-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US OPEN - Kazaks Says ECB Not Done With Big Rate Rises

EXECUTIVE SUMMARY:

- KAZAKS SAYS ECB NOT DONE WITH BIG RATE RISES

- VISCO SAYS ITALY SPREADS HIGHER THAN FUNDAMENTALS SUGGEST

- RUSSIA STRIKES PORT CITY OF ODESA JUST DAYS AFTER GRAIN DEAL SIGNED

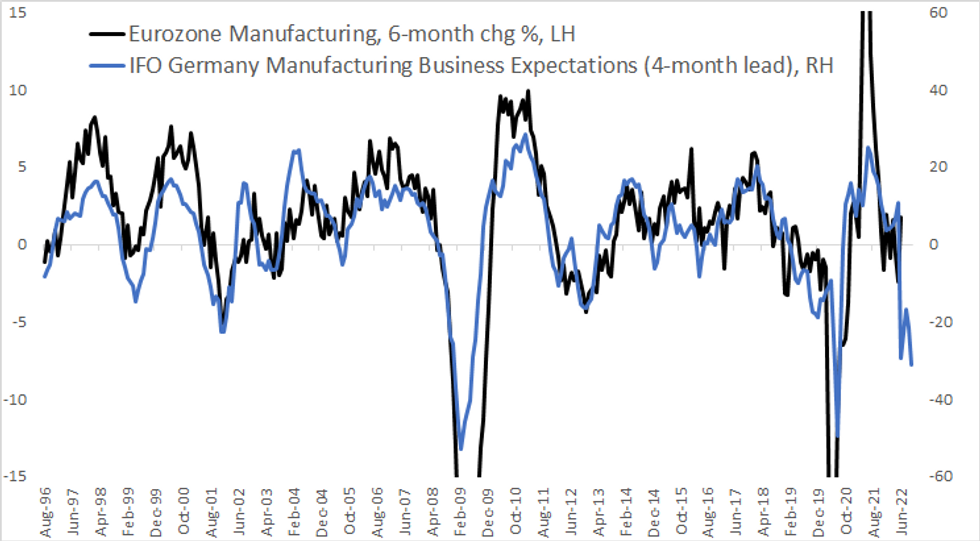

- IFO SURVEY POINTS TO WEAKNESS AHEAD FOR EZ MANUFACTURING

Fig 1. IFO Expectations Signal Potential for Sharp Slowdown in Eurozone Manufacturing

NEWS

ECB (BBG): The European Central Bank will follow a step-by-step approach in raising borrowing costs, according to Governing Council member Ignazio Visco. “We will see depending on data how to go on, but this does not mean that we are not going to proceed in a gradual way,” the Italian central bank governor said in an interview with Bloomberg Television. Gradualism “means moving step by step, not being very slow.”

ECB (BBG): The European Central Bank may not be done with big increases in interest rates after surprising with an initial half-point hike last week, according to Governing Council member Martins Kazaks. “I would not say that this was the only front-loading,” Kazaks, one of the ECB’s most-hawkish officials, said in an interview in Frankfurt. “I would say that the rate increase in September also needs to be quite significant.”

RUSSIA/UKRAINE (BBG): Wheat prices jumped after Russia attacked the sea port of Odesa with cruise missiles at the weekend, just hours after signing a deal to unblock grain exports from Ukraine, a move that was hailed as a vital step toward alleviating the global food crisis. Futures in Chicago surged as much as 4.6%, before paring gains to trade 3.1% higher at $7.82 1/4 a bushel by 3:21 p.m. in Singapore. Prices slumped almost 6% Friday to close at the lowest since early February after the agreement was reached to allow shipments from three Black Sea ports including Odesa.

AUSTRALIA (MNI): RBA Confident Of Avoiding Recession As Econ Cools

The Reserve Bank of Australia is not expecting a domestic recession as the economy heads to lower growth later this year on weaker consumer spending as part of the cost of controlling inflation, MNI understands. The RBA's view is that the economy is currently running hot largely due to strong employment, and while wages are increasing, they are still likely to be lagging inflation which is expected to reach around 7% this year.

CHINA/US (BBG): China Getting ‘Seriously Prepared’ for Pelosi Visit to Taiwan

China said it was getting “seriously prepared” for the possibility that Nancy Pelosi visits Taiwan in the coming weeks, underscoring the risk of a showdown between Washington and Beijing over a trip by the US House speaker. Chinese Foreign Ministry spokesman Zhao Lijian made the comment in response to a Financial Times report that Beijing had privately issued warnings about the planned trip that were “significantly stronger” than past threats. Zhao didn’t elaborate on China’s preparations for the trip, which would be the first delegation by someone in that role in 25 years.

JAPAN (MNI): New BOJ Board Faces Spur Talk On Kuroda Successor

Fresh off a robust victory in upper house elections, the government of Fumio Kishida has started a process that could replace five slots on the nine-member Bank of Japan Board by April of next year, including Governor Haruhiko Kuroda and two deputies, Masayoshi Amamiya and Masazumi Wakatabe. A focus for BOJ officials is whether veterans will fill the top roles, likely either Amamiya who handles monetary operations now, or a former deputy governor Hiroshi Nakaso, a seasoned hand in global central banking circles. Both have solid contacts with lawmakers and their terms end on March 19.

JAPAN (MNI): Takata, Tamura Appointed As New BOJ Board Members

The Japanese government has appointed Hajime Takata, an economist at brokerage Okasan Securities, and Naoki Tamura, a senior adviser at Sumitomo Mitsui Banking Corp, as new Bank of Japan board members, the BOJ said on Monday.

Ifo Survey Sees the German Economy "on the Cusp of Recession"

GERMANY JUL IFO BUSINESS CLIMATE 88.6 (FCST 90.1); JUN 92.2r

GERMANY JUL IFO CURRENT ASSESSMENT 97.7 (FCST 97.5); JUN 99.4r

GERMANY JUL IFO EXPECTATIONS 80.3 (FCST 83.0); JUN 85.5r

- The German Ifo survey saw another miss in both the business climate index and expectations in the July print.

- The business climate index slipped by 3.6 points to 88.6, falling a further 1.5 points than anticipated to a June 2020 low. The business expectations index saw a 5.2-point fall, a further 2.7 points than expected whilst the assessment of the current business climate was marginally higher than forecasts, seeing a softer 1.7-point fall.

- High energy prices and fears of gas shortages are feeding into further recessionary fears in Germany.

- Manufacturing pessimism was at an April 2020 high, and new orders contracted for the first time in two years, confirming waning demand as outlooks cloud over.

- The assessment of the current situation in construction nosedived to the lowest in over six years and all retail sectors turned to negative outlooks.

- Following the surprise dive in the US services PMI on Friday, the Ifo services index saw services expectations collapse, undoing the June optimism boost.

- With Ifo calling the German economy "on the cusp of a recession" and the service sector buckling, the survey saw no silver lining.

BONDS: Lower on the day

- Core fixed income quickly shook off spikes higher on a weaker-than-expected German IFO expectations component and is now lower than Friday's close (although still far above Thursday's closing levels).

- Schatz have underperformed 2-year USTs while 10-year Treasuries have underperformed Bunds on the day. Gilts have seen the smallest moves.

- Markets are already beginning to look ahead to the FOMC meeting this week, although given the sensitivity of the market to any signals of recession at present, there will probably be more attention than usual on the Chicago and Dallas Fed indices.

- TY1 futures are down -0-5+ today at 119-23 with 10y UST yields up 6.0bp at 2.812% and 2y yields up 3.4bp at 3.006%.

- Bund futures are down -0.55 today at 153.91 with 10y Bund yields up 4.5bp at 1.072% and Schatz yields up 5.9bp at 0.464%.

- Gilt futures are down -0.15 today at 117.12 with 10y yields up 1.8bp at 1.954% and 2y yields up 2.0bp at 1.847%.

FOREX: Ranges Respected As Markets Gear for Fed

- The JPY is the weakest currency across G10 early Monday, with markets gearing for the Fed rate decision later this week. Nonetheless, price action is generally muted with ranges being respected across DM FX. EUR/USD saw an swift dip on the back of a lower-than-expected IFO survey, but losses were short-lived and the pair sits slightly higher pre-NY crossover.

- Scandi currencies are the early outperformers, with USD/SEK trading just above last week's lows of 10.149. A break through here opens the 50-dma support at 10.129 and the lowest levels since late June.

- A number of ECB speakers have been on the tape this morning, defending last week's rate decision and suggesting further tightening is still to come. ECB's Kazaks noted that big interest rates across the Eurozone may not be over, and the September hike needs to be "quite significant". Meanwhile, Visco touched on the newly unveiled TPI tool, warning that Italian bond yield spreads are much higher than fundamentals can justify.

- Chicago Fed National Activity Index data crosses later today, but the central bank speaker slate remains quiet given the Fed's media blackout ahead of Wednesday's rate decision.

COMMODITIES: European natgas 5% higher

- WTI Crude down $0.11 or -0.12% at $94.59

- Natural Gas (NYM) up $0.07 or +0.84% at $8.369

- Natural Gas (ICE Dutch TTF) up $8.07 or +5.05% at $167.935

- Gold spot up $0.97 or +0.06% at $1728.57

- Copper up $2.25 or +0.67% at $337.2

- Silver up $0.1 or +0.51% at $18.6953

- Platinum down $1.36 or -0.16% at $875.53

EQUITIES: European/US futures flat after Asian stocks moved lower

- Japan's NIKKEI down 215.41 pts or -0.77% at 27699.25 and the TOPIX down 12.76 pts or -0.65% at 1943.21.

- China's SHANGHAI closed down 19.586 pts or -0.6% at 3250.388 and the HANG SENG ended 46.2 pts lower or -0.22% at 20562.94.

- German Dax down 5.43 pts or -0.04% at 13244.07, FTSE 100 up 1.79 pts or +0.02% at 7276.23, CAC 40 up 2.68 pts or +0.04% at 6217.5 and Euro Stoxx 50 up 1.72 pts or +0.05% at 3596.88.

- Dow Jones mini up 56 pts or +0.18% at 31929, S&P 500 mini up 8.25 pts or +0.21% at 3972.25, NASDAQ mini up 34.25 pts or +0.28% at 12454.75.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/07/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/07/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/07/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 25/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 25/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 25/07/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 26/07/2022 | 0600/0800 | ** |  | SE | PPI |

| 26/07/2022 | 0700/0900 | ** |  | ES | PPI |

| 26/07/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 26/07/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 26/07/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 26/07/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 26/07/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/07/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 26/07/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 26/07/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 26/07/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.