-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, Aug 21

MNI BRIEF: China Aluminium Imports To Increase In 2024

MNI US OPEN: More European Tightening Talk

EXECUTIVE SUMMARY:

- BOE'S HUW PILL: FURTHER TIGHTENING OF MONETARY POLICY IS NEEDED

- ECB'S REHN: `VERY LIKELY' SEPT. RATE HIKE BIGGER THAN 0.25 PPTS

- UK RAIL STRIKES GET UNDER WAY AFTER UNIONS REJECT LATE OFFER

- BIGGER RBA RATE HIKE TO ADDRESS "INFLATION MINDSET": MINUTES

- JAPAN PM KISHIDA: BOJ NEEDS TO MAINTAIN EASY POLICY

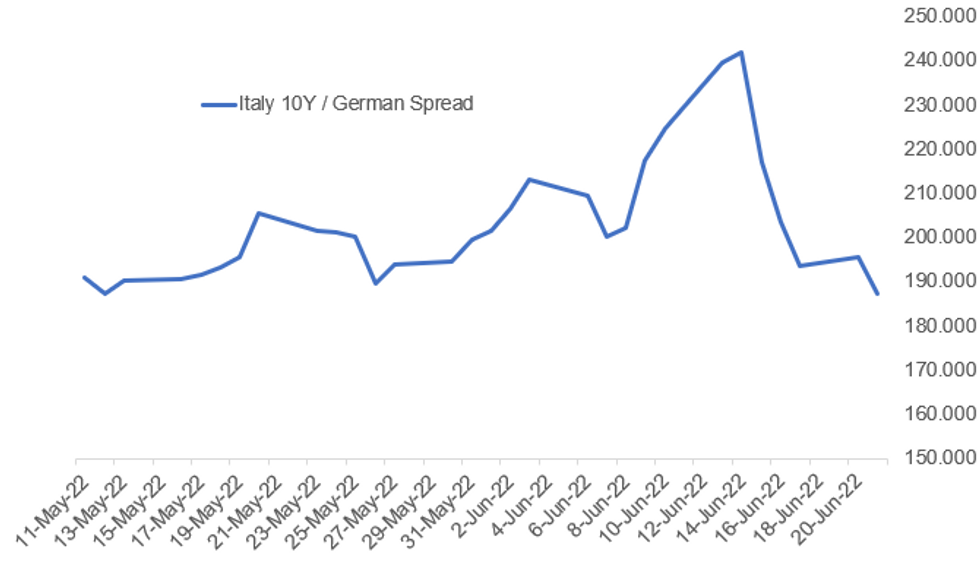

Fig. 1: Italy Spreads Continue To Narrow As Anti-Fragmentation Tool In The Works

Source: BBG, MNI

Source: BBG, MNI

NEWS:

BOE (BBG): The BOE is ready to act “more aggressively” if needed, BOE chief economist Huw Pill says in web event hosted by ICAEW. There are risks of a self-sustaining momentum in inflation, and it is crucial to halt the second round effects, he says. Still, rate hikes will take 12-18 months to have an impact, and it is impossible to offset the shock of energy price rises, Pill says. Pill reiterates inflation, not the exchange rate, is the BOE’s target.

ECB (BBG): The European Central Bank has “good reason” to start raising interest rates next month, said Governing Council member Olli Rehn. Major increases in energy and raw-material costs are being transmitted more broadly to the prices of other products and services, according to the Bank of Finland, which he heads. “With inflation rising sharply, there has been good reason to expedite the normalization of monetary policy,” Rehn said in a statement on Tuesday. “The aim is to ensure that inflation stabilizes at its 2% target over the medium term.”

ECB (BBG): Italian bonds surge, tightening their premiums over German counterparts to the lowest since May 17 after ECB’s Rehn says the central bank is committed to containing unwarranted fragmentation.

ECB (BBG): “Negative rates must be history by September,” European Central Bank Governing Council Member Peter Kazimir tells reporters in in Bratislava on Tuesday. Given the fact that the ECB must tighten monetary policy against the backdrop of weaker macroeconomic conditions, he sees slower growth in the area. Some countries might fall into a technical recession, Kazimir says

UK (BBG): UK rail workers began Britain’s biggest rail strike in three decades after unions rejected a last-minute offer from train companies, bringing services nationwide to a near standstill. A proposal from track manager Network Rail was considered and rejected on Friday, and another one from train companies was turned down on Monday, National Union of Rail, Maritime and Transport Workers General Secretary Mick Lynch said in statement broadcast from near Euston Station, north London. The failure of negotiations means some 40,000 staff at 13 train operating companies and Network Rail will walk out on Tuesday, Thursday and Saturday, bringing commuter services to a halt and threatening to cause transport chaos in London. Only about 20% of services will survive the stoppages, with Scotland and Wales hit hardest.

FRANCE: The Elysee Palace has confirmed that Prime Minister Elisabeth Borne offered her resignation to President Emmanuel Macron earlier today, but that the president rejected this offer. The Elysee told AFP that Macron rejected the offer, "so that the government stays on task", adding that Macron intends to carry out “the necessary political consultations (…) in order to identify possible constructive solutions in the service of the French [people]”. Borne's resignation offer comes after a poor election campaign for Macron and his centrist Ensemble alliance, which retained a plurality in the National Assembly, but lost its overall majority.

GERMANY (BBG): Germany’s federal finance agency is sticking with its ample debt-issuance plans for the third quarter as the government continues to spend freely to help offset the impact of the coronavirus pandemic and Russia’s invasion of Ukraine.Debt issuance will total 106.5 billion euros ($112.2 billion) in the three months through September, in line with a plan published in December, according to a statement by the Federal Finance Agency on Tuesday.

RBA: The Reserve Bank of Australia opted for a larger 50 basis point interest rate hike in June because it wanted to "mitigate" the risk of higher inflation expectations, and because interest rates were still very low and stimulatory. The comments come from the minutes of the RBA's June board meeting released on Tuesday, where the central bank surprised with a 50bps rise to take official rates to 0.85%

JAPAN: Prime Minister Fumio Kishida said on Tuesday that the Bank of Japan needs to maintain the current easy policy but the methods of management is up to the central bank. "Monetary policy affects foreign exchange rates and also affects smaller firms' funding and housing loans and the overall economy. (The BOJ) should manage monetary policy in comprehensive way," Kishida said at debate between party leaders ahead of upper house elections on July 10. He added that senior officials at the BOJ, the Ministry of Finance and the Financial Services Agency, have all voiced concern over the rapid yen fall against the dollar, and they agreed to take appropriate policy, while carefully monitoring future developments.

SWEDEN / EUROPE ENERGY (BBG): The Swedish Energy Agency issued an “early warning” that there is a potential for disruptions of gas supplies, it said in a statement on Tuesday. It doesn’t mean a reduction of supplies, but is a notice that the gas market is strained and that issues with supplies may happen

DATA:

No key data released in the European morning.

USD/JPY Cycle Highs Back in Sight

- USD/JPY continues to test the upper-end of the recent range, with the cycle highs at Y135.59 back in sight as equities find some more stable footing to put Wall Street on track for a solidly positive open later today.

- This gives markets a somewhat positive backdrop after the US holiday on Monday, with the greenback among the poorest performing currencies so far Tuesday.

- Commodity-tied currencies also sit higher, with NOK and CAD recouping recent lost ground and putting USD/CAD back toward the C$1.2900 level at the NY crossover.

- The EUR is also trading favourably, putting EUR/USD on course to test the key upside level at the 1.0622 50-dma. ECB speakers so far this morning have talked up the likelihood of tighter policy be year-end, with ECB's Rehn favouring a rate hike of more than 25bps at the September meeting.

- US Chicago Fed National Activity Index data and existing home sales are the focus for the session going forward, with Canadian retail sales also on the docket. Central bank speakers include Fed's Barkin and Mester.

FIXED INCOME: Moving a little higher on low volumes

- Treasuries, Bunds and gilts have drifted a little higher this morning but on little volume, and little in the way of new news (some comments from BOE's Pill and a couple of ECB GC members in line with previous guidance).

- The German curve has bull steepened while gilts have bull flattened.

- The focus this morning has instead been on syndications with the EU looking to launch a new 25-year Feb-48 green bond and the UK reopening the 1.125% Oct-73 gilt.

- Later today we will hear from Fed's Barkin and Mester as well as receive US existing home sales data.

- TY1 futures are down -0-7+ today at 115-30+ with 10y UST yields up 4.3bp at 3.271% and 2y yields up 2.5bp at 3.208%.

- Bund futures are up 0.41 today at 143.87 with 10y Bund yields down -1.5bp at 1.730% and Schatz yields down -4.4bp at 1.095%.

- Gilt futures are up 0.14 today at 111.41 with 10y yields down -2.6bp at 2.576% and 2y yields down -1.9bp at 2.267%.

EQUITIES: Stocks Stronger, Cyclicals Leading

- Asian stocks closed mostly higher: Japan's NIKKEI closed up 475.09 pts or +1.84% at 26246.31 and the TOPIX ended 37.26 pts higher or +2.05% at 1856.2. China's SHANGHAI closed down 8.711 pts or -0.26% at 3306.719 and the HANG SENG ended 395.68 pts higher or +1.87% at 21559.59.

- European stocks are stronger, with the German Dax up 150.17 pts or +1.13% at 13265.6, FTSE 100 up 41.69 pts or +0.59% at 7121.81, CAC 40 up 88.55 pts or +1.5% at 5920.09 and Euro Stoxx 50 up 45.06 pts or +1.3% at 3469.83.

- U.S. futures are higher, led by tech: Dow Jones mini up 486 pts or +1.63% at 30355, S&P 500 mini up 67.5 pts or +1.84% at 3743.25, NASDAQ mini up 224.25 pts or +1.99% at 11521.

COMMODITIES: Copper And Oil Regain Some Ground

- WTI Crude up $2.29 or +2.09% at $110.27

- Natural Gas down $0.23 or -3.27% at $6.694

- Gold spot down $3.31 or -0.18% at $1838.83

- Copper up $4.95 or +1.23% at $402.25

- Silver down $0.09 or -0.42% at $21.609

- Platinum up $11.59 or +1.24% at $935.11

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/06/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 21/06/2022 | 1215/1315 |  | UK | BOE Tenreyro Seminar at Goethe University | |

| 21/06/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 21/06/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 21/06/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 21/06/2022 | 1500/1100 |  | US | Richmond Fed's Tom Barkin | |

| 21/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 21/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 21/06/2022 | 1600/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 21/06/2022 | 1930/1530 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.