-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Further Support For A July ECB Hike

EXECUTIVE SUMMARY:

- UK APRIL INFLATION HITS 9% AS ENERGY COSTS SOAR

- ECB’S REHN: NECESSARY TO MOVE QUICKLY FROM NEGATIVE RATES

- TRUMP ALLY CAWTHORN LOSES N.C. GOP PRIMARY, PA SEN RACE TOO CLOSE TO CALL

- FINLAND AND SWEDEN SUBMIT OFFICIAL NATO APPLICATIONS, TURKEY STILL STANDS IN WAY

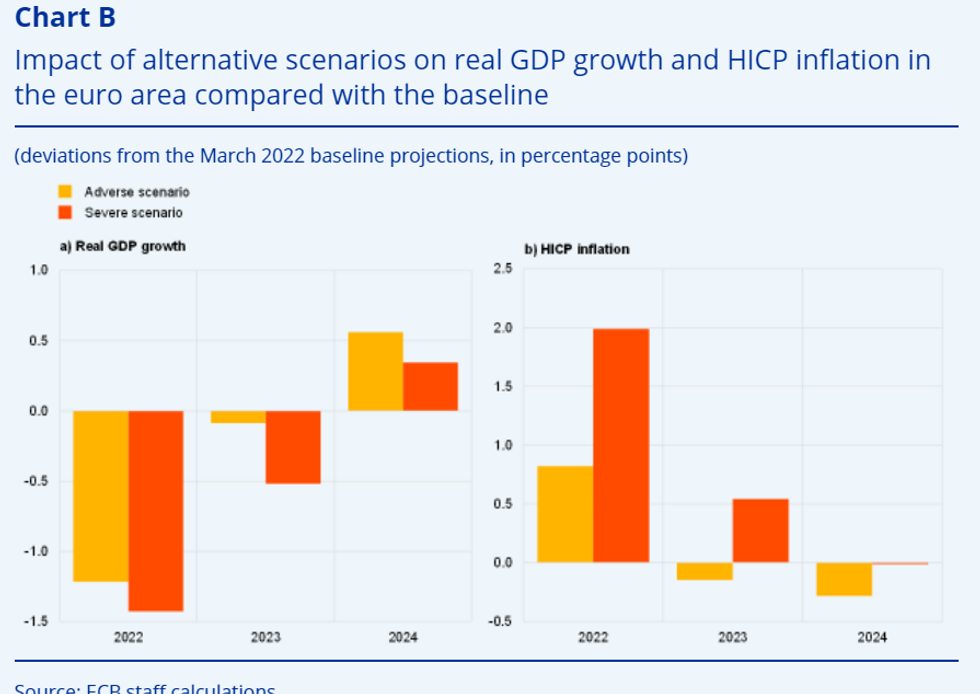

Fig. 1: ECB's Rehn Eyes The Downside Scenarios

Source: ECB March 2022 Projections

Source: ECB March 2022 Projections

NEWS:

ECB (BBG): There’s broad agreement among members of the European Central Bank Governing Council that policy rates should exit sub-zero terrain “relatively quickly,” according to Bank of Finland Governor Olli Rehn.That’s to prevent inflation expectations from becoming de-anchored, Rehn said in a speech in Helsinki on Wednesday. “It is my view that it seems necessary that in our policy rates we move relatively quickly out of negative territory and continue our gradual process of monetary policy normalization,” he said. “I am not alone, as this is also the indication given by many of my colleagues in the ECB Board and Governing Council.”

ECB: ECB's Olli Rehn commenting this morning that the first rate hike is likely to take place this summer (no surprise), but also providing his view that the ECB's June macroeconomic projections will be “closer to the adverse and severe scenarios than the [March 2022 projections] baseline, especially due to continuously high energy prices and the prolonged supply chain bottlenecks”. In short, that means weaker growth and higher inflation in 2022 than had been previously expected.

BOJ (MNI INSIGHT): Lingering supply-chain disruptions and dour consumer spending as energy and food costs bite amid weak wages will keep Bank of Japan officials focused on easy policy as an expected second quarter rebound could be tepid, MNI understands. For full article contact sales@marketnews.com

US (MNI POLITICAL RISK): Representative Madison Cawthorn (R-NC), a vocal supporter of former President Donald Trump and one of the most hard-line 2020 election deniers in the Republican party has lost his party's primary to moderate candidate Chuck Edwards. The result will come as a blow to the Trump wing of the party, which had vociferously backed the 26-year old freshman representative over challenger, State Senator Chuck Edwards, who had the backing of many state-level Republicans including sitting US Senator Thom Tillis (R-NC). The other major GOP race of the evening, for Pennsylvania's GOP US Senate nomination, remains too close to call. Trump-backed Mehmet 'Doc' Oz leads hedge fund CEO Dave McCormick by just over 2,500 votes with 6% left to call according to the NYT. Should Oz be unable to hold the lead, it would mark a mixed night for Trump backed candidates. The bright spot for the Trump campaign was the win for 2020 election denier Doug Mastriano in the GOP Pennsylvania gubernatorial primary.

NATO (MNI POLITICAL RISK): Earlier this morning Sweden and Finland's ambassadors to NATO officially submitted their respetive nations' applications to join the alliance to Secretary-General Jens Stoltenberg. However, there remains a sizeable obstacle in both Sweden and Finland's path to NATO accession in the form of Turkey. Turkish President Recep Tayyip Erdogan has stated that both Nordic states 'should not bother' seeking to join the alliance, due to their alleged role as 'incubators' for terrorist groups (referring primarily to the Kurdistan Workers' Party (PKK)).

DATA:

MNI BRIEF: UK April Inflation Hits 9% As Energy Costs Soar

UK inflation hit an annual rate of 9.0% in April, jumping two full percentage points from the 7.0% pace recorded in March, according to data released by the Office for National Statistics on Wednesday. Electricity and gas prices provided the biggest upward contribution to CPI, after the rise in the energy price cap took effect in April. Electricity prices added 0.67 percentage points to the change in CPI, while gas prices added 0.86 percentage points.

The surge in prices takes UK inflation above the prevailing measure in other developed countries. Eurozone inflation hit an annual rate of 7.5% last month, while U.S. inflation rose to 8.3%. It leaves CPI well above the Bank of England's 2% price target, although it comes in largely in line with their recent April forecast.

RPI surged to 11.1% last month, from 9.0% in March, the highest since January 1982. RPIX jumped to an annual rate of 11.2% from 9.1% the previous month.

MNI BRIEF: UK April PPI Hits Record High

UK factory gate prices surged by a record margin in April, suggesting even further rises to consumer inflation are likely in the months to come. Output PPI rose by 2.3% between March and April, the biggest rise on record, taking the annual rate to 14.0% from 11.9% in March. That’s the highest year-on-year rate since 2005.

Input prices jumped by 18.6, matching the downwardly-revised pace recorded in March (originally reported as +19.4%), the highest rate since records began in 1985. However, the input PPI rose by 1.1% between March and April, down from a 4.6% gain in March, the first monthly slowdown since December.

EUROZONE: Inflation Steady at 7.4% in April

EUROZONE APRIL FINAL CPI +0.6% M/M; +7.4%r Y/Y (MAR 7.4%)

APRIL Y/Y CPI REVISED DOWN 0.1PP

EUROZONE APRIL FINAL CORE CPI +3.5% Y/Y; +1.0%r M/M

- The April inflation print for the Euro area saw a 0.1pp downwards revision to 7.4% y/y, leaving it unchanged from the euro-high March rate.

- Core inflation rose by 3.5% y/y in April, a 0.5pp uptick on March. The monthly rate alone saw 1.0% acceleration.

- The highest rates of inflation were seen in Estonia (19.1% y/y), Lithuania (16.6% y/y) and Czechia (13.2% y/y).

- Energy continued to be the key upside driver of prices, contributing 3.70pp to the annualised rate, followed by services (+1.38pp), food etc (+1.35pp) and industrial goods (+1.02pp).

- This follows the European Commission’s Spring forecasts yesterday which pointed to inflation averaging 6.1% for 2022.

- This confirmation underlines the shift in ECB rhetoric seen over the past month, with markets now pricing a 25bp hike in July.

FIXED INCOME: Divergence between UK and Germany

There has been some divergence in core fixed income markets this morning.

- Gilts are the outperformers following a one tenth miss to CPI. This followed six consecutive prints of above-consensus inflation. Gilts have been retracing some of the sharp selloff they saw yesterday following the stronger than expected labour market print. The SONIA strip is also up by around 6 ticks with a steepening in the Whites.

- The German curve has underperformed as ECB's Rehn said that recent economic data releases have been "near" the "adverse" scenario in the ECB's March staff projections. Euribor Whites are down up to 5.5 ticks on the day with 10-year Bunds unch but Schatz yields up 4.3bp.

- Treasuries are a little higher on the day, splitting the difference between gilts and Bunds.

- US housing data and Canadian CPI are the highlights on the calendar with Fed's Harker also due to speak.

FOREX: Most of the action has been in the Pound this morning

- Mostly a steady start for FX, with the USD in the green across G10s, besides versus the Yen, down a small 0.13%.

- Crosses trades well with past ranges, but the notable move so far today, has been in the Pound, following the small CPI miss, by 1 tenth for the MoM and YoY reading.

- The British Pound collapsed and Cable trades in a 129 pips range, but 10 pips off the low at the time of typing.

- EURGBP broke through initial 0.8475 resistance, but failed to break above 0.8500, printed 0.84943 high.

- The EUR also got a small boost after ECB Rehn (leaning Dove): "First rate hike likely to be in the Summer, necessary to move quickly from negative rates".

- But the moves are still limited, given the underpinned USD.

- Looking ahead, nothing in terms of market moving data for the afternoon.

- Fed Harker is the only speaker scheduled for the session.

EQUITIES: Energy Stocks Push Higher

- Asian markets closed mixed: Japan's NIKKEI closed up 251.45 pts or +0.94% at 26911.2 and the TOPIX ended 17.98 pts higher or +0.96% at 1884.69. China's SHANGHAI closed down 7.72 pts or -0.25% at 3085.977 and the HANG SENG ended 41.76 pts higher or +0.2% at 20644.28.

- European stocks are slightly lower (though European energy indices are hitting multi-year highs), with the German Dax down 2.37 pts or -0.02% at 14172.12, FTSE 100 down 4.38 pts or -0.06% at 7511.49, CAC 40 down 15.05 pts or -0.23% at 6410.31 and Euro Stoxx 50 down 6.31 pts or -0.17% at 3732.4.

- U.S. futures are retracing, with the Dow Jones mini down 66 pts or -0.2% at 32516, S&P 500 mini down 13.25 pts or -0.32% at 4071.5, NASDAQ mini down 73.5 pts or -0.59% at 12486.25.

COMMODITIES: Crude Edges Higher, Precious Metals Flat

- WTI Crude up $1.88 or +1.67% at $114.27

- Natural Gas down $0.06 or -0.66% at $8.257

- Gold spot up $0.88 or +0.05% at $1815.59

- Copper down $3 or -0.71% at $420.2

- Silver up $0 or +0.01% at $21.6269

- Platinum up $6.81 or +0.71% at $962.05

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 18/05/2022 | - |  | EU | ECB Lagarde & Panetta in G7 Meeting | |

| 18/05/2022 | 1230/0830 | *** |  | CA | CPI |

| 18/05/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 18/05/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 18/05/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 18/05/2022 | 2000/1600 |  | US | Philadelphia Fed's Patrick Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.