-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

MNI US OPEN: Tech Stock Rout Continues

EXECUTIVE SUMMARY:

- ERDOGAN SAYS TURKEY WILL SAY NO TO SWEDEN, FINLAND NATO ENTRY

- GERMANY'S SCHOLZ: TALKING ABOUT EU TREATY CHANGE NOT TABOO FOR US

- CHINA WARNS US OF "DANGEROUS SITUATION" OVER TAIWAN

- ECB TO PUBLISH APRIL MEETING ACCOUNTS

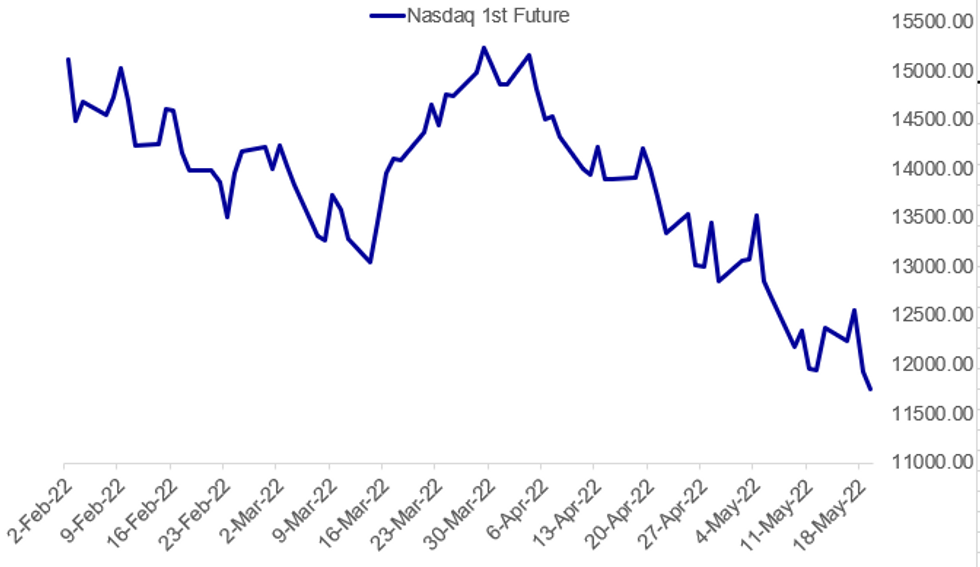

Fig. 1: Tech Stock Rout Continues

Source: BBG, MNI

Source: BBG, MNI

NEWS:

TURKEY / NATO (BBG): Turkey will say no to Sweden and Finland’s entry into NATO, President Recep Tayyip Erdogan says in a video published on Twitter. “We will say no to Sweden and Finland’s entry to NATO and we have communicated our decision to relevant friends and we will continue our way as such.”

ECB: The Accounts of the April ECB meeting will be released at 12:30BST /13:30CET. Although a little dated now, these will be closely watched in light of recent comments from policymakers. Notably the Netherlands' Knot left the door open to a 50bp hike while Finland's Rehn said yesterday that it was important to "relatively quickly" move away from negative rates and suggested that the first hike could occur in the summer. Note that the an MNI sources piece yesterday played down the likelihood of any 50bp hike and stated that a majority of ECB policymakers back at least two 25bp hikes this year with some leaving the door open to three.

GERMANY / EU: Chancellor Olaf Scholz delivering a statement to the Bundestag regarding the upcoming 30/31 May extraordinary European Council leaders' summit and the EU's actions regarding the war in Ukraine. Scholz: "If necessary, we can talk about changing the EU Treaty. It's not a taboo for us. But that requires consensus. Because if there's anything we don't need, it's a long navel-gazing debate about the EU institutions." Last week French President Emmanuel Macron announced his support for backing EU treaty change recommended by the Conference on the Future of Europe.

US - CHINA (BBG): China’s top diplomat again warned the US over its increased support for Taiwan, showing the island democracy remains a major sticking point between the world’s biggest economies as Beijing sent more military aircraft toward the island. “If the US side insists on playing the Taiwan card and goes further and further down the wrong road, it will certainly lead to a dangerous situation,” Yang Jiechi, Beijing’s top diplomat, said in a phone call with National Security Advisor Jake Sullivan.

SRI LANKA / EM DEBT (BBG): Sri Lanka fell into default for the first time in its history as the government struggles to halt an economic meltdown that prompted mass protests and a political crisis. Policy makers had flagged to creditors that the nation wouldn’t be able to make payments until the debt is restructured, and is therefore in pre-emptive default, central bank Governor Nandalal Weerasinghe said at a briefing Thursday. The coupon payments, originally due April 18, were worth $78 million combined on notes maturing 2023 and 2028, with a 30-day grace period that expired on Wednesday.

UK/RUSSIA (RTRS): Britain said on Thursday it was introducing new sanctions against the Russian airline sector to prevent state-owned Aeroflot, Ural Airlines and Rossiya Airlines from selling their unused landing slots at British airports. "We’ve already closed our airspace to Russian airlines. Today we’re making sure they can’t cash in their lucrative landing slots at our airports," British Foreign Secretary Liz Truss said in a statement. The British government said it estimated the landing slots were worth 50 million pounds ($61.9 million).

DATA:

MNI: EUROZONE MAR CONSTRUCTION 0.0% M/M; +3.3% Y/Y

* FEB +1.1%r M/M (REV DOWN 0.8PP); FEB +8.9%r Y/Y (REV DN 0.5PP)

FIXED INCOME: Off the highs a little but still up on the day

- The risk-off move first triggered by Target's earnings miss yesterday which triggered concerns about stagflation in the US (and more globally) continued through the overnight session to a lesser extent, but the pace of the move has picked up in the European morning session.

- As well as the moves seen in futures, we have seen some divergences in curve moves today.

- With concerns largely being centered around the US, the US curve has seen a largely parallel move with 2s10s just 0.1bp flatter than yesterday's close.

- However, across the pond, moves have been larger in 10-years but smaller at the 2-year point relative to USTs.

- So we have seen decent flattening across German / UK 2s10s.

- Looking ahead, the ECB Accounts at 12:30BST / 7:30ET are the highlight of the day. A little dated, but still worth watching given yesterday's MNI sources story and recent comments from Knot and Rehn.

- We will hear from ECB's de Guindos, de Cos, Verstager and Holzmann later inthe session.

- In terms of US events, the calendar is relatively light with the Philly Fed, jobless claims and existing home sales the highlights. Fed's Kashkari is due to speak on inflation, but after the European session.

- TY1 futures are up 0-10 today at 119-24 with 10y UST yields down -5.4bp at 2.833% and 2y yields down -5.2bp at 2.619%.

- Bund futures are up 0.69 today at 153.63 with 10y Bund yields down -6.6bp at 0.961% and Schatz yields down -1.3bp at 0.361%.

- Gilt futures are up 0.41 today at 119.57 with 10y yields down -5.2bp at 1.811% and 2y yields down -2.8bp at 1.419%.

FOREX: Risk Off leads cross Assets

- All the action has been in the Swissy this morning in FX, with the currency extending gains across the board this morning, a continuation from yesterday, after SNB Jordan noted that the SNB is ready to act if inflation pressures continue.

- Risk off tone this morning has also provided further strength for the CHF.

- The currency lead against the USD up 1.12%%, with next support now seen towards 0.9785.

- Below the latter, opens to 0.9733, the 38.2% retrace of the March/May rally.

- The USD trades in the red today, taking its cue from the lower yield, as investors move into safer Haven, on the back of the risk off tone.

- US Retailers warned of rising cost pressures yesterday, and Global inflation concerns have put pressure in Equities.

- Looking ahead, there's no market moving data of note.

- Focus turns to the ECB Accounts (minutes).

- Speakers include, ECB Guindos, de Cos, Holzmann, Riksbank Floden, and Fed Kahskari

EQUITIES: Tech Stock Rout Continues

- Asian markets closed mostly weaker: Japan's NIKKEI closed down 508.36 pts or -1.89% at 26402.84 and the TOPIX ended 24.61 pts lower or -1.31% at 1860.08. China's SHANGHAI closed up 10.988 pts or +0.36% at 3096.965 and the HANG SENG ended 523.6 pts lower or -2.54% at 20120.68.

- European futures are sharply lower, with the German Dax down 262.62 pts or -1.87% at 13739.05, FTSE 100 down 147.7 pts or -1.99% at 7285.89, CAC 40 down 105.07 pts or -1.65% at 6253.5 and Euro Stoxx 50 down 77.15 pts or -2.09% at 3614.58.

- U.S. futures are down, with tech names leading lower: Dow Jones mini down 386 pts or -1.23% at 31054, S&P 500 mini down 53.5 pts or -1.36% at 3869.25, NASDAQ mini down 185.75 pts or -1.56% at 11749.75.

COMMODITIES: Energy Prices Slip, Precious Metals Gain On Weaker USD

- WTI Crude down $1.17 or -1.07% at $109.21

- Natural Gas down $0.34 or -4.02% at $8.085

- Gold spot up $9.74 or +0.54% at $1815.28

- Copper up $1.9 or +0.45% at $421.3

- Silver up $0.08 or +0.39% at $21.3715

- Platinum down $4.8 or -0.51% at $928.91

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/05/2022 | 1130/1330 |  | EU | ECB April meeting Accounts | |

| 19/05/2022 | - |  | EU | ECB Lagarde & Panetta in G7 Meeting | |

| 19/05/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/05/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 19/05/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 19/05/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 19/05/2022 | 1230/1430 |  | EU | ECB de Guindos Keynote Address at Harvard | |

| 19/05/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 19/05/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 19/05/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 19/05/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 19/05/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 19/05/2022 | 2000/1600 |  | US | Minneapolis Fed's Neel Kashkari | |

| 20/05/2022 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 20/05/2022 | 0600/0800 | ** |  | DE | PPI |

| 20/05/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 20/05/2022 | 0730/0830 |  | UK | BOE Chief Economist Huw Pill speech | |

| 20/05/2022 | - |  | EU | ECB Lagarde & Panetta in G7 Meeting | |

| 20/05/2022 | 1200/1400 |  | EU | ECB Lane in Discussion at Stockholm Uni | |

| 20/05/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/05/2022 | 1400/1000 | * |  | US | Services Revenues |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.