-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI US OPEN: Rate Rout

EXECUTIVE SUMMARY:

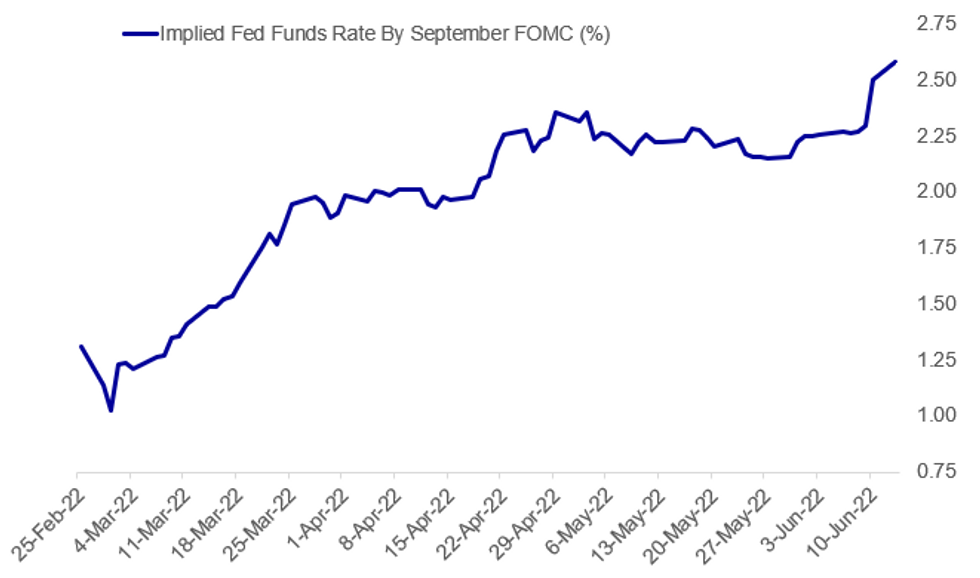

- FUTURES PRICE 175BP OF FED HIKES BY SEPTEMBER

- S&P EMINI, NASDAQ FUTURES TOUCH FRESH POST-2020 LOWS

- UK GDP SEES SURPRISE APRIL DECLINE

- CHINA IS WALKING BACK VIRUS LOOSENING WEEKS AFTER REOPENING

- BOJ TO OFFER ADDITIONAL JGB BUYING OPS ON TUESDAY

Fig. 1: September Hike Pricing Tops 175bp From Now

Source: BBG, MNI

Source: BBG, MNI

NEWS:

BOJ: The Bank of Japan said on Monday that it will conduct additional purchase of Japanese government bonds with a remaining life of 5 to 10 years worth JPY500 billion on Tuesday. The decision is aimed at curbing a rise in the 10-year bond yield, which rose to 0.255%, above a range of -0.25% to +0.25% that the BOJ tolerates. “The BOJ will make changes in the auction schedule and amounts of outright purchases of JGBs as needed, taking account of market conditions,” (See: MNI INTERVIEW: Ex-BOJ Economist Defends Easy Policy, Yield Cap).

CHINA / COVID (BBG): China is starting to re-impose Covid-19 restrictions just weeks after major easing in key cities, raising concern the country may once again employ strict lockdowns to control its outbreak. Beijing reported 45 new local cases on Monday afternoon, after having single digit cases on most days last week. City officials said an outbreak linked to a popular bar is proving more difficult to control than previous clusters, in a weekend that saw mass testing and rising infections both in the capital and in Shanghai. A total of 37 cases were reported for Shanghai on Sunday, including five detected in the community. There was one additional community case disclosed on Monday, with the full city results still to come.

UK-EU: European Commission Exec VP Maros Sefcovic tweets: "Spoke to [UK Foreign Sec] Liz Truss earlier where she informed me of UK legislation to unilaterally disapply the Protocol. The EU has always paid utmost attention to the impact Brexit has on NI, offering workable solutions. Unilateral action is damaging to mutual trust & a formula for uncertainty." Gov't set to present the legislation later this afternoon, while Truss isalso set to provide a pre-recorded video clip explaining the gov'ts actions and motives.

GERMANY: Wires carrying comments from German Economy Minister and Vice-Chancellor Robert Habeck. States that 'it is right that interest rates are being raised'. * On inflation: 'The inflation we are experiencing now is not driven mainly bymoney supply, but by energy prices'. Habeck has become one of the more popular politicians in Germany in recent months, with his hard-line stance against Russia and efforts to diversify the economy away from Russian fossil fuel use gaining him plaudits.The Greens, of which he is a member, now sits either alongside or just ahead of Chancellor Olaf Scholz's Social Democrats in most opinion polling, behind only the centre-right Christian Democratic Union of Friedrich Merz.

DATA:

FIXED INCOME: Continuing the descent

- Core fixed income is continuing to move lower this morning, following on from the US CPI-induced sell-off on Friday. The moves are being led by a repricing of rate hike expectations and hence curves are bear flattening. Peripheral spreads continue to widen, too, while the biggest moves in core FI are in USTs.

- Today's calendar is UK-dominated. However, the release of the NI protocol bill to the UK House of Commons this afternoon which is unlikely to be immediately market moving, and the release earlier this morning of disappointing UK April activity data saw little market movement.

- The focus of markets, however, is very much looking ahead to this week's FOMC and BOE meetings.

- TY1 futures are down -0-22+ today at 116-03+ with 10y UST yields up 7.8bp at 3.236% and 2y yields up 13.2bp at 3.197%.

- Bund futures are down -0.87 today at 146.11 with 10y Bund yields up 3.9bp at 1.553% and Schatz yields up 9.1bp at 1.053%.

- Gilt futures are down -0.61 today at 112.43 with 10y yields up 4.3bp at 2.488% and 2y yields up 9.9bp at 2.131%.

FOREX: Dollar Nearing YTD Highs as Bond Rout Persists

- The bond rout is persisting early Monday, with last week's hot CPI fueling a further pricing-in of aggressive easing from G10 central banks this morning. A handful of sell-side institutions have revised their calls for this week's meeting, seeing a 75bps rate rise to ward off accelerating price pressures.

- Resultingly, Treasury yields are surging across the curve, putting the 2yr yield at 3.2%, the highest level since 2007. The greenback is following rates north, putting the USD Index on track to test May's best levels at 105.00 - which marked the strongest USD in twenty years.

- The higher, flatter US yield curve has sapped equity market sentiment, putting US futures deeper into bear market territory as prices continue to chew through the post-pandemic stock rally. This has helped support haven currencies ahead of the NY crossover, with JPY and CHF among the better performing currencies.

- At the bottom-end of the table, NOK and AUD have been dented by the shakier sentiment, while GBP extends recent weakness on the back of a poorer-than-expected monthly GDP release, with April GDP contracting by 0.3% in what's expected to be a rocky few quarters for the economy.

- The Monday speaker and data docket is typically empty, with no major data releases. Fed's Brainard makes an appearance later in the day, but the event is not policy-oriented, with the FOMC remaining inside the pre-meeting media blackout period.

MNI BRIEF: UK GDP Sees Surprise April Decline

The UK economy unexpectedly slowed in April, falling 0.3% m/m, below analyst expectations for a 0.1% gain. The decline was driven by the end of the test and trace programme across the country and a significant decline in the number of Covid-19 vaccinations delivered, which took 0.5% of overall GDP from the previous month.

According to the Office for National Statistics, GDP would have just about held in positive territory for the month if the T&T and vaccination hit was removed. Despite the decline, GDP was still 0.9% above its pre-Covid February 2020 level.

The 0.3% decline in headline growth in April followed a fall of 0.1% in March and marked the first back-to-back falls in 2 years (last March/Apr 2020 at the start of the pandemic). Heading into this week's Bank of England Monetary Policy Committee meeting, the data will only underline the problems for policymakers facing slowing growth and well-above target inflation.

EQUITIES: Futures Touch Fresh Post-2020 Lows Amid Global Rout

- Japan's NIKKEI closed down 836.85 pts or -3.01% at 26987.44 and the TOPIX ended 42.03 pts lower or -2.16% at 1901.06. China's SHANGHAI closed down 29.283 pts or -0.89% at 3255.551 and the HANG SENG ended 738.6 pts lower or -3.39% at 21067.58.

- European futures are off sharply, with the German Dax down 297.86 pts or -2.16% at 13761.83, FTSE 100 down 133.61 pts or -1.83% at 7317.52, CAC 40 down 151.85 pts or -2.45% at 6187.23 and Euro Stoxx 50 down 86.02 pts or -2.39% at 3599.2.

- U.S. futures are sinking, with tech leading the way lower: Dow Jones mini down 599 pts or -1.91% at 30789, S&P 500 mini down 93.75 pts or -2.4% at 3805.25, NASDAQ mini down 346.25 pts or -2.92% at 11493.75.

COMMODITIES: Sharp Losses Across Energy And Metals

- WTI Crude down $1.97 or -1.63% at $119.6

- Natural Gas down $0.2 or -2.21% at $8.68

- Gold spot down $16.7 or -0.89% at $1869.58

- Copper down $8.7 or -2.03% at $428.95

- Silver down $0.41 or -1.86% at $21.9305

- Platinum down $27.43 or -2.81% at $977.2

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/06/2022 | 1100/1300 |  | EU | ECB de Guindos at Arab Central Banks & Monetary Authorities' Meeting | |

| 13/06/2022 | 1230/0830 | * |  | CA | Household debt-to-disposable income |

| 13/06/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 13/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 13/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 14/06/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 14/06/2022 | 0600/0800 | *** |  | DE | HICP (f) |

| 14/06/2022 | 0600/0800 | *** |  | SE | Inflation report |

| 14/06/2022 | 0600/0800 | * |  | DE | Wholesale Prices |

| 14/06/2022 | 0900/1100 | ** |  | EU | industrial production |

| 14/06/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 14/06/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 14/06/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 14/06/2022 | 1230/0830 | *** |  | US | PPI |

| 14/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 14/06/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 14/06/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 14/06/2022 | 1700/1900 |  | EU | ECB Schnabel Commencement Speech at Universite Paris |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.