-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Yields Lower, With EU Energy In Focus

EXECUTIVE SUMMARY:

- REVISED EU GAS CUT PLAN AIMS FOR APPROVAL TODAY

- CHINA SEEKING TO INFILTRATE FEDERAL RESERVE, SENIOR REPUBLICAN SAYS

- SPANISH PPI PPI SLOWS FOR 3RD CONSECUTIVE MONTH

- JAPAN GOV'T UPS ECONOMY, PRIVATE CONSUMPTION, LABOUR VIEWS

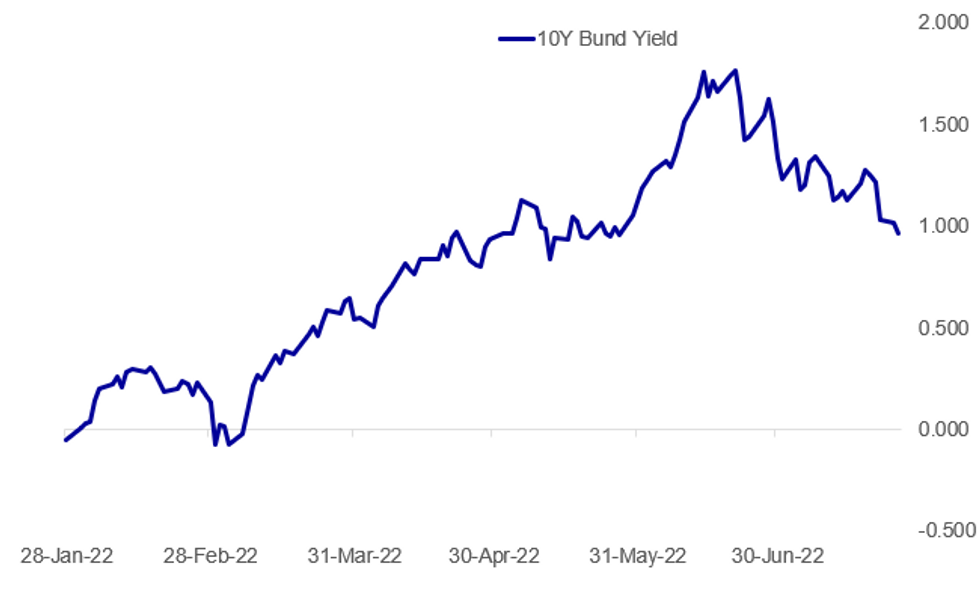

Fig. 1: 10 Year German Bund Yield At 2-Month Low

Source: BBG, MNI

Source: BBG, MNI

NEWS:

EUROPE / ENERGY (BBG): The EU aims to get a watered-down version of gas cut plans through for approval today that now contains numerous opt outs and concessions. The initial plan last week was for every EU country to cut its gas use by 15% from August to March voluntarily, which would become mandatory in a supply emergency. The initial draft was rejected publicly by a swathe of EU nations forcing it back to the drawing board for exemptions for various countries and industries. Reports suggest the revisions now look set for approval but the more relaxed approach leaves the EU in a precarious situation to get it gas storage high enough for this winter given Russians latest move to limit Nord Stream 1 flows to 20% this week.

FED / CHINA (BBG): A senior US Republican lawmaker accused China of a broad campaign to obtain confidential information from the Federal Reserve, including recruiting central bank staffers and detaining a Fed employee visiting Shanghai. The report, from Ohio Senator Rob Portman, said the Fed’s own investigations had identified several employees with connections to Chinese talent recruiters, as well as efforts to gain insight into monetary policy and access to internal data.“ The risk is clear, I urge the Fed to do more, working with the FBI, to counter this threat from one of our foremost foreign adversaries,” Portman, the ranking member on the Senate Committee on Homeland Security and Governmental Affairs, said in a statement.

JAPAN: Japan's government raised its main economic assessment for the first time in three months and also its assessment on private consumption and employment while keeping an eye on a surge in Covid-19 cases, the Cabinet Office said on Tuesday. “The Japanese economy is picking up moderately.” The previous view was “The Japanese economy shows movements of picking up," the Cabinet Office said, with an official adding that the upward revision was due mainly to a recovering private consumption, which supports spending and jobs.

UK POLITICS: Following the first head-to-head debate on the evening of 25 July between the two remaining candidates in the Conservative Party leadership contest, betting markets have shown a further shift towards frontrunner Foreign Secretary Liz Truss. Data from Smarkets shows Truss with a 75.8% implied probability of winning the contest and becoming the next PM, up from 64.9% before the BBC debate. Former Chancellor Rishi Sunak was seen to have failed to have done enough to win the debate, with his implied probability of becoming PM falling from 34.0% to 23.3% presently.

ITALY POLITICS: The conservative coalition of the nationalist Brothers of Italy (FdI), populist League (Lega) and centre-right Forza Italia (FI) is on course to win comfortable majorities in both the Chamber of Deputies and the Senate according to the latest seat projection polling from Agenzia Quorum/YouTrend. In the each of the hypothetical scenarios offered - centre-left coalition (CSX) teams up with centrist parties (CX), centre-left coalition runs alone, and centre-left runs with 5-Star Movement (M5S) - the centre-right coalition (CDX) wins more than 200 seats in the Chamber and more than 100 in the Senate, guaranteeing a majority under the new reduced seat totals.

UKRAINE / CDS (BBG): Ukraine’s plan to freeze foreign-bond payments to give it some financial breathing space could trigger payouts for investors on $2.4 billion of default insurance contracts, according to analysts. The war-torn country, reeling from its invasion by Russia, has asked for consent to restructure its debts after meeting all payment commitments so far. The proposal could breach the terms of Ukraine’s credit-default swaps, which act as insurance for bondholders.

ECB/ESRB: A disorderly green transition could lead to corporate defaults and credit losses for banks, with implications for investment funds and insurers also affected by sharp repricing of climate risks, according to a new ECB/ESRB report that calls for a coordinated micro- and macroprudential approach to mitigating the danger. “In a disorderly transition scenario, marked by an immediate and substantial increase in carbon prices, respective market losses of insurers and investment funds could potentially amount to 3% and 25% on stress-tested assets in the near term,” the report concludes. “An orderly transition towards net zero by 2050 could soften such shocks and alleviate the fallout for companies and banks, reducing the probability of corporate defaults by around 13-20% in 2050 compared with today’s policies. It would also lessen credit losses for banks,” the report adds.

DATA:

SPAIN: PPI Slows for Third Consecutive Month

SPAIN JUN PPI +1.9% M/M, +43.2% Y/Y, MAY +43.6% Y/Y

SPAIN JUN CORE PPI +15.2% Y/Y, MAY +15.3% Y/Y

- Despite remaining substantially elevated, Spanish PPI recorded its third consecutive month of decline in June.

- Headline PPI softened by 0.4pp to +43.2% y/y, whilst core PPI edged down 0.1pp to +15.2%.

- Intermediate goods and energy prices both decelerated in June, by 1pp to +24.1% y/y and by over 2pp to +111.6% y/y respectively.

- Non-durable consumer goods continued to see prices accelerate, rising 0.5pp to +10.5% y/y.

- The continued slowing of factory-gate inflation will be welcome news, following the surprise 1.5pp jump to +10.2% y/y headline inflation recorded in June.

- Barring any significant acceleration in energy prices from here, September and October will start to see some bigger declines in the annual rate as base effects drop out.

Source: INE

SWEDEN: Factory Gate Inflation Continues to Accelerate

SWEDEN JUN PPI +2.5% M/M, +25.6% Y/Y; MAY +24.4% Y/Y

- A further uptick of 2.5% m/m and acceleration to +25.6% y/y for Swedish producer prices in June to the highest annual rate since 1991.

- No relief was seen from energy prices over the month, which were up 81.9% y/y.

- Depreciation in the Krona contributed to further imported inflation, resulting in a 3.7% m/m increase in the import price index in June.

- Headline PPI ex. energy rose to +17.3% y/y.

- With the next Riksbank meeting not until September 19, signs of easing commodity prices remain yet to materialise for the Swedish economy.

EQUITIES: Energy Leads Europe Gains

- Asian markets closed mixed: Japan's NIKKEI closed down 44.04 pts or -0.16% at 27655.21 and the TOPIX ended 0.04 pts lower or 0% at 1943.17. China's SHANGHAI closed up 27.048 pts or +0.83% at 3277.436 and the HANG SENG ended 342.94 pts higher or +1.67% at 20905.88.

- European markets are stronger, with energy easily outperforming: German Dax down 40.26 pts or -0.3% at 13176.52, FTSE 100 up 55.31 pts or +0.76% at 7362.17, CAC 40 up 1.56 pts or +0.03% at 6238.57 and Euro Stoxx 50 down 5.89 pts or -0.16% at 3599.97.

- U.S. futures are a little softer, with the Dow Jones mini down 116 pts or -0.36% at 31851, S&P 500 mini down 10.25 pts or -0.26% at 3959.5, NASDAQ mini down 41.5 pts or -0.34% at 12312.75.

COMMODITIES: Copper Continues To Claw Back

- WTI Crude up $1.74 or +1.8% at $98.5

- Natural Gas up $0.19 or +2.22% at $8.921

- Gold spot up $2.53 or +0.15% at $1722.16

- Copper up $8.75 or +2.61% at $344.25

- Silver up $0.18 or +0.96% at $18.6125

- Platinum up $4.32 or +0.49% at $887.5

FIXED INCOME: Bund yields at lowest level in 2 months

- Core fixed income has been grinding higher this morning with Bunds futures having surpassed Friday's highs, gilt futures challenged Friday's highs, but Treasury futures sitting in below the highs. 10-year Bund yields have moved to their lowest levels since 27 May.

- The main talking point today surrounds the EU energy ministers meeting where they are discussing plans to reduce consumption.

- Today will also see the release of housing data in the US, but the market continues to look forward to tomorrow's FOMC policy announcement. See the full MNI preview here.

- TY1 futures are up 0-10 today at 119-31 with 10y UST yields down -2.0bp at 2.778% and 2y yields unch at 3.015%.

- Bund futures are up 0.61 today at 155.36 with 10y Bund yields down -4.5bp at 0.970% and Schatz yields down -2.4bp at 0.371%.

- Gilt futures are up 0.27 today at 117.55 with 10y yields down -1.9bp at 1.915% and 2y yields down -1.0bp at 1.799%.

FOREX: Dollar Stronger Within a Range

- Treasury yields have drifted lower across European hours Tuesday, while US equity futures have improved - albeit only slightly. The greenback is generally firmer putting both EUR/USD and GBP/USD at the session's worst levels at the NY crossover. Nonetheless, both pairs have respected the recent range, with the Monday lows still out of reach on both counts.

- Oil prices are extending the recovery off the Monday lows, with the imminent restrictions on Nord Stream 1 pipeline gas flows (due to limit capacity to 20% tomorrow) supporting energy prices across the board. This has lent support to the NOK, putting NOK/SEK at the best levels since Jul12 and through the 200-dma. Next resistance crosses at the 100-dma of 1.0492 and July's highs at 1.0539.

- JPY is on the front foot, putting EUR/JPY just below the 50-dma crossing at 139.78. 138.72 marks the first support for the cross, but the trend direction remains higher for now.

- Data picks up Tuesday, but are largely tier 2 releases, with S&P house price data, June new home sales, Richmond Fed manufacturing index and the July consumer confidence print. ECB's de Cos is scheduled to speak on inflation at 1800BST/1300ET.

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/07/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 26/07/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 26/07/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 26/07/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 26/07/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/07/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 26/07/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 26/07/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 26/07/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 27/07/2022 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 27/07/2022 | 0130/1130 | *** |  | AU | CPI inflation |

| 27/07/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 27/07/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 27/07/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 27/07/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 27/07/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 27/07/2022 | 0800/1000 | ** |  | EU | M3 |

| 27/07/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 27/07/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 27/07/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 27/07/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 27/07/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 27/07/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 27/07/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 27/07/2022 | 1800/1400 | *** |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.