-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: ECB To Set The Table For Tightening

EXECUTIVE SUMMARY:

- ECB EXPECTED TODAY TO ANNOUNCE CONCLUSION OF APP, SIGNAL JULY HIKE

- TOOMEY DEMANDS ANSWERS FROM KANSAS CITY FED ON FINTECH ACCOUNT

- DRAGHI: IN EU RISING INFLATION NOT SIGN OF OVERHEATING

- UK PM JOHNSON TO DELIVER "RESET" POLICY SPEECH

- THAILAND RATES OUTLOOK TURNING HAWKISH (MNI INSIGHT)

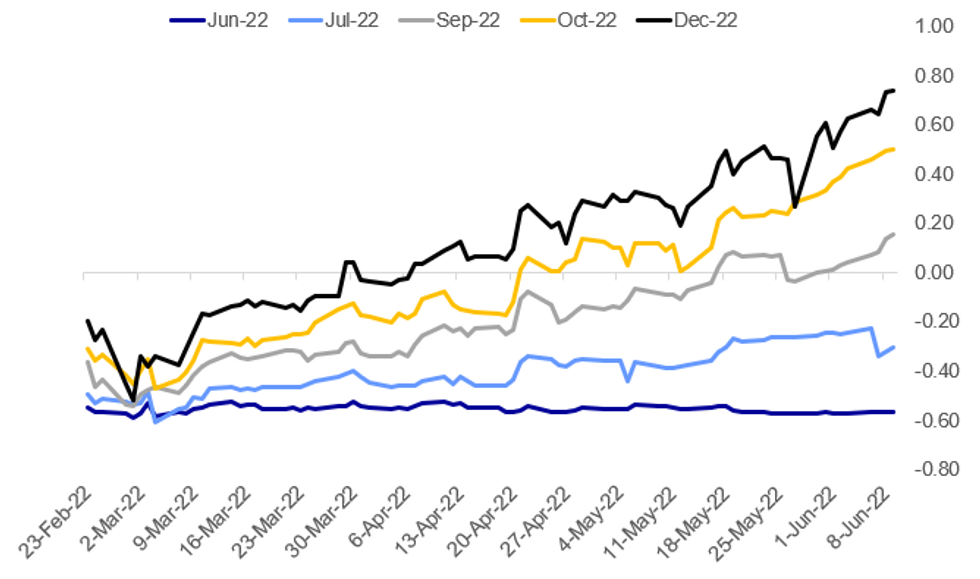

Fig. 1: Implied OIS Rates For Upcoming ECB Meetings

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ECB: The ECB's monetary policy statement is due for release at 12:45BST / 13:45CET followed by its press conference at 13:30BST / 14:30CET. The immediate focus will be on the scheduled end date of asset purchases and the telegraphing of future rate hikes. Lagarde's blog post implied that there would be 25bp hikes in July and September and the focus will be both on whether the ECB leaves wiggle room to hike by 50bp at any point, and what the outlook post-September looks like.

EU / ITALY (BBG): Italian Premier Mario Draghi said surging inflation in Europe doesn’t reflect excess demand, and there’s still spare capacity to be found in the region’s economy. The former European Central Bank president spoke out on the day that officials led by his successor, Christine Lagarde, are set to stop bond purchases and firm up plans for interest-rate increases to stop record consumer-price increases from spiraling out of control. “In the European Union, rising inflation is not wholly the sign of overheating, but largely the result of a series of supply shocks,” he said at the annual ministerial meeting of the OECD in Paris on Wednesday. “Wages must recover their purchasing power, but without creating a price-wage spiral that would result in turn in even higher interest rates.”

FED / CONGRESS (BBG): Senator Pat Toomey, the top Republican on the Banking Committee, is demanding answers from the Federal Reserve Bank of Kansas City about the status of a Fed master account for Colorado fintech firm, Reserve Trust, which had figured in a recent confirmation controversy. “It has been brought to my attention that the Kansas City Fed recently revoked Reserve Trust’s master account after determining, among other things, that the company is no longer eligible for one,” Toomey said in a letter obtained by Bloomberg News to Kansas City Fed President and CEO Esther L. George.Toomey said he had been “stonewalled” when he sought details on why the company received its master account in 2018, when former Fed governor and former deputy Treasury Secretary Sarah Bloom Raskin was on its board, and asked for a briefing and documents regarding the bank’s actions.

UK: Prime Minister Boris Johnson is set to deliver a policy speech this afternoon in Blackpool, as he seeks to reset his gov't agenda in the wake of a narrow win in Monday's confidence vote among Conservative MPs.

- Johnson is due to talk about his gov'ts plans for dealing with rising inflationary pressures as well as efforts to get more people onto the housing ladder.

- Politico reports that Johnson will state that “The global headwinds are strong. But our engines are stronger...And, while it’s not going to be quick or easy, you can be confident that things will get better, that we will emerge from this a strong country with a healthy economy.”

- The PM is, however, not set to include a plan on cutting income tax, one of the potential areas speculated Johnson might move on swiftly in order to placate angry backbench Conservatives.

- Johnson is slated to speak in the afternoon, although there is no set time for the speech as of yet.

CHINA / TECH (BBG): Chinese financial regulators have started early stage discussions on a potential revival of Ant Group Co.’s initial public offering, according to people familiar with the matter, one of the clearest signs yet that authorities are dialing back a crackdown on the tech industry that began with the scuttling of the world’s biggest listing almost two years ago. The China Securities Regulatory Commission has established a team to reassess the fintech giant’s share sale plans, said one of the people, who asked not to be named discussing private information.

IRAN/IAEA: Tehran has lashed out at the International Atomic Energy Agency (IAEA) following a vote of the body's Board of Governors last night that adopted a resolution censuring Iran for 'non-cooperation' with the IAEA's monitoring work.

- Iranian gov't stated that, "Iran condemns the adoption of the resolution [...] as a political, unconstructive and incorrect action...The adoption of the resolution, which is based on the hasty and unbalanced report of the director general of the IAEA and on false and fabricated information from the Zionist regime [Israel], will only weaken the process of cooperation and interaction between the Islamic Republic of Iran and the agency,"

- Iran singled out IAEA Director-General Rafael Grossi for criticism following his visit to Israel before the Board of Governors meeting.

CHINA/US: China noted the recent comments from the U.S. that suggest a consideration of lifting the additional tariffs imposed on Chinese goods since start of the 2018 trade war, and Beijing still aims for the cancellation of all additional tariffs, Shu Jueting, spokeswoman of the Ministry of Commerce, said at a briefing on Thursday.

THAILAND (MNI INSIGHT): Hawks are emerging on the Monetary Policy Committee of Thailand's central bank, and MNI understands that the timing of an interest rate rise is now much closer than previously thought. For full article contact sales@marketnews.com

DATA:

No key data released in the European morning.

FIXED INCOME: Looking to the ECB for direction

There has been some divergence in core fixed income this morning.

- Bund futures moved to cycle lows overnight but have since drifted a bit higher, albeit remaining below yesterday's close. Focus is on the ECB decision later with the end date of asset purchases likely to be announced and how much the ECB pre-commits to hikes in July, September and further forward will be the main market moving question.

- Gilts have moved lower following a fire in a Texas LNG export terminal which has pushed up UK/European natgas futures prices, and risks higher natgas prices through the winter as it will be harder for Europe to refill its storage capacity.

- Treasuries moved below yesterday's lows overnight but are now largely flat on the day.

- TY1 futures are down -0-1 today at 118-01+ with 10y UST yields down -0.1bp at 3.022% and 2y yields up 1.0bp at 2.785%.

- Bund futures are down -0.17 today at 148.77 with 10y Bund yields up 0.9bp at 1.360% and Schatz yields down -0.3bp at 0.687%.

- Gilt futures are down -0.26 today at 114.57 with 10y yields up 1.7bp at 2.262% and 2y yields up 1.7bp at 1.783%.

FOREX: JPY Bounce Soothes Oversold Condition

- In contrast with Wednesday's price action, the JPY is the strongest currency in G10 so far Thursday, with the currency bouncing off the multi-decade lows printed earlier in the week. Having printed 134.56 overnight - the highest level since 2002.

- JPY's recovery appears fleeting, however, with USD/JPY's primary uptrend still intact and the pattern of higher highs still running after 10 consecutive sessions. The modest moderation in the pair has allowed the overbought condition in USD/JPY to unwind somewhat, putting the RSI back toward the 70 level - a similar pattern as seen during the March and April rallies this year.

- GBP is among the poorest performers in G10 so far, with focus turning to an appearance from the PM Johnson, who looks to revive his fragile leadership position after a leadership challenge earlier in the week. 1.2431 and 1.2317 mark the first key levels of support in GBP/USD.

- The ECB rate decision takes focus going forward, with the Bank seen keeping headline policy unchanged but hinting heavily that rate hikes could come as soon as July. Weekly jobless claims data is the focus in the US, while the Bank of Canada release their financial system review, with governor Macklem then addressing reporters.

EQUITIES: Energy Stocks Gain Amid Broader Losses In Europe

- Asian markets closed mostly lower: Japan's NIKKEI closed up 12.24 pts or +0.04% at 28246.53 and the TOPIX ended 0.93 pts lower or -0.05% at 1969.05. China's SHANGHAI closed down 24.839 pts or -0.76% at 3238.954 and the HANG SENG ended 145.54 pts lower or -0.66% at 21869.05.

- European equities are a little weaker pre-ECB, with the German Dax down 62.57 pts or -0.43% at 14382.92, FTSE 100 down 33.42 pts or -0.44% at 7560.1, CAC 40 down 13.29 pts or -0.21% at 6438.61 and Euro Stoxx 50 down 5.74 pts or -0.15% at 3782.71.

- U.S. futures have edged higher, with tech stocks leading: Dow Jones mini up 114 pts or +0.35% at 33003, S&P 500 mini up 17 pts or +0.41% at 4131, NASDAQ mini up 63.75 pts or +0.51% at 12679.5.

COMMODITIES: U.S. NatGas Slumps After LNG Export Terminal Fire

- WTI Crude down $0.17 or -0.14% at $122

- Natural Gas down $0.41 or -4.7% at $8.3

- Gold spot down $3.05 or -0.16% at $1850.45

- Copper down $7.1 or -1.59% at $438.5

- Silver down $0.05 or -0.22% at $22.0069

- Platinum down $21.32 or -2.11% at $987.82

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/06/2022 | 1145/1345 | *** |  | EU | ECB Deposit Rate |

| 09/06/2022 | 1145/1345 | *** |  | EU | ECB Main Refi Rate |

| 09/06/2022 | 1145/1345 | *** |  | EU | ECB Marginal Lending Rate |

| 09/06/2022 | - | *** |  | CN | Trade |

| 09/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 09/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 09/06/2022 | 1230/1430 |  | EU | ECB Press Conference Following Governing Council Meeting | |

| 09/06/2022 | 1400/1000 |  | CA | BOC Financial System Review | |

| 09/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 09/06/2022 | 1500/1100 |  | CA | BOC Governor press conference | |

| 09/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 09/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 09/06/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 10/06/2022 | 0130/0930 | *** |  | CN | CPI |

| 10/06/2022 | 0130/0930 | *** |  | CN | Producer Price Index |

| 10/06/2022 | 0600/0800 | * |  | NO | CPI Norway |

| 10/06/2022 | 0700/0900 | *** |  | ES | HICP (f) |

| 10/06/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 10/06/2022 | 0830/0930 | ** |  | UK | Bank of England/TNS Inflation Attitudes Survey |

| 10/06/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 10/06/2022 | 1230/0830 | *** |  | US | CPI |

| 10/06/2022 | 1345/1545 |  | EU | ECB Lagarde Message for Goethe Uni Law & Finance Institute | |

| 10/06/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 10/06/2022 | 1400/1000 | * |  | US | Services Revenues |

| 10/06/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 10/06/2022 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.