-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Euro And BTPs Up As Draghi's Future Eyed

EXECUTIVE SUMMARY:

- ITALY PM DRAGHI SAYS COALITION CAN BE REBUILT

- UK INFLATION SURGE UNDERLINES BOE DILEMMA

- SPAIN ECO MINISTER: ECB HIKES SHOULD AVOID RATTLING DEBT MARKET

- CHINA 5YR LPR EYED AS POLICY TURNS CAUTIOUS (MNI STATE OF PLAY)

- GERMANY'S UNIPER MAY PASS ON SOME COSTS TO CONSUMERS UNDER RESCUE DEAL (RTRS)

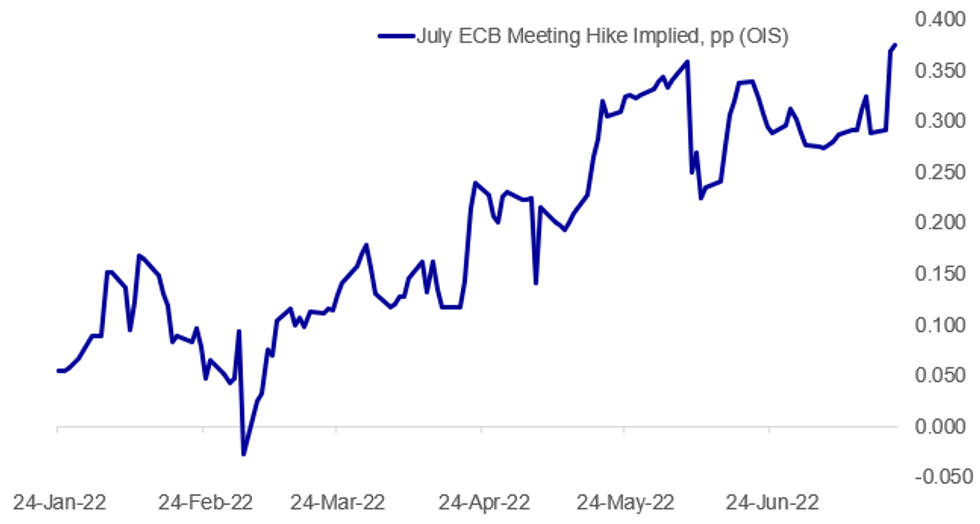

Fig. 1: Tomorrow's ECB Hike Pricing Remains 50/50 Between 25 and 50bp

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ITALY POLITICS: Prime Minister Mario Draghi has concluded his address to the Italian Senate ahead of a confidence vote later this evening. The vote is expected at around 1845CET (1245ET, 1745BST).

- Draghi: "The confidence vote of the last Thursday certified the end of the pact of trust...If we want to stay together we must rebuild this pact."

- Draghi: "We need strong support for government action, not unjustified protests".

- Two major factors will decide whether the Draghi gov't continues or collapses. First is the populist 5-Star Movement (M5S). The party boycotted a confidence vote in the Senate last week, sparking the current crisis. Further splits in the party could see a number of senators remain on board with the Draghi gov't, allowing the PM the ability to say he has retained the party's support.

- The other is the stance of the right-wing populist League and centre-right Forza Italia. Both have stated that they would refuse to work with M5S in any administration, however the incentive to bring the gov't down is relatively small for both parties. The League now sit well behind the nationalist Brothers of Italy in opinion polls, while Forza Italia have steadily regained some previous support during time in gov't.

- The gov't will win the confidence vote, but the size of the majority is likely to determine if Draghi remains in office. A sizeable win with all League, Forza and a number of M5S senators could be enough to keep the former ECB president in position. Should either of the two parties on the right, or all M5S senators not vote with the gov't it could presage Draghi's resignation, likely resulting in an autumn general election.

SPAIN / ECB (BBG): The European Central Bank should avoid rattling the region’s debt markets as it gears up to raise borrowing costs, Spanish Economy Minister Nadia Calvino said. Speaking a day before the first ECB interest rate hike in more than a decade, Calvino said Wednesday the central bank “should guarantee that this doesn’t produce a rupture in debt markets.”

PBOC (MNI STATE OF PLAY): China's reference lending rate may see a cut in the five-year tenor later this year but conditions are cautious now as bank interest margins narrow, and rising inflation and accelerating economic recovery keeps policy in check, market analysts said.

CBRT (MNI PREVIEW): The CBRT are again firmly expected to keep policy rates unchanged at 14.00% in July in the seventh consecutive unchanged decision at the bank, which seemingly continues to operate under considerable political influence and is willing to look through inflation that could exceed 80% in the coming months. Looking ahead, rate hikes remain a tail risk, with the bank board unwilling to tighten policy ahead of the election cycle next year. As such, most analysts expect rates at 14.00% into year-end.

GERMANY / ENERGY / UNIPER (RTRS): could be allowed to pass on some of its higher gas costs to consumers under the terms of a rescue package being discussed with the German government, sources told Reuters on Wednesday. Germany is scrambling to rescue the utility, which has become a high-profile casualty of an economic standoff between the West and Russia that has sent gas prices soaring and raised fears of severe energy shortages this winter.

RUSSIA / EUROPE / ENERGY: Slow progress to equipment maintenance could reduce capacity on the Nord Stream 1 pipeline according to Putin speaking after his visit to Tehran. The pipeline has been undergoing maintenance from July 11-21. After initial fears it would not be switched back on, Reuters sources reported yesterday it is due to return on schedule but at reduced capacity.

UK (BBG): The support program offering Government-backed loans to small businesses will be extended for a further two years, according to an emailed statement. The Recovery Loan Scheme, originally launched in April 2021 to help businesses recovering from the Covid-19 pandemic, has supported nearly 19,000 businesses with an average of £202,000 in support

DATA:

GERMANY: First Signs of PPI Easing Since 2020

GERMANY JUN PPI +0.6% M/M, +32.7% Y/Y (FCST 33.7%), MAY +33.6% Y/Y

- German factory gate inflation softened 0.9pp to +32.7% y/y, coming off the May record high.

- This is the first sign of German producer prices easing since March 2020, when PPI was back in negative territory.

- Energy prices continue to account for the bulk of PPI, rising by 86.1% y/y in June. This is however 1.0pp lower than in May.

- Notable increases were seen in intermediate goods (+22.3% y/y), capital goods (+7.4% y/y) and durable and non-durable consumer goods (+10.5% y/y and +14.7% y/y).

- Intermediate goods previously largely imported from Russia and Ukraine continue to see high prices, with fertilisers over doubling and flour up by close to 50%.

- The 7.4% increase in capital goods' costs was the highest since 1975, as machinery and automotive prices continue to climb.

- Core PPI was recorded at +15.5% y/y, down 1.0pp from May, implying that factory-gate inflation in Germany is beyond the peak.

- The data comes the same day UK input producer prices for June were reported at 24.0%, the highest on record.

MNI BRIEF: UK Inflation Surge Underlines BOE Dilemma

UK inflation rose to a fresh 40-year high in June, with the consumer price index rising 9.4% year-on-year, the biggest increase since the comparable 10.2% increase recorded in February 1982, the Office for National Statistics said Wednesday. Once again, the increase outpaced expectations of City analysts, albeit marginally.

The data will make further difficult reading for the Bank of England ahead of the August policy meeting and could take the Monetary Policy Committee a step closer to a 50bps hike, although the increase is within the trajectory policymakers see towards an October 'peak' around 11%.

Once again, the pressure on consumer spending was highlighted by the continued year-on-year surge in the costs of running the household, with the Housing, Water, Electricity and Gas up 19.6% -- although it was flat on the month. Transport costs rose sharply on the month, up 2.3%, extending the annualised gain to 14.9%, driven by an increase in petrol prices to record highs

MNI: UK MAY HOUSE PRICE INDEX +12.8% Y/Y; APR +11.9%r

FIXED INCOME: Gilts lead core FI higher while BTPs look to confidence vote

- Core fixed income has been grinding higher this morning, led by a repricing of rate hike expectations and partially reversing some of the moves seen yesterday.

- Gilts are leading the way higher in core FI following inflation data that only marginally beat economists' consensus expectations - the market had likely been looking for more.

- BTPs are the other notable movers this morning as Draghi addresses the Senate. 10-year spreads to Bunds are 5.8bp tighter on the day at the time of writing. The confidence vote is due to be held later today, with out policy team expecting around 17:45BST / 12:45ET.

- Today will also see the final MP votes in the Conservative party leadership race with Sunak expected to get through but it remains uncertain whether he will be joined on the members' ballotpaper by Penny Mordaunt or Liz Truss - with only 6 votes between the latter two in the last round of voting.

- We will also see US existing home sales data released today.

- TY1 futures are up 0-8+ today at 118-07+ with 10y UST yields down -3.5bp at 2.988% and 2y yields down -5.4bp at 3.188%.

- Bund futures are up 0.61 today at 151.71 with 10y Bund yields down -4.7bp at 1.226% and Schatz yields down -3.3bp at 0.587%.

- Gilt futures are up 0.84 today at 115.34 with 10y yields down -6.5bp at 2.112% and 2y yields down -4.8bp at 1.973%.

FOREX: EUR Holds Recovery as Draghi Looks to Fight On

- The single currency trades well in early European hours, with EUR/USD touching a new recovery high of 1.0273 through the London open as Draghi's speech in front of the Senate looks to confirm that he'll aim to continue his role as PM with a strengthened mandate from lawmakers. This has helped benefit Italian markets this morning, with the Italian-German 10y yield spread tighter as a result. The next upside level worth monitoring in EUR/USD is 1.0359, the Jun 15 low, with the 20-day EMA now broken.

- Growth- and commodity-tied currencies are extending their recent bout of strength, putting the likes of AUD and NZD at the top of the G10 pile. GBP/AUD is now through the uptrendline drawn off the early May lows, putting the cross on track to test next support of 1.7310.

- Equity markets support the risk positive backdrop, with US futures indicating the third positive open of the week today. The e-mini S&P is off the overnight highs, but is holding the bulk of the late Tuesday rally.

- At the other end of the table, the greenback remains weak, pulling lower for a fourth consecutive session and putting the USD Index on track to test its first level of major support at 106.24, the 38.2% retracement for the May - July upleg.

EQUITIES: Energy, Financials, Industrials Lead Europe Gains

- Japan's NIKKEI closed up 718.58 pts or +2.67% at 27680.26 and the TOPIX ended 43.65 pts higher or +2.29% at 1946.44. China's SHANGHAI closed up 25.293 pts or +0.77% at 3304.724 and the HANG SENG ended 229.16 pts higher or +1.11% at 20890.22.

- The biggest contributors to early European gains have come from Energy, Financials, and Industrials, with the German Dax up 41.53 pts or +0.31% at 13317.24, FTSE 100 up 20.39 pts or +0.28% at 7320.4, CAC 40 up 5.29 pts or +0.09% at 6216.02 and Euro Stoxx 50 up 6.21 pts or +0.17% at 3584.12.

- U.S. futures are a little higher, with the Dow Jones mini up 43 pts or +0.14% at 31834, S&P 500 mini up 7 pts or +0.18% at 3944.5, NASDAQ mini up 34.5 pts or +0.28% at 12308.5.

COMMODITIES: Copper Continues To Claw Back From Recent Lows

- WTI Crude down $0.82 or -0.79% at $103.4

- Natural Gas down $0.03 or -0.37% at $7.253

- Gold spot down $2.9 or -0.17% at $1707.94

- Copper up $5.8 or +1.76% at $334.6

- Silver up $0.08 or +0.43% at $18.8318

- Platinum up $3.48 or +0.4% at $880.6

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/07/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 20/07/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 20/07/2022 | 1230/0830 | *** |  | CA | CPI |

| 20/07/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/07/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 20/07/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 20/07/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 21/07/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 21/07/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 21/07/2022 | 0800/0900 |  | UK | BOE Pill Intro at BOE & ECB Conference | |

| 21/07/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 21/07/2022 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 21/07/2022 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 21/07/2022 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 21/07/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 21/07/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 21/07/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 21/07/2022 | 1245/1445 |  | EU | ECB Press Conference | |

| 21/07/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 21/07/2022 | 1515/1715 |  | EU | ECB Lagarde Presents Policy Decision via Podcast | |

| 21/07/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.