-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS - EUR/USD Bounces Off New Cycle Lows

Highlights:

- EUR bounces off new lows, EUR/USD now either side of 1.0150

- Treasury yields hold close to week's best levels

- Markets eye payroll gains of 250-300k

US TSYS SUMMARY: Treasuries Pause For Breath Ahead Of Payrolls

- Cash Tsys have consolidated two days of sizeable sell-offs, with little direction ahead of payrolls. A small bull steepening on the day sees 2s5s dip further back into positive territory and 2s10s almost completely flat.

- 2YY -1.4bps at 3.000%, 5YY -0.5bps at 3.027%, 10YY -0.5bps at 2.989%, 30YY -0.1bps at 3.184%.

- TYU2 trades 5 tickers higher at 118-14 with subdued volumes but keeps very much towards the bottom of the week’s range. The short-term pullback is considered corrective, with support at yesterday’s low of 118-06 and resistance at 120-16+ (Jul 6 high).

- Data: Payrolls for Jun at (0830ET), final wholesale inventories for May (1000ET) and consumer credit for May (1500ET). In-depth payrolls preview here: https://marketnews.com/markets/pdfs/mni-us-payrolls-preview-growth-concerns-thrown-into-the-mix

- Fedspeak: Bostic (’24 voter) with CNBC interview at 0845ET and NY Fed’s Williams with expected mon pol discussion at 1100ET.

STIR FUTURES: Fed Hikes Within Yesterday Range Pre-Payrolls

- There is 71bps for Jul, 125bp for Sep and 178bp for Dec meetings with a peak 185bp with the Mar’23 meeting to 3.44%. The latter has fluctuated this week between 3.20% on Wed prior to the ISM services beat, and 3.50% yesterday.

- Bullard and Waller yesterday still backed a 75bp hike for July and see a soft landing. Waller sees it followed by “probably 50 in September. And then after that we can debate about whether to go back down to 25s, or if inflation doesn’t seem to be coming down we have to do more”.

- Bostic (’24 voter) to speak to CNBC at 0845ET before NY Fed’s Williams speaks in Puerto Rico on topics including US mon pol and the economic outlook at 1100ET. Williams noted on Jun 28 the debate at the July decision will be between 50 and 75bps whilst definitely seeing the need to get rates to 3-3.5% this year.

Source: Bloomberg

Source: Bloomberg

EGBS/GILT SUMMARY: Gilts Underperforming Ahead Of US Payrolls

German bonds are easily outperforming UK counterparts early Friday, in a reversal of Thursday's price action.

- Amid relatively few headline/data drivers, the Bund curve is bull steepening, with Schatz yields moving lower alongside the Euro edging toward parity with the USD.

- UK instruments are underperforming global counterparts and are weaker in parallel across the curve, with yields roughly 1.5bp higher out to 10Y. Weakness has persisted from the open.

- Periphery EGB spreads are a little tighter

- Attention is firmly on an appearance by ECB Pres Lagarde at 1255BST, followed by the US employment report at 1330BST.

Latest levels:

- Germany: The 2-Yr yield is down 7.5bps at 0.483%, 5-Yr is down 7.3bps at 0.904%, 10-Yr is down 4.8bps at 1.27%, and 30-Yr is down 2.2bps at 1.53%.

- UK: The 2-Yr yield is up 1.5bps at 1.842%, 5-Yr is up 1.4bps at 1.825%, 10-Yr is up 1.5bps at 2.143%, and 30-Yr is down 0.3bps at 2.545%.

- Italian BTP spread down 4.6bps at 194.5bps

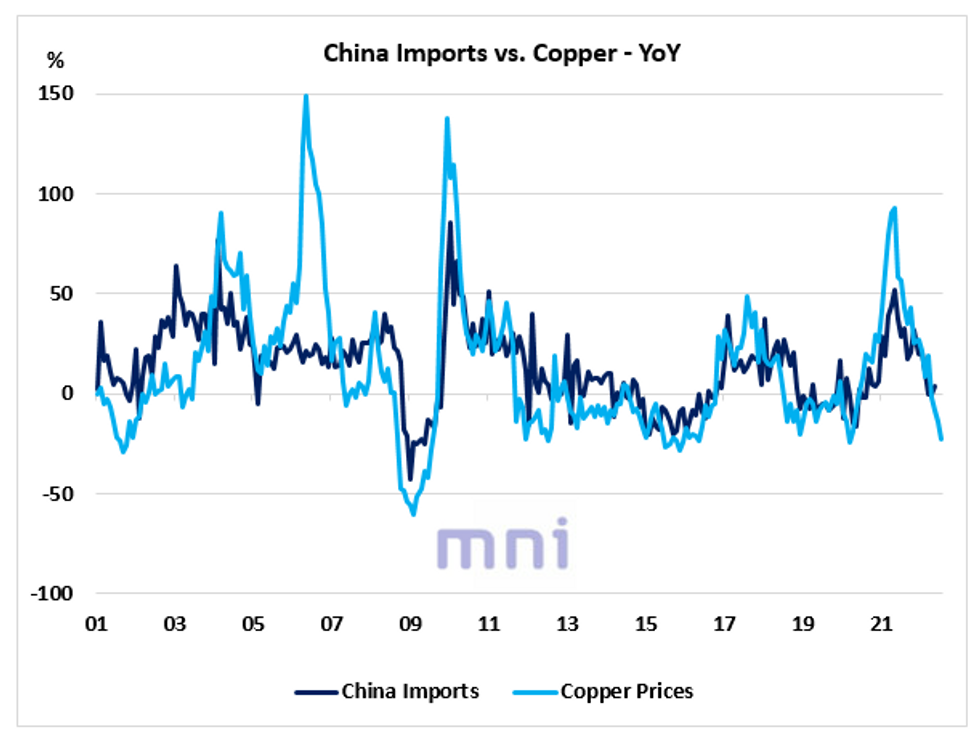

CHINA: Should We Expect Further Weakness in Chinese Imports?

- In the past year, China imports have been decelerating sharply due to the sharp slowdown in the domestic economic activity and the liquidity contraction in 2021.

- As for South Korea exports, macro analysts have historically used China imports as one of the key inputs when computing a global leading economic indicator.

- For instance, the chart below shows that China imports have strongly co-moved with industrial commodity prices (i.e. copper) and have been pricing in lower copper prices since the start of the year.

- With economic data deteriorating sharply in the past two months in the major economies, investors have questioned if global demand will continue to fall in the medium term, pressuring commodity prices to the downside.

- The chart below shows that G10 economic surprises have historically strongly led China imports by 6 months.

- Note that we limited the range of the G10 economic surprise index to -100 / +100 following the Covid shock.

Source: Bloomberg/MNI

US DATA PREVIEW: Primary Dealer NFP Estimates

| Primary Dealer | Estimate | Primary Dealer | Estimate |

|---|---|---|---|

| Amherst Pierpoint | +375K | TD Securities | +350K |

| Bank of America | +325K | Morgan Stanley | +325K |

| Jefferies | +320K | Societe Generale | +310K |

| Daiwa | +300K | NatWest | +300K |

| Scotiabank | +300K | Citi | +290K |

| Nomura | +290K | Barclays | +275K |

| Credit Suisse | +275K | J.P.Morgan | +275K |

| Goldman Sachs | +250K | HSBC | +250K |

| Wells Fargo | +240K | BNP Paribas | +230K |

| Deutsche Bank | +225K | UBS | +225K |

| BMO | +200K | Mizuho | +200K |

| Dealer Median | +282.5K | BBG Whisper | +245K |

FOREX: EUR Dips Further, But Oversold Condition Could Slow Progress to Parity

- The greenback has resumed its deep-seated uptrend early Friday, putting the index at fresh multi-decade highs and touching 107.786. The primary driver remains EUR weakness, with the pair extending the week's losses to near parity and put prices off by over 3.5% since this time last week.

- There are few signs of a slowdown in the downside momentum for EUR/USD - with the market focus remaining on the downtrend channel drawn off the February high. Nonetheless, the EUR/USD RSI has now dipped into oversold territory for the first time since March - which could slow downside progress, but is unlikely to stop the primary downtrend.

- JPY is the sole currency to be outperforming the greenback ahead of the NY crossover, with negative global equity futures pointing to a lower open on Wall Street later today. This reinforces the general risk-off theme, although the e-mini S&P holds the bulk of the week's recovery headed into next week's earnings season. Markets also watch the passing of ex-PM Abe in Japan, who was shot while taking part in election campaigning.

- Focus going forward is on the June nonfarm payrolls report, at which markets expect monthly job gains of somewhere between 250-300k. Earnings growth is expected to moderate, while the participation rate inches higher to 62.4% - equalling the post-pandemic high.

FX OPTIONS: Expiries for Jul08 NY cut 1000ET (Source DTCC)

- USD/JPY: Y135.00($1.1bln)

- EUR/GBP: Gbp0.8585-00(E996mln)

- AUD/USD: $0.7100(A$2.2bln)

Price Signal Summary - EURUSD Bear Bear Cycle Extends

- In the equity space, S&P E-Minis have continued to recover this week and remain above recent lows. Trend conditions are bearish though and a resumption of weakness would open 3735.00, the Jun 23 low. A break of this level would expose key support at 3639.00, the Jun 17 low and bear trigger. Clearance of 3950.00, Jun 28 high is required to strengthen a bullish case. EUROSTOXX 50 futures remain above Tuesday’s low. Gains are considered corrective and the trend outlook is bearish. This week’s breach of support at 3384.00, Jun 16 low, reinforces bearish conditions and confirms a resumption of the broader downtrend. The focus is on 3321.30, 50.0% of the major 2020 - 2021 upleg. Key short-term resistance is at 3584.00, the Jun 27 high.

- In FX, EURUSD maintains a bearish tone and has traded lower again today. This week’s fresh cycle lows confirm a resumption of the primary downtrend and an extension lower within the bear channel drawn from the Feb 10 high. The focus is on 1.0018, the channel base. GBPUSD remains vulnerable. This week’s extension lower highlights a continuation of the downtrend and opens 1.1795, 0.764 projection of the Mar 23 - May 13 - 27 price swing. USDJPY is unchanged and still in consolidation mode. The trend condition is bullish and price is trading above support at 134.27, Jun 23 low. A resumption of gains would open 137.30 next, 1.50 projection of the Feb 24 - Mar 28 - 31 price swing.

- On the commodity front, Gold remains vulnerable following this week’s move lower that resulted in a breach of the bear trigger at $1787.00, May 16 low. The break confirms a resumption of the broader downtrend and opens $1706.3 next, 1.618 projection of the Mar 8 - 29 - Apr 18 price swing. In the Oil space, WTI futures remain vulnerable following this week’s move lower and break of support at $101.53, the Jun 22 low. Potential is for weakness towards $93.45 next. Short-term gains are considered corrective.

- In the FI space, Bund futures remain in a short-term bull cycle. The focus is on153.36, May 31 high. Gilts cleared resistance on Jul 1 at 114.55, the Jun 24 high. The break highlights potential for a stronger short-term recovery and this has opened 117.48, 1.236 projection of the Jun 16 - 24 - 29 price swing. The latest pullback is considered corrective.

EQUITIES: Soft Start To US Payrolls Day

- Asian markets closed mixed: Japan's NIKKEI closed up 26.66 pts or +0.1% at 26517.19 and the TOPIX ended 5.1 pts higher or +0.27% at 1887.43. China's SHANGHAI closed down 8.32 pts or -0.25% at 3356.078 and the HANG SENG ended 82.2 pts higher or +0.38% at 21725.78.

- European stocks are a little softer, with Materials/Financials weakness weighing most heavily: German Dax down 67.04 pts or -0.52% at 12790.44, FTSE 100 down 9.06 pts or -0.13% at 7177.74, CAC 40 down 29.98 pts or -0.5% at 5974.07 and Euro Stoxx 50 down 33.1 pts or -0.95% at 3458.99.

- U.S. futures are slightly lower, with the Dow Jones mini down 132 pts or -0.42% at 31235, S&P 500 mini down 19.75 pts or -0.51% at 3885.25, NASDAQ mini down 76.25 pts or -0.63% at 12062.25.

COMMODITIES: Metals Pull Back Again As Dollar Firms

- WTI Crude down $0.83 or -0.81% at $102.19

- Natural Gas down $0.17 or -2.65% at $6.139

- Gold spot down $4.71 or -0.27% at $1735.94

- Copper down $9.1 or -2.55% at $348.55

- Silver down $0.12 or -0.65% at $19.1068

- Platinum down $7.35 or -0.84% at $870.68

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/07/2022 | 1155/1355 |  | EU | ECB Lagarde at Les Rencontres Economiques | |

| 08/07/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 08/07/2022 | 1230/0830 | *** |  | US | Employment Report |

| 08/07/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 08/07/2022 | 1230/0830 |  | US | New York Fed's John Williams | |

| 08/07/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/07/2022 | 1500/1100 |  | US | New York Fed's John Williams | |

| 08/07/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.