-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Curve Steeper Ahead of JOLTS

MNI US OPEN - Censure Motion Against France Gov't Due Today

MNI US OPEN: Dollar Continues To Soften Post-Fed

EXECUTIVE SUMMARY:

- GERMAN STATE CPI DATA SUGGEST UPSIDE RISKS TO NATIONAL ESTIMATE LATER

- INFLATION REDUCTION ACT AGREEMENT FACES EARLY HURDLE IN SEN. SINEMA (MNI POLITICS)

- POLITBURO: CHINA WILL STICK TO DYNAMIC COVID ZERO POLICY (XINHUA)

- AMAMIYA: FED VIEWS DON'T DIRECTLY IMPACT BOJ POLICY

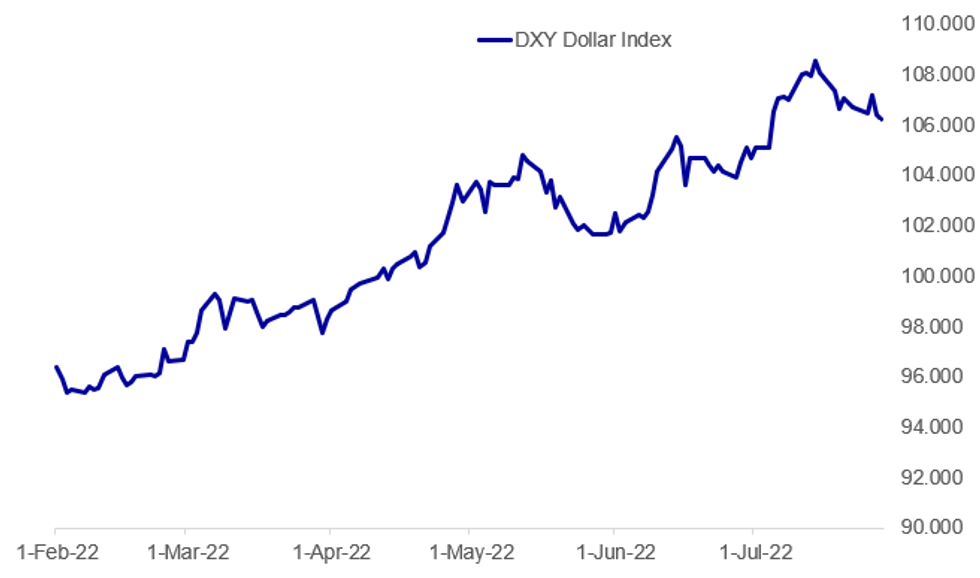

Fig. 1: Dollar Continues To Retrace From Highs

Source: BBG, MNI

Source: BBG, MNI

NEWS:

U.S. (MNI POLITICS): The Inflation Reduction Act agreed to on the evening of 27 July by Senate majority leader Chuck Schumer (D-NY) and centrist Senator Joe Manchin (D-WV) already faces a potentially significant obstacle to its passage in the form of another moderate Democrat, Senator Kyrsten Sinema. The Inflation Reduction Act, a slimmed-down version of the reconciliation bill that came out of the White House's Build Back Better package, includes revenue-raising measures such as imposing a corporate minimum tax of 15%,prescription drug pricing reform that will allow Medicare to negotiate drug prices, beefing up IRS enforcement, and closing tax loopholes. The expenditures side of the ledger includes and unprecedented USD369bn in climate change spending.

CHINA: State-run outlet Xinhua reporting comments from the Politburo of the Chinese Communist Party's monthly meeting stating that China will maintain its controversial 'dynamic zero COVID' policy that has seen strict lockdowns enacted long after the rest of the world has moved to a more managed relationship with the virus.

- Politburo: '[China] must immediately prevent and control the epidemic when it occurs. Efforts should be made to track viral mutations and develop new vaccines and drugs.'

- Politburo: "Macro policies need to play an active role in expanding demand...will strike to achieve the best results for the economy'.

- Politburo: Gov't will work to keep economic operations within reasonable range, will keep liquidity ample, step up credit support to companies, will stabilise employment, prices in H222.

- Politburo: CCP 'will promote the healthy and sustainable development of platform economy. Will normalise supervision of platform economy'.

BOJ: Bank of Japan Deputy Governor Masayoshi Amamiya said on Thursday that the Federal Reserve's policy decisions do not directly affect Japan's monetary policy, but the U.S. economy is being closely monitored for the impact on Japan's economy and prices. "Central banks manage monetary policy based on the own economic and price conditions," Amamiya told reporters, a day after the Fed hiked rates.

EUROZONE DATA (BBG): Confidence in the euro-area economy fell to the weakest in almost 1 1/2 years as fears of energy shortages haunt consumers and businesses, and the European Central Bank’s first interest-rate increase in a more than decade feeds concerns that a recession is nearing. A gauge compiled by the European Commission dropped to 99 in July from 103.5 the previous month. That’s well below the level of 102 that economists had expected.

DATA:

MNI: EZ JUL CONSUMER CONFIDENCE -27.0, JUN -23.8

- MNI: EUROZONE JUL ECONOMIC SENTIMENT INDEX 99

- EZ JUL SERVICES CONFIDENCE 10.7, JUN 14.1

German State CPI

- MNI: BADEN WUERT JUL CPI +0.8% M/M, +7.1% Y/Y

- MNI: BAVARIA JUL CPI +1% M/M, +8% Y/Y

- MNI: SAXONY JUL CPI +0.6% M/M, +7.2% Y/Y

FIXED INCOME: German inflation and US GDP in focus

- After reacting to yesterday's FOMC statement, the focus this morning has been on German inflation. Initial state prints pointed to a much higher print than the consensus for the national print would suggest, but later prints were not quite so high. There are still upside risks of around 2-3 tenths in the data, but this is less than had been previously expected. The national print is due at 13:00BST / 8:00ET.

- Overall this has led to shorter-term yields falling in EGBs and gilts, but 10-year yields moving higher.

- At 13:30BST / 8:30ET, we have the first print of US GDP for Q2 due this afternoon. Powell said yesterday that the US economy doesn't seem to be in recession now but that we are seeing some slowdown in growth and that the slowdown in the second quarter is "notable". The Bloomberg consensus looks for a 0.5%quarterly print, but most economists submitted their expectations before yesterday's durable goods and inventory data, both of which were above expectations and point to upside risks.

- We are also due to receive US weekly claims data while Banca d'Italia's Visco is due to speak this afternoon and any further comments he makes on BTP-Bund spreads will be watched - particularly in the context of TPI. He has previously said that moves for the 10-year spread above 200bp are not justified by the fundamentals.

- TY1 futures are down -0-11 today at 120-02+ with 10y UST yields unch at 2.788% and 2y yields down -1.6bp at 2.983%.

- Bund futures are down -0.79 today at 155.37 with 10y Bund yields up 3.5bp at 0.978% and Schatz yields down -3.2bp at 0.393%.

- Gilt futures are down -0.46 today at 116.97 with 10y yields up 3.7bp at 1.993% and 2y yields down -1.0bp at 1.851%.

FOREX: USD Holds Losses Post-Fed, USD/JPY Nears Key Support

- Following the Fed's 75bps rate rise on Wednesday, the USD Index has broken lower, touching the lowest levels since early July to drop around 1.25% from yesterday's pre-Fed levels.

- The JPY is the firmest currency so far Thursday, putting USD/JPY at the lowest levels since early July to narrow the gap with the 50-dma. This level marks a key support going forward and hasn't been tested in any material way since March. The support crosses at 134.18.

- The weakest currency in G10 is the SEK, falling alongside the single currency, which is generally shrugging off the uptick in inflationary pressures evident across German regions.

- The risk backdrop is generally positive, with the e-mini S&P holding above the 4,000 level following the Fed, with the index eyeing yesterday's highs of 4,042.75 - the best level since mid-June.

- The national read for German CPI is next up, with regional figures so far suggesting an uptick in inflationary pressures. EU-harmonized figures will be confirmed at 1300BST/0800ET.

- Focus will then turn to the Q2 advance GDP reading from the US which, if it comes in negative, would confirm two quarters of negative growth to confirm what some would define as a recession. Nonetheless, median looks for a +0.5% read today.

EQUITIES: Paring Post-FOMC Gains

- Asian markets closed higher: Japan's NIKKEI closed up 99.73 pts or +0.36% at 27815.48 and the TOPIX ended 3.1 pts higher or +0.16% at 1948.85. China's SHANGHAI closed up 6.821 pts or +0.21% at 3282.576 and the HANG SENG ended 47.36 pts lower or -0.23% at 20622.68.

- European equities have pared most post-Fed futures implied gains, with the German Dax down 62.22 pts or -0.47% at 13096.86, FTSE 100 down 21.85 pts or -0.3% at 7324.28, CAC 40 down 2.02 pts or -0.03% at 6258.08 and Euro Stoxx 50 down 7.28 pts or -0.2% at 3598.

- U.S. futures are lower, led by tech, with the Dow Jones mini down 45 pts or -0.14% at 32127, S&P 500 mini down 15 pts or -0.37% at 4009.5, NASDAQ mini down 113.25 pts or -0.9% at 12504.75.

COMMODITIES: Copper Gaining For 3rd Straight Day

- WTI Crude up $1.68 or +1.73% at $98.92

- Natural Gas up $0 or +0.04% at $8.56

- Gold spot up $10.22 or +0.59% at $1745.05

- Copper up $6.6 or +1.92% at $349.5

- Silver up $0.3 or +1.58% at $19.408

- Platinum up $5.9 or +0.66% at $896.11

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/07/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/07/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 28/07/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 28/07/2022 | 1230/0830 | *** |  | US | GDP (adv) |

| 28/07/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 28/07/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 28/07/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 28/07/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 28/07/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 28/07/2022 | 1730/1330 |  | US | Treasury Secretary Janet Yellen | |

| 29/07/2022 | 0530/0730 | ** |  | FR | Consumer Spending |

| 29/07/2022 | 0530/0730 | *** |  | FR | GDP (p) |

| 29/07/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 29/07/2022 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 29/07/2022 | 0630/0830 | ** |  | CH | retail sales |

| 29/07/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 29/07/2022 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 29/07/2022 | 0700/0900 | *** |  | ES | GDP (p) |

| 29/07/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 29/07/2022 | 0755/0955 | ** |  | DE | Unemployment |

| 29/07/2022 | 0800/1000 | * |  | NO | Norway Unemployment Rate |

| 29/07/2022 | 0800/1000 | *** |  | DE | GDP (p) |

| 29/07/2022 | 0800/1000 | *** |  | IT | GDP (p) |

| 29/07/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/07/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/07/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 29/07/2022 | 0900/1100 | *** |  | EU | GDP preliminary flash est. |

| 29/07/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 29/07/2022 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 29/07/2022 | 1000/1200 |  | IT | PPI | |

| 29/07/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/07/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 29/07/2022 | 1230/0830 | ** |  | US | Employment Cost Index |

| 29/07/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 29/07/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 29/07/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.