-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Yen Hits 20-Year Low v USD As Global Yields Rise

EXECUTIVE SUMMARY:

- JAPAN FINANCE MINISTER SAYS SUDDEN FX MOVES PROBLEMATIC: KYODO

- IEA CUTS OIL DEMAND FORECAST AS CHINA REIMPOSES LOCKDOWNS

- UK MARCH CPI TOPS EXPECTATIONS

- PBOC SEEN TARGETING LOAN DEMAND AS COVID, WAR, SAP GROWTH (MNI)

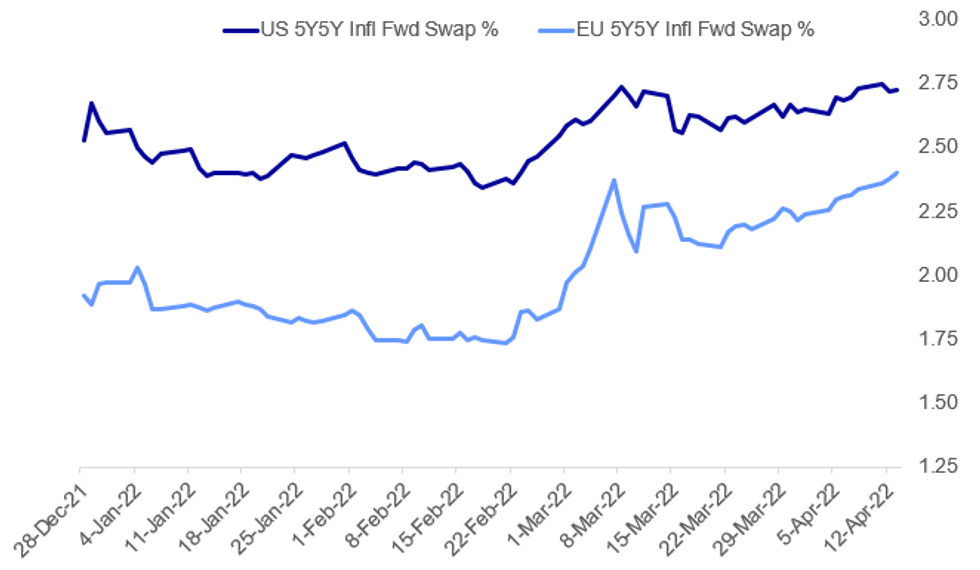

Fig. 1: Eurozone Inflation Expectations Catching Up To US

Source: BBG, MNI

Source: BBG, MNI

NEWS:

JAPAN / YEN (BBG/KYODO): Japanese Finance Minister Shunichi Suzuki says sudden moves in foreign exchange rates are “very problematic,” Kyodo reports, after the yen plummeted to a 20-year low against the dollar on Wed. Tells reporters in Tokyo the government will watch the situation “with great care”.

IEA / OIL (BBG): The International Energy Agency cut its forecast for global oil demand this year after China reimposed lockdowns to contain the spread of a resurgent coronavirus. With the weaker demand outlook and the massive release of emergency oil reserves by IEA members, the agency now sees global markets in balance for much of the year. Crude prices have already lost most of their gains since Russia’s attack on Ukraine, to trade near $100 a barrel in New York on Wednesday.

CHINA / PBOC (MNI): The most serious Covid outbreak since 2020 and soaring materials prices in the wake of the war in Ukraine are making it increasingly difficult for China to reach its 2022 growth target, leaving the People's Bank of China looking for ways to channel cheap money into the economy at a time when credit demand is weak, policy advisors and economists told MNI.

ECB PREVIEW (MNI - SEE WEBSITE FOR FULL PREVIEW): While consensus expects no material change in policy at the April ECB meeting, we believe that it is a close call and that markets should be prepared for a hawkish surprise. Inflation has accelerated rapidly since the last meeting and waiting until September or later before starting to unwind negative rates feels like an exceptionally long time given the magnitude of recent inflation surprises and upside risks to energy prices.

BANK OF KOREA PREVIEW (MNI - SEE WEBSITE FOR FULL PREVIEW): The sell-side is split when it comes to the prospect of action from the BoK at its April meeting, with those that are calling for a 25bp rate hike nowhere near certain that such a move will come to fruition (11/21 in the BBG survey look for a hike). We are also non-committal, with no meaningful bias in either direction. BoK Senior Deputy Governor Lee has noted that this meeting will be “tricky,” pointing squarely at the combination of higher inflationary risks and downward pressure on economic growth.

FRANCE POLITICS: Latest polling from Ifop-Fiducial shows no change from yesterday's numbers, with President Emmanuel Macron with 52.5% support to right-wing Rassemblement National leader Marine Le Pen's 47.5%.

JAPAN (BBG): Bank of Japan Governor Haruhiko Kuroda says that consumer prices are likely to clearly rise for the time being, led by a sharp increase in energy and rising raw materials costs that will be reflected in food prices. Cost-push inflation stemming from the rise in import costs is a negative factor that will drag on the economy, Kuroda says in speech in Tokyo Wednesday.

GERMANY (BBG): Economic institutes advising Germany’s government pared their outlook for Europe’s biggest economy and warned that a full halt in Russian natural gas imports would result in a “sharp recession.” Growth this year will slow to 2.7% before rebounding to 3.1% in 2023, the five think tanks said Wednesday in a joint forecast. The numbers compare with previous projections for expansion of 4.8% and 1.9%. Inflation will average 6.1% in 2022 -- the most in 40 years.

DATA:

MNI: UK MAR CPI +1.1% M/M, +7% Y/Y

MNI BRIEF: UK March CPI Tops Expectations as Petrol Costs Bite

UK inflation surged to an annual rate of 7.0% last month, the highest since March 1992, the Office for National Statistics said Wednesday, exceeding the 6.7% forecast by City analysts. That tops the 6.2% pace recorded in January and now sits far in excess of the Bank of England's 2% target.

Surging fuel costs accounted for 0.25 percentage points of the change in CPI, but seven of the other major sub categories also exerted upward pressure, with no significant downward influences. Excluding food and energy, core CPI rose to 5.7% in March from 5.2% a month earlier, well above expectations of a 5.3% rise.

That’s the fastest pace since the series began in January of 1997, although core inflation hit higher levels in 1992, according to a reconstructed series. RPI rose by an annual 9.0%, the fastest pace since January 1991.

MNI: SPAIN FINAL HICP MAR +3.9% M/M , +9.8% Y/Y; FEB 7.6% Y/Y

FOREX: USD/JPY Cracks to New High Despite Verbal Intervention

- NZD is the poorest performing currency in G10, falling against all others (including the JPY) after the RBNZ policy decision overnight. While the bank hiked rates by 50bps against a consensus expectation of a 25bps rise, the decision was perceived as dovish as the bank opted to bring forward the beginning of the tightening cycle, but critically stop short of raising market expectations of a higher terminal rate. The bank's minutes noted that members increased the OCR by more "now, rather than later". NZD weakness followed, putting AUD/NZD at the best levels since mid-2020.

- JPY is another underperformer, tipping USD/JPY to new cycle highs and the best levels seen since 2002. The rate cleared the highs seen earlier in the week, touching 126.32 in the process. The move coincided with a speech from BoJ's Kuroda, who doubled down on the BoJ's intent to "persistently" pursue easing. Markets volatility prompted a number of comments from government ministers - most notably economy minister Yamagiwa, who noted that FX stability is "important", adding that sharp FX moves are "undesirable". The comments had little impact on the pair.

- Focus turns to US PPI data due following the CPI release yesterday, as well as the Bank of Canada rate decision. The Bank are seen raising rates by 50bps to 1.00%. Earnings season unofficially kicks off, with BlackRock and JPMorgan due today.

FIXED INCOME: Futures Weaken With Bear Steepening In US And UK

Latest levels:

- Jun US 10-Yr futures (TY) down 10/32 at 120-06 (L: 119-31 / H: 120-17)

- Jun Bund futures (RX) down 43 ticks at 154.93 (L: 154.51 / H: 155.13)

- Jun Gilt futures (G) down 70 ticks at 118.79 (L: 118.54 / H: 119.01)

- Jun BTP futures (IK) down 23 ticks at 133.86 (L: 133.22 / H: 134.06)

- Jun OAT futures (OA) down 33 ticks at 147.19 (L: 146.7 / H: 147.27)

- Italy / German 10-Yr spread 0.5bps tighter at 161.4bps

EQUITIES: Japanese Stocks Close Higher As Yen Weakness Persists

- Asian markets closed mostly higher: Japan's NIKKEI closed up 508.51 pts or +1.93% at 26843.49 and the TOPIX ended 26.43 pts higher or +1.42% at 1890.06. China's SHANGHAI closed down 26.506 pts or -0.82% at 3186.824 and the HANG SENG ended 55.24 pts higher or +0.26% at 21374.37

- European stocks are mixed, with the German Dax down 37.39 pts or -0.26% at 14084.46, FTSE 100 up 10.41 pts or +0.14% at 7584.8, CAC 40 up 16.25 pts or +0.25% at 6548.85 and Euro Stoxx 50 down 1.95 pts or -0.05% at 3827.87.

- U.S. futures are gaining, with the Dow Jones mini up 194 pts or +0.57% at 34334, S&P 500 mini up 29.75 pts or +0.68% at 4422.75, NASDAQ mini up 122 pts or +0.87% at 14067.

COMMODITIES: Metals Lead Early Gains

- WTI Crude up $0.13 or +0.13% at $100.66

- Natural Gas up $0.01 or +0.15% at $6.687

- Gold spot up $7.51 or +0.38% at $1973.89

- Copper up $0.3 or +0.06% at $471.4

- Silver up $0.27 or +1.07% at $25.6305

- Platinum up $16.15 or +1.67% at $985.66

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/04/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 13/04/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 13/04/2022 | 1400/1000 |  | CA | BOC Monetary Policy Report | |

| 13/04/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 13/04/2022 | 1500/1100 |  | CA | BOC Governor Press Conference | |

| 13/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 13/04/2022 | 1630/1230 |  | US | Richmond Fed's Thomas Barkin | |

| 13/04/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 14/04/2022 | 2301/0001 | * |  | UK | RICS House Prices |

| 14/04/2022 | 0130/1130 | *** |  | AU | Labor force survey |

| 14/04/2022 | 0600/0800 | *** |  | SE | Inflation report |

| 14/04/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 14/04/2022 | 1145/1345 | *** |  | EU | ECB Deposit Rate |

| 14/04/2022 | 1145/1345 | *** |  | EU | ECB Main Refi Rate |

| 14/04/2022 | 1145/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 14/04/2022 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 14/04/2022 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 14/04/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 14/04/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 14/04/2022 | 1230/0830 | *** |  | US | PPI |

| 14/04/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 14/04/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 14/04/2022 | 1230/1430 |  | EU | ECB President Lagarde Post-meet presser | |

| 14/04/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 14/04/2022 | 1400/1000 | * |  | US | Business Inventories |

| 14/04/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 14/04/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 14/04/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 14/04/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 14/04/2022 | 1920/1520 |  | US | Cleveland Fed's Loretta Mester | |

| 14/04/2022 | 2200/1800 |  | US | Philadelphia Fed's Patrick Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.