-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Big Downside UK PMI Surprise

EXECUTIVE SUMMARY:

- UK MAY SERVICES PMI PLUMMETS; EUROZONE PMIS MIXED

- PBOC, REGULATOR URGE BANKS TO BOOST LENDING

- SNAP SINKS 31% IN PREMARKET TRADING AFTER CUTTING FORECASTS

- VILLEROY SAYS HALF-POINT RATE HIKE ISN'T ECB CONSENSUS

- UK BORROWING SLOWS IN APRIL ON HIGHER TAX TAKE

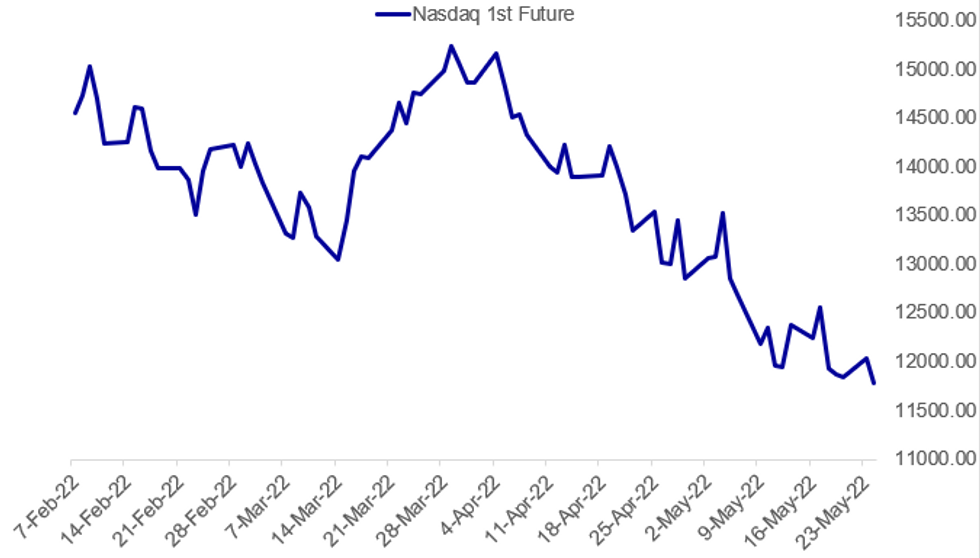

Fig. 1: Nasdaq Bounce Proving Short-Lived?

Source: BBG, MNI

Source: BBG, MNI

NEWS:

EUROPE PMIS: Tuesday's round of flash PMI readings for May saw downside surprises across the board, except for German manufacturing.

- Services softened in France (-0.5 points), Germany (-1.3 points), the Eurozone (-1.4 points) and the UK (-7.1 points), the latter being a substantial 5.2-points below forecasts.

- Eurozone services were reported as strong, with job gains the strongest in 15 years. Expectations continued to deteriorate, despite a strong post-lockdown tailwind continuing to aid service growth.

- The UK highlighted a sharp slowing in activity growth on the back of inflationary pressures and economic and geopolitical uncertainty sapping consumer demand. Business optimism fell to a 2-year low.

- Manufacturing contracted in France (-1.2 points), the Eurozone (-1.1 points), the UK (-1.2 points). A 0.1 uptick for German manufacturing highlighted the surprising robustness of the industry as new business continued to expand.

- Order book inflows fell, dampening Eurozone manufacturing.

- Supply chain disruptions and inflationary pressures made acute by the Ukraine war continue to exert substantial pressure on manufacturing industries.

- All readings remained in expansive territory, above the 50-point breakeven mark.

- The eurozone saw a second month of easing input costs, although prices charged continued to grow at near all-time highs.

ECB (BBG): European Governing Council member Francois Villeroy de Galhau pushed back against the idea of a half-point rate increase.“A 50 basis-point hike is not part of the consensus at this point, I am clear,” he said in an interview from the World Economic Forum in Davos, Switzerland. “Interest rate hikes will be gradual.”

ECB (BBG): European Central Bank President Christine Lagarde said the euro area will leave the era of negative interest rates in the coming months as the currency bloc has reached a “turning point” in monetary policy. In an exclusive Bloomberg Television interview at the World Economic Forum in Davos, Lagarde said that the ECB will move out of negative rates by the end of the third quarter but is “not in a panic mode.” She added that a recession isn’t the central bank’s base-line scenario for the euro zone.

PBOC / CHINA (BBG): China’s central bank and banking regulator urged lenders to boost loans as the economy is battered by Covid outbreaks that have threatened growth this year.People’s Bank of China Governor Yi Gang and other officials met with 24 major financial institutions Monday to discuss credit conditions and work, the central bank said in a statement Tuesday. The meeting called on banks to accelerate the delivery of approved loans, and also maintain the stable growth of property loans, according to the statement. “Major financial institutions need to shoulder their responsibilities, make use of all resources to effectively connect with credit demand and strengthen policy transmission,” according to a statement that quoted from the meeting. It added that banks should focus on key areas such as small businesses, green projects, technology innovation, energy supply and infrastructure.

SNAP / SOCIAL MEDIA STOCKS (BBG): Snap Inc. cut its revenue and profit forecasts below the low end of its previous guidance, sending shares plunging as much as 31% and pushing other social media stocks down. The company will also slow hiring, filling 500 roles before the end of the year, Chief Executive Officer Evan Spiegel said in a note to staff. “Like many companies, we continue to face rising inflation and interest rates, supply chain shortages and labor disruptions, platform policy changes, the impact of the war in Ukraine, and more,” he wrote in the memo obtained by Bloomberg. The collapse in Snap’s share spread to other internet and advertising stocks, with Meta Platforms Inc. falling 7% in pre-market trading on Tuesday. Major advertising houses also dropped, with WPP Plc dropping as much as 3.9% in early trading in London.In total, social media stocks were on course to shed more than $100 billion in market value following Snap’s announcement.

GERMANY / RUSSIA / ENERGY (BBG): Germany plans to reactivate coal and oil power plants if Russian President Vladimir Putin decides to cut off gas exports to the country. Economy Minister Robert Habeck will present an emergency decree on Tuesday that will enable the government to reactivate plants that were supposed to be shut-off in line with Germany’s coal exit plan. “This means that the short-term use of coal-fired plants in the electricity sector is made possible on demand, should the need arise,” according to the decree seen by Bloomberg.

COMMODITIES (BBG): India is set to restrict sugar exports as a precautionary measure to safeguard its own food supplies, another act of protectionism after banning wheat sales just over a week ago. Sugar prices jumped. The government is planning to cap sugar exports at 10 million tons for the marketing year that runs through September, according to a person familiar with the matter. The aim is to ensure there are adequate stockpiles before the next sugar season starts in October, the person said, asking not to be identified as the information is private.

BANK INDONESIA: Indonesia's central bank has maintained its benchmark rate unchanged at 3.5% but has once again tightened the statutory reserve requirement ratio (RRR) for commercial banks at its meeting on Tuesday. As expected, Bank Indonesia kept the 7-day reverse repo rate unchanged at 3.5%, the Deposit Facility interest rate at 2.75% and the Lending Facility rate at 4.25%

NATO: Ragip Soyglu at Middle East Eye tweets: "Sweden, Finland diplomatic delegations will arrive in Turkey this evening. They will meet senior Turkish officials [presidential spox & chief foreign policy advisor Ibrahim] Kalin and [Deputy Foreign Minister Sedat] Onal, and representatives from defense ministry and Intel to discuss NATO bid. Turkey to present files on PKK activities — Officials to Turkish media" There seems to be an increasing acceptance in Helsinki and Stockholm that the accession process is likely to take longer than initially expected with Finnish Foreign Minister Pekka Haavisto stating on 22 May that talks could "take several weeks".

EUROPE TAX (BBG): French Finance Minister Bruno Le Maire said an agreement on implementing a global minimum corporate tax in Europe is possible by the end of June despite Poland repeatedly blocking a deal.Le Maire has set the target of getting the necessary unanimous backing for a directive on the matter during France’s presidency of the European Union. But France removed the topic from the official agenda of a meeting of finance ministers in Brussels on Tuesday with little progress in convincing Poland to sign up. That’s despite US Treasury Secretary Janet Yellen’s efforts to sway Warsaw in a visit last week.

RUSSIA/BALTICS: Brussels should look at legal ways to seize up to EUR300 billion in frozen Russian central bank assets and use them to fund Ukrainian reconstruction, a paper published Tuesday by the EU's Baltic State countries argues, which could be a "solid basis for reconstruction." Finance Minister Giintare Skaiste of Lithuania, one of the three Baltic States, said assets frozen by a 'coalition of the willing' could be treated as 'war reparations'.

DATA:

GERMANY PMI: Details more concerning

Manufacturing PMI rose a tenth (7 tenths above consensus), services missed expectations by 8 tenths and composite rose 3 tenths (beat consensus by 7 tenths). Unlike the French data, the German data looks a bit more concerning, and price pressures remained strong, but didn't set a new record this month.

- "there were signs of demand starting to come under pressure from market uncertainty, rising prices and supply issues, with manufacturers reporting the steepest drop in new orders for almost two years... overall inflows of new business continued to rise in May, growth slowed to the weakest in the current five month sequence and was confined to the service sector."

- "Manufacturers faced a particularly steep decline in new export orders, which contrasted with a slight uptick in new business received from abroad across the service sector."

- "The overall rates of increase in both input costs and output prices eased slightly from April’s record highs, although they were still faster than at any other time in the series history."

- "Business confidence towards the year-ahead outlook for activity remained relatively subdued in May. Expectations ticked up slightly from April, owing to slightly stronger optimism among services firms, though they were still the second-lowest in the past two years as businesses continued to voice concerns over rising prices, supply bottlenecks and heightened uncertainty. This was especially the case in manufacturing, where expectations turned increasingly pessimistic."

FRANCE PMI: Employment and inflation high

Composite a couple of tenths higher than consensus, services a tenth lower and manufacturing 7 tenths lower. Some of the details look fairly positive, however, albeit with prices rising at a record pace. Highlights from the press release:

- "The rise in overall activity levels was almost entirely driven by services firms as goods production increased at a sluggish pace"

- "French employment levels rose at the fastest pace since March 2001, while incidences of supplier delays across the manufacturing sector were at their least widespread for almost a year-and-a-half"

- "Price pressures once again intensified in May, with rates of input cost and output price inflation accelerating to fresh record highs."

- "New business intakes rose at a strong pace, although the expansion slowed from the ten month high seen in April. As was the case with output, the increase in new orders at services companies was noticeably faster than among goods producers during May."

UK PMI: Big fall in composite and services

Big falls in the service and composite PMIs in the UK, with the details not looking positive either. Highlights from the press release:

- For the composite PMI "the month-on-month loss of momentum in May (-6.4 index points) was the fourth-largest on record and exceeded anything seen prior to the pandemic."

- "Latest data indicated the fastest rise in operating expenses since this index began in January 1998, led by a rapid acceleration in input cost inflation across the service economy"

- "Service providers signalled the greatest loss of momentum in May (index at 51.8, down from 58.9 in April), with survey respondents often noting that economic and geopolitical uncertainty had contributed to a slowdown in client demand. However, many businesses in the travel, leisure and events sector still commented on strong growth conditions due to a rapid recovery from pandemic restrictions."

- "Manufacturing output (index at 51.8, down from 54.3 in April) mirrored the marginal growth trend seen in the service sector, although this represented a more modest loss of momentum relative to the prior month. "

- "business expectations eased to the lowest for two years in May amid worries about the global economic outlook and downbeat projections for consumer spending. The latest drop in business optimism was most acute in the service sector, with the month-on-month loss of momentum the greatest since March 2020."

MNI BRIEF: UK Borrowing Slows In April On Higher Tax Take

UK government borrowing slowed in line with financial market expectations in April, but debt interest costs continued to accelerate in April, the latest data from the Office for National Statistics show.

Net borrowing slowed to GBP18.6 billion (GBP18.7 bn forecast) in the month, GBP5.6 billion below the level seen in April 2021, although still a hefty GBP7.9 billion above the pre-pandemic April 2019 numbers. April's data was boosted by a higher tax take, including revenues from the increase in National Insurance payments and other modest hikes, but weighed somewhat by the fuel cost Council Tax subsidy.

The ONS saying payments on outstanding debt instruments stood at GBP 4.4 billion, with GBP3.9 billion due to the Jan-Feb RPI uplift over and above accrued coupon payments. Against debt payments, there was a dividend payment from the BOE APF Fund of GBP3.2 billion.

UK Government debt-to-GDP %

FIXED INCOME: Gilts move notably higher post-PMI data; German curve holds after Villeroy

- Gilts are leading the way after a significant repricing of BOE hiking expectations following the fourth largest ever month-to-month fall in the UK composite PMI (and exceeding anything prior to the pandemic). The picture for the labour market is also looking gloomy with companies not fully replacing those who have voluntarily left.

- The gilt curve has seen a notable bull steepening and has dragged 10-year UST and Bund yields higher.

- After hitting their highest level since May 5 ahead of the data overnight, 2-year gilt yields are almost 11bp lower on the day now.

- There was no lasting reaction in bond markets to the Eurozone PMI releases.

- Also this morning we have heard from ECB's Villeroy who said that 50bp hikes are not the consensus of the ECB but that the repo rate would be back at the neutral rate next year (which he described as between 1-2%). This has helped anchor Schatz and the rest of the German curve somewhat, although yields are still lower on the day after the UK PMI print.

- Looking ahead we are due to receive the US flash PMI data, Richmond Fed and new home sales as well as a speech from Fed's Powell.

- TY1 futures are up 0-13 today at 119-31+ with 10y UST yields down -4.7bp at 2.806% and 2y yields down -4.8bp at 2.575%.

- Bund futures are up 0.20 today at 153.31 with 10y Bund yields down -2.7bp at 0.987% and Schatz yields down -1.2bp at 0.392%.

- Gilt futures are up 0.78 today at 118.77 with 10y yields down -7.8bp at 1.891% and 2y yields down -10.6bp at 1.449%.

FOREX: A busy morning session

- A busy morning session for FX, starting with a EUR rally, after ECB Lagarde in an Bloomberg interview in Davos, noted that the ECB were attentive to the EUR level.

- The EUR strength initially kept the lid on the Dollar, but both currencies reversed, after ECB Villeroy said that a 50bps hike was not the consensus at the ECB.

- The second main story of the session was the big UK Services and Composite PMI miss, which saw the Pound plummeting, and in turn lifted Govies and rate markets.

- As per S&P: "Service providers signaled the greatest loss of momentum in May (index at 51.8, down from 58.9 in April), with survey respondents often noting that economic and geopolitical uncertainty had contributed to a slowdown in client demand. However, many businesses in the travel, leisure and events sector still commented on strong growth conditions due to a rapid recovery from pandemic restrictions."

- Even employment growth "was the least marked for 13 months. Some businesses noted that a desire to reduce costs had led to the non-replacement of voluntary leavers."

- Cable crashed through 1.2500, over 100 pips range for the pair.

- The Yen is the best performer against the Pound in G10, up 1.31%, and GBP trades in the red across the majors.

- Looking ahead, US PMIs are the notable data. Speakers still scheduled, ECB Villeroy, Riksbank Breman, and Fed Powell (pre recorded Welcoming remarks at an Economic Summit).

EQUITIES: Tech Stocks Sink On Social Media Woes

- Asian markets closed weaker: Japan's NIKKEI closed down 253.38 pts or -0.94% at 26748.14 and the TOPIX ended 16.31 pts lower or -0.86% at 1878.26. China's SHANGHAI closed down 75.93 pts or -2.41% at 3070.927 and the HANG SENG ended 357.96 pts lower or -1.75% at 20112.1.

- European futures are lower, with the German Dax down 142.92 pts or -1.01% at 14032.77, FTSE 100 down 40.45 pts or -0.54% at 7472.44, CAC 40 down 77.34 pts or -1.22% at 6281.56 and Euro Stoxx 50 down 46.55 pts or -1.26% at 3661.46.

- U.S. futures are down again, led by tech / social media stocks: Dow Jones mini down 280 pts or -0.88% at 31559, S&P 500 mini down 51 pts or -1.28% at 3920.75, NASDAQ mini down 226.25 pts or -1.88% at 11810.25.

COMMODITIES: Mixed Trade Early, Precious Metals Edge Higher

- WTI Crude down $0.13 or -0.12% at $110.15

- Natural Gas up $0.09 or +1.02% at $8.833

- Gold spot up $4.9 or +0.26% at $1858.53

- Copper down $3.8 or -0.87% at $430.75

- Silver up $0.08 or +0.38% at $21.8778

- Platinum up $0.96 or +0.1% at $962.16

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/05/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 24/05/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 24/05/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 24/05/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 24/05/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/05/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/05/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 24/05/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 24/05/2022 | 1620/1220 |  | US | Fed Chair Jerome Powell | |

| 24/05/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 24/05/2022 | 1800/2000 |  | EU | ECB Lagarde Opens World Economic Forum Dinner | |

| 25/05/2022 | 2301/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 25/05/2022 | 0130/1130 | *** |  | AU | Quarterly construction work done |

| 25/05/2022 | 0200/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 25/05/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 25/05/2022 | 0600/0800 | *** |  | DE | GDP (f) |

| 25/05/2022 | 0600/0800 | ** |  | SE | PPI |

| 25/05/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 25/05/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 25/05/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 25/05/2022 | 0700/0900 | ** |  | ES | PPI |

| 25/05/2022 | 0700/0900 |  | EU | ECB Panetta Speaks at Goethe University | |

| 25/05/2022 | 0730/0930 |  | SE | Riksbank Financial Stability Report | |

| 25/05/2022 | 0800/1000 |  | EU | ECB Lagarde in Stakeholder Dialogue | |

| 25/05/2022 | 0900/1100 | ** |  | SE | Economic Tendency Indicator |

| 25/05/2022 | 0945/1145 |  | EU | ECB Lane Speaks at German Bernacer Prize | |

| 25/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 25/05/2022 | 1230/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 25/05/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 25/05/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 25/05/2022 | 1515/1615 |  | UK | BOE Tenreyro Panels Discussion | |

| 25/05/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 25/05/2022 | 1615/1215 |  | US | Fed Vice Chair Lael Brainard | |

| 25/05/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 25/05/2022 | 1800/1400 | * |  | US | FOMC Minutes |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.