-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: 2nd Half Starts On The Back Foot

EXECUTIVE SUMMARY:

- EUROZONE HEADLINE INFLATION AT FRESH HIGH, TO TEST ECB RESOLVE

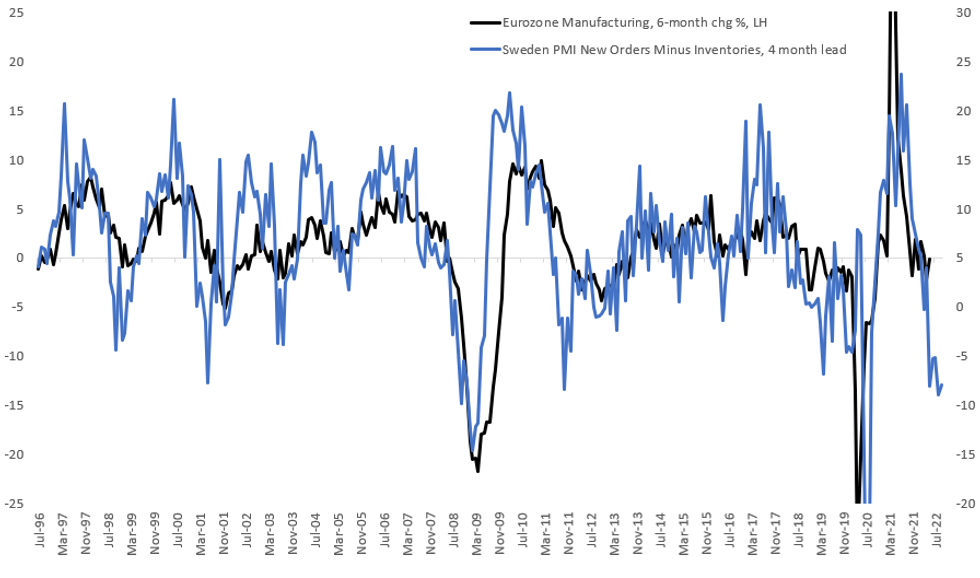

- PMIS SHOW EUROZONE MANUFACTURING REMAINS UNDER PRESSURE

Fig. 1: Sweden PMI A Good Leading Indicator - For Bad Eurozone Manufacturing Numbers

Source: Swedbank, Eurostat, BBG, MNI

Source: Swedbank, Eurostat, BBG, MNI

NEWS:

CHINA / HONG KONG (BBG): Chinese President Xi Jinping urged Hong Kong to shore up its economy after an era of “chaos,” in a landmark visit that offered few clear answers for how to balance Beijing’s demands for limiting perceived foreign threats with its desire to remain an international financial hub. Xi delivered a defiantly optimistic vision for Hong Kong at an event Friday to celebrate the former British colony’s 25th anniversary of Chinese rule. In remarks after swearing in the city’s new, security-minded leader, Xi attempted to move past a tumultuous period of social unrest and pandemic shocks that drew international criticism and left many wondering whether the city could remain a viable bridge between China and the outside world.

RUSSIA/ENERGY (BBG): President Vladimir Putin signed a decree to transfer rights to the Sakhalin-2 natural gas project to a new Russian company, a move that could force foreign owners including Shell Plc to abandon their investment in the facility.The decree cites threats to Russia’s national interests and economic security, according to a statement dated June 30, issued by the Kremlin and signed by Putin. Stakeholders have one month to say whether they’ll take a holding in the new company, and those who opt out may not be fully compensated, the statement said.

UK (BBG): The number of UK house sales fell in May, the latest sign that the red-hot property market is starting to cool.Sales agreed in May were down 13% year-on-year, according to Zoopla’s UK House Price Index report. The average time to agree a sale is also rising -- taking 22 days in May, from 20 days in March. “There are signals that the impetus in the market is slowing, and more price sensitivity in the market will spell a slowdown in price growth during the remainder of 2022,” Grainne Gilmore, Zoopla’s head of research, said in the report.

DATA:

MNI: EZ FINAL JUN MANUFACTURING PMI 52.1 (FLSH 52.0); MAY 54.6

- GERMANY FINAL JUNE MANUFACTURING PMI 52.0; MAY 54.8

- FRANCE FINAL JUNE MANUFACTURING PMI 51.4 (FLSH 51.0); MAY 54.6

- MNI: ITALY JUNE MANUFACTURING PMI 50.9 (FCST 50.6); MAY 51.9

MNI: SPAIN JUNE MANUFACTURING PMI 52.6 (FCST 52.2); MAY 53.8

* The June survey saw the Spanish manufacturing PMI weaken by 0.8 points,albeit coming in stronger than expected. This is the lowest reading sinceJanuary 2021 during the initial Omicron Covid wave, however, remains inexpansionary territory.* A slump in new orders was the key downwards driver of manufacturing in June.Output still remained high, boosted by previous order levels.* The war in Ukraine and energy price inflation continued to generateuncertainty in growth outlooks. This combined with soaring inflation hitting10.2% in the June flash estimate has led to a considerable decline in demand. * Inflationary pressures saw signs of easing, as well as modest upticks inemployment leading to outlooks improving marginally.

MNI: UK FINAL JUNE MANUFACTURING PMI 52.8 (FLSH 53.4); MAY...>

*MNI: UK JUN M4 MONEY SUPPLY +0.5% M/M, +5.1% Y/Y

*MNI: NORWAY JUNE UNEMPLOYMENT RATE 1.6% VS MAY 1.6%

Eurozone Headline Inflation at Fresh High, To Test ECB Resolve

Eurozone inflation soared to a new high of 8.6% in June, according to a preliminary release from Eurostat, up from 8.1% in May and outpacing market expectations of an 8.5% increase.

- Month-over-month, prices rose an estimated 0.8%.

- The increase was driven in part by higher gas prices, with strong y/y gains seen in Italy and Spain. German harmonised inflation slowed modestly, helped by fuel and travel subsidies, but it wasn't enough to slow the increase across the entire bloc.

- Core inflation, ex-energy, food, alcohol and tobacco slowed moderately in June, dipping to 3.7% from 3.8% in May. Alone, energy inflation stood at 41.9% y/y, up from 39.1% in May.

- The upside surprise will provide further headaches for the ECB ahead of the July 20/21 meeting. The strength of the number will increase the calls of the hawks for a 50 bps hike in July, testing the resolve of President Lagarde who reiterated the intention of a 25 bps hike. It also makes a 50 bps hike in September a near certainty, barring a sudden reversal of price pressures over the summer.

Source: Eurostat

*MNI: ITALY JUN FLASH HICP +1.2% M/M, +8.5% Y/Y

FIXED INCOME: Another wide range start

- A wide trading session for EGBs and Bund, with most trading in over 100 ticks range.

- Bonds have traded heavier this morning unwinding some of the latest rallies.

- The main event of the day, was the EU inflation data.

- Month-over-month, prices rose an estimated 0.8%, with the increase driven in part by higher gas prices, with strong y/y gains seen in Italy and Spain. German harmonised inflation slowed modestly, helped by fuel and travel subsidies, but it wasn't enough to slow the increase

- across the entire bloc.

- Core inflation, ex-energy, food, alcohol and tobacco slowed moderately in June, dipping to 3.7% from 3.8% in May.

- Alone, energy inflation stood at 41.9% y/y, up from 39.1% in May.

- Peripherals are mixed, Greece is 8.2bps tighter, while Portugal is 1.8bps wider.

- Gilt outperforms Germany and EGBs, pushing the Gilt/Bund spread 2.2bps tighter, but well with yesterday's range.

- US Treasuries have also hold onto gains in the shorter and part of the curve 2s and 5s.

- Most of the US, EU and UK curves are steeper, as the longer end 30yr trades in the red.

- Looking ahead, US ISM is the notable release left.

- Speakers include ECB Panetta, de Cos.

FOREX: Equity Risk-Off Fades as Stocks Bounce

- Equity futures across both the US and Europe traded lower in early European hours, with the EuroStoxx future dropping to new weekly lows and exposing the bear trigger at 3384.00. The price action soon reversed, however, with most futures markets well off the lows headed into the NY crossover.

- Nonetheless, the JPY is still comfortably the best performer Friday, with USD/JPY's retracement putting the pair briefly back below the Y135.00 handle. The pair has bounced alongside equities, but the price action this week underlines that two-way price action has returned to the pair after a lengthy uptrend.

- Eurozone CPI data came in just ahead of expectations at 8.6% Y/Y, however core inflation came in below forecast at 3.7% - making for a broadly market-neutral release. The EUR is in minor negative territory against the USD, with the greenback benefiting from the early equity weakness.

- Focus turns to the June manufacturing ISM release as well as a series of ECB speakers, with ECB's Panetta and de Cos both due to speak.

EQUITIES: US Futures Starting 2nd Half Lower

- Asian markets closed sharply lower: Japan's NIKKEI closed down 457.42 pts or -1.73% at 25935.62 and the TOPIX ended 25.78 pts lower or -1.38% at 1845.04. China's SHANGHAI closed down 10.979 pts or -0.32% at 3387.637.

- European futures are up slightly (though cyclical stocks continue to weaken, with tech lagging): the German Dax up 44.03 pts or +0.34% at 12783.77, FTSE 100 up 14.36 pts or +0.2% at 7169.28, CAC 40 up 25.77 pts or +0.44% at 5922.86 and Euro Stoxx 50 up 7.15 pts or +0.21% at 3454.86.

- U.S. futures are a little lower to start the month/half, with the Dow Jones mini down 70 pts or -0.23% at 30712, S&P 500 mini down 7.75 pts or -0.2% at 3782, NASDAQ mini down 23 pts or -0.2% at 11506.5.

COMMODITIES: U.S. NatGas Bounces After Big Prior Day Drop, But Copper Sinks

- WTI Crude up $1.48 or +1.4% at $107.03

- Natural Gas up $0.25 or +4.63% at $5.94

- Gold spot down $12.09 or -0.67% at $1812.23

- Copper down $12.9 or -3.48% at $370.95

- Silver down $0.43 or -2.12% at $20.4529

- Platinum down $8.21 or -0.92% at $905.33

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/07/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/07/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/07/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/07/2022 | 1400/1000 | * |  | US | Construction Spending |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.