, +0.8% 3MM

MNI: UK FEB TRADE BALANCE GBP -9.26BN

MNI: UK FEB IND PROD -0.6% M/M, +1.6% Y/Y

MNI BRIEF: UK Feb GDP Up, But Short of Expectations

UK economic growth slowed to a crawl in February, rising by just 0.1% after a 0.8% increase in January, the Office for National Statistics said Monday. That’s well below the expected 0.3% forecast, but falls in line with the outcome suggested by MNI’s preview published last week. That leaves output 1.1% above pre-pandemic levels.

The manufacturing sector declined by 0.4%, dampened by a 5.4% plunge in transport equipment. Auto companies reported increased difficulties in sourcing components, according to an ONS official. Manufacturing shaved 0.04 percentage points from total GDP growth and remains 0.7% below pre-pandemic levels.

The services sector did all the heavy lifting in February, rising by 0.2% to contribute 0.13 percentage points to growth. Tourism, accommodation and travel agents accounted for much of the strength, said an official. Construction declined by 0.1%, but remains above pre-pandemic levels.

MNI BRIEF: UK Feb Trade Gap Narrows

The UK trade deficit narrowed to GBP9.261 billion in February from GBP12.838 billion in January, however the decline was distorted by an operational change in the measurement of exports to the European Union.

EU exports rose by 25.4% in February, but that follows a 22.0% decline in January, the month that the reporting change took place. Compared to December of 2021, exports to the EU rose by 0.3%. That took the EU trade gap down to GBP8.456 billion from GBP12.259 billion in January, but up from GBP 4.855 billion in December.

The non-EU trade gap, which was unaffected by the change, expanded to GBP12.138 billion from GBP11.639 billion in January. The total trade gap in goods declined to GBP20.594 billion from GBP23.898 billion. Excluding non-monetary gold, the total trade gap narrowed to GBP18.325 billion from GBP21.422 billion in January.

CHINA DATA: Aggregate Financing Surges By 4.65tr CNY in March

- *CHINA MARCH AGGREGATE FINANCING 4,650.0B YUAN; EST. 3,550.0B

- *CHINA MARCH NEW YUAN LOANS 3,130.0B YUAN; EST. 2,750.0B

- *CHINA MARCH M2 MONEY SUPPLY RISES 9.7% Y/Y; EST. 9.2% (BBG)

FIXED INCOME: French election drives bond yields to new cycle highs

- EGBs are the drivers for core fixed income markets this morning with the implied probability of a Macron victory in the French elections increasing as first round results showed he did better than expected (albeit still looking like a fairly close race with Le Pen not out of the running yet). Nevertheless this has been enough to see further cycle highs in yields across most maturities on the German, UST and gilt curves.

- UK activity data this morning did little to move the docket, with the focus instead on French polls. There is little on the calendar for the rest of today other than Fed speakers, with focus instead on US inflation tomorrow and the ECB on Thursday.

- TY1 futures are down -0-8+ today at 119-27+ with 10y UST yields up 4.1bp at 2.746% and 2y yields up 5.1bp at 2.567%.

- Bund futures are down -1.01 today at 155.56 with 10y Bund yields up 7.1bp at 0.775% and Schatz yields up 5.9bp at 0.105%.

- Gilt futures are down -0.67 today at 119.25 with 10y yields up 7.3bp at 1.821% and 2y yields up 7.2bp at 1.542%.

FOREX: Higher Yields lead the Dollar

- The Yen has been under considerable pressure across the Board as Yields continue to rise.

- USDJPY spiked through the 125.09 level, and above the resistance at 125.28 High Aug 12 2015, after US 10yr hits highest level since January 2019, above 2.75%.USDJPY printed a 125.44 high at the time of typing.

- Despite the rally in USDJPY, the EUR is the best performer today against the YEN, up 1.09%.

- Next immediate resistance comes at 136.84 High Mar 31.

- And a clear break above the latter opens to the March 2022 high at 137.53.

- The Dollar has pared some of the early gains, with the EUR now up 0.28% against the Greenback.

- The SEK, GBP and CHF are back to flat versus the Dollar, while in the green with JPY, NOK, AUD, NZD and the CAD.

- Looking ahead, there are no tier 1 data left for the session.

- Speakers include, Fed Bostic, Bowman, Waller and Evans.

- But attention turns to UK and US inflation data, as well as the ECB this week.

- Also some expected hikes from the RNBZ and BoC.

EQUITIES: Tech Leads Early Losses

- Asian equities closed lower, with China underperforming: Japan's NIKKEI closed down 164.28 pts or -0.61% at 26821.52 and the TOPIX ended 7.15 pts lower or -0.38% at 1889.64. China's SHANGHAI closed down 84.724 pts or -2.61% at 3167.126 and the HANG SENG ended 663.71 pts lower or -3.03% at 21208.3.

- European equities are mostly lower, with the German Dax down 93.04 pts or -0.65% at 14188.67, FTSE 100 down 33.31 pts or -0.43% at 7635.93, CAC 40 up 17.02 pts or +0.26% at 6548.53 and Euro Stoxx 50 down 14.31 pts or -0.37% at 3843.17.

- U.S. futures are a little lower, with the Dow Jones mini down 92 pts or -0.27% at 34521, S&P 500 mini down 24.5 pts or -0.55% at 4459, NASDAQ mini down 139 pts or -0.97% at 14188.

COMMODITIES: Oil Sharply Lower On Renewed Demand Concers

- WTI Crude down $2.45 or -2.49% at $95.96

- Natural Gas up $0.05 or +0.76% at $6.323

- Gold spot up $9.44 or +0.48% at $1957.71

- Copper down $1.8 or -0.38% at $470.35

- Silver up $0.19 or +0.76% at $24.982

- Platinum up $17.47 or +1.78% at $997.78

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/04/2022 | 1330/0930 |  | US | Atlanta Fed's Raphael Bostic | |

| 11/04/2022 | 1330/0930 |  | US | Fed Governors Michelle Bowman and Christopher Waller | |

| 11/04/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 11/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 11/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/04/2022 | 1600/1200 |  | US | New York Fed's John Williams | |

| 11/04/2022 | 1640/1240 |  | US | Chicago Fed's Charles Evans | |

| 11/04/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 12/04/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 12/04/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 12/04/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 12/04/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 12/04/2022 | 0645/0845 | * |  | FR | Current Account |

| 12/04/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 12/04/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 12/04/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 12/04/2022 | 1230/0830 | *** |  | US | CPI |

| 12/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/04/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 12/04/2022 | 1610/1210 |  | US | Fed Governor Lael Brainard | |

| 12/04/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 12/04/2022 | 1700/1300 |  | US | Philadelphia Fed's Patrick Harker | |

| 12/04/2022 | 1800/1400 | ** |  | US | Treasury Budget |

| 12/04/2022 | 2245/1845 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.